Pressure Relief Devices Market Size

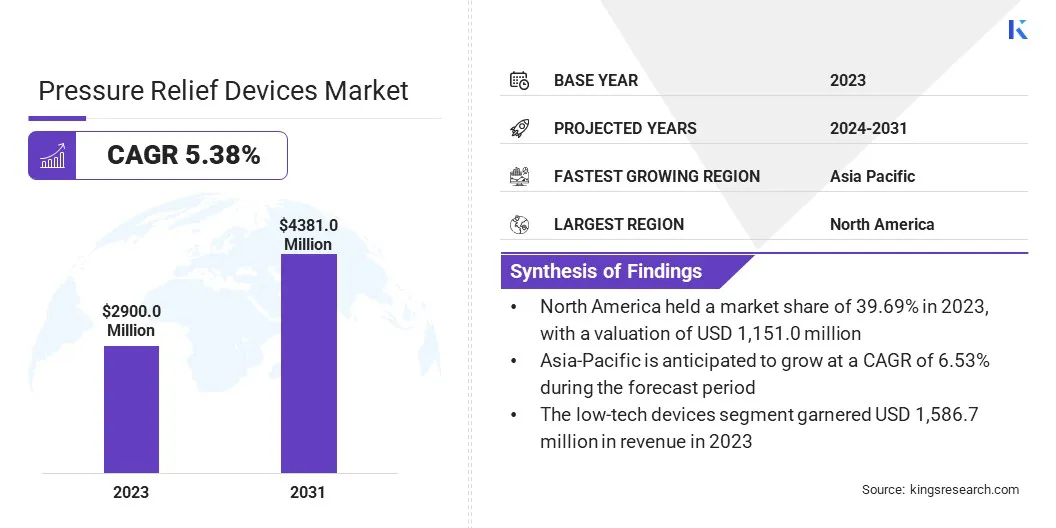

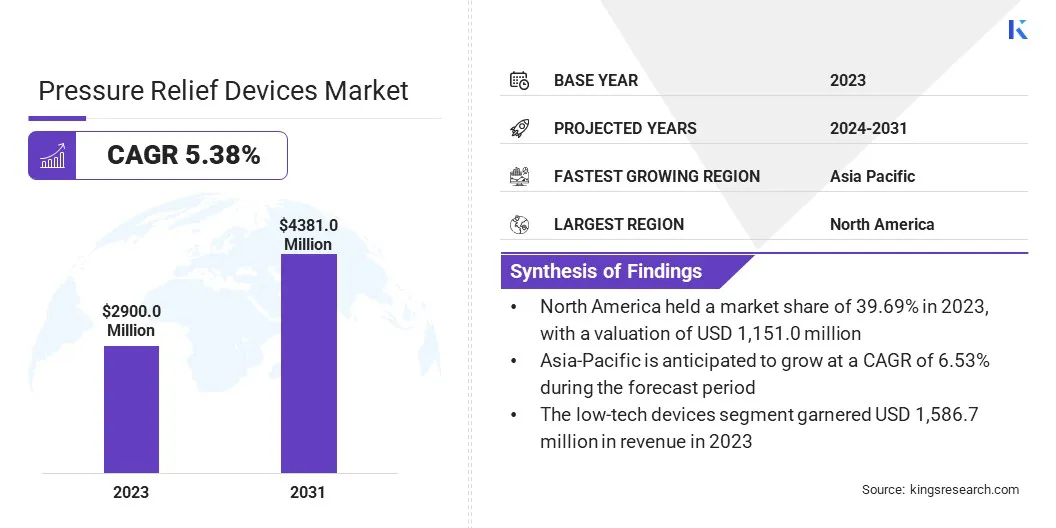

The global Pressure Relief Devices Market size was valued at USD 2,900.0 million in 2023 and is projected to grow from USD 3,036.0 million in 2024 to USD 4,381.0 million by 2031, exhibiting a CAGR of 5.38% during the forecast period. The market is expanding rapidly due to increasing healthcare investments and advancements in medical technology. With a growing emphasis on improving quality of life, healthcare providers are adopting more sophisticated medical devices.

