Market Definition

The market refers to the industry involved in the production of carbon black that is recovered from used tires, rubber, or other waste materials through recycling processes.

Carbon black is a fine, black powder made from burning hydrocarbons in insufficient air and is primarily used as a reinforcing filler in tires, rubber products, and as a pigment in inks and paints. rCB is an environmentally friendly alternative to virgin carbon black. It is produced by pyrolyzing waste materials in a controlled environment, which separates carbon black from other materials.

Recovered Carbon Black Market Overview

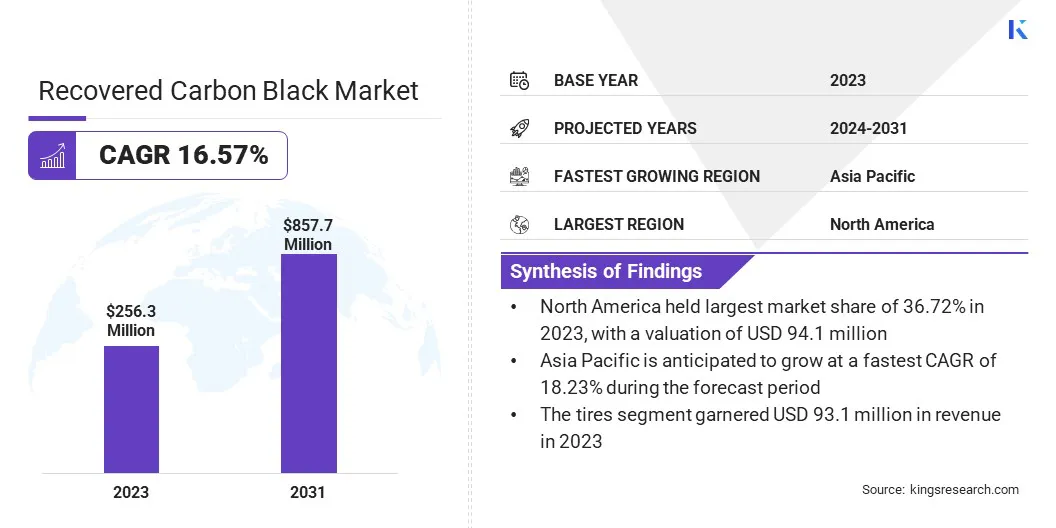

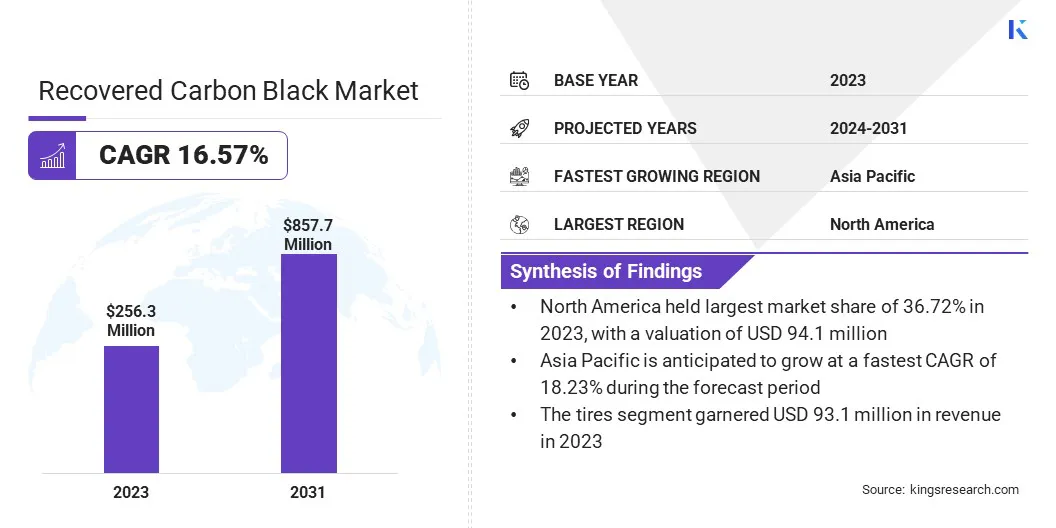

The global recovered carbon black market size was valued at USD 256.3 million in 2023, which is estimated to be USD 293.3 million in 2024 and reach USD 857.7 million by 2031, growing at a CAGR of 16.57% from 2024 to 2031.

