Market Definition

The market involves tools and systems that measure, control, and monitor processes in industries like chemicals, oil and gas, food and beverages, and pharmaceuticals. These instruments ensure optimal operation of processes by collecting data and providing real-time insights.

Key applications include flow, pressure, temperature, and level measurement. They help maintain process efficiency, improve quality, and ensure safety. Advanced technologies like smart sensors and automated systems are increasingly being used to enhance precision and reliability in various industrial applications.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Process Instrumentation Market Overview

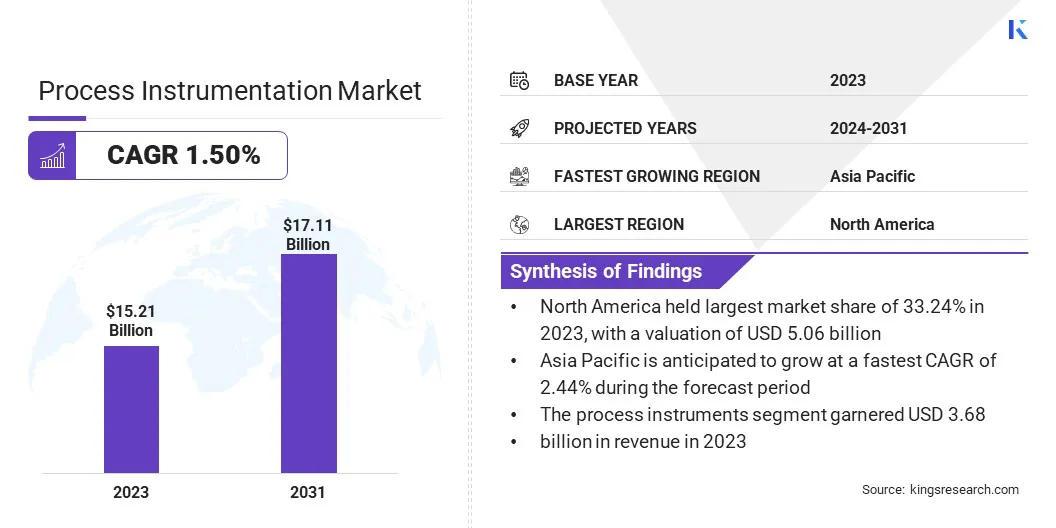

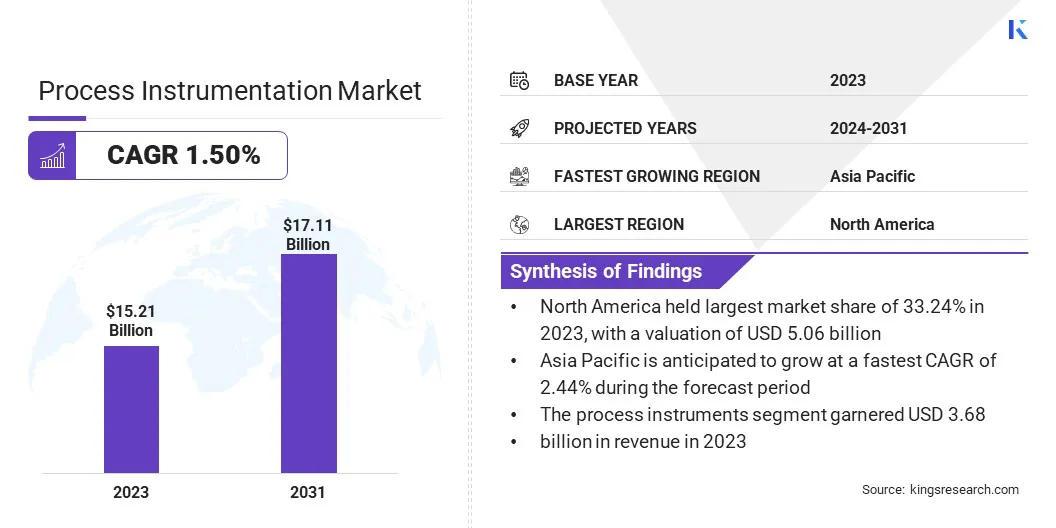

The global process instrumentation market size was valued at USD 15.21 billion in 2023 and is projected to grow from USD 15.41 billion in 2024 to USD 17.11 billion by 2031, exhibiting a CAGR of 1.50% during the forecast period.

The growth of the market is driven by the increasing industrial automation in manufacturing, which enhances efficiency and precision in operations. Additionally, the integration of IoT and big data analytics allows for real-time monitoring and optimization, boosting the demand for advanced instrumentation solutions across various industries.

