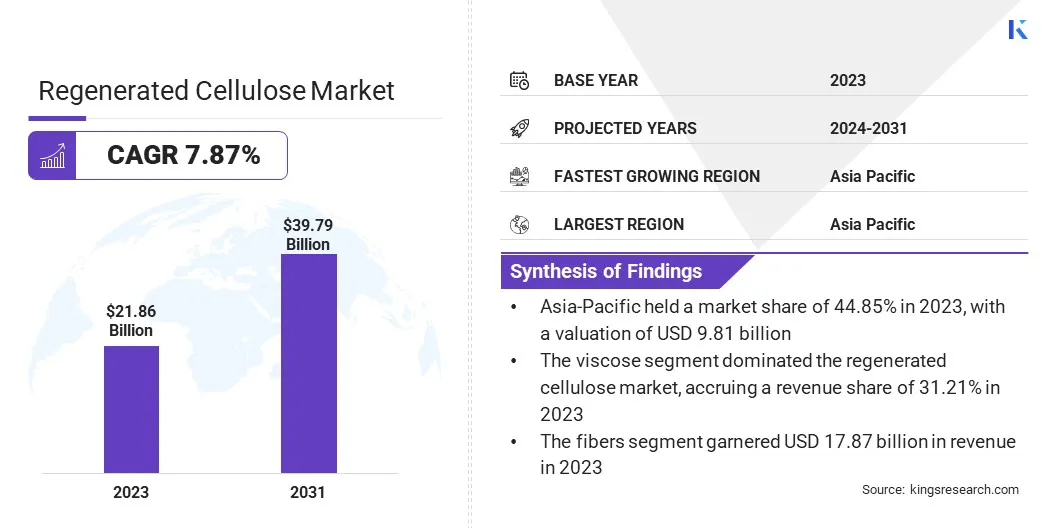

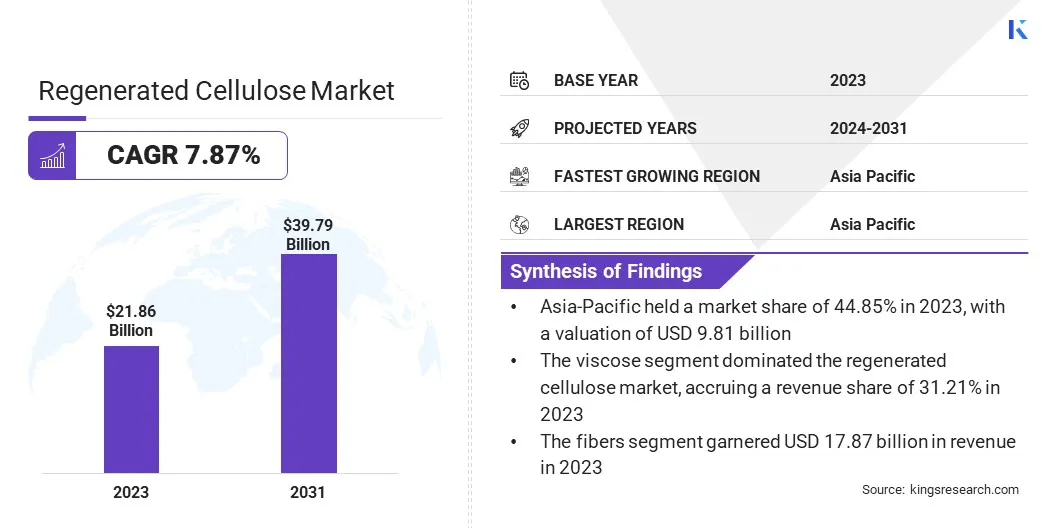

Regenerated Cellulose Market Size

The global Regenerated Cellulose Market size was valued at USD 21.86 billion in 2023 and is projected to reach USD 39.79 billion by 2031, growing at a CAGR of 7.87% from 2024 to 2031. The global market is experiencing significant growth, mainly fueled by the burgeoning demand for sustainable fashion.

With increasing environmental concerns and growing consumer awareness regarding the ecological footprint of the fashion industry, there is a shift toward the utilization of eco-friendly materials. In the scope of work, the report includes products offered by companies such as Ahlstrom-Munksjö, Asahi Kasei Corporation, Domtar Corporation, Milliken & Company, LENZING AG, Sateri, Birla Cellulose, Win-Win Textiles, Domo Chemicals, Kelheim Fibres GmbH, and others.

