Recloser Market Size

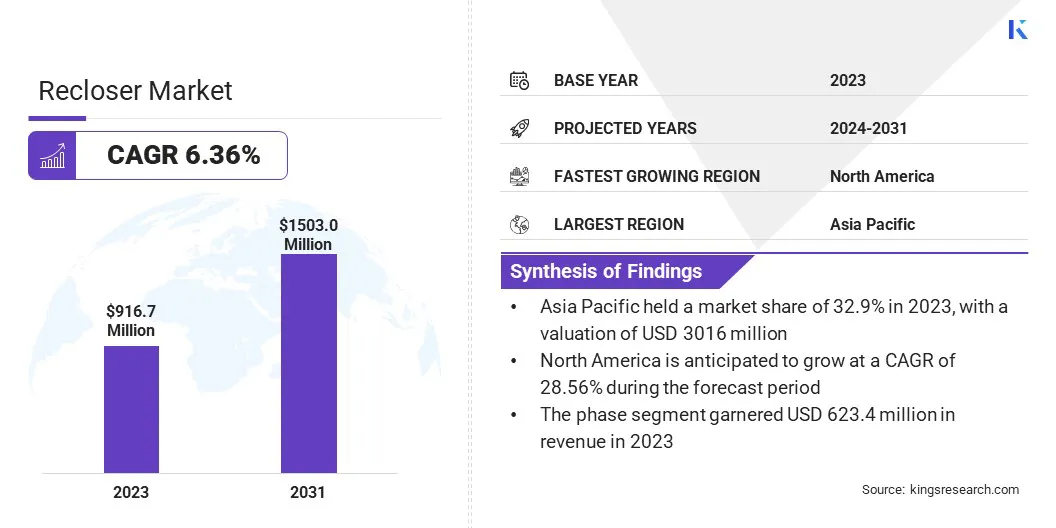

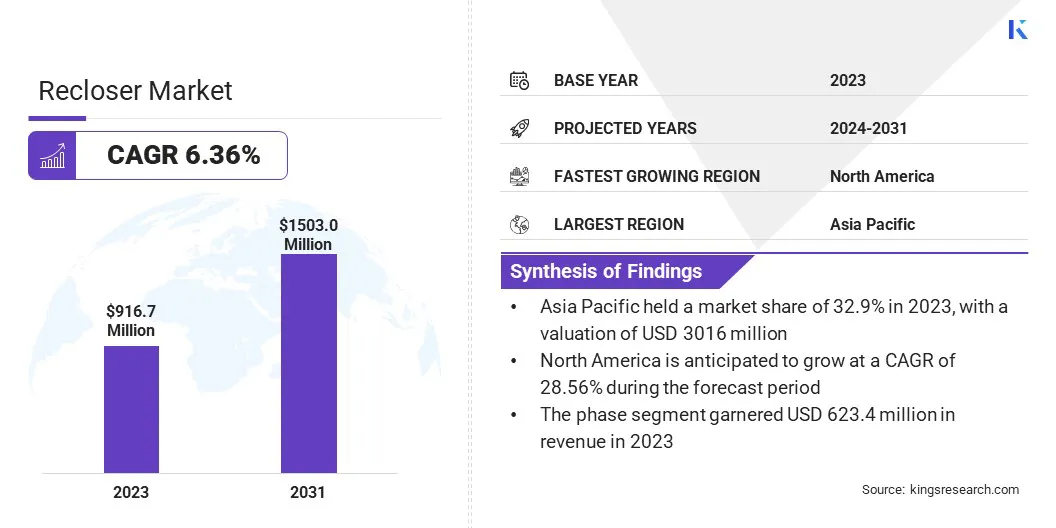

The global Recloser Market size was valued at USD 916.7 million in 2023 and is projected to reach USD 1,503.0 million by 2031, growing at a CAGR of 6.36% from 2024 to 2031.

Increasing demand for electricity due to rapid urbanization, infrastructural development, grid modernization, and shifting emphasis on renewable energy is driving market growth. In the scope of work, the report includes products offered by companies such as Schneider Electric, ABB, Tavrida Electric, Eaton, NOJA Power Switchgear Pty Ltd, Siemens, S&C Electric Company, Hubbell, ARTECHE, CG Power & Industrial Solutions Ltd, and Others.

Ongoing grid modernization initiatives in developed regions, such as North America and Europe, are driving market growth. Countries across North America, Europe, and parts of Asia-Pacific are modernizing and upgrading the aging electricity infrastructure on priority to enhance its reliability, efficiency, and resiliency in order to reduce power outages.

- In the U.S., the ‘Smart Grid Investment Grant Program’, funded by the Department of Energy, has incentivized utilities to invest in advanced grid technologies, including reclosers equipped with intelligent controls and communication capabilities.

These modern recloser solutions enable utilities to detect and isolate faults more efficiently, which helps in minimizing outage durations and improving overall grid performance.