Additionally, the rise in surgical procedures and the need for post-operative care are contributing to the growing demand for pressure relief solutions, thereby contributing to the market growth. In the scope of work, the report includes products offered by companies such as Stryker, Arjo, Hill-Rom Holdings, Inc, Invacare Corporation., PARAMOUNT BED CO., LTD., Talley Group Ltd, Rober Limited, 5 Minds Mobility Group, Smith+Nephew, Medtronic, and others.

The pressure relief devices market is experiencing significant growth, driven by an increasing demand for solutions that prevent and manage pressure ulcers in both clinical and home care settings. The rising prevalence of chronic illnesses and a global shift toward home-based care, is fueling innovation in portable and user-friendly devices. Additionally, the growing aging population particularly those over 60, that is more susceptible to pressure ulcers further contributes to a larger market share.

- According to the World Health Organization, in a significant demographic shift, the global population aged 60 and above is expected to double from 12% in 2015 to 22% by 2050. This dramatic increase will bring the elderly population to an estimated 2.1 billion individuals, the urgent need for enhanced healthcare solutions, including pressure relief devices, to meet the growing demands of an aging society.

As the elderly population continues to grow, the need for effective pressure relief solutions will become more critical, driving growth and innovation in the market.

Pressure relief devices are specialized medical tools designed to prevent and manage pressure ulcers, also known as bedsores, which are caused due to prolonged pressure on the skin that restricts blood flow and causes tissue damage. These devices include a range of products such as mattresses, cushions, and overlays that distribute body weight evenly to alleviate pressure on vulnerable areas.

Advanced versions of these devices feature technologies like air inflation systems and sensors to provide real-time adjustments and monitoring. By enhancing blood circulation and reducing pressure points, pressure relief devices play a critical role in improving patient comfort, preventing skin damage, and supporting overall skin health in both clinical and homecare settings.

Analyst’s Review

Key players are driving market growth through strategic collaborations, cutting-edge research, and substantial investments. By partnering with healthcare providers and investing in innovative technologies, they are aiming to develop advanced pressure relief devices, improve patient outcomes, and expand market reach.

- In September 2023, Arjo advanced the field of pressure injury prevention by focusing on early detection and efficient prevention. The company presented its research and field insights at the European Pressure Ulcer Advisory Panel annual meeting in Leeds, UK, highlighting its contributions to improving patient outcomes.

These advancements in early detection and prevention strategies, coupled with industry collaboration, are set to drive innovation and enhance patient care. As a result, they are projected to significantly accelerate market growth and expand the adoption of pressure relief devices.

Pressure Relief Devices Market Growth Factors

The increasing prevalence of chronic conditions like diabetes and obesity, which often result in reduced mobility, is significantly boosting the demand for pressure relief devices.

- According to the World Health Organization, approximately 422 million people globally have diabetes, with the majority residing in low- and middle-income countries. Each year, diabetes is directly responsible for 1.5 million fatalities.

These conditions make patients more susceptible to developing pressure ulcers, particularly as they age. As the global population continues to age, the incidence of these ulcers is expected to rise, creating a high demand for effective preventive measures. The growing awareness of the serious complications associated with pressure ulcers is driving healthcare providers to invest more in advanced pressure relief technologies, thereby propelling the market's growth.

However, one of the major challenges in the pressure relief devices market is the high cost associated with advanced technologies, which can limit product adoption, particularly in low- and middle-income regions. Additionally, there is a need for continuous education and training for healthcare providers to effectively use these devices and ensure proper patient outcomes.

Key players are addressing these challenges by investing in cost-effective, scalable solutions and expanding their product lines to include both advanced and basic options. They are also focusing on training programs and support services for healthcare providers to ensure optimal device use and patient care. Collaborations with regional partners and governments are further helping to improve accessibility and affordability, broadening the reach of pressure relief solutions.

Pressure Relief Devices Market Trends

Innovations in pressure relief devices, particularly smart mattresses equipped with integrated sensors, are revolutionizing patient care. Advanced mattresses continuously monitor pressure points and automatically adjust to redistribute pressure, reducing the risk of ulcers.

By providing real-time data to healthcare providers, these devices enable more personalized care, allowing for timely adjustments based on individual patient needs. This technology improves patient comfort and also enhances the effectiveness of preventive care, which leads to better clinical outcomes.

As healthcare systems have started prioritizing patient safety and outcomes, the adoption of these smart pressure relief solutions is rapidly increasing, which is expected to drive the market for pressure relief devices over the forecast period.