Regenerated cellulose, known for its biodegradability and low environmental impact compared to traditional synthetic fibers, has emerged as a preferred choice among both environmentally conscious consumers and fashion brands. Moreover, stringent regulations and initiatives promoting sustainability in the textile industry have propelled the adoption of regenerated cellulose fibers.

The push toward circular economy models and the rising trend of upcycling and recycling have further contributed to the regenerated cellulose market growth, as regenerated cellulose offers recyclability without compromising on performance or quality. However, challenges such as the high cost of production and limited availability of raw materials pose constraints to market expansion. Innovations in production processes and increasing investments in research and development are expected to address these challenges, thereby fostering market growth in the coming years.

Analyst’s Review

The global regenerated cellulose market is poised to experience robust growth in the near future, mainly driven by the rising shift towards sustainable consumer demands, supported by regulatory initiatives and a growing emphasis on circular economy principles. While challenges persist, ongoing efforts to innovate and optimize production processes are likely to unlock new opportunities for market players in the sustainable textile industry. Moreover, strategic imperatives among key players create lucrative opportunities for market growth.

Market Definition

Regenerated cellulose, a synthetic fiber, is crafted from cellulose, a plant-derived polymer. Through a process involving the dissolution of cellulose pulp sourced from various plants such as wood and cotton, it undergoes regeneration into fresh fibers. These fibers possess qualities similar to those of natural counterparts such as cotton, while also boasting enhanced attributes, including increased strength and eco-friendliness.

Leveraging the complete spectrum from production to distribution and utilization, the regenerated cellulose market encompasses the intricate network vital for the development, dissemination, and adoption of these innovative fibers. As sustainability gains prominence in consumer choices, regenerated cellulose is emerging as a compelling eco-friendly option, driving its adoption across diverse industries and reshaping the global market landscape.

Market Dynamics

The regenerated cellulose market is experiencing substantial growth, propelled by a global focus on environmental sustainability. Increasing emphasis on sustainability is driving various industries to seek eco-friendly alternatives. Regenerated cellulose, derived from renewable sources such as wood pulp and other recycled feedstock, emerges as a compelling solution. Its production entails reduced reliance on fossil fuels and emits lower levels of greenhouse gases compared to traditional synthetic fibers.

As governments worldwide enact regulations to curb environmental impact, the demand for regenerated cellulose is projected to rise over the forecast period. Growing preference for sustainable options is addressing consumer needs as well as fostering a greener future specifically within the regenerated cellulose market and its associated sectors.

- According to a 2023 study, 70% of consumers worldwide are willing to pay extra for sustainable products, highlighting a substantial market potential for regenerated cellulose fibers.

Moreover, regenerated cellulose is extending its reach beyond the textile and apparel sector, identifying new applications across various sectors owing to its exceptional qualities such as breathability, biodegradability, and versatility. It is making strides in diverse fields, including automotive interiors, where it serves as a highly preferred substitute for conventional materials such as leather and synthetic fabrics.

Additionally, it is being utilized in the production of non-woven materials, contributing to the manufacturing of hygiene products, wipes, and filtration systems. Moreover, in the packaging industry, regenerated cellulose emerges as an eco-friendly option, providing sustainable alternatives to traditional plastic-based packaging solutions.

However, the need for scalable and cost-effective production methods presents a major challenge to the regenerated cellulose market development. While the demand for sustainable materials is increasing, production processes for regenerated cellulose often require significant investment in technology and infrastructure. Achieving economies of scale to make these processes more efficient and cost-competitive is impacting market growth.

Additionally, sourcing sustainable raw materials consistently and ethically presents challenges, especially as demand grows. Addressing these production challenges is essential for ensuring the viability and competitiveness of regenerated cellulose as a sustainable alternative in various industries. Collaboration between stakeholders, technological innovation, and strategic investments are crucial in overcoming these obstacles and unlocking the full potential of the market.

Segmentation Analysis

The global market is segmented based on product type, manufacturing process, source, end-use industry, and geography.

By Product Type

Based on product type, the market is categorized into fibers and films. Fibers accounted for a significant valuation of USD 17.87 billion in 2023. The increasing demand for sustainable textiles and apparel contributes significantly to the growth of this segment. Consumers are increasingly becoming conscious of environmental impact, thereby favoring the demand for materials such as regenerated cellulose fibers.

