Market Definition

Radiotherapy is a medical treatment that uses high-energy radiation to kill or control the growth of cancer cells and reduce tumors. The market has been studied under external beam radiotherapy, internal radiotherapy (brachytherapy), and systemic radiotherapy segments. This treatment is primarily used to treat various cancers, reduce tumor size, relieve pain from metastases, and eliminate residual cancer cells after surgery.

Radiotherapy Market Overview

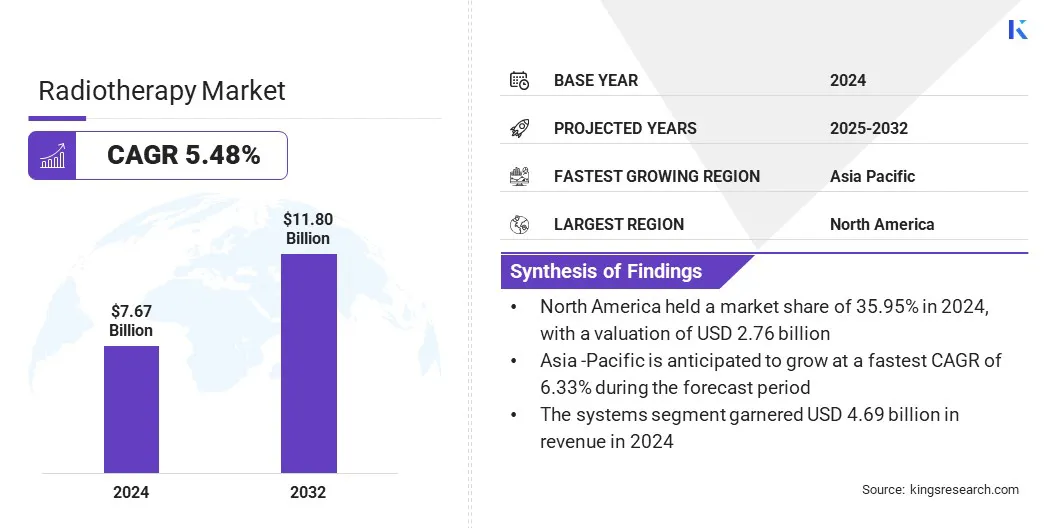

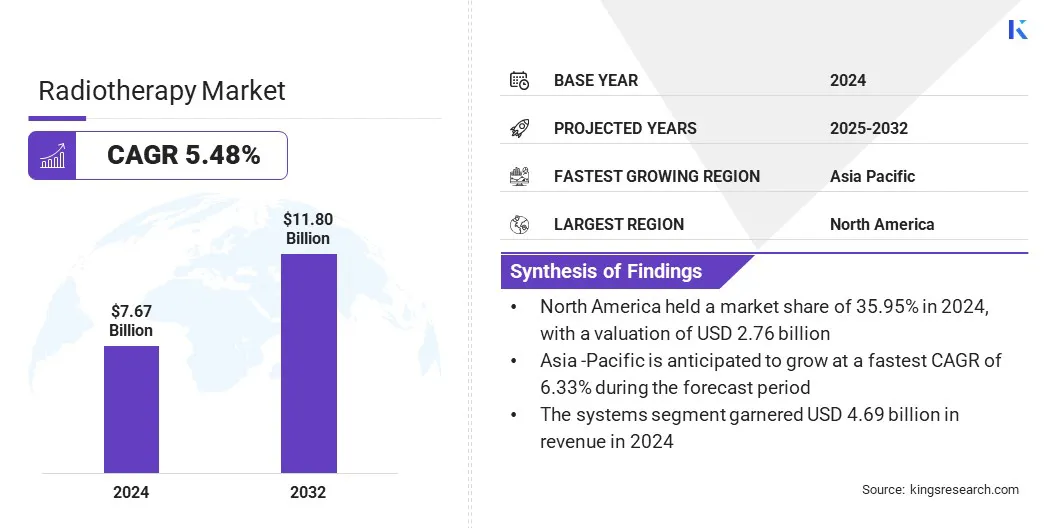

The global radiotherapy market size was valued at USD 7.67 billion in 2024 and is projected to grow from USD 8.07 billion in 2025 to USD 11.80 billion by 2032, exhibiting a CAGR of 5.48% over the forecast period.

Market growth is fueled by the rising incidence of cancer, which increases the demand for effective and advanced treatment options such as radiotherapy. The adoption of state-of-the-art radiotherapy equipment, including linear accelerators and proton therapy systems, is further driving this growth by improving treatment accuracy, efficiency, and patient care.

Key Highlights:

- The radiotherapy industry size was recorded at USD 7.67 billion in 2024.

- The market is projected to grow at a CAGR of 5.48% from 2024 to 2032.

