Market Definition

The market involves the production of printed signage materials using printing technologies for communication, advertising, branding, and navigation. Commonly found in storefronts, malls, public buildings, events, roads, and transport systems, these signs serve diverse applications.

The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape influencing growth through the forecast period.

Printed Signage Market Overview

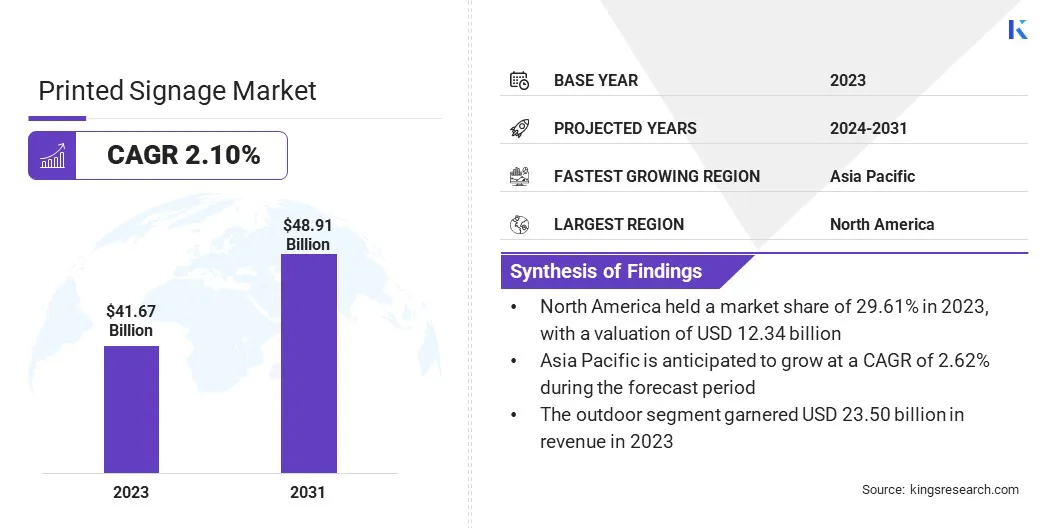

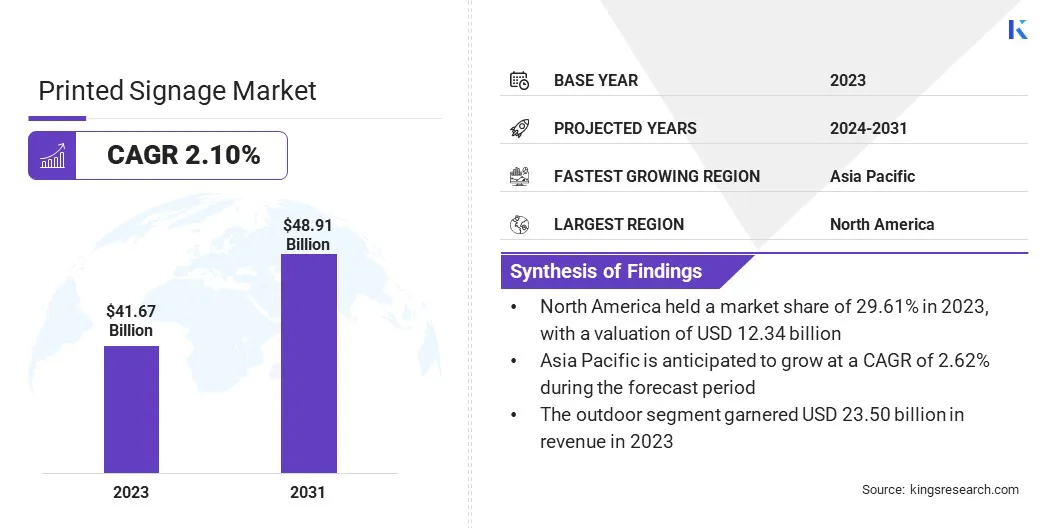

Global printed signage market size was valued at USD 41.67 billion in 2023, which is estimated to be valued at USD 42.28 billion in 2024 and reach USD 48.91 billion by 2031, growing at a CAGR of 2.10% from 2024 to 2031.

