Recycled Aluminum Market Size

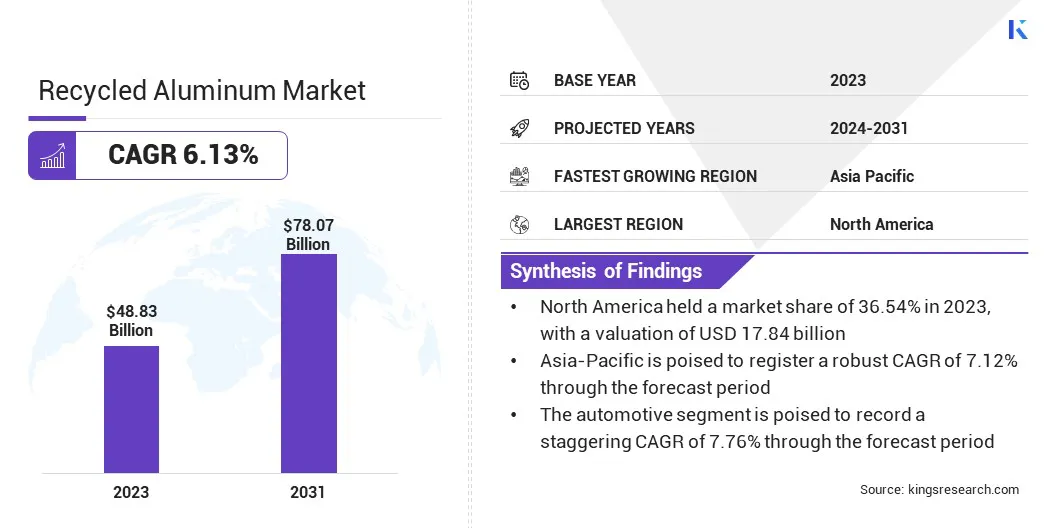

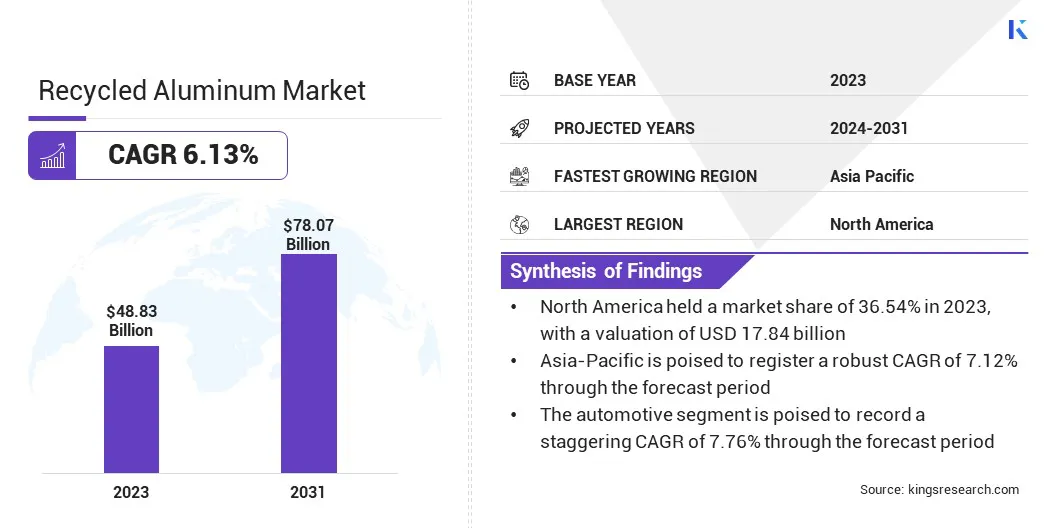

The global Recycled Aluminum Market size was valued at USD 48.83 billion in 2023 and is projected to grow from USD 51.47 billion in 2024 to USD 78.07 billion by 2031, exhibiting a CAGR of 6.13% during the forecast period. Increase in scrap availability and stringent environmental regulations and policies aimed at reducing emissions are fostering market growth.

In the scope of work, the report includes services offered by companies such as Aditya Birla Group (Novelis), Arconic, Constellium SE, Kaiser Aluminum Corporation, Gränges AB, Tri-Arrows Aluminum Inc., Reynolds Consumer Products LLC, Alcoa Corporation, Norsk Hydro ASA, JW Aluminum Company, and others.

