Market Definition

Protein engineering involves designing and modifying proteins to meet specific requirements of structure, function, or stability. It uses molecular biology, bioinformatics, and chemical engineering to create proteins with enhanced therapeutic and industrial value.

The field covers applications in drug discovery, enzyme development, and vaccine formulation, enabling the production of more effective biologics. Its use extends to pharmaceuticals, biotechnology, agriculture, and diagnostics, supporting innovation in healthcare solutions and industrial bioprocesses.

Protein Engineering Market Overview

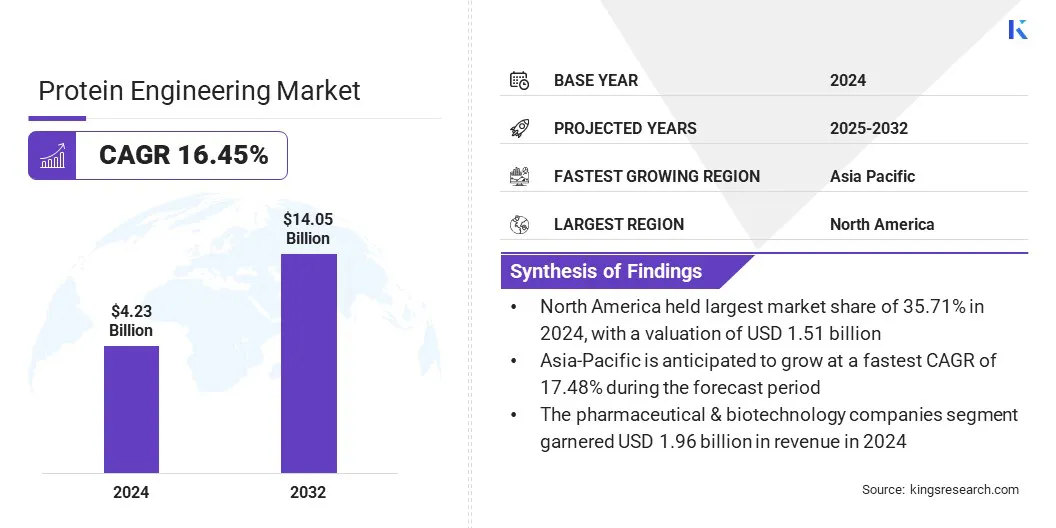

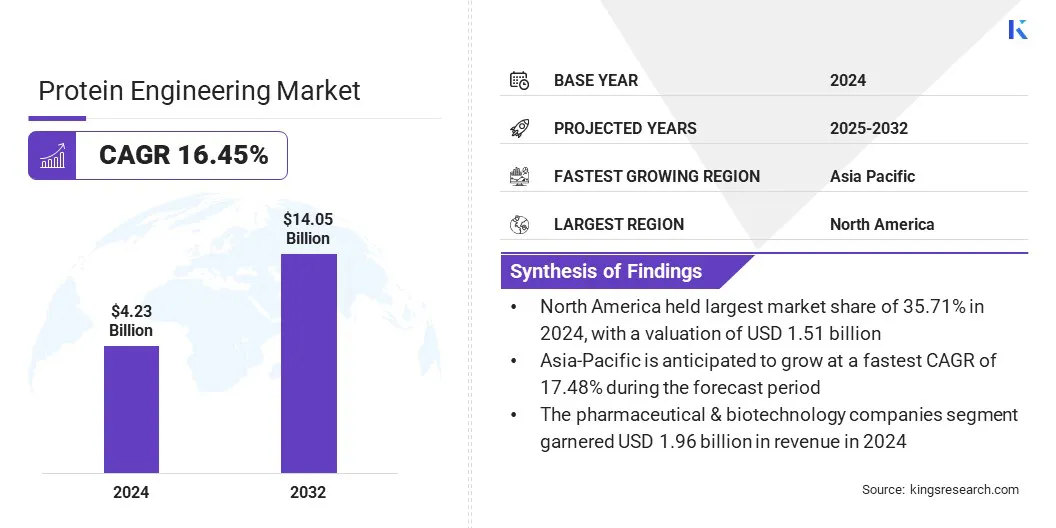

The global protein engineering market size was valued at USD 4.23 billion in 2024 and is projected to grow from USD 4.84 billion in 2025 to USD 14.05 billion by 2032, exhibiting a significant CAGR of 16.45% during the forecast period.