Moreover, the increasing frequency and severity of extreme weather events, such as hurricanes, wildfires, and storms, are driving utilities to reinforce their grid infrastructure with resilient components. By deploying recloser systems, utilities are strategically sectionalizing the grid and isolating affected areas during outages, thereby limiting the impact on customer service reliability.

Stringent regulatory mandates aimed at improving grid reliability are also driving utilities to invest in advanced recloser solutions. Regulatory bodies in developed regions are increasingly emphasizing the importance of adopting smart grid technologies, including reclosers, to enhance the resilience of power networks and ensure uninterrupted electricity supply to consumers.

The recloser market encompasses the manufacturing, distribution, and deployment of recloser devices used in electricity distribution systems. Reclosers are specialized circuit breakers equipped with advanced controls and sensors designed to automatically detect and isolate faults in power lines.

This improves grid reliability and minimizes outage durations. This market caters to various sectors, including utilities, energy infrastructure, and industrial applications, offering a range of recloser solutions tailored for specific voltage levels, operating conditions, and grid configurations.

Analyst’s Review

Analyst’s Review

The global recloser market is poised to witness considerable growth in the foreseeable future. Rising electricity demand due to rapid urbanization and infrastructure development is necessitating grid modernization. Furthermore, the widespread adoption of renewable energy sources is propelling the demand for solutions for managing bi-directional power flow and fault isolation.

While several factors such as grid standardization and workforce training are posing challenges to market expansion, key players are actively engaging in strategies such as acquisitions to address these obstacles.

- In March 2023, Eaton Corporation acquired Cooper Power Systems, a leading provider of electrical distribution and control products. This acquisition would enhance Eaton’s portfolio by adding reclosers and sectionalizers, key components in electricity transmission and distribution systems.

By developing cost-effective solutions, expanding service offerings, and catering to emerging markets, key players can likely overcome these challenges.

Recloser Market Growth Factors

The growing adoption of solar and wind energy sources has led to an increased demand for reclosers in utility distribution grids. With the bi-directional power flow offered by renewable energy systems, reclosers play a crucial role in isolating faults and protecting the grid from disruptions.

For instance, in California, where solar power penetration is high, reclosers are essential for ensuring grid stability by managing the intermittent nature of solar generation. As renewable energy installations continue to rise globally, the demand for reclosers capable of handling bi-directional power flow is expected to increase.

Furthermore, the development of smart grids is driving the demand for advanced recloser solutions. Reclosers equipped with intelligent controls and communication capabilities can provide real-time data on grid health, enabling utilities to monitor and manage distribution networks more effectively. Automated fault isolation and self-healing functionality offered by smart reclosers enhance grid reliability and minimize downtime.

For instance, utilities in Germany and the U.S. are investing in smart grid technologies to optimize grid operations and improve service reliability, thus boosting the demand for smart recloser solutions.

- In June 2022, GE Industrial Solutions, GE's global electrification solutions company, was bought by ABB. This purchase broadened ABB's selection of sectionalizers and reclosers, used in mining, oil and gas, electric utilities, substations, and renewable energy applications.

However, lack of standardization and interoperability pose are the major challenges in integrating reclosers into smart grids. These issues can be resolved by harmonizing communication protocols and data formats among recloser manufacturers. Additionally, addressing the shortage of skilled personnel capable of handling advanced recloser technologies is essential.

Utility providers are aiming at establishing common standards and protocols for recloser communication while focusing on overcoming these challenges through industrial collaborations. Moreover, investments are being made to offer comprehensive training programs for utility personnel to enhance their proficiency in operating and maintaining recloser systems.

Recloser Market Trends

The adoption of remote monitoring and control capabilities is on the rise, which is supporting the growth of the recloser market. Utility providers are increasingly deploying reclosers equipped with sensors and communication modules to enable real-time monitoring of the grid as well as control operations remotely. This facilitates utilities to proactively detect faults, optimize grid performance, and minimize downtime.

For instance, NOJA Power offers reclosers with advanced remote monitoring features, enabling utilities to monitor grid health and diagnose issues remotely. This reduces maintenance costs and improves operational efficiency. Moreover, the growing demand for modular and scalable solutions, capable of adapting to varying grid requirements and evolving needs, is propelling the adoption of reclosers.

Utilities are actively seeking flexibility in deploying recloser systems tailored to specific voltage levels, load capacities, and grid configurations. Manufacturers are responding to this trend by offering modular recloser platforms that allow easy expansion and customization.

For instance, Eaton Corporation provides modular reclosers that can be adjusted as per utility requirements, enabling cost-effective upgrades and expansion of the grid infrastructure. This trend reflects the industry's shift toward agile and adaptable solutions to meet the dynamic challenges of modern grid environments.

Segmentation Analysis

The global recloser market has been segmented on the basis of phase type, voltage, control type, and geography.

