Market Definition

The market involves the manufacturing, distribution, and application of devices that measure and transmit pressure data in various industrial processes. These transmitters convert physical pressure into an electrical signal that can be read and analyzed for process control, safety monitoring, and performance optimization.

The market encompasses a range of technologies including differential, absolute, and gauge pressure transmitters, tailored to specific industrial needs and environmental conditions. The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Pressure Transmitter Market Overview

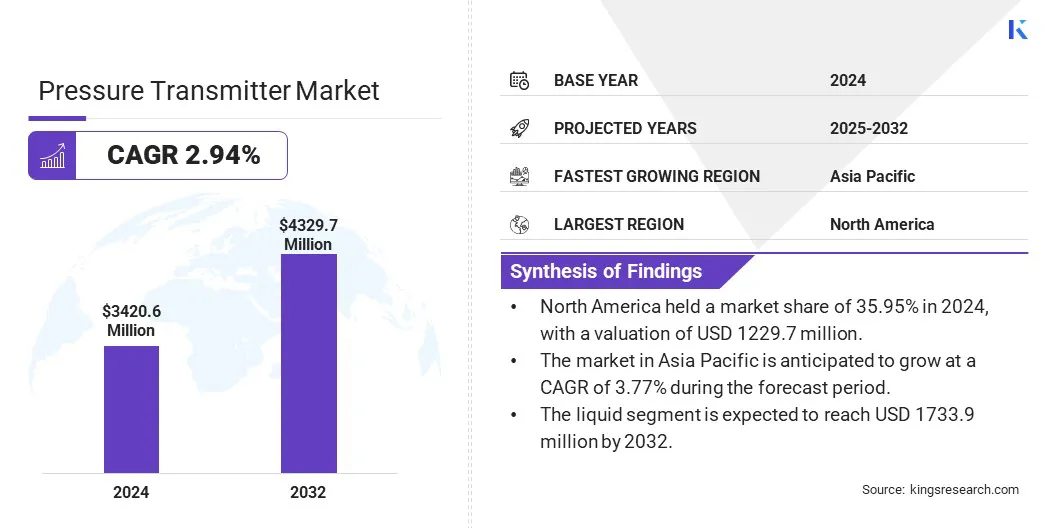

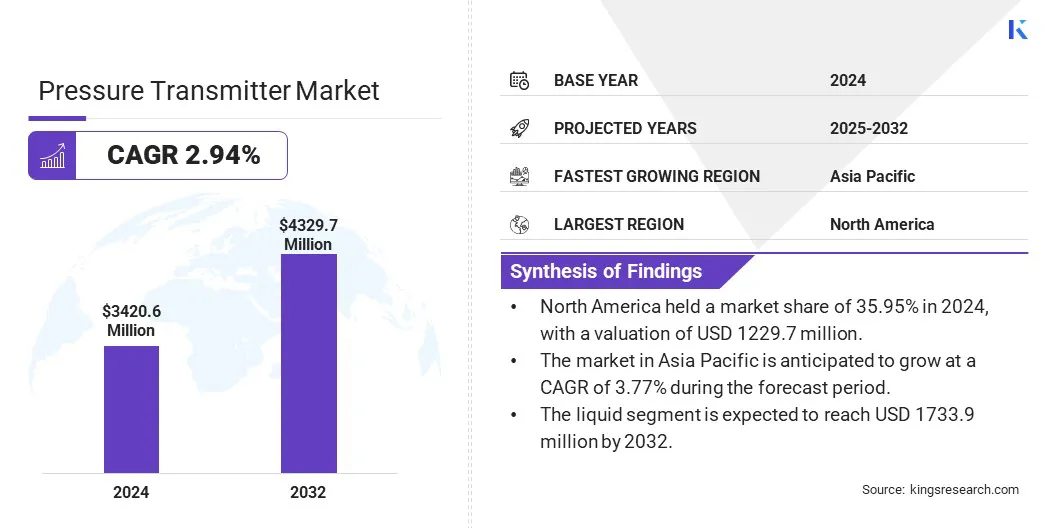

The global pressure transmitter market size was valued at USD 3420.6 million in 2024 and is projected to grow from USD 3513.3 million in 2025 to USD 4329.7 million by 2032, exhibiting a CAGR of 2.94% during the forecast period.

This growth is attributed to rising demand for real-time pressure monitoring in oil and gas, chemical, and power industries, driven by a focus on safety and efficiency. The need for reliable instrumentation in hazardous and high-pressure environments is further contributing to the market expansion.

Major companies operating in the pressure transmitter industry are Honeywell International Inc., Yokogawa Electric Corporation, ABB, MICRO SENSOR CO., LTD, Siemens, TE Connectivity, Emerson Electric Co, WIKA Group, Ashcroft, Inc., Schneider Electric, Fuji Electric Co., Ltd., Huba Control AG, Dwyer Instruments, LLC, Danfoss, and Azbil Corporation.