The shift toward home-based care is significantly driving market growth for pressure relief devices. As more patients choose to manage chronic conditions at home, the demand for accessible and user-friendly pressure relief solutions has surged. Manufacturers are responding by developing innovative, portable devices that cater specifically to the home care environment.

This expansion into the home care market is opening new revenue streams and broadening the consumer base beyond traditional healthcare facilities. The increased focus on aging, combined with the need for effective home management of chronic conditions, is fueling sustained growth in the pressure relief devices market.

Segmentation Analysis

The global market has been segmented based on product, application, end user, and geography.

By Product Type

Based on product type, the pressure relief devices market has been categorized into low-tech devices and hi-tech devices. The low-tech devices segment garnered the highest revenue of USD 1,586.7 million in 2023. This segment is further sub-segmented into foam-based mattress, gel-based mattress, air filled mattress, fluid filled mattress, and others.

These devices provide a reliable and affordable solution for pressure ulcer prevention, making them widely popular across various healthcare settings and home care environments. Their straightforward functionality ensures ease of use with minimal training.

As both healthcare facilities and home care users prioritize budget-friendly yet effective solutions, the demand for low-tech pressure relief devices remains robust. This sustained demand underscores the segment's ongoing market relevance and contributes significantly to its steady growth trajectory.

By Application

Based on application, the market has been categorized into pressure ulcers, burns, surgical wounds, and others. The pressure ulcers segment captured the largest pressure relief devices market share of 60.62% in 2023. This growth is primarily driven by the increasing elderly populations and their susceptibility to pressure ulcers and the rising prevalence conditions such as diabetes and immobility.

These factors aid the demand for effective pressure ulcer management solutions. Additionally, advancements in wound care technologies and pressure relief devices are enhancing treatment efficacy and offering market opportunities. As healthcare systems focus more on improving patient outcomes and preventing complications, the demand for comprehensive pressure ulcer solutions continues to rise. This trend reflects the segment's robust growth potential in the coming years.

By End User

Based on end user, the market has been categorized into hospitals, home care, long-term care centers, rehabilitation centers, and others. The hospitals segment is expected to garner the highest revenue of USD 1,928.1 million by 2031. As hospitals focus on enhancing care quality and preventing pressure ulcers, the demand for advanced pressure relief devices such as smart mattresses and high-performance cushions is rising.

Technological advancements further propel this growth, with hospitals adopting innovative solutions to improve patient outcomes and minimize complications. This segment's expansion aligns with broader healthcare trends favoring superior patient management and safety, which is expected to fuel the segment demand.