Increasing investments in tire recycling and pyrolysis infrastructure are driving the market. These investments enhance production capabilities, expand supply chains, and improve rCB availability, supporting market growth.

Major companies operating in the recovered carbon black industry are Black Bear Carbon B.V., Scandinavian Enviro Systems AB, Klean Industries Inc, Radhe Group Of Energy, RCB Nanotechnologies GmbH, Bolder Industries Corporate, ENRESTEC, Hosokawa Micron B.V., NEUMAN & ESSER, Cabot Corporation, ECO Infinic Co., Ltd, Waverly Carbon Ltd, Pyrum Innovations AG, Rieco Industries Limited, and Aditya Birla Management Corporation Pvt. Ltd.

The market is evolving rapidly as industries seek sustainable and environmentally friendly alternatives to traditional carbon black. rCB offers a valuable way to recycle waste materials like end-of-life tires into high-performance carbon black, catering to the growing global demand for circular economy solutions and eco-conscious products.

rCB is gaining traction in sectors such as automotive, rubber, and coatings with increasing regulatory support for waste recycling and sustainability, positioning itself as a key player in the transition to greener industrial practices.

- In February 2024, Nokian Tyres signed a long-term agreement with a tire recycling joint venture formed by Antin Infrastructure Partners and Scandinavian Enviro Systems to increase the use of rCB in tire production. This partnership supports their sustainability goal to achieve 50% recycled and renewable raw materials in tires by 2030.

Key Highlights:

- The recovered carbon black industry size was valued at USD 256.3 million in 2023.

- The market is projected to grow at a CAGR of 16.57% from 2024 to 2031.

- North America held a market share of 36.72% in 2023, with a valuation of USD 94.1 million.

- The tires segment garnered USD 93.1 million in revenue in 2023.

- The industrial segment is expected to reach USD 354.4 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 18.23% during the forecast period.

Market Driver

Investment in Infrastructure

Investment in tire recycling and pyrolysis infrastructure is a major driver of the market. Many companies are investing in advanced recycling technologies and pyrolysis plants, expanding the production capacity of rCB and ensuring a steady and reliable supply.

This, in turn, enhances the availability of rCB for various industries, including automotive and rubber manufacturing. Increased infrastructural activities improve the economies of scale, leading to cost reductions, greater efficiency, and ultimately, a boost in the adoption of rCB solutions.

- In May 2024, Orion S.A. announced an investment in Alpha Carbone, a French tire recycling company. This partnership will scale up tire pyrolysis and rCB production, strengthening infrastructure and supporting the growing demand for sustainable rCB solutions.

Market Challenge

Quality Variability

One of the challenges faced in the recovered carbon black market is quality variability, as rCB can sometimes exhibit inconsistent performance compared to virgin carbon black. This can limit its use in high-performance applications, such as in premium tires or specialized rubber products.

Advancements in pyrolysis technology and refining processes can be developed to improve the consistency and quality of rCB. Companies can also focus on establishing strict quality control measures to ensure that rCB meets industry standards and customer specifications.

Market Trend

Circular Economy

A notable trend in the market is the shift toward circular economy models, where waste materials, particularly end-of-life tires, are converted into valuable resources like rCB. This trend aligns with global sustainability goals, as it reduces waste, lowers carbon footprints, and conserves natural resources.

Manufacturers are increasingly adopting rCB to meet both regulatory requirements and consumer demand for eco-friendly products. The demand for eco-friendly solutions is increasing, boosting the adoption of rCB and driving innovation and growth in various sectors such as automotive and rubber.

- In March 2025, Klean Industries partnered with Viva Energy to launch a tire recycling initiative at the Geelong Refinery. This collaboration aims to transform end-of-life tires into valuable resources, supporting sustainability and advancing Australia's circular economy through rCB production.

Recovered Carbon Black Market Report Snapshot

|

Segmentation

|

Details

|

|

By Application

|

Tires, Rubber, High-performance Coatings , Others

|

|

By End-user Industry

|

Automotive, Construction, Industrial, Electronics, Printing and Packaging

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Application (Tires, Rubber, High-performance Coatings, Others): The tires segment earned USD 93.1 million in 2023, due to the growing demand for eco-friendly materials and sustainable tire production.