Furthermore, technological advancements in smart and wireless pressure transmitters, along with the growing adoption of the Industrial Internet of Things (IIoT) and automation, are fueling market growth. The implementation of stringent regulatory standards for environmental and workplace safety, combined with efforts to modernize legacy industrial infrastructure is further contributing to the market growth.

- In July, In November 2024, ABB launched its new high-performance P-Series pressure transmitters at the China International Import Expo (CIIE) in Shanghai. The portfolio includes the P-100, P-300, and P-500 models, offering ultra-accurate measurements with advanced features like Bluetooth programming and RFID (Radio Frequency Identification) integration.

Key Highlights

- The pressure transmitter market size was valued at USD 3420.6 million in 2024.

- The market is projected to grow at a CAGR of 2.94% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 1229.7 million.

- The differential segment garnered USD 1239.0 million in revenue in 2024.

- The liquid segment is expected to reach USD 1733.9 million by 2032.

- The level segment is anticipated to witness the fastest CAGR of 3.05% during the forecast period.

- The oil & gas segment garnered USD 767.0 million in revenue in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 3.77% during the forecast period.

Market Driver

Expansion of the Oil & Gas and Chemical Sectors

The market is growing steadily, driven by the rapid expansion of the oil & gas and chemical sectors across developed and emerging economies.

As global energy demand rises, oil and gas companies are ramping up exploration and production activities, particularly in offshore and high-pressure environments, where accurate and durable pressure monitoring is essential for safety and process efficiency.

At the same time, the chemical and petrochemical industries are investing in capacity expansion and modernization of facilities to meet increasing demand for industrial and consumer chemicals, further driving the need for reliable instrumentation.

Moreover, the integration of advanced automation and process control systems in these sectors, along with stricter safety and environmental regulations, is expected to reinforce the demand for high-performance pressure transmitters in the coming years.

- In July 2024, ABB announced that its PGS300 Gauge Pressure Transmitter received an Environmental Product Declaration (EPD) certification. The EPD provides an assessment of the product’s environmental impact throughout its lifecycle, offering transparency for customers. The PGS300 is used in industries such as chemicals and oil & gas, and the certification supports compliance with environmental regulations and informed decision-making.

Market Challenge

Maintenance and Calibration Requirements

Regular maintenance and calibration requirements present a significant challenge for the pressure transmitter market, particularly in industries where continuous and accurate pressure monitoring is critical to process performance and safety.

Exposure to harsh operating conditions such as extreme temperatures, corrosive chemicals, and high-vibration environments can cause sensor drift or degradation, leading to inaccurate readings. This necessitates routine calibration and inspection to ensure optimal performance, which often involves system downtime, skilled labor, and increased operational costs.

The need for manual intervention and shutdowns can hinder productivity and complicate asset management, especially in large-scale or remote facilities.

To overcome this challenge, manufacturers are increasingly adopting smart pressure transmitters equipped with self-diagnostic features and remote calibration capabilities. These systems enable continuous health monitoring and predictive maintenance, reducing the frequency of manual checks and minimizing downtime.

The integration of wireless communication protocols allows real-time data transmission to centralized control systems, enhancing visibility and operational efficiency. Furthermore, the use of modular designs and quick-connect interfaces simplifies replacement and servicing.

Training programs to upskill maintenance personnel, combined with investment in advanced asset management software, further support streamlined calibration schedules and lifecycle cost reduction.

Market Trend

Technological Advancements in Sensor Materials

Technological advancements in sensor materials are significantly enhancing pressure transmitters by improving their accuracy, durability, and operational range.

Modern pressure transmitters now utilize advanced materials such as silicon-based microelectromechanical systems (MEMS) and graphene, which offer greater sensitivity and stability even under extreme environmental conditions like high temperature, corrosion, and pressure.

These innovations enable transmitters to deliver more reliable and precise measurements, expanding their usability across diverse and demanding industrial applications. The miniaturization enabled by these materials also supports the development of compact and lightweight devices, facilitating easier integration into complex systems with limited space.

Furthermore, improved sensor materials contribute to faster response times and lower energy consumption, supporting the growing demand for efficient, smart instrumentation.

- In January 2024, Huba Control launched the Type 560 pressure transmitter for OEM refrigeration and heat pump systems. It features a hermetically sealed stainless steel sensor compatible with refrigerants like ammonia and CO₂, offers high accuracy, operates in extreme temperatures, and meets safety standards for flammable refrigerants.

Pressure Transmitter Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Differential, Absolute, Gauge, and Multivariable

|

|

By Fluid

|

Liquid, Gas, and Steam

|

|

By Application

|

Level, Flow, and Pressure

|

|

By Vertical

|

Oil & Gas, Chemical & Petrochemical, Water & Wastewater Treatment, Food & Beverage, Pulp & Paper, Pharmaceutical, Power generation, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Differential, Absolute, Gauge, and Multivariable): The differential segment earned USD 1239.0 million in 2024 due to its widespread use in industrial applications requiring accurate measurement of pressure differences for process control and efficiency.