Urbanization and infrastructure development are creating a strong demand for printed signage, particularly directional and promotional signs, to support navigation and marketing in expanding urban areas.

Major companies operating in the printed signage industry are Avery Dennison Corporation., Kelly Signs, ORAFOL Europe GmbH, Kuhn Corp Print & Packaging, Identity Group, LLC., LINTEC Corporation, Signs Express, EhKo Sign Industries Kft., L&H Companies, Inc., Sabre Graphics, Sauce, James Publishing and Signs, Palram Industries Ltd., ARC DOCUMENT SOLUTIONS INDIA, FASTSIGNS International. Inc, and others.

The market is experiencing significant expansion, driven by small businesses increasingly investing in custom signage to enhance brand visibility and attract customers.

- According to a June 2024 article by the United Nations, Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in the global economy, comprising 90% of businesses worldwide. These enterprises are responsible for generating 60 to 70% of employment and contribute to about 50% of global GDP.

As these businesses recognize the importance of effective marketing, high-quality printed signs such as banners, storefront displays, and promotional materials are emerging as essential tools.

This shift toward personalized, eye-catching signage is supported by advancements in printing technologies, providing small businesses with affordable, impactful options to strengthen their presence and engage with local communities.

Key Highlights:

- The printed signage industry size was recorded at USD 41.67 billion in 2023.

- The market is projected to grow at a CAGR of 2.10% from 2024 to 2031.

- North America held a share of 29.61% in 2023, valued at USD 12.34 billion.

- The banner and backdrop segment garnered USD 10.56 billion in revenue in 2023.

- The screen segment is expected to reach USD 19.57 billion by 2031.

- The retail segment held a share of 35.90% in 2023.

- The outdoor segment is anticipated to witness a CAGR of 2.24% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 2.62% through the projection period.

Market Driver

Rapid Urbanization and Infrastructure Development

With rapid urbanization and expanding infrastructure projects, the need for effective signage continues to rise. According to the World Bank Group, approximately 56% of the global population currently resides in urban areas, a figure projected to reach nearly 70% by 2050.

This urban shift drives increased reliance on printed signage across construction, real estate, and public infrastructure sectors for traffic management, wayfinding, and service promotion.

In emerging urban centers, directional signage faciliatates navigation, while promotional signs enhance business visibility. As cities develop, the need for signage to support new developments, public spaces, and transport systems fuels innovation and market expansion.

Market Challenge

Environmental Impact

A key challenge hindering the expansion of the printed signage market is the environmental impact of materials and ensuring sustainable disposal practices. The production of printed signage involves the use of non-biodegradable materials such as vinyl and plastic, which contribute to waste and pollution.

To address this challenge, companies are shifting toward eco-friendly alternatives such as recyclable substrates, biodegradable inks, and sustainable printing processes. Additionally, implementing recycling programs and promoting the reuse of materials can reduce the environmental footprint and support signage production.

Market Trend

Sustainability in Materials

A prominent trend influencing the market is the growing adoption of sustainable materials. As environmental awareness grows among businesses and consumers, the market is witnessing a transition to eco-friendly, biodegradable, and recyclable materials for signage production.

Companies are increasingly opting for substrates such as recycled paper, cardboard, and fabric, along with water-based, non-toxic inks. This trend supports waste reduction, aligns with global sustainability goals, and enables businesses to improve their environmental footprint while maintaining high-quality.

- In February 2025, Smartpress introduced six new eco-friendly materials for sustainable signs, banners, and décor, aligning with the growing trend toward eco-conscious signage. These options include FSC-certified honeycomb boards and non-PVC polyethylene, offering recyclable, durable, and lightweight solutions.

