Market Definition

Process mining software refers to tools that help organizations analyze and visualize their business processes. These tools work by extracting data from IT systems and then mapping, modeling, and analyzing the actual flow of business activities.

Process mining software allows businesses to get insights into their existing workflows; identify inefficiencies, bottlenecks, and opportunities for improvement; and ensure that processes are being followed as designed.

Process Mining Software Market Overview

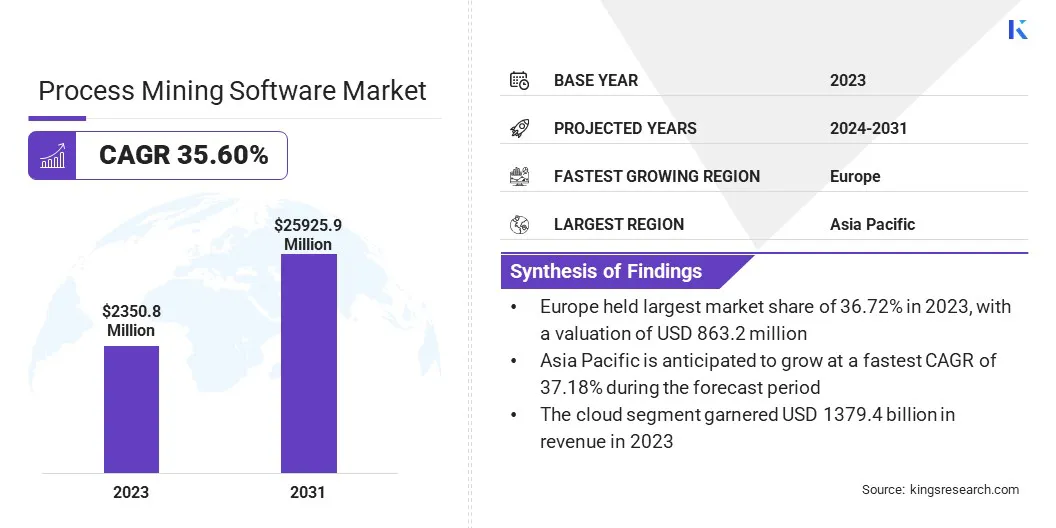

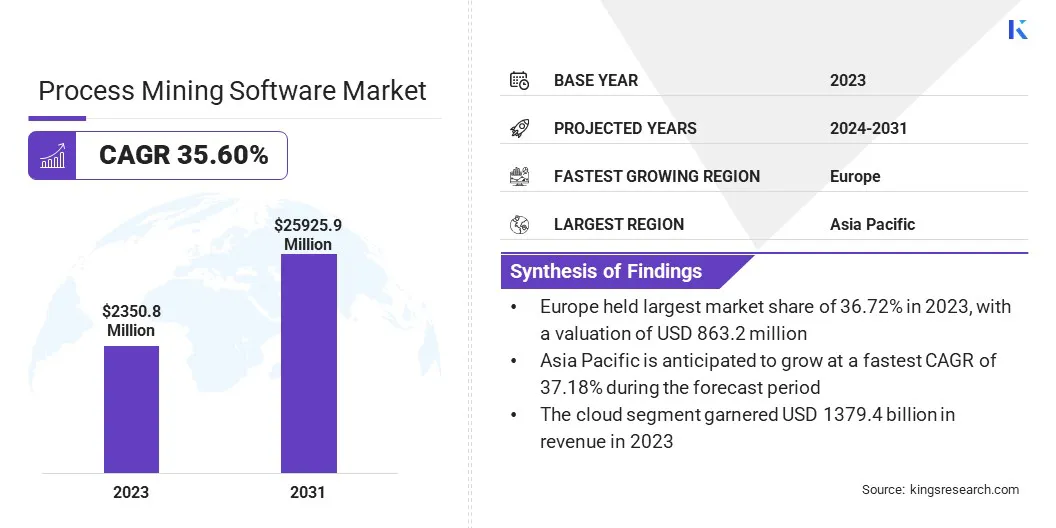

The global process mining software market size was valued at USD 2,350.8 million in 2023, which is estimated to be valued at USD 3,074.9 million in 2024 and reach USD 25,925.9 million by 2031, growing at a CAGR of 35.60% from 2024 to 2031.