Major companies operating in the process instrumentation industry are Emerson Electric Co., Siemens, Honeywell International Inc., Endress+Hauser Group, Schneider Electric, Yokogawa Electric Corporation, ABB, Rockwell Automation, Inc., KROHNE Group, Fuji Electric Co., Ltd., Bürkert Fluid Control Systems, Metrohm AG, Allied Motion Technologies Inc., SICK AG, and Omega Engineering Inc.

The market is significantly driven by the rapid advancements in automation technology. Industries are increasingly adopting automated systems to enhance productivity, minimize human error, and reduce operational costs.

These technologies demand precise monitoring and control systems, fueling the demand for process instrumentation tools. The integration of smart sensors and real-time data analytics into automation systems further enhances operational efficiency, creating opportunities for the growth of the market across various sectors.

- In October 2024, the Kansas Board of Regents approved an amended Automation Engineer Technology Program Alignment, aiming to enhance educational pathways in automation engineering. This initiative supports the development of a skilled workforce equipped to meet the growing demands of automated systems in various industries.

Key Highlights

- The process instrumentation market size was valued at USD 15.21 billion in 2023.

- The market is projected to grow at a CAGR of 1.50% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 5.06 billion.

- The pressure instruments segment garnered USD 3.68 billion in revenue in 2023.

- The programmable logic controller (PLC) segment is expected to reach USD 6.08 billion by 2031.

- The water & wastewater treatment segment secured the largest revenue share of 29.90% in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 2.44% during the forecast period.

Market Driver

Increasing Industrial Automation in Manufacturing

The manufacturing sector is undergoing significant digital transformation, driving the process instrumentation market. With Industry 4.0 on the rise, there is a greater need for precise measurement and control of processes. Process instrumentation systems allow for the automation of routine tasks, enhancing consistency and quality.

The demand for improved operational processes, higher precision, and minimized downtime in manufacturing is pushing the adoption of these technologies, accelerating the market.

- In February 2024, Honeywell introduced the Experion PKS R530, a next-generation process automation system designed to enhance control and monitoring in industrial environments. The system features advanced analytics, real-time data visualization, and integration with cloud-based services, providing improved efficiency and operational insights.

Market Challenge

High Initial Investment and Maintenance Costs

High initial investment and ongoing maintenance costs associated with advanced instrumentation systems pose significant challenges to the growth of the process instrumentation market. These systems require substantial capital outlay, which can be a barrier for small and mid-sized companies.

Several key players are offering cost-effective solutions, such as modular instrumentation systems, which allow businesses to scale and upgrade as needed. Additionally, companies are providing long-term service contracts, offering predictive maintenance through IoT-enabled sensors, and providing financing options to ease the burden of upfront costs, making the technology more accessible.

Market Trend

Integration of IoT and Big Data Analytics

The integration of the Internet of Things (IoT) and big data analytics is transforming the market. IoT-enabled sensors allow for real-time data collection and transmission, providing greater insights into process performance.

Big data analytics helps industries predict maintenance needs, reduce downtime, and optimize processes. This integration enables industries to monitor and control operations more effectively, leading to higher efficiency, productivity, and a strong market demand for process instrumentation tools.

- In April 2025, Yokogawa Electric Corporation, in collaboration with Kuraray Engineering, introduced a process data analytics solution that integrates IoT-enabled sensors and big data analytics. This platform enhances predictive maintenance capabilities and operational efficiency, supporting the adoption of advanced process control systems across various industries.

Process Instrumentation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Pressure Instruments, Flow Instruments, Level Instruments, Temperature Instruments, Analytical Instruments, Control Valves, Others

|

|

By Technology

|

Programmable Logic Controller (PLC), Distributed Control System (DCS), Supervisory Control and Data Acquisition (SCADA), Manufacturing Execution System (MES)

|

|

By End User

|

Water & Wastewater Treatment), Chemical and Petrochemicals, Energy & Utilities, Oil & Gas, Metals & Mining, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E. , Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Pressure Instruments, Flow Instruments, Level Instruments, Temperature Instruments, Analytical Instruments, Control Valves, Others): The pressure instruments segment earned USD 3.68 billion in 2023, due to their essential role in ensuring accurate measurements and control across various industries, including oil & gas, chemicals, and manufacturing.

- By Technology (Programmable Logic Controller (PLC), Distributed Control System (DCS), Supervisory Control and Data Acquisition (SCADA), and Manufacturing Execution System (MES)): The programmable logic controller (PLC) segment held 35.65% share of the market in 2023, due to its ability to offer flexible, reliable, and cost-effective automation solutions that enhance operational efficiency, reduce downtime, and ensure seamless integration with various industrial processes.