The global recycled aluminum market for recycled aluminum is significantly benefiting from the proliferation of circular economy initiatives. These initiatives emphasize the reduction of waste, the recycling of materials, and the reintegration of those materials into production processes, all of which are critical for sustainable development.

- For instance, in 2023, Abralatas reported that a quarter of Brazil's aluminum sales, totaling approximately 400 billion units, are through Brazilian Association of Aluminum Can Manufacturers (Abralatas). In 2022, Brazil became the only country globally to recycle nearly 100% of aluminum beverage cans, benefiting 800,000 recycling families and showcasing successful industry-government collaboration.

Recycled aluminum is central to these initiatives due to its infinite recyclability without losing its quality. The circular economy model promotes the continuous use of resources, allowing recycled aluminum to be utilized in various applications, such as automotive manufacturing and consumer electronics, thereby reducing the need for virgin aluminum extraction.

Companies adopting circular economy practices are expected to achieve cost savings, lower environmental impact, and gain competitive advantages in markets increasingly focused on sustainability. Additionally, circular economy initiatives help stabilize the supply of aluminum by promoting the collection and recycling of aluminum scrap. This may lead to a more resilient supply chain, less reliant on raw material extraction.

The widespread adoption of circular economy principles is likely to continue boosting the demand for recycled aluminum, offering significant growth opportunities for industry players. Recycled aluminum refers to aluminum reprocessed from scrap material rather than being produced from raw bauxite ore. The recycling process involves melting down aluminum scrap and purifying it for reuse, which requires significantly less energy compared to the production of primary aluminum.

Recycled aluminum can be derived from two primary types of scrap: post-consumer scrap and pre-consumer scrap. Post-consumer scrap consists of used and discarded products, such as beverage cans, automotive parts, and construction materials. Pre-consumer scrap comprises manufacturing waste, including trimmings and off-cuts from the production process.

The end-users of recycled aluminum are diverse and span across multiple industries. The automotive industry extensively uses it for manufacturing lightweight vehicle components, while the construction sector employs recycled aluminum in building materials and infrastructure projects.

Additionally, the packaging industry relies heavily on recycled aluminum for producing cans, foil, and other packaging materials. The use of recycled aluminum in these sectors conserves natural resources and reduces environmental impact.

Analyst’s Review

In the recycled aluminum market, companies are increasingly adopting strategies that align with sustainability goals and the growing demand for eco-friendly materials.

Leading firms are focusing on expanding their recycling capacities by investing in advanced technologies that enhance the efficiency and quality of aluminum recycling processes. This strategic investment allows companies to meet the rising demand for high-quality recycled aluminum, particularly in automotive and construction industries, where material performance is critical.

- For instance, in August 2024, Exlabesa enhanced its aluminum recycling operations in Spain by leveraging technology from Hertwich Engineering, a subsidiary of SMS Group. Hertwich is anticipated to supply a continuous homogenizing furnace, an air cooling station, long-billet stacker, and semi-automatic PET strapping system, to enhance recycled aluminum production from post-consumer scrap.

Furthermore, companies are forming strategic partnerships and collaborations to secure a steady supply of aluminum scrap, ensuring a consistent input for their recycling operations. The current growth trajectory of the market is influenced by the increasing emphasis on circular economy practices and regulatory pressures to reduce carbon emissions.

Key players are likely to prioritize innovation in alloy development, incorporating recycled content to fulfill industry-specific requirements. The imperatives for success in this market include maintaining competitive pricing, ensuring the availability of quality scrap, and meeting the evolving demands of end-users who are increasingly focused on sustainability.

Recycled Aluminum Market Growth Factors

The recycled aluminum market is experiencing significant growth due to an increase in the availability of aluminum scrap. This increase is driven by the expanding use of aluminum across various industries, including automotive, construction, and packaging. As these industries grow, the volume of aluminum waste generated rises, providing a substantial supply of scrap for recycling.

The increase in scrap availability is further supported by improved collection and sorting processes, which ensure that more aluminum waste is recovered and channeled back into the recycling stream. This steady supply of aluminum scrap is crucial for meeting the rising demand for recycled aluminum, as industries seek to reduce their reliance on primary aluminum, which is more energy-intensive to produce.