The growing need for improved process visibility and transparency drives the market. Organizations seek tools that reveal hidden inefficiencies, optimize workflows, and ensure better performance management and compliance.

Key Market Highlights:

- The process mining software industry size was valued at USD 2,350.8 million in 2023.

- The market is projected to grow at a CAGR of 35.60%from 2024 to 2031.

- Europe held a market share of 36.72% in 2023, with a valuation of USD 863.2 million.

- The cloud segment garnered USD 1,379.4 million in revenue in 2023.

- The Small and Medium-Sized Enterprises (SMEs) segment is expected to reach USD 13,304.2 million by 2031.

- The transactional procurement segment held a market share of 38.54% in 2023.

- The BFSI segment is anticipated to register a CAGR of 39.41% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 37.18% during the forecast period.

Major companies operating in the process mining software industry are UiPath, Celonis, IBM, Fluxicon BV, Fujitsu, Hyland Software, Inc., Appian Corporation, QPR Software, Software GmbH, ABBYY, mindzie, Inverbis, Apromore Pty Ltd, Pegasystems Inc., and SAP SE.

The growing demand for data-driven decision-making and operational efficiency is significantly driving the market. Businesses are increasingly relying on process mining tools to gain actionable insights from event data, optimize workflows, and improve performance.

Furthermore, organizations can identify inefficiencies, reduce costs, and enhance productivity by visualizing and analyzing actual business processes. This shift toward data-centric strategies helps companies streamline operations, ensure better resource allocation, and make more informed decisions to stay competitive in dynamic markets.

- In April 2023, QPR Software was named a Visionary in Gartner's Magic Quadrant for Process Mining Tools. This recognition highlights the company's commitment to providing data-driven insights that improve business processes, aligning with the increasing demand for operational efficiency and informed decision-making in the process mining market.

Enhancing Process Transparency

Improving process visibility and transparency is a key growth driver of the process mining software market. Businesses require tools that provide clear insights into how processes are executed in real time as they optimize their operations.

Process mining software enables organizations to make informed decisions by identifying inefficiencies, bottlenecks, and deviations from the planned workflow. This transparency enhances accountability, improves performance monitoring, and helps in meeting compliance standards, thereby fostering better resource allocation and driving operational improvements across industries.

- In June 2023, Microsoft launched Power Automate Process Mining, enhancing process visibility and transparency. This tool helps organizations across industries such as manufacturing, healthcare, finance, and retail detect inefficiencies, optimize workflows, and drive continuous process improvement, supporting data-driven decision-making.

Data Quality

A major challenge faced by the process mining software market is the reliance on data quality. The effectiveness of process mining tools depends heavily on the quality and completeness of the data collected. Inaccurate, incomplete, or fragmented data can lead to incorrect insights, hindering process optimization efforts.

Thus, organizations must invest in robust data governance practices, ensuring consistent data capture, cleansing, and integration across systems. Implementing automated data validation and utilizing AI-driven tools can also help enhance data accuracy and completeness.

Integration of Process Mining in Healthcare

The integration of process mining software in healthcare has become a notable trend, as organizations increasingly recognize its potential to optimize operations and improve patient care. Process mining helps identify inefficiencies, bottlenecks, and areas for improvement by analyzing data from healthcare management systems.

This technology empowers healthcare providers to streamline workflows, reduce delays, and enhance decision-making, leading to better outcomes and cost savings. Process mining software is emerging as a key tool for driving efficiency and continuous improvement as healthcare systems globally embrace digital transformation.

- In September 2024, Inverbis launched The Open Healthcare Process Mining Project (TOHM) to accelerate digital transformation in healthcare. TOHM fosters collaboration by providing resources for process mining, helping healthcare organizations optimize workflows, improve efficiency, and share knowledge globally.

Process Mining Software Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

On-premise, Cloud

|

|

By Enterprise Size

|

Large Enterprises, Small and Medium-Sized Enterprises (SMEs)

|

|

By Application

|

Strategic Sourcing, Contract Management, Category Management, Transactional Procurement, Supplier Management

|

|

By End-use Industry

|

BFSI, IT and Telecom, Manufacturing, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Deployment (On-premise, Cloud): The cloud segment earned USD 1,379.4 million in 2023, due to the increased adoption of scalable, flexible solutions for real-time process monitoring and data analysis.