- By End User (Water & Wastewater Treatment, Chemical and Petrochemicals, Energy & Utilities, Oil & Gas, Metals & Mining, Others): The water & wastewater treatment segment is projected to reach USD 12 billion by 2031, owing to the increasing global demand for efficient water management solutions and stricter environmental regulations.

Process Instrumentation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 33.24% share of the process instrumentation market in 2023, with a valuation of USD 5.06 billion. North America is registering rapid industrial automation and digital transformation, particularly in manufacturing and energy sectors. The shift toward more efficient and automated operations demands enhanced process measurement tools, boosting the demand for process instrumentation.

Moreover, North America is home to many of the world’s leading companies in sensor technology. These companies are constantly innovating to create sensors that offer higher accuracy, reliability, and efficiency. These technological advancements are crucial in sectors such as manufacturing, chemicals, and pharmaceuticals, boosting the market.

- In November 2024, Allegro MicroSystems unveiled its latest inductive position sensors, the A17802 and A17803, at Electronica 2024. These sensors deliver high-resolution position sensing with built-in diagnostics, offering a compact and cost-effective solution compared to traditional resolvers and encoders. They are specifically designed for motor position sensing applications, including traction motors in Electric Vehicles (EVs) and servo motors in industrial automation and robotics.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 2.44% over the forecast period. The rapid growth in renewable energy infrastructure is driving the process instrumentation industry in Asia Pacific.

These renewable energy projects require advanced process instrumentation solutions to monitor performance, ensure safety, and optimize production. Furthermore, the increasing adoption of IoT, AI, and big data analytics in industrial operations in Asia Pacific is contributing to the expansion of the market, providing opportunities for growth.

Regulatory Frameworks

- In the U.S., the market is governed by standards set by organizations like the National Institute of Standards and Technology (NIST) and Underwriters Laboratories (UL). NIST provides calibration certifications, while UL ensures safety through testing and certification of devices. These regulations help maintain accuracy and safety across industrial processes.

- In the European Union (EU), the Measuring Instruments Directive (MID) 2014/32/EU regulates the sale and use of measuring devices. It ensures that these instruments are accurate and reliable for commercial and industrial purposes. Additionally, Legal Metrology regulations enforce compliance with measurement standards to guarantee fairness in trade and the accuracy of measurements across industries.

- In China, the China Pattern Approval (CPA) system regulates the import and use of measuring instruments. Instruments must undergo certification to be marketed within the country, ensuring they meet required standards for accuracy and safety. This regulation is crucial for industries relying on precise measurements, such as manufacturing and petrochemicals.

Competitive Landscape

Market players in the process instrumentation market are increasingly adopting strategies like partnerships and technological advancements, which are significantly contributing to the growth of the market. Forming strategic alliances enables companies to combine their expertise and deliver more innovative solutions.

Technological advancements, such as improved sensor systems, AI integration, and real-time data analysis, help optimize industrial processes, enhancing efficiency and sustainability. These efforts are improving operational performance and meeting the growing demand for more precise and reliable instrumentation in various industries, including chemicals, manufacturing, and energy.

- In January 2025, Endress+Hauser and SICK announced a strategic partnership to advance new technological solutions for the decarbonization of the process industry. The collaboration focuses on gas analysis and flow measurement technology to support sustainable transformation.

List of Key Companies in Process Instrumentation Market:

- Emerson Electric Co.

- Siemens

- Honeywell International Inc.

- Endress+Hauser Group

- Schneider Electric

- Yokogawa Electric Corporation

- ABB

- Rockwell Automation, Inc.

- KROHNE Group

- Fuji Electric Co., Ltd.

- Bürkert Fluid Control Systems

- Metrohm AG

- Allied Motion Technologies Inc.

- SICK AG

- Omega Engineering Inc.

Recent Developments (Product Launches)

- In April 2025, Yokogawa launched OpreX Plant Stewardship, a comprehensive solution designed to optimize plant operations, enhance efficiency, and support sustainable practices in various industries.

- In April 2025, ABB showcased its latest innovations at bauma 2025, including the HES580 Mobile Inverter, AMXE160 Motor, and the Pro Traction Battery Series. These products aim to reduce emissions in the construction and mining industries.

- In April 2024, Metrohm Process Analytics launched the 2060 VA/CVS Process Analyzer, an online analyzer for trace metal and organic additives analysis. The analyzer addresses challenges in delivering low limits of quantification while handling matrix variations.

- In August 2023, Fuji Electric launched the S-Flow Ultrasonic Flow Meter, designed to provide accurate and reliable flow measurement in various industrial applications, contributing to enhanced process control and efficiency.