This growth is attributed to the rising demand for therapeutic proteins such as monoclonal antibodies, vaccines, and insulin, supported by advancements in rational design and directed evolution technologies. Increasing applications in drug discovery, diagnostics, and biopharmaceutical production are driving adoption across pharmaceutical and biotechnology companies.

Key Highlights

- The protein engineering industry size was valued at USD 4.23 billion in 2024.

- The market is projected to grow at a CAGR of 16.45% from 2024 to 2032.

- North America held a market share of 35.71% in 2024, valued at USD 1.51 billion.

- The instruments segment garnered USD 1.79 billion in revenue in 2024.

- The rational protein design segment is expected to reach USD 5.56 billion by 2032.

- The vaccines segment is anticipated to witness the fastest CAGR of 17.43% during the forecast period.

- The pharmaceutical & biotechnology companies segment garnered USD 1.96 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 17.48% through the projection period.

Major companies operating in the protein engineering market are Lonza, GenScript, Agilent Technologies, Inc., Evotec SE, Eurofins Discovery, Bio-Techne, Charles River Laboratories, Amgen Inc., DH Life Sciences, LLC., Codexis, Inc., Thermo Fisher Scientific Inc., Eli Lilly and Company, Abzena, DNA TwoPointO, Inc., and Creative BioMart.

Additionally, the growing emphasis on improving protein stability, enhancing process efficiency, and enabling cost-effective biopharmaceutical development is supporting wider utilization. Additionally, continuous innovations in computational modeling, integration of artificial intelligence, and expanding research collaborations are accelerating market growth.

- In February 2025, Capgemini announced a generative AI-driven breakthrough in protein engineering, powered by a specialized protein large language model that cuts data requirements by over 99%. The approach significantly reduces development timelines and costs, enabling faster innovation and broader access to advanced biotechnology solutions.

Market Driver

Surging Requirement for Engineered Protein Therapeutics

The growth of the protein engineering market is mainly propelled by the rising demand for therapeutic proteins to address chronic and infectious diseases. Engineered proteins such as monoclonal antibodies, insulin analogs, vaccines, and growth factors provide enhanced efficacy, reduced side effects, and improved patient outcomes compared to conventional treatments.

Therefore, pharmaceutical and biotechnology companies are increasingly investing in advanced protein design and modification techniques to accelerate the development of next-generation biologics.

Advancements in rational and semi-rational design technologies are also enabling the creation of stable, cost-effective, and scalable protein therapeutics. This accelerating shift toward engineered proteins is positioning them as critical solutions in modern healthcare, fueling strong industry growth across both established and emerging markets.

- In January 2025, Bio-Techne announced the expansion of its R&D Systems portfolio with AI-engineered designer proteins, such as IL-2 Heat Stable Agonist, Activin A Hyperactive, FGF basic Heat Stable (RUO and GMP), and Wnt/RSPO agonists. These next-generation proteins are optimized for improved heat stability, activity, and receptor affinity to support advances in cell therapy and regenerative medicine

Market Challenge

Complexity of Protein Design and Optimization

The complexity of protein design and optimization creates a significant barrier to the growth of the protein engineering market. Small modifications in protein sequences can cause unpredictable changes in folding, stability, and activity, often resulting in extensive trial-and-error processes. These challenges increase development time, research costs, and make it difficult for smaller organizations to compete with well-resourced pharmaceutical and biotechnology companies.

Industries relying on engineered proteins for therapeutics, enzymes, and vaccines face additional hurdles, as the precision required for safety and efficacy demands advanced expertise and technologies. The shortage of skilled professionals and limited accessibility to high-throughput screening or computational modeling tools further intensify these difficulties.

To address these constraints, researchers and companies are increasingly investing in AI-driven protein modeling, next-generation screening platforms, and improved bioinformatics resources. These advancements aim to streamline optimization processes, enhance predictability, and make protein engineering more efficient and commercially viable.