- By Enterprise Size [Large Enterprises, Small and Medium-Sized Enterprises (SMEs)]: The Small and Medium-Sized Enterprises (SMEs) segment held 57.67% share of the market in 2023, due to rapid digital transformation and process optimization in biopharmaceuticals and healthcare sectors.

- By Application (Strategic Sourcing, Contract Management, Category Management, Transactional Procurement, Supplier Management): The transactional procurement segment is projected to reach USD 11,096.9 million by 2031, owing to automation and improved data-driven decision-making in procurement processes.

- By End-use Industry (BFSI, IT and Telecom, Manufacturing, Healthcare, Others): The BFSI segment is anticipated to register a CAGR of 39.41% during the forecast period, driven by the increasing demand for compliance, risk management, and process efficiency solutions in financial services.

Process Mining Software Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

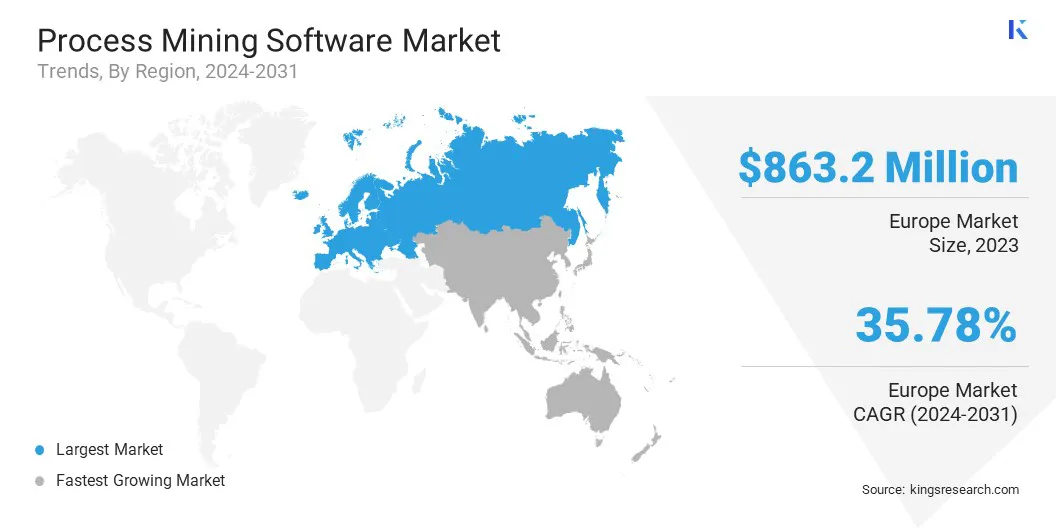

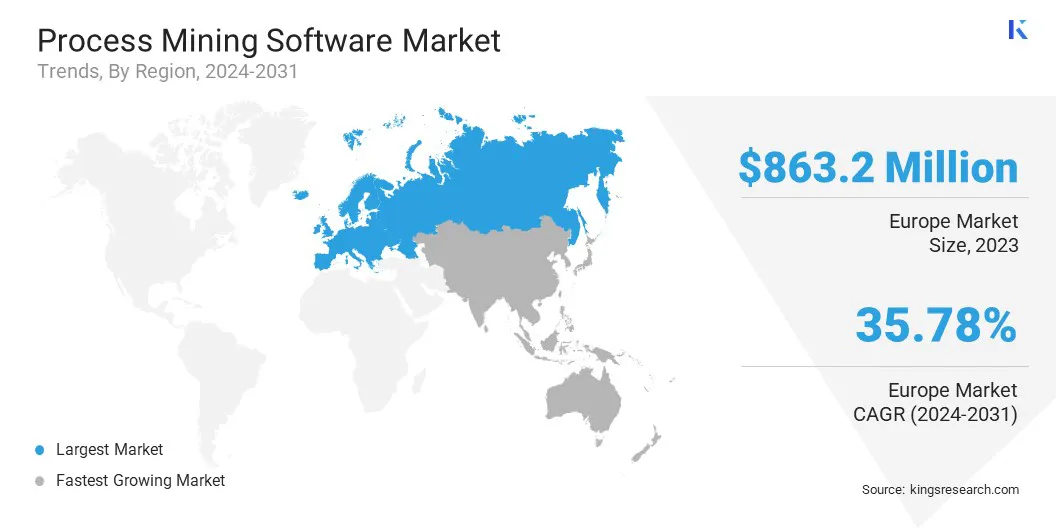

Europe process mining software market accounted for a market share of around 36.72% in 2023, with a valuation of USD 863.2 million. Europe is a dominant region in the market, due to its strong focus on technological innovation and operational efficiency.