- By Fluid (Liquid, Gas, and Steam): The liquid segment held 40.47% of the market in 2024, due to the extensive use of pressure transmitters in liquid-based processes across industries such as water and wastewater treatment, chemical processing, and oil refining.

- By Application (Level, Flow, and Pressure): The flow segment is projected to reach USD 1616.6 million by 2032, owing to the increasing demand for precise flow measurement in process industries to ensure operational efficiency, resource optimization, and regulatory compliance.

- By Vertical (Oil & Gas, Chemical & Petrochemical, Water & Wastewater Treatment, Food & Beverage, Pulp & Paper, Pharmaceutical, Power generation, and Others): The pulp & paper segment is anticipated to grow at a CAGR of 3.06% during the forecast period due to the increasing need for reliable pressure monitoring to optimize production processes, reduce energy consumption, and maintain consistent product quality in highly automated manufacturing environments.

Pressure Transmitter Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America pressure transmitter market share stood at around 35.95% in 2024, with a valuation of USD 1229.7 million. This dominance is attributed to the region’s well-established industrial infrastructure, widespread adoption of advanced automation technologies, and the presence of leading pressure transmitter manufacturers.

Furthermore, major investments in oil and gas, chemicals, and power generation are boosting demand for accurate and reliable pressure measurement solutions to enhance safety and efficiency. The region's emphasis on digital transformation and integration of Industrial Internet of Things (IIoT) technologies supports the growing deployment of smart pressure transmitters.

Additionally, stringent regulatory standards and a strong focus on process safety and efficiency are further boosting the market growth in North America.

The pressure transmitter industry in Asia-Pacific is poised for significant growth at a robust CAGR of 3.77% over the forecast period. This growth is fostered by rapid industrialization, expanding infrastructure projects, and increasing investments by governments and private companies in the oil & gas, chemical, and power generation sectors across emerging economies such as China and India.

Additionally, the rising demand for automation and digitalization in manufacturing processes is fueling the adoption of advanced pressure measurement technologies. Government initiatives aimed at enhancing environmental regulations and safety standards are also encouraging the implementation of reliable instrumentation solutions.

The presence of a large manufacturing base and growing emphasis on improving operational efficiency are further driving the market growth in Asia-Pacific.

- In May 2025, ESI Technology Ltd. partnered with Lierlever Pneuline Pte Ltd to strengthen its presence in Southeast Asia. This collaboration will leverage Lierlever’s local expertise to provide enhanced support and faster access to ESI’s range of pressure transducers and transmitters, including the ESI-USB digital and Hydrogen Compatible series, across the region.

Regulatory Frameworks

- In the U.S., 21 CFR Part 820 (Quality System Regulation) governs medical pressure transmitters used in healthcare and life sciences applications. It ensures that devices are designed and manufactured to meet quality requirements.

- In the European Union, the Pressure Equipment Directive (PED) 2014/68/EU regulates pressure transmitters operating above 0.5 bar. It ensures product safety, conformity assessment, and CE marking for access to the EU market.

- In Canada, pressure transmitters used in pressure systems must comply with the CRN (Canadian Registration Number) system governed by each province’s jurisdiction, under the Canadian Standards Association (CSA B51).

Competitive Landscape

The pressure transmitter market features a balanced competitive environment, comprising both well-established global instrumentation manufacturers and niche technology providers. Leading companies are prioritizing technological innovation, such as the integration of smart sensors, wireless connectivity, and enhanced diagnostics, to improve accuracy, reliability, and ease of use.

Investments in research and development are focused on creating compact, energy-efficient, and customizable pressure transmitters that meet stringent industry standards across diverse applications.

Additionally, strategic collaborations with key end-users, mergers and acquisitions, and expansion into emerging markets are being utilized to broaden product portfolios, enhance market presence, and address evolving industrial demands.

- In May 2025, ESI Technology Ltd. formed a strategic partnership with ISATECK Colombia to expand its presence in Latin America. The collaboration aims to provide local support and deliver advanced pressure measurement solutions, including ESI’s Silicon-On-Sapphire technology, to Colombian industries.

List of Key Companies in Pressure Transmitter Market:

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB

- MICRO SENSOR CO., LTD

- Siemens

- TE Connectivity

- Emerson Electric Co

- WIKA Group

- Ashcroft, Inc.

- Schneider Electric

- Fuji Electric Co., Ltd.

- Huba Control AG

- Dwyer Instruments, LLC

- Danfoss

- Azbil Corporation

Recent Developments (Product Launch)

- In November 2023, SOR Controls Group expanded its 1800 Series with three new pressure transmitters: the 1800PR gauge pressure transmitter with extended range options, the 1800DM for direct mount diaphragm seals, and the 1800RM for remote mount diaphragm seals. All models offer high accuracy and meet industry standards for hazardous environments.

- In October 2023, Air Monitor Corporation launched the VELTRON III Pressure & Airflow Transmitter, a dual-channel device for accurate airflow measurement in HVAC systems. It features high accuracy, environmental compensation, and supports BACnet and MODBUS communication protocols.

tates