Market Definition

The market involves software platforms designed to manage medical imaging data, patient scheduling, radiologist workflows, and reporting within diagnostic imaging departments. These systems streamline image tracking, examination records, billing, and result sharing across healthcare networks.

Radiology information systems are used in hospitals, diagnostic centers, and research institutions for managing high imaging volumes and ensuring regulatory compliance. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

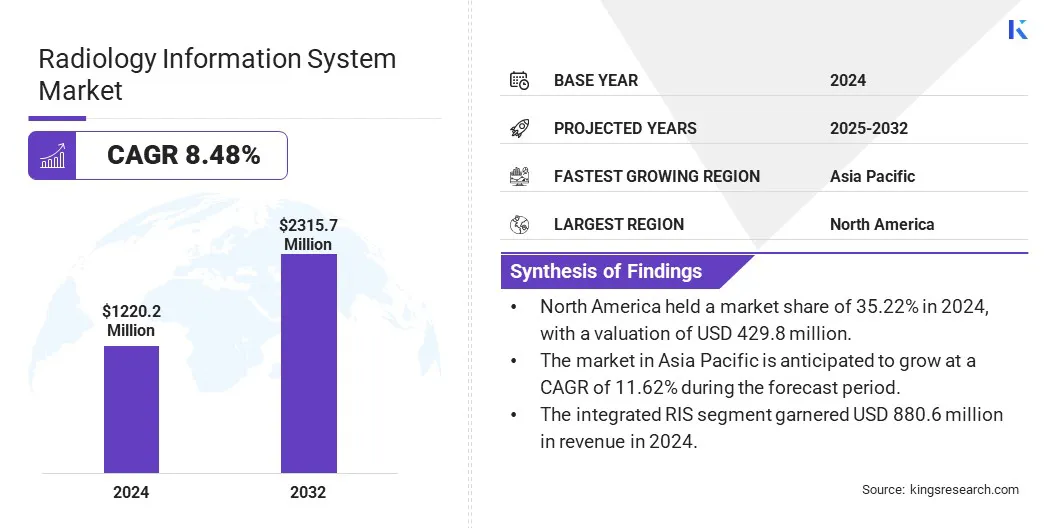

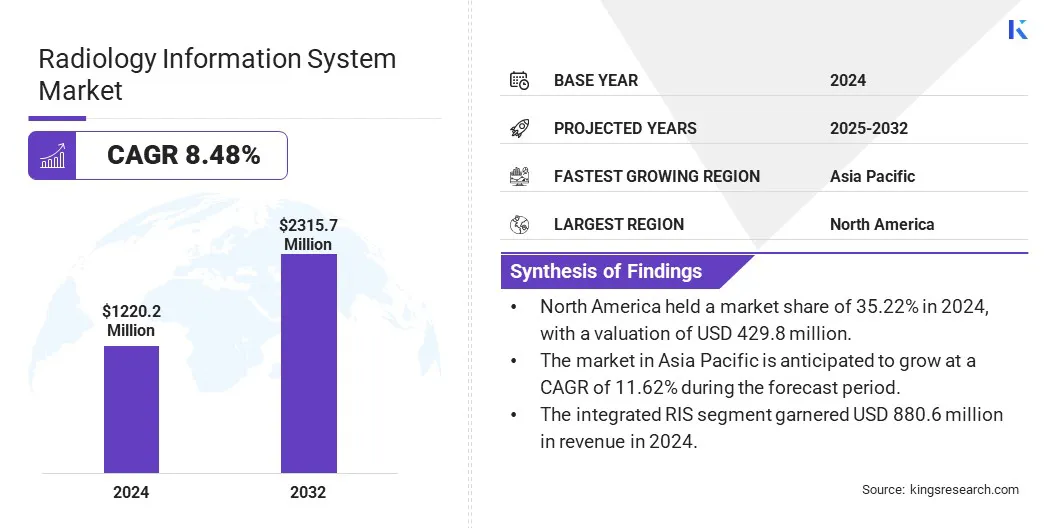

The global radiology information system market size was valued at USD 1,220.2 million in 2024 and is projected to grow from USD 1,310.1 million in 2025 to USD 2,315.7 million by 2032, exhibiting a CAGR of 8.48% during the forecast period.

The market is driven by increasing integration with Electronic Health Records (EHR), which enhances data accessibility and workflow efficiency. Additionally, the expansion of teleradiology and remote diagnostics is boosting demand, enabling faster and more flexible patient care across various healthcare settings.

Major companies operating in the radiology information system industry are Cerner Corporation, McKesson Corporation, Epic Systems Corporation, General Electric Company, Siemens, Koninklijke Philips N.V., IBM, Allscripts Healthcare Solutions, MedInformatix, Inc., eRAD, Inc., Pro Medicus Ltd., Carestream Health, Agfa-Gevaert Group, Sectra AB, and Intelerad.