Companies across various industries are increasingly adopting process mining solutions to optimize business processes, enhance decision-making, and gain real-time insights. The region’s emphasis on digital transformation, data-driven strategies, and continuous improvement fosters the widespread implementation of process mining tools. These factors, coupled with a favorable regulatory environment, position Europe as a leader in the global market.

- In January 2025, a leading European telecom operator chose QPR ProcessAnalyzer for process mining, integrating it with Snowflake AI Data Cloud to enhance operational performance. This collaboration provides real-time insights, enabling smarter decision-making and improved business process efficiency.

The process mining software industry in Asia Pacific is poised for significant growth at a robust CAGR of 37.18% over the forecast period. Asia Pacific is the fastest-growing region in the market, driven by rapid digital transformation and increased adoption of automation technologies.

The region’s expanding industrial sectors, including manufacturing, retail, and finance, are adopting process mining solutions to enhance operational efficiency and streamline workflows.

Rising investments in AI and data analytics, along with growing awareness of process optimization, further accelerate the market growth. Additionally, favorable government initiatives and an increasing number of SMEs are contributing to the swift market expansion in the region.

Regulatory Frameworks

- In India, the Information Technology Act, 2000 (ITA-2000) provides a legal framework for electronic transactions, cybersecurity, and cybercrime, regulating software solutions like process mining to ensure secure digital operations.

- In the U.S., the Health Insurance Portability and Accountability Act of 1996 (HIPAA) regulates the transfer of healthcare information, ensuring that healthcare data used in process mining is protected and shared under strict confidentiality standards.

- In the EU, the General Data Protection Regulation (GDPR) enforces strict rules on data collection, processing, and storage, requiring transparency, user consent, and data minimization for the ethical use of process mining applications.

Competitive Landscape:

Companies in the process mining software industry are attracting investments to accelerate product development, expand their market reach, and enhance capabilities.

Funding supports innovation in AI and data analytics, enabling these companies to refine their software, integrate advanced features, and scale operations. It also helps drive the market, improve customer acquisition, and establish partnerships to fuel long-term growth.

- In April 2023, Inverbis Analytics, a process mining startup, received a USD 431,714 investment from Lugo Transforma. This funding will support the company's growth, job creation in Lugo, and its mission to expand process intelligence across broader markets.

Key Companies in Process Mining Software Market:

- UiPath

- Celonis

- IBM

- Fluxicon BV

- Fujitsu

- Hyland Software, Inc.

- Appian Corporation

- QPR Software

- Software GmbH

- ABBYY

- mindzie

- Inverbis

- Apromore Pty Ltd

- Pegasystems Inc.

- SAP SE

Recent Developments (Recognition/Partnerships/Launch)

- In March 2023, Inverbis Analytics was recognized as an Honorable Mention in the Gartner Magic Quadrant for Process Mining Tools. This recognition highlights their commitment to innovation, helping organizations optimize business processes through advanced data analysis and process mining solutions.

- In May 2023, Pegasystems launched Pega Process Mining, integrating AI-powered capabilities and generative AI-ready APIs. This solution enables businesses to continuously identify and fix process inefficiencies, enhancing workflow optimization within the Pega Platform for improved customer and employee experiences.

- In February 2025, Fairmar and QPR Software formed a strategic partnership to drive digital excellence. The collaboration leverages QPR ProcessAnalyzer’s AI-powered process mining capabilities, enabling businesses to optimize processes, enhance compliance, and accelerate digital transformation through real-time insights.

- In March 2023, UiPath launched Communications Mining, an AI-driven tool using NLP to analyze business communications. It extracts valuable insights from emails and tickets, enabling automation of workflows, enhancing service, reducing inefficiencies, and driving business process optimization.

- In December 2023, EY and Appian formed a strategic collaboration to drive digital transformation using AI, low-code, and process automation technologies. This partnership aims to help businesses simplify processes, enhance customer experiences, and modernize operations for greater efficiency.