Pressure Relief Devices Market Regional Analysis

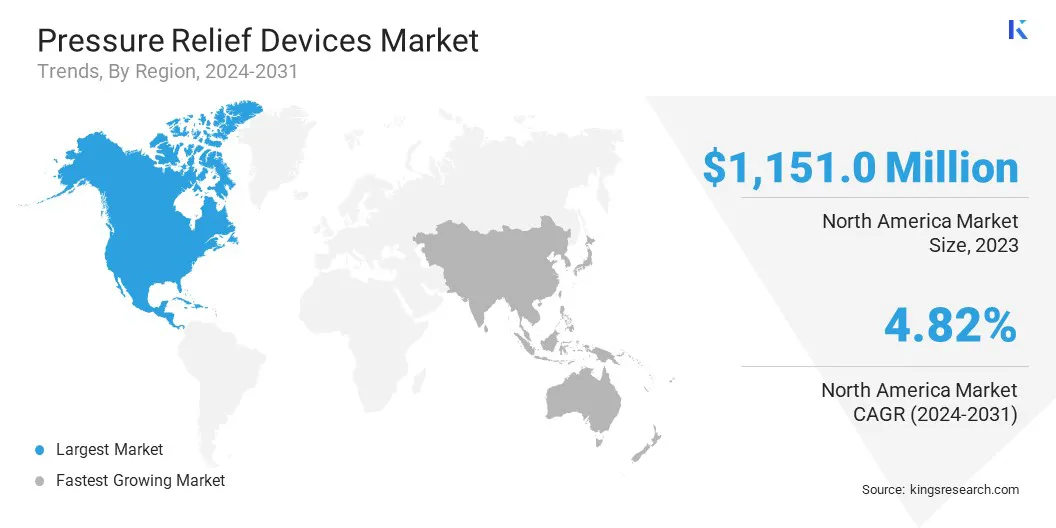

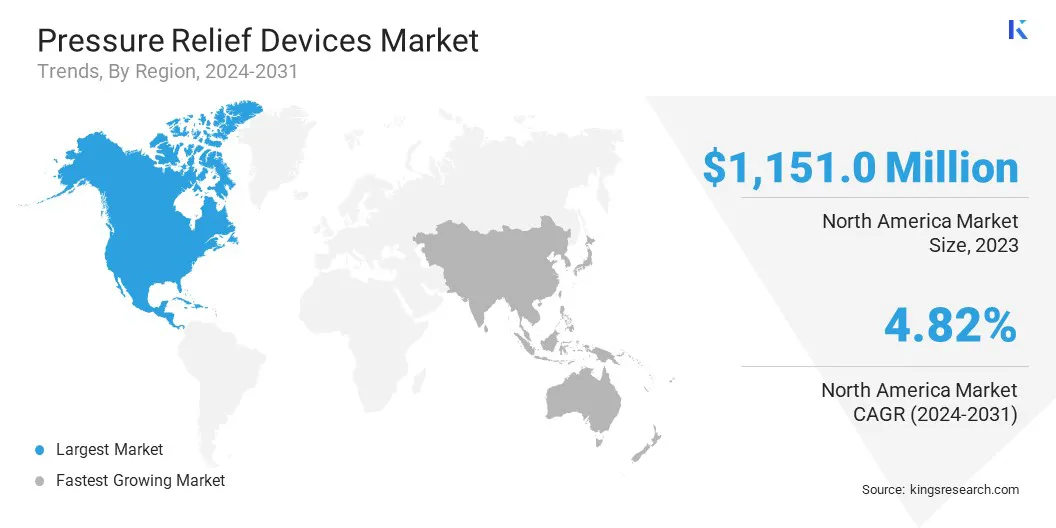

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America pressure relief devices market share stood around 39.69% in 2023 in the global market, with a valuation of USD 1,151.0 million. The region's advanced healthcare infrastructure supports the adoption of sophisticated pressure relief solutions, including high-tech mattresses and smart cushions. The focus on improving patient outcomes and preventing pressure ulcers is leading healthcare facilities to invest in advanced and high-end devices.

Additionally, stringent regulatory standards and a growing awareness of patient safety are further boosting market demand. The presence of key players and ongoing research and development activities in North America are contributing to its market expansion.

Asia-Pacific is anticipated to witness the fastest growth at a CAGR of 6.53% over the forecast period from 2024 to 2031. The region's diverse healthcare landscape, including a mix of developing and developed markets, drives the demand for cost-effective and scalable pressure relief solutions. Urbanization and economic growth are contributing to higher adoption rates in hospitals and home care settings.

Additionally, the rising prevalence of lifestyle-related diseases and an expanding elderly population are fueling the need for advanced pressure relief products. Regional government initiatives to improve healthcare infrastructure and increasing awareness of pressure ulcer prevention are further supporting market growth.

- In June 2022, Smith+Nephew opened a state-of-the-art manufacturing facility in Penang, Malaysia, covering 250,000 square feet and representing an investment of over USD 100 million. This facility is dedicated to supporting the company's orthopaedics business, which would witness significant growth in the Asia-Pacific region. The establishment of this facility underscored the region's expanding market opportunities and the company's commitment to enhancing its production capabilities to meet increasing demand for advanced orthopaedic solutions.

Competitive Landscape

The global pressure relief devices market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Pressure Relief Devices Market

- Stryker

- Arjo

- Hill-Rom Holdings, Inc

- Invacare Corporation.

- PARAMOUNT BED CO., LTD.

- Talley Group Ltd

- Rober Limited

- 5 Minds Mobility Group

- Smith+Nephew

- Medtronic

Key Industry Development

- July 2024 (Product Development): Bruin Biometrics, a leader in medical technology innovations, announced that its Pressure Injury Prevention Personal Assistant (PIPPA) will now integrate the updated Standardized Pressure Injury Prevention Protocol (SPIPP) checklist 2.0 from the National Pressure Injury Advisory