- North America held a market of 35.95% in 2024, with a valuation of USD 2.76 billion.

- The systems segment garnered USD 4.69 billion in revenue in 2024.

- The external beam radiation therapy segment is expected to reach USD 4.92 billion by 2032.

- The cervical & gynecological cancers segment is anticipated to witness the fastest CAGR of 5.78% during the forecast period.

- The hospitals segment held a market of 33.24% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 6.33% through the forecast period.

Major companies operating in the radiotherapy market are Siemens, Elekta, Accuray Incorporated, IBA Worldwide, Mevion Medical Systems, Hitachi, Ltd, ViewRay Systems, Inc., BEBIG Medical, ZEISS Group, Mirion Technologies, Inc., Theragenics Corporation, RefleXion, Shinva Medical Instrument Co., Ltd, Best Medical International, Inc., and CQ Medical.

Public funding and initiatives are driving the market by supporting research and development of advanced treatment technologies. This has accelerated innovation, facilitated the adoption of cutting-edge radiotherapy solutions, and enhanced treatment precision, improving patient outcomes.

- The National Cancer Institute (NCI) allocated USD 7.22 billion in FY 2025 to support cancer research, including advancements in radiotherapy, boosting the development and adoption of advanced treatment technologies in the U.S.

Market Driver

Increasing Incidence of Cancer

A key factor influening the radiotherapy market is the rising incidence of cancer that increases the demand for effective treatment options. Hospitals and clinics are adopting advanced radiotherapy technologies, such as image-guided and intensity-modulated radiotherapy to improve treatment outcomes and reduce harm to healthy tissues. This growing focus on precise and targeted cancer treatment is facilitating wider adoption of radiotherapy solutions.

- The American Cancer Society (ACS) projects approximately 2,041,910 new cancer cases in the United States in 2025, reflecting a rising cancer burden and increasing demand for effective treatment options.

Market Challenge

High Cost of Advanced Radiotherapy Equipment and Treatments

A significant challenge impeding the progress of the radiotherapy market is the high cost of advanced equipment and treatments. Technologies such as linear accelerators, proton therapy systems, and adaptive radiotherapy require substantial capital investment for procurement, installation, and maintenance. These financial barriers can limit adoption, restrict patient access to innovative therapies, and slow market growth.

To address this challenge, market players are focusing on strategic partnerships, leasing models, and flexible financing options to reduce upfront investment for healthcare providers.

Companies are also developing more cost-effective, compact, and modular radiotherapy systems that require lower installation and maintenance expenses. They are offering training programs and technical support to optimize operational efficiency, enabling wider adoption of advanced technologies in hospitals and clinics.

Market Trend

Integration of AI and Imaging Technologies in Radiotherapy

A key trend influencing the radiotherapy market is the growing integration of AI and imaging technologies to enhance precision and personalization in cancer treatment. Healthcare providers are adopting AI-powered adaptive CT-Linacs and advanced imaging systems that adjust radiation doses in real time and accurately target tumors. This shift has improved patient outcomes, reduced side effects, and optimized treatment workflows.

- In May 2024, Elekta launched its AI-powered adaptive CT-Linac named Evo, featuring high-definition imaging and adaptive radiation therapy capabilities. The system enables precise, personalized cancer treatments and integrates with AI-driven planning software for improved treatment accuracy and efficiency.

Radiotherapy Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Systems, Services

|

|

By Type

|

External Beam Radiation Therapy, Internal Radiation Therapy, Systemic Radiation Therapy

|

|

By Application

|

Breast Cancer, Lung Cancer, Prostate Cancer, Head & Neck Cancer, Cervical & Gynecological Cancers, Others

|

|

By End User

|

Hospitals, Ambulatory & Radiotherapy Centers, Specialty Cancer Clinics, Academic & Research Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Systems and Services): The systems segment earned USD 4.69 billion in 2024, due to the increasing adoption of advanced radiotherapy technologies and rising cancer incidence.

- By Type (External Beam Radiation Therapy, Internal Radiation Therapy, and Systemic Radiation Therapy): The external beam radiation therapy segment held 42.17% of the market in 2024, due to widespread use in treating various cancers with high precision.

- By Application (Breast Cancer, Lung Cancer, Prostate Cancer, Head & Neck Cancer, Cervical & Gynecological Cancers, and Others): The breast cancer segment is projected to reach USD 3.53 billion by 2032, owing to its rising prevalence and early detection initiatives.

- By End User (Hospitals, Ambulatory & Radiotherapy Centers, Specialty Cancer Clinics, and Academic & Research Institutes): The ambulatory & radiotherapy centers segment is anticipated to witness the fastest CAGR of 5.78% during the forecast period, due to growing outpatient treatment demand and improved accessibility.