- In December 2024, AI Proteins Inc. entered a research collaboration and option agreement with Bristol Myers Squibb to develop miniprotein-based therapeutics. Utilizing its AI-driven platform, AI Proteins will design and optimize miniproteins for two undisclosed targets. These high-affinity miniproteins aim to offer advantages over traditional antibody-based therapies.

Market Trend

Expansion of Monoclonal Antibody and Vaccine Engineering

The protein engineering market is witnessing strong momentum in monoclonal antibody and vaccine innovation, supported by rising demand for advanced biologics in oncology, infectious diseases, and autoimmune conditions.

Engineered antibodies are being optimized for higher specificity, lower immunogenicity, and improved safety, while next-generation vaccines are designed using recombinant proteins and subunit approaches that deliver better efficacy profiles. This trend has gained further traction in the wake of global health crises, where rapid-response vaccine development has become a strategic priority for governments and pharmaceutical companies.

Manufacturers and research organizations are investing in advanced protein design tools, high-throughput platforms, and collaborative development models to accelerate therapeutic and vaccine pipelines. The continuous refinement of antibody engineering and vaccine technologies is positioning protein engineering as a cornerstone of modern drug discovery and public health preparedness, creating sustained opportunities for growth in the years ahead.

Protein Engineering Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Instruments, Consumables/Reagents, and Software & Services

|

|

By Technology

|

Rational Protein Design, Irrational/Directed-Evolution Design, and Hybrid/Semi-Rational Design

|

|

By Protein Type

|

Insulin, Vaccines, Monoclonal Antibodies, Colony Stimulating Factors, Interferon, and Others

|

|

By End Use

|

Academic Research Institutes, Contract Research Organizations (CROs), and Pharmaceutical & Biotechnology Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Instruments, Consumables/Reagents, and Software & Services): The instruments segment earned USD 1.79 billion in 2024 due to rising adoption of advanced analytical and screening systems for precise protein design and optimization.

- By Technology (Rational Protein Design, Irrational/Directed-Evolution Design, and Hybrid/Semi-Rational Design): The rational protein design held 41.23% of the market in 2024, due to its ability to leverage computational modeling and structural biology for precise and efficient protein modification.

- By Protein Type (Insulin, Vaccines, Monoclonal Antibodies, Colony Stimulating Factors, Interferon, and Others): The monoclonal antibodies segment is projected to reach USD 3.99 billion by 2032, owing to their expanding use in targeted therapies for cancer, autoimmune, and infectious diseases, supported by continuous advancements in antibody engineering technologies.

- By End Use (Academic Research Institutes, Contract Research Organizations (CROs), and Pharmaceutical & Biotechnology Companies): The contract research organizations (CROs) segment is anticipated to grow at a CAGR of 16.87% through the projection period, driven by increasing outsourcing of protein engineering services to reduce development costs and accelerate drug discovery timelines.

Protein Engineering Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America protein engineering market share stood at 35.71% in 2024, valued at USD 1.51 billion. This leadership is reinforced by strong research capabilities, high adoption of advanced biotechnologies, and a well-established pharmaceutical and biotechnology sector. The region benefits from robust investments in therapeutic protein development, particularly in monoclonal antibodies and vaccines, which are driving innovation and clinical adoption.

- In August 2025, the U.S. National Science Foundation (NSF) invested nearly USD 32 million through its Use-Inspired Acceleration of Protein Design (USPRD) initiative to advance AI-driven protein design. The funding supports five U.S. research teams in applying AI approaches to biomanufacturing, advanced materials, and other key industries, aiming to strengthen the national bioeconomy.

Supportive regulatory policies, extensive academic-industry collaborations, and the presence of major contract research organizations further strengthen growth prospects. Continuous advancements in computational biology, automation, and high-throughput screening position North America as a critical hub for protein engineering advancements.

- In January 2025, Profluent, a U.S.-based company, introduced Protein2PAM, an AI model that engineers protein-DNA interactions without iterative laboratory screening. Trained on 45,816 protein-PAM pairs, the model enables single-shot customization of Cas enzymes for alternate PAM recognition, enhancing CRISPR editing flexibility and supporting faster therapeutic development.