Moreover, advancements in production technologies have made these fibers more cost-effective and versatile, thereby contributing to their dominance. Additionally, the versatility of regenerated cellulose fibers allows for a wide range of applications beyond traditional textiles, including automotive interiors and packaging materials, which is expanding its market reach and driving growth.

By Manufacturing Process

Based on manufacturing process, the market is classified into viscose, cuprammonium, NMMO, and acetate. The viscose segment dominated the regenerated cellulose market, accruing a revenue share of 31.21% in 2023. The dominance of viscose is supported by various driving factors beyond sustainability. While its cost-effectiveness and eco-friendly nature are notable, other factors, such as production efficiency and scalability, are equally crucial.

Viscose benefits from a well-established production infrastructure that enables high-volume manufacturing at relatively low costs, making it an attractive option for large-scale production of textiles and non-woven materials. Moreover, its versatility in adapting to various manufacturing processes and applications strengthens its leading position in the market.

By Source

Based on source, the regenerated cellulose market is divided into wood pulp, non-wood pulp, and recycled pulp. The wood pulp segment generated the highest revenue of USD 10.61 billion in 2023. This growth trajectory is driven by its inherent renewable and eco-friendly nature, positioning it favorably in the existing sustainability-conscious landscape.

Additionally, its cost-effectiveness compared to alternative sources enhances its attractiveness to businesses seeking efficient and economical solutions. Furthermore, the robustness and efficiency of wood pulp supply chains play a crucial role in its sustained prominence. The presence of well-established networks ensures consistent availability, thereby mitigating production risks and facilitating continuous growth. Overall, these insights highlight the sustained popularity and market dominance of wood pulp as a primary material for various applications, particularly in regenerated cellulose products.

Regenerated Cellulose Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Regenerated Cellulose Market share stood around 44.85% in 2023 in the global market, with a valuation of USD 9.81 billion. The region serves as a major textile and apparel manufacturing hub, fostering a robust demand for regenerated cellulose fibers as sustainable alternatives. The region benefits from a growing middle-class population with rising disposable incomes, characterized by increased spending on eco-friendly products, including regenerated cellulose.

Moreover, government initiatives through policies promoting sustainability encourage adoption across diverse industries. With a well-established production base and the presence of key players such as Lenzing AG and Sateri operating prominently, Asia-Pacific is anticipated to dominate the market over 2024-2031.

Additionally, the increased awareness of sustainability among consumers fuels demand, while the expansion of applications into sectors such as packaging and automotive propels market growth. Technological advancements, along with research into alternative raw materials, hold the potential to bolster competitiveness and sustainability, thus fostering market expansion within the region.

North America witnessed notable growth in the regenerated cellulose market, accruing a valuation of USD 4.31 billion in 2023. This growth is mainly fueled by the growing demand for sustainable apparel among North American consumers, which has led to increased adoption of regenerated cellulose fibers in the apparel industry. Moreover, companies in the region are increasingly focusing on innovation, investing in research and development to enhance the production processes and functionalities of these fibers, thus improving their competitiveness against traditional materials.

Additionally, government initiatives, such as the Sustainable Apparel Coalition in the U.S., are encouraging the adoption of sustainable practices in the textile industry, thereby benefiting the market. The region is experiencing notable growth, particularly in hygiene products and wipes, where regenerated cellulose offers a biodegradable and sustainable alternative. Furthermore, the rising demand for sustainable home decor products among North American consumers presents potential opportunities for regenerated cellulose fibers in applications such as towels, bedsheets, and curtains.

Competitive Landscape

The regenerated cellulose market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Regenerated Cellulose Market

- Ahlstrom-Munksjö

- Asahi Kasei Corporation

- Domtar Corporation

- Milliken & Company

- LENZING AG

- Sateri

- Birla Cellulose

- Win-Win Textiles

- Domo Chemicals

- Kelheim Fibres GmbH

Key Industry Developments

- October 2023 (Acquisition) - Sumitomo Bakelite Co., Ltd. announced its agreement with Asahi Kasei Corp. to acquire a majority stake of 90% in a newly established company resulting from an incorporation-type split. This new entity was to assume ownership of Asahi Kasei Pax Corp.'s film business.

The Global Regenerated Cellulose Market is Segmented as:

By Product Type

By Manufacturing Process

- Viscose

- Cuprammonium

- NMMO

- Acetate

By Source

- Wood-Pulp

- Non-Wood Pulp

- Recycled Pulp

By End-Use Industry

- Agriculture

- Automotive

- Fabric

- Packaging

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America