The increasing number of diagnostic imaging procedures in hospitals and outpatient clinics is contributing to the growth of the market. Radiology departments are under pressure to manage higher volumes efficiently without compromising quality. Radiology information systems streamline imaging workflows, automate scheduling, and reduce turnaround times.

The need to handle and organize imaging data accurately across departments has become critical, encouraging greater adoption of integrated software solutions in medical imaging environments.

- In February 2025, DeepHealth, a subsidiary of RadNet, unveiled advanced AI-powered radiology informatics and population screening solutions at the European Congress of Radiology (ECR 2025) in Vienna. These innovations, built on the cloud-native DeepHealth OS, aim to enhance clinical workflows and operational efficiency in radiology departments.

Key Highlights

- The radiology information system industry size was valued at USD 1,220.2 million in 2024.

- The market is projected to grow at a CAGR of 8.48% from 2025 to 2032.

- North America held a market share of 35.22% in 2024, with a valuation of USD 429.8 million.

- The integrated RIS segment garnered USD 880.6 million in revenue in 2024.

- The on-premise segment is expected to reach USD 931.6 million by 2032.

- The software segment secured the largest revenue share of 68.13% in 2024.

- The diagnostic imaging centers is poised for a robust CAGR of 10.81% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 11.62% during the forecast period.

Market Driver

EHR Integration

The growing need for interoperability and centralized patient records is boosting the radiology information system market. Integration of RIS with EHR platforms enables seamless access to patient histories, imaging results, and treatment plans across care teams. This improves diagnostic accuracy and supports better clinical decisions.

Hospitals and imaging centers are increasingly investing in solutions that allow smooth data exchange, ensuring continuity of care and minimizing the risk of medical errors, which contributes to the market growth.

- In April 2024, AbbaDox partnered with Radiology Imaging Associates to improve radiology operations and patient care by integrating its Radiology Information System (RIS) platform. This integration will streamline key functions like appointment scheduling and automated patient communications. Additionally, the platform’s tailored workflows for breast and lung health, along with AI-driven follow-up recommendations, are expected to significantly enhance the quality of patient care.

Market Challenge

Data Security and Privacy Concerns

Ensuring robust data security and patient privacy is essential. RIS platforms handle sensitive medical information. They face risks from cyberattacks and data breaches, which can lead to legal and reputational damage.

Key market players are investing in advanced encryption technologies, implementing strict access controls, and complying with regional data protection regulations such as HIPAA and GDPR. Additionally, ongoing employee training and regular security audits help maintain system integrity and build trust with healthcare providers and patients, supporting steady market growth.

Market Trend

Expansion of Teleradiology and Remote Diagnostics

The expansion of teleradiology services is influencing the radiology information system market. With radiologists increasingly working across geographic locations, RIS platforms provide essential support for remote access, centralized data management, and communication between dispersed teams.

These systems facilitate quick sharing of imaging studies and allow faster report generation. The need for scalable RIS platforms is becoming more pronounced as healthcare systems embrace remote diagnostics and 24/7 radiology coverage.

- In May 2025, Konica Minolta Healthcare Americas, Inc. collaborated with NewVue to launch Exa Teleradiology, powered by NewVue, addressing the advanced requirements of modern teleradiology groups. Created specifically for distributed reading environments, Exa Teleradiology enhances the reading workflow across various systems and facilities, including imaging centers. This cloud-based solution offers a unified platform with more comprehensive integration capabilities than typical interfaced systems.

|

Segmentation

|

Details

|

|

By Product Type

|

Integrated RIS, Standalone RIS

|

|

By Deployment Mode

|

On-premise, Cloud-based, Web-based

|

|

By Component

|

Software, Services

|

|

By End User

|

Hospitals, Outpatient Clinics, Diagnostic Imaging Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Integrated RIS and Standalone RIS): The integrated RIS segment earned USD 880.6 million in 2024, due to its ability to streamline workflows by combining multiple functionalities into a single platform.

- By Deployment Mode (On-premise, Cloud-based, and Web-based): The on-premise segment held 47.12% share of the market in 2024, as healthcare providers prefer greater control over data security, customization, and integration with existing hospital infrastructure.

- By Component (Software and Services): The software segment is projected to reach USD 1,429.1 million by 2032, owing to its critical role in managing, storing, and analyzing medical imaging data efficiently.

- By End User (Hospitals, Outpatient Clinics, Diagnostic Imaging Centers, and Others): The diagnostic imaging centers segment is poised for significant growth at a CAGR of 10.81% through the forecast period, due to their high volume of imaging procedures and growing demand for efficient, centralized management of patient data and workflows.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America radiology information system market share stood at around 35.22% in 2024, with a valuation of USD 429.8 million. The well-established healthcare infrastructure in North America provides a strong foundation for the growth of the regional market.