Printed Signage Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Banner and Backdrop, Corporate Graphics, Exhibitions, and Trade Shows, Backlit Displays, Pop Display, Billboards, Other Signage Types

|

|

By Print Technology

|

Screen, Inkjet, Sheetfed, Other Print Technologies

|

|

By End Use Vertical

|

BFSI, Retail, Transportation and Logistics, Healthcare, Other End-user Verticals

|

|

By Application

|

Indoor, Outdoor

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Banner and Backdrop, Corporate Graphics, Exhibitions, and Trade Shows, Backlit Displays, Pop Display, Billboards, and Other Signage Types): The banner and backdrop segment earned USD 10.56 billion in 2023 due to growing demand for customizable, high-visibility promotional materials in events and marketing campaigns.

- By Print Technology (Screen, Inkjet, Sheetfed, and Other Print Technologies): The screen segment held a share of 40.26% in 2023, largely attributed to its cost-effective, high-volume production for large-format signage and durability.

- By End Use Vertical (BFSI, Retail, Transportation and Logistics, Healthcare, and Other End-user Verticals): The retail segment is projected to reach USD 18.09 billion by 2031 owing to increasing demand for storefront visibility and in-store promotional signage.

- By Application (Indoor and Outdoor): The outdoor segment is anticipated to grow at a CAGR of 2.24% over the forecast period, boosted by the rising use of large-scale advertising and directional signs in public spaces.

Printed Signage Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America printed signage market share stood at around 29.61% in 2023, valued at USD 12.34 billion. This dominance is reinforced by a well-established advertising industry and high demand for innovative signage solutions. The region's robust economic infrastructure, coupled with the presence of major industry players, further contributes to this dominance.

Additionally, the growth of the retail, real estate, and commercial sectors in the U.S. and Canada is highlighting the need for customized signage. Technological advancements in printing and growing awareness of brand visibility further solidify North America's leading market position.

Asia Pacific printed signage industry is estrimated to grow at a CAGR of 2.62% over the forecast period. This rapid growth is bolstered by rapid urbanization, infrastructure development, and expanding retail industries. Major countries in the region are investing heavily in construction and public infrastructure, creating a strong demand for signage in various sectors.

The rise of e-commerce and increased disposable income in this region further underscore the need for outdoor and promotional signage. Moreover, the adoption of cost-effective and eco-friendly printing technologies supports regional market expansion.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) sets quality standards for signage materials to ensure safety and durability.

- In the U.S., the Environmental Protection Agency (EPA) oversees the use of eco-friendly materials in signage production, focusing on waste disposal and recycling.

- In the EU, the REACH Regulation mandates compliance with environmental and health standards for chemicals used in signage production.

Competitive Landscape

Companies in the printed signage industry are increasingly adopting advanced printing technologies and sustainable materials to meet growing consumer demand for eco-friendly, high-quality signage. They are expanding product offerings, including digital and interactive signage, to cater to diverse industries.

Additionally, businesses are focusing on improving customization options, enhancing design capabilities, and providing integrated solutions to meet specific marketing and branding needs.

- In February 2024, Kuhn Corp Print & Packaging acquired Regal Signs & Designs to expand its signage division. This strategic acquisition strengthens its product offerings and customer service by leveraging over 60 years of combined industry expertise.

List of Key Companies in Printed Signage Market:

- Avery Dennison Corporation.

- Kelly Signs

- ORAFOL Europe GmbH

- Kuhn Corp Print & Packaging

- Identity Group, LLC.

- LINTEC Corporation

- Signs Express

- EhKo Sign Industries Kft.

- L&H Companies, Inc.

- Sabre Graphics

- Sauce

- James Publishing and Signs

- Palram Industries Ltd.

- ARC DOCUMENT SOLUTIONS INDIA

- FASTSIGNS International. Inc

Recent Developments (M&A, Product Launch)

- In September 2024, Epson introduced the SC-S9100, a compact, high-performance signage printer with enhanced productivity, precise color accuracy, and a user-replaceable printhead, aimed at expanding large-format signage capabilities.

- In December 2023, Panther Premier Print Solutions acquired Advertising Arts to expand its service offerings in signage, vehicle graphics, and promotional solutions strengthening its market position and operational synergies.