Asia-Pacific is poised for significant growth at a CAGR of 17.48% over the forecast period. This growth is fueled by rising demand for therapeutic proteins, increasing R&D investments, and the expansion of pharmaceutical manufacturing capabilities in emerging economies. The biotechnology sector is being strengthened by government funding, infrastructure development, and academic-industry collaborations.

The presence of a large patient pool and growing adoption of biologics are creating strong opportunities for protein engineering applications in healthcare. In addition, advancements in computational tools, automation, and enzyme engineering for industrial use are accelerating innovation, positioning Asia-Pacific as a key growth engine for the global market.

Regulatory Frameworks

- In the European Union, Regulation (EC) No 726/2004 regulates the authorization and supervision of medicinal products. It provides a centralized approval pathway for biologics, making it highly relevant to protein engineering services involved in therapeutic protein development.

- In Japan, the Pharmaceuticals and Medical Devices Act regulates biologics and medical innovations. It sets out requirements for clinical trials and market authorization, impacting protein engineering services that focus on therapeutic protein and vaccine design.

- In the U.S., the Food, Drug, and Cosmetic Act regulates biologics and therapeutic proteins. It establishes safety, efficacy, and quality requirements, ensuring that protein engineering services used in drug development and antibody design meet strict regulatory standards.

Competitive Landscape

Companies operating in the protein engineering industry are maintaining competitiveness through investments in advanced computational tools, artificial intelligence-driven protein modeling, and high-throughput screening technologies. They are focusing on developing engineered proteins with improved stability, specificity, and therapeutic efficacy to meet rising demand in pharmaceuticals, biotechnology, and industrial applications.

Key players are expanding their portfolios to include monoclonal antibodies, vaccines, enzymes, and other engineered proteins, supported by strategic collaborations, acquisitions, and joint ventures.

Focus is being placed on strengthening partnerships with academic institutions and contract research organizations to accelerate innovation and reduce development timelines. Additionally, companies are enhancing customer-focused solutions, technical expertise, and integrated service offerings, while leveraging digital platforms and automation to achieve greater efficiency and sustain a competitive advantage.

- In December 2023, Arbor Biotechnologies announced a collaboration with Ginkgo Bioworks to advance precision gene editors. The partnership leverages Ginkgo's high-throughput Mammalian Foundry to optimize Arbor’s editors, featuring unique PAMs, varied cut types, smaller editing technologies, and high specificity for broad therapeutic applications.

Key Companies in Protein Engineering Market:

- Lonza

- GenScript

- Agilent Technologies, Inc.

- Evotec SE

- Eurofins Discovery

- Bio-Techne

- Charles River Laboratories

- Amgen Inc.

- DH Life Sciences, LLC.

- Codexis, Inc.

- Thermo Fisher Scientific Inc.

- Eli Lilly and Company

- Abzena

- DNA TwoPointO, Inc.

- Creative BioMart

Recent Developments (Collaborations/Partnerships)

- In August 2025, LeadXpro and Orbion announced a collaboration to enhance membrane protein production through advanced protein engineering. The partnership combines structural biology and engineering expertise to improve protein quality and yield, accelerating drug discovery and therapeutic development.

- In June 2025, Cradle partnered with Google Cloud to enhance the security of its AI-driven protein engineering platform. The collaboration leverages advanced data protection solutions to safeguard sensitive R&D data while enabling Cradle to focus on advancing its AI algorithms.

- In March 2025, AMSilk and BRAIN Biotech announced the first-phase success of their collaboration, optimizing a natural structural protein for high-performance fibers. Using rational protein engineering and AI-driven bioinformatics, the partnership secured a PCT patent and aims to deliver biodegradable, recyclable alternatives to fossil-based textiles.

- In September 2023, Navigo Proteins partnered with Nostrum Biodiscovery to advance Affilin ligand discovery through AI and molecular modeling techniques. The collaboration focuses on developing de novo ubiquitin-based ligands to streamline the production of high-affinity, highly specific binders for next-generation therapeutic applications.