- By End-user Industry (Automotive, Construction, Industrial, Electronics, Printing and Packaging): The industrial segment held 37.33% share of the market in 2023, due to the increased adoption of rCB in various industrial applications.

Recovered Carbon Black Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America

North America accounted for a market share of around 36.72% in 2023, with a valuation of USD 94.1 million. North America remains the dominant region for the recovered carbon black market, due to a well-established industrial base, stringent environmental regulations, and a strong focus on sustainability.

The region benefits from advanced technological capabilities, which enable efficient production and processing of rCB. Additionally, the increasing demand from key sectors such as automotive and tire manufacturing, along with government initiatives promoting circular economy practices, strengthens North America's position as a leader in the global market.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 18.23% over the forecast period. Asia Pacific is the fastest-growing market for rCB, due to increasing industrialization, high volume of end-of-life tires, and rising demand for sustainable materials.

The rapid adoption of environmental regulations and growing focus on circular economy practices in the region further boost the demand for eco-friendly alternatives like rCB. Additionally, the presence of large-scale manufacturing hubs and the shift toward sustainable solutions in industries such as automotive and rubber contribute significantly to the market growth.

- In June 2024, Klean Industries expanded its rCB production in India and Malaysia, responding to the global demand for sustainable raw materials in tire, rubber, and plastics manufacturing, while significantly reducing carbon emissions and enhancing circular economy practices.

Regulatory Frameworks:

- In the U.S., the Environmental Protection Agency (EPA) protects public health and the environment by regulating carbon black disposal and recycling, ensuring compliance with environmental standards for emissions and waste management.

- In the EU, the REACH Regulation protects human health and the environment by ensuring all chemicals, including carbon black, are properly assessed for their potential environmental and health impacts.

- In India, the National Green Tribunal (NGT), established under the National Green Tribunal Act 2010, enforces environmental regulations and resolves disputes related to pollution control and carbon black recycling processes.

Competitive Landscape:

Companies in the recovered carbon black industry are increasingly focusing on improving the quality and performance of rCB through advanced technologies and innovation. Efforts are aimed at enhancing properties such as dispersion, consistency, and compatibility with various applications.

These advancements enable rCB to replace higher amounts of virgin carbon black in tire and rubber industries, promoting sustainability and reducing environmental impact.

- In October 2023, Scandinavian Enviro Systems developed a new type of rCB with improved dispersion properties. This innovation enhances performance in tire and rubber manufacturing, offering a more sustainable alternative to virgin carbon black, reducing carbon emissions by up to 93%.

List of Key Companies in Recovered Carbon Black Market:

- Black Bear Carbon B.V.

- Scandinavian Enviro Systems AB

- Klean Industries Inc

- Radhe Group Of Energy

- RCB Nanotechnologies GmbH

- Bolder Industries Corporate

- ENRESTEC

- Hosokawa Micron B.V.

- NEUMAN & ESSER

- Cabot Corporation

- ECO Infinic Co., Ltd

- Waverly Carbon Ltd,

- Pyrum Innovations AG

- Rieco Industries Limited

- Aditya Birla Management Corporation Pvt. Ltd.

Recent Developments (JV/Partnerships/Agreements/Investments)

- In July 2024, Continental signed a long-term agreement with Pyrum Innovations to use high-quality rCB from end-of-life tires in passenger car tire production. This partnership advances Continental's goal of increasing recycled material usage, contributing to a circular economy.

- In February 2024, Michelin, Antin, and Enviro finalized a joint venture to build a tire recycling plant in Uddevalla, Sweden. The plant will produce rCB from 35,000 tons of used tires annually, contributing to sustainable carbon black alternatives and reducing emissions.

- In February 2024, Marubeni Corporation announced its investment in RCB Nanotechnologies GmbH, a company developing next-generation recovered carbon black (rCB2.0). This investment aims to enhance sustainability in the tire and rubber industry by producing high-quality rCB, replacing virgin carbon black and reducing environmental impact.

- In February 2023, Klean Industries and Niersberger strengthened their tire pyrolysis partnership to expand tire recycling projects across Europe. The partnership focuses on recovering carbon black and renewable fuels, utilizing modular, cost-effective plants to drive the transition to a circular, low-carbon economy.