Hospitals and imaging centers in the region are equipped with cutting-edge diagnostic tools, creating a demand for sophisticated RIS solutions that can efficiently manage complex imaging workflows. The existing technology landscape encourages rapid adoption of innovative software platforms, making the region a key market for advanced radiology IT systems.

Healthcare providers in North America prefer using cloud-based RIS platforms to enhance data accessibility, reduce IT costs, and support remote collaboration. This growing preference for scalable, secure cloud solutions accelerates the growth of the regional market by allowing easier integration with other healthcare IT systems and facilitating teleradiology services across multiple locations.

The radiology information system industry in Asia Pacific is poised for significant growth at a robust CAGR of 11.62% over the forecast period. Asia Pacific is registering fast growth in healthcare infrastructure, including new hospitals and diagnostic centers.

This expansion creates strong demand for RIS solutions to support efficient management of increasing imaging workflows. Modern medical facilities prioritize digital tools that enhance coordination and improve diagnostic processes, driving the demand for RIS adoption.

- In January 2025, Philips introduced the AI-enabled CT 5300 at the 23rd Asian Oceanian Congress of Radiology. This 128-slice system features a nano-panel precise detector and advanced AI capabilities, including AI reconstruction and smart workflows, aiming to improve imaging quality and efficiency.

Several governments in Asia Pacific are actively promoting digital healthcare through policy frameworks and funding programs. These initiatives encourage hospitals and clinics to implement IT solutions such as RIS to improve patient care and data management.

Regulatory Frameworks

- In the U.S., the market is governed by the Health Insurance Portability and Accountability Act (HIPAA), which mandates strong protection for patient data privacy and security. The 21st Century Cures Act enforces interoperability and access to health data. Additionally, the Mammography Quality Standards Act (MQSA) imposes strict standards for radiology workflows in mammography, impacting how RIS platforms handle documentation and reporting.

- The European Union’s General Data Protection Regulation (GDPR) establishes a unified data privacy framework across member states, requiring all RIS platforms to implement strong consent protocols, data encryption, and user access controls. Additionally, RIS is classified as a medical device under the Medical Device Regulation (EU) 2017/745. This subjects vendors to rigorous safety, clinical evaluation, and post-market surveillance requirements before and after RIS deployment.

- China regulates the RIS market through its Cybersecurity Law and the Data Security Law. These laws require data localization, meaning patient data managed by RIS must be stored within Chinese territory. Additionally, medical devices, including RIS, are regulated by the National Medical Products Administration (NMPA), which enforces strict safety and performance requirements. Vendors must align with national IT standards and comply with regulatory processes before market entry.

- In Japan, the Act on the Protection of Personal Information (APPI) governs how personal health data is handled within RIS platforms, requiring transparency, security, and user consent. The Ministry of Health, Labour and Welfare (MHLW) regulates RIS as medical devices, enforcing strict approval and monitoring protocols. Japan is also advancing regulatory guidelines to allow limited use of anonymized data from RIS for research and AI.

Competitive Landscape

Leading players are adopting strategies such as integrating advanced AI tools into their platforms, forming strategic partnerships, and focusing on enhancing workflow efficiencies. These strategies contribute to the market growth by improving clinical decision-making and operational performance. Such strategic moves enable companies to offer more innovative, user-friendly solutions that meet the evolving needs of healthcare providers and radiologists globally.

- In November 2024, Intelerad launched InteleGence, a platform designed to integrate best-of-breed AI algorithms into radiology workflows. This initiative aims to enhance operational and clinical efficiencies by providing radiologists with advanced tools to support decision-making processes. InteleGence represents Intelerad's commitment to advancing AI-driven solutions in radiology.

List of Key Companies in Radiology Information System Market:

- Cerner Corporation

- McKesson Corporation

- Epic Systems Corporation

- General Electric Company

- Siemens

- Koninklijke Philips N.V.

- IBM

- Allscripts Healthcare Solutions

- MedInformatix, Inc.

- eRAD, Inc.

- Pro Medicus Ltd.

- Carestream Health

- Agfa-Gevaert Group

- Sectra AB

- Intelerad

Recent Developments (Product Launches)

- In August 2024, Pro Medicus introduced new capabilities in its Visage RIS, reinforcing its AI readiness for the Visage 7 platform. These enhancements aim to streamline radiology workflows and improve diagnostic accuracy by integrating AI algorithms into the RIS.

- In December 2024, Sectra presented its next-generation enterprise imaging solutions at the RSNA 2024 conference. The company highlighted advancements in its radiology information system, focusing on enhancing diagnostic workflows and improving accessibility to imaging data. Sectra's innovations aim to support radiologists in delivering timely and accurate diagnoses.