Propionic Acid Market Size

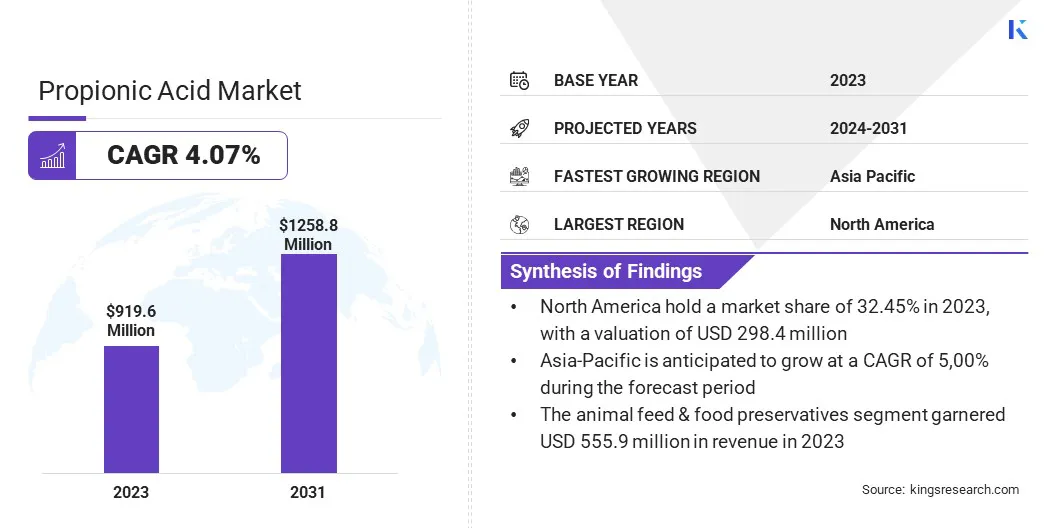

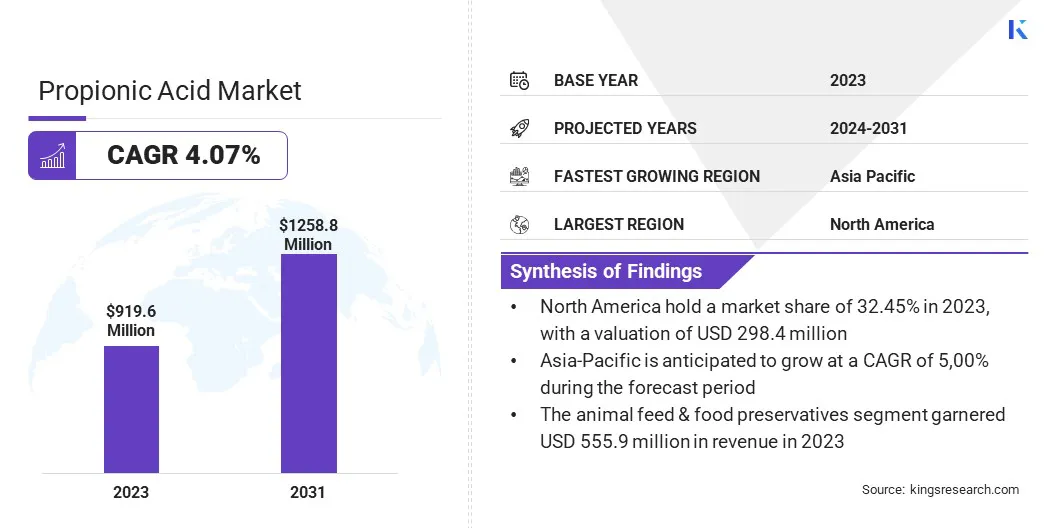

The global Propionic Acid Market size was valued at USD 919.6 million in 2023 and is projected to grow from USD 952.0 million in 2024 to USD 1,258.8 million by 2031, exhibiting a CAGR of 4.07% during the forecast period. In the scope of work, the report includes products offered by companies such as Celanese Corporation, BASF SE, Daicel Corporation, Dow, Eastman Chemical Company, Merck KGaA, Hawkins, OQ Chemicals GmbH, Perstorp, Yancheng Hongtai Bioengineering Co., Ltd and others.