Radiotherapy Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America radiotherapy market stood at 35.95% in 2024, with a valuation of USD 2.76 billion. This dominance is attributed to advanced healthcare infrastructure and well-equipped oncology centers in the region. The region also benefits from the widespread adoption of state-of-the-art radiotherapy technologies, including linear accelerators, proton therapy, and image-guided systems, which enhance treatment precision and patient outcomes.

Rising cancer incidence and strong research and development investments are driving the demand and adoption of radiotherapy solutions across North America. Additionally, the focus on targeted and precision-based cancer therapies is driving investment in advanced radiotherapy and expanding treatment options, contributing to market expansion in the region.

- In May 2024, Novartis acquired Mariana Oncology to develop novel radioligand therapies (RLTs) for cancers with significant unmet patient needs. The acquisition aims to enhance Novartis’ RLT pipeline, expand its research capabilities, and advance next-generation targeted oncology treatments across breast, prostate, and lung cancers.

Asia Pacific radiotherapy industry is set to grow at a CAGR of 6.33% over the forecast period. This growth is attributed to the rising incidence of cancer and increasing patient awareness about early diagnosis and treatment.

Increasing collaborations between hospitals and technology providers are supporting the wider adoption of advanced radiotherapy solutions and precision cancer treatments. Additionally, expanding healthcare infrastructure and rising investments from governments and private sectors are enhancing access to radiotherapy services, collectively driving the market growth in the region.

- In August 2024, Sahyadri Hospitals launched Asia’s first TomoTherapy Radixact X9 system with VitalHold technology, featuring AI-driven imaging and motion management. The system provides enhanced precision for treating thoracic, abdominal, prostate, and pediatric cancers, improving treatment accuracy and patient outcomes.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates radiotherapy devices, including linear accelerators, brachytherapy sources, and imaging equipment. It oversees product safety, performance standards, clinical trial approvals, radiation dose accuracy, and post-market surveillance to ensure patient safety and compliance with federal health regulations.

- In the U.K., the Medicines and Healthcare Products Regulatory Agency (MHRA) regulates radiotherapy devices, including linear accelerators and brachytherapy equipment. It monitors safety standards, clinical evaluations, manufacturing compliance, risk assessment, and post-market surveillance, ensuring safe use of radiation in medical treatments, while promoting innovation and adherence to healthcare regulations.

- In China, the National Medical Products Administration (NMPA) regulates radiotherapy equipment, radioactive sources, and associated devices. It monitors device registration, safety standards, clinical trial approvals, quality control, and adverse event reporting, ensuring safety and effectiveness while supporting domestic innovation in medical technologies.

- In India, the Atomic Energy Regulatory Board (AERB) oversees radiotherapy equipment, radioactive sources, and facilities. It enforces safety protocols, licensing, radiation dose monitoring, equipment installation standards, and staff training requirements to protect patients, healthcare workers, and the environment from radiation hazards.

Competitive Landscape

Major players operating in the market are expanding their networks of cancer care centers across multiple countries to increase patient reach and improve service accessibility. They are enhancing oncology care quality by upgrading facilities and adopting advanced radiotherapy technologies.

Companies are also consolidating operations to strengthen their market presence and boost operational efficiency. Key players are pursuing strategic collaborations and acquisitions to accelerate growth and integrate specialized expertise to enhance treatment offerings.

- In April 2025, Fremman Capital acquired Amethyst, a leading European cancer care provider, to expand its 19-centre network across six countries and enhance delivery of high-quality, accessible radiotherapy. This reflects growing investment and consolidation in the European radiotherapy market.

Key Companies in Radiotherapy Market:

- Siemens

- Elekta

- Accuray Incorporated.

- IBA Worldwide

- Mevion Medical Systems

- Hitachi, Ltd

- ViewRay Systems, Inc

- BEBIG Medical

- ZEISS Group

- Mirion Technologies, Inc

- Theragenics Corporation

- RefleXion

- Shinva Medical Instrument Co., Ltd

- Best Medical International, inc

- CQ Medical.

Recent Developments (Product Launch)

- In May 2025, IBA launched the myQA Blue Phantom at ESTRO 2025, featuring the fastest automatic levelling and real-time positioning control for radiation therapy quality assurance. The system enhances precision, efficiency, and patient safety during treatment delivery.

- In October 2024, Aster DM Healthcare introduced the Intra-Operative Electron Radiation Therapy at Aster Whitefield Hospital, Bengaluru, providing focused radiation during surgery to decrease post-operative treatments and protect surrounding healthy tissues.

- In September 2024, RefleXion Medical delivered the world’s first single-plan multi-modality radiotherapy at Yale New Haven Health, combining SCINTIX biology-guided radiotherapy with stereotactic body radiotherapy (SBRT). This approach enables real-time monitoring and precise radiotherapy, reflecting advancements in adaptive treatment technologies.