- According to a CRU International report for the International Aluminium Institute (IAI), global aluminum demand is projected to surge by nearly 40% by 2030, highlighting the need to produce an additional 33.3 metric tons. Several sectors, including transportation, construction, packaging, and electrical, are anticipated to boost this demand, accounting for 75% of the metal needed.

Additionally, the availability of diverse scrap types, including post-consumer and pre-consumer scrap, allows recyclers to produce a wide range of aluminum products tailored to specific industry needs. The growing availability of scrap aluminum plays a pivotal role in sustaining the supply chain of recycled aluminum and supporting its adoption across various sectors.

Quality variability in recycled aluminum presents a significant challenge to its widespread adoption in high-precision applications. Recycled aluminum often contains impurities or inconsistencies due to the varying quality of the scrap material used in the recycling process. These variations can affect the performance of aluminum products, particularly in industries such as aerospace and automotive, where material consistency is critical.

The presence of impurities can affect the mechanical properties of the aluminum, making it less reliable for applications that require high strength and durability. Mitigating this challenge requires advanced sorting and purification technologies to ensure contaminant removal from the scrap material.

Additionally, implementing stringent quality control measures throughout the recycling process help maintain the consistency of recycled aluminum. By adopting these strategies, companies aim to produce recycled aluminum that meets the stringent requirements of high-performance industries, thereby expanding its applications and enhancing its overall quality.

Recycled Aluminum Market Trends

The increasing demand for sustainable materials is a major trend reshaping the landscape of the recycled aluminum market. As environmental concerns grow, industries face increasing pressure to reduce their carbon footprints and adopt sustainable practices. Recycled aluminum is emerging as a key material in this shift toward sustainability due to its lower environmental impact compared to primary aluminum.

Recycling aluminum uses up to 95% less energy than producing it from raw ore, making it an eco-friendlier option. This energy efficiency results in a significant reduction in greenhouse gas emissions, aligning with global efforts to combat climate change.

Moreover, aluminum’s durability, versatility, and infinite recyclability make it an ideal material for industries looking to enhance their sustainability credentials. The automotive, construction, and packaging sectors are increasingly turning to recycled aluminum to meet both regulatory requirements and rising consumer demand for greener products.

- According to The Aluminum Association, over 90% of aluminum used in vehicles, buildings, and industrial products is recycled. Additionally, aluminum beverage containers are recycled at significantly higher rates than glass, plastic bottles, or composite packaging. However, $800 million worth of recyclable aluminum still discarded in landfills each year, presenting a significant opportunity.

Segmentation Analysis

The global market has been segmented based on type, deployment, and geography.

By Scrap Type

Based on scrap type, the market has been segmented into wire scrap, extrusion scrap, sheet scrap, and others. The extrusion scrap segment captured the largest recycled aluminum market share of 41.23% in 2023, largely attributed to its widespread use and high recyclability. Extrusion scrap is generated primarily from the production of aluminum products such as window frames, door frames, and structural components used in construction and automotive industries.

The manufacturing processes in these industries generate substantial amounts of scrap, which are easily recyclable due to the homogeneity of the material. Aluminum extrusion is a process that involves forcing aluminum through a die to create shapes with a consistent cross-section, making it ideal for creating complex and lightweight structures.

The substantial demand for aluminum extrusions in the construction and automotive sectors results in a large volume of extrusion scrap generated annually. Moreover, the recycling of extrusion scrap is highly efficient and cost-effective. The scrap is often high-purity and requires minimal processing to be converted into usable aluminum, which aligns with the industry's focus on sustainability and cost reduction.

The increasing adoption of circular economy practices, which emphasize material reuse and recycling, accelerates the collection and recycling of extrusion scrap. Additionally, advancements in recycling technologies are improving aluminum recovery rates from extrusion scrap, thereby increasing its value.

By End User

Based on end user, the recycled aluminum market has been classified into building and construction, automotive, electronics, and others. The automotive segment is poised to record a staggering CAGR of 7.76% through the forecast period, primarily due to the automotive industry's increasing shift toward lightweight materials and sustainable practices.

The automotive sector faces significant pressure to reduce vehicle weight for improved fuel efficiency and compliance with strict emission regulations. Aluminum’s lightweight and highly durable make it a preferred material for automakers seeking to enhance vehicle performance and efficiency.