The market is experiencing significant growth across food preservation, cosmetics, and pharmaceutical sectors. Its role in inhibiting mold and bacterial growth in animal feed, as well as in preserving cosmetic formulations, underscores its critical importance in maintaining product quality and safety standards, particularly in the face of rising global demands.

The propionic acid market is growing rapidly due to its critical role in various industries such as food preservation, cosmetics, and pharmaceuticals. As global food demands continue to rise, propionic acid's effectiveness in inhibiting mold and bacterial growth in animal feed becomes increasingly essential. In the cosmetics sector, it serves as a key preservative, ensuring product stability and extending shelf life.

This versatility across industries underscores propionic acid's significance in maintaining product quality and safety standards. With continual advancements in production technologies and growing consumer awareness regarding product safety, the market for propionic acid is expected to witness sustained growth and innovation to meet evolving industrial needs globally.

- For instance, according to Eurostat, cheese production in the EU reached 10.43 million tons in 2022, marking a 0.5% decrease compared to 2021.

- According to Cosmetics Europe, the European cosmetics and personal care market was valued at EUR 88 billion (USD 92.7344 billion) in 2022, making it the largest market for cosmetic products globally.

The growing European cosmetics and personal care market is driving demand for propionic acid, which is widely used as a preservative and antimicrobial agent in cosmetic products. This strong market demand is significantly propelling the growth of the propionic acid market.

Propionic acid, also known as propionic acid, is a carboxylic acid widely utilized across various industries due to its antimicrobial properties and its role as a food preservative. It is a clear, colorless liquid with a pungent odor, derived primarily through bacterial fermentation of sugars. In the food industry, propionic acid effectively inhibits mold and bacterial growth, thereby extending the shelf life of products such as bread, cheese, and animal feed.

Beyond food preservation, it is employed in pharmaceuticals to control acidity and in cosmetics to prevent microbial contamination. Its versatility and effectiveness make propionic acid a key component in maintaining product quality and safety across diverse applications.

Analyst’s Review

The propionic acid market is experiencing notable growth, fueled by its diverse applications across various industries. A key driver propelling this growth is its pivotal role in food preservation and cosmetic formulations. Propionic acid, derived naturally through bacterial fermentation, enhances the flavor profile of Swiss cheese and also serves as a crucial preservative in the food industry. In the cosmetics sector, propionic acid's ability to inhibit bacterial growth and regulate pH levels is pivotal in preserving the integrity of cosmetic formulations.

- The European cosmetics and personal care market, valued at USD 92.7344 billion in 2022 according to Cosmetics Europe, stands as the largest global market for cosmetic products.

This substantial market size underscores the significant role of propionic acid in supporting the growth of the industry.

Propionic Acid Market Growth Factors

As the agricultural sector continues to expand in order to meet the growing global food demands, there is a rising need for effective feed preservatives. This rising demand is propelling market growth, as feed preservatives such as propionic acid are essential for ensuring the longevity and safety of animal feed.

By preventing mold and bacterial growth, propionic acid directly impacts livestock health and productivity, making it a critical component in maintaining high-quality feed. The increasing need for such preservatives is fostering market expansion, highlighting the essential role of propionic acid in sustaining the global food supply chain and addressing the increasing demands of food consumption.

- According to the fourth advance estimates for 2021-22 released by the Ministry of Agriculture's India, notable production figures include 130.29 million tons of rice, 33.62 million tons of maize, and 9.62 million tons of bajra.

However, fluctuating feedstock prices present a significant hurdle to the development of the propionic acid market. Propionic acid production heavily relies on raw materials such as ethylene, whose prices can exhibit significant volatility attributed to factors such as global energy markets and supply chain disruptions.

To navigate this challenge, robust supply chain management with diversified sourcing and inventory control is crucial. Additionally, exploring alternative, cost-stable feedstock options through research and development is expected to fuel market growth in the coming years.

Propionic Acid Market Trends

Increasing consumer awareness and mounting concerns regarding synthetic preservatives are on the rise. This trend is propelling the demand for natural preservatives such as propionic acid in the food and beverage industry. This shift is evident in the increasing use of clean label messaging on product packaging, highlighting the absence of artificial ingredients.

Manufacturers are reformulating products to incorporate propionic acid and cater to this growing consumer preference. Propionic acid suppliers are well-positioned to benefit from this trend, with the propionic acid market anticipated to witness a surge in demand for natural and safe food preservation solutions.