By Phase Type

Based on phase type, the market has been bifurcated into single phase and three phase. Three phase segment garnered the highest revenue of USD 623.4 million in 2023. This dominance is due to its extensive deployment across transmission and distribution lines globally.

As the main component of power delivery infrastructure, three phase lines require robust fault isolation capabilities. Three-phase reclosers effectively address this by simultaneously interrupting faults across all three phases, thereby minimizing outage durations and protecting critical equipment.

Furthermore, the growing focus on grid modernization projects is fueling the growth of this segment. These projects prioritize grid reliability and resilience, aligning precisely with the functionalities offered by three-phase reclosers. While single-phase reclosers cater to specific applications, the widespread use of three-phase technology in core grid infrastructure will likely ensure its continued dominance in the foreseeable future.

By Voltage

Based on voltage, the market has been categorized into low, medium, and high voltage. The low segment captured the largest market share of 54.90% in 2023. This dominance can be attributed to the widespread deployment of low voltage reclosers in residential, commercial, and small-scale industrial applications.

With rapid urbanization and implementation of electrification initiatives in emerging economies, the demand for reliable electricity distribution systems at the low voltage level is growing. Additionally, the rise in renewable energy installations, particularly rooftop solar systems, is driving the adoption of low voltage reclosers to manage distributed generation and ensure grid stability.

For instance, in the residential sector, the proliferation of smart homes and IoT devices is expected to drive the adoption of reclosers to maintain uninterrupted power supply, thereby fueling demand within the low voltage segment.

By Control Type

Based on control type, the market has been divided into electronic and hydraulic. The electronic segment is projected to garner a revenue of USD 952.9 million by 2031. The increasing adoption of electronic recloser technologies driven by their superior performance, advanced features, and compatibility with smart grid applications, is propelling the growth of the segment.

Electronic reclosers offer faster operation, precise fault detection, and seamless integration with communication protocols, enabling utilities to improve grid reliability and efficiency. Moreover, the shift toward digitalization and automation in electricity distribution systems fuels the demand for electronic reclosers.

With utilities prioritizing grid modernization and resilience, electronic reclosers are expected to witness widespread adoption, thereby fueling the growth of the electronic segment in the recloser market.

Recloser Market Regional Analysis

Based on region, the global recloser market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Recloser market share stood at around 32.9% in 2023 in the global market, with a valuation of USD 301.6 million. The region is dominating the global recloser industry, supported by rapid urbanization, industrialization, and infrastructure development across major regions of China, India, and Southeast Asia.

The Asia Pacific Recloser market share stood at around 32.9% in 2023 in the global market, with a valuation of USD 301.6 million. The region is dominating the global recloser industry, supported by rapid urbanization, industrialization, and infrastructure development across major regions of China, India, and Southeast Asia.

The region's expanding population and rising energy demand are prompting investments in electricity distribution infrastructure, including recloser systems. Furthermore, favorable government initiatives promoting electrification and grid reliability are fueling the adoption of reclosers in the region.

Additionally, increasing renewable energy projects, particularly in China and India, are creating potential opportunities for recloser manufacturers to address grid stability challenges associated with intermittent power generation. With its burgeoning economies and growing energy needs, Asia-Pacific will likely maintain its market position.

North America emerged as a prominent region in the recloser market, accounting for a 28.56% share in 2023. Aging grid infrastructure coupled with rapid urbanization, is spurring investments in grid modernization projects, driving the demand for recloser solutions. Moreover, stringent regulations to enhance grid reliability and lower outage durations are incentivizing utilities to deploy advanced recloser technologies.

- In February 2023, Eaton Corporation declared an investment of USD 100 million in the construction of electrical production and distribution facilities in North America. The business intends to utilize the money to boost sales of its in-demand intelligent solutions, such as switchboards, load centers, circuit breakers, and residential solutions.

Additionally, the increasing adoption of renewable energy sources, such as solar and wind, is boosting the need for reclosers to tackle challenges associated with grid integration. Furthermore, the presence of key market players and a mature electricity distribution sector contribute to North America's global standing.

Competitive Landscape

The global recloser market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are undertaking effective strategic initiatives involving expansions & investments, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

List of Key Companies in Recloser Market

- Schneider Electric

- ABB

- Tavrida Electric

- Eaton

- NOJA Power Switchgear Pty Ltd

- Siemens

- S&C Electric Company

- Hubbell

- ARTECHE

- CG Power & Industrial Solutions Ltd

Recent development:

- In March 2024 (Expansion): NOJA Power Switchgear Pvt Ltd announced a new Distribution Centre Facility in its Brisbane headquarters. The strategy is expected to provide company a 50% increase in manufacturing floorspace, allowing it to meet growing demand for the Australian NOJA Power switchgear products.

The Global Recloser Market is Segmented as:

By Phase Type

By Voltage

By Control Type

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America