- For instance, in May 2024, Nissan Motor Co., Ltd. announced its plan to incorporate low CO2 emission aluminum parts, made from green or recycled aluminum, in new and existing models starting fiscal year 2024, with a complete transition by 2030. This initiative aligns with Nissan's goal of achieving carbon neutrality across the vehicle lifecycle by 2050.

The growing adoption of electric vehicles (EVs) is further boosting the demand for aluminum in the automotive industry, as lighter vehicles enhance energy efficiency and extend EV range. Moreover, the use of recycled aluminum in automotive manufacturing is rising as automakers seek to lower their environmental impact and reduce costs.

Recycled aluminum offers equivalent mechanical properties to primary aluminum while substantially reducing carbon footprint, making it an attractive option for manufacturers focused on sustainability. The expansion of global EV production and the increasing use of advanced aluminum alloys in vehicle design are expected to augment the expansion of the automotive segment.

Recycled Aluminum Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America recycled aluminum market accounted for a considerable share of 36.54% and was valued at USD 17.84 billion in 2023. This dominance is attributed to the region’s well-established recycling infrastructure, strong regulatory frameworks promoting sustainability, and high demand from the automotive, construction, and packaging industries.

The United States and Canada, in particular, have robust recycling programs and policies that promote the collection and processing of aluminum scrap, ensuring a steady supply of recycled aluminum in the region.

- In 2023, The Aluminum Association reports that the North American aluminum industry has successfully reduced its carbon footprint by more than 50% in the past 30 years. This reflects the industry's dedication to sustainability and environmental responsibility.

The automotive sector’s demand for lightweight and fuel-efficient vehicles leads to the rising adoption of recycled aluminum. Additionally, the construction industry’s use of sustainable materials propels the demand for recycled aluminum in the region. North America's growing emphasis on circular economy practices and its commitment to reducing carbon emissions are further supporting regional market expansion.

Asia-Pacific is projected to emerge as the fastest-growing region with a CAGR of 7.12% in the forthcoming years. This notable growth is stimulated by rapid industrialization, urbanization, and the increasing focus on sustainability across the region. Countries such as China, India, and Japan are at the forefront of this growth, with expanding automotive and construction industries that are increasingly adopting recycled aluminum to meet both economic and environmental goals.

The region's automotive sector, particularly in China and India, is experiencing significant growth due to a rising demand for lightweight vehicles to improve fuel efficiency and reduce emissions. This demand is propelling the use of recycled aluminum in vehicle manufacturing.

Moreover, growing middle class and urban population in Asia-Pacific is leading to increased consumption of packaged goods. This increase is further boosting the demand for aluminum packaging, which is derived from recycled materials.

Governments across the region are implementing stricter environmental regulations and promoting recycling initiatives to manage waste and reduce carbon footprints, thereby supporting regional market growth. Additionally, the availability of abundant aluminum scrap and the development of advanced recycling technologies are enhancing the efficiency and cost-effectiveness of recycled aluminum production, thus facilitating domestic market expansion in the region.

Competitive Landscape

The global recycled aluminum market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Recycled Aluminum Market

- Aditya Birla Group (Novelis)

- Arconic

- Constellium SE

- Kaiser Aluminum Corporation

- Gränges AB

- Tri-Arrows Aluminum Inc.

- Reynolds Consumer Products LLC

- Alcoa Corporation

- Norsk Hydro ASA

- JW Aluminum Company

Key Industry Developments

- August 2024 (Expansion): Vestas was awarded a contract to supply and install 46 V162-6.2 MW turbines from the EnVentus platform for CS Energy’s Lotus Creek Wind Farm in Queensland. The project, with a 285 MW capacity, includes a long-term Active Output Management 5000 (AOM 5000) service agreement.

- July 2024 (Launch): Nordex Group expanded its product portfolio in the 5 MW segment with the launch of the N169/5.X turbine. This launch, aimed at the U.S. market, represents a strategic move to strengthen its presence in North America by offering one of the largest and most efficient turbines.

- April 2024 (Expansion): RUSAL, a leading global aluminum producer, successfully delivered rolling slabs with recycled content, addressing the growing demand for sustainable aluminum products, particularly in the food and beverage sector.

The global recycled aluminum market is segmented as:

By Scrap Type

- Wire Scrap

- Extrusion Scrap

- Sheet Scrap

- Others

By End User

- Building and Construction

- Automotive

- Electronics

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.