Technological advancements in feed production are significantly enhancing the efficacy and adoption of propionic acid as a preservative. Innovations such as improved formulation techniques and advanced delivery methods are increasing the efficiency of propionic acid in preventing mold and bacterial growth. These technological improvements are boosting market growth by providing more reliable and effective feed preservation solutions.

Agricultural producers are increasingly incorporating propionic acid into their feed management practices to ensure higher quality and longer-lasting feed, thus supporting the overall productivity and profitability of livestock farming operations.

Segmentation Analysis

The global market is segmented based on application, end-use industry, and geography.

By Application

Based on application, the propionic acid market is categorized into animal feed & food preservatives, chemical intermediates, herbicides, and others. The animal feed & food preservatives segment garnered the highest revenue of USD 555.9 million in 2023 largely attributed to its effectiveness in inhibiting mold and bacterial growth.

As a food preservative, propionic acid extends the shelf life of bakery products, cheese, and animal feed, thereby ensuring product safety and quality. In the animal feed sector, it serves to prevent spoilage, thereby maintaining nutritional integrity and supporting livestock health.

This segment benefits from increasing global food demands and stringent regulations mandating food safety standards. Propionic acid's prominence in these applications underscores its significance in sustaining the efficiency and safety of the food supply chain worldwide.

By End-Use Industry

Based on end-use industry, the market is divided into food & beverage, healthcare & pharmaceuticals, animal nutrition, cosmetics & personal care, agriculture, and others. The food & beverage segment captured the largest propionic acid market share of 34.67% in 2023. The segmental growth is bolstered by its role as a preservative that inhibits mold and bacterial growth in various food products.

Propionic acid extends the shelf life of bread, dairy products such as cheese, and processed meats, ensuring they remain safe for consumption. This growth is further facilitated by the increasing consumer demand for convenient and safe food options, leading to the increased need for effective preservatives.

Additionally, stringent food safety regulations worldwide mandate the use of reliable preservatives such as propionic acid. Its versatile application and effectiveness in food preservation underscore its critical role in maintaining food quality and meeting regulatory standards globally.

Propionic Acid Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America propionic acid market share stood around 32.45% in 2023 in the global market, with a valuation of USD 298.4 million. The region's advanced food processing sector relies heavily on propionic acid for effective food preservation, ensuring safety and extending shelf life. Stringent regulatory standards further contribute to this demand, reinforcing the necessity for reliable preservatives.

Additionally, the pharmaceutical and cosmetics industries utilize propionic acid for its antimicrobial properties, which enhance product stability and efficacy. With a mature industrial infrastructure and a focus on innovation, North America continues to foster market expansion by setting high standards for product quality and safety in food, pharmaceuticals, and cosmetics sectors.

- According to data published by the Food and Agriculture Organization of the United Nations, feeding a world population of 9.1 billion people by 2050 will require increasing food production by approximately 70%

This highlights the growing need for effective food preservation methods such as propionic acid.

Asia-Pacific is anticipated to witness the fastest growth, depicting a CAGR of 5.00% over the forecast period. This notable expansion is augmented by rising disposable incomes and an increasing demand for packaged food products in developing economies such as China and India. As consumer preferences evolve and the middle class population expands in these regions, there is an increasing need for effective food preservation solutions such as propionic acid.

This trend signifies a well-distributed market and highlights significant potential for further expansion and investment opportunities in developing regions, positioning the Asia Pacific as a major region in the propionic acid market.

Competitive Landscape

The propionic acid market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Propionic Acid Market

Key Industry Development

- October 2022 (Product Launch): BASF introduced neopentyl glycol (NPG) and propionic acid (PA) with a zero-product carbon footprint (PCF), manufactured at its Ludwigshafen Verbund facility in Germany. These products, named NPG ZeroPCF and PA ZeroPCF, were made available worldwide. This initiative demonstrated BASF's commitment to sustainability by offering environmentally friendly options. By reducing carbon emissions associated with production, BASF aimed to meet the growing demand for sustainable chemicals while supporting global efforts to combat climate change.

The global propionic acid market is segmented as:

By Application

- Animal Feed & Food Preservatives

- Chemical Intermediates

- Herbicides

- Others

By End-Use Industry

- Food & Beverage

- Healthcare & Pharmaceuticals

- Animal Nutrition

- Cosmetics & Personal Care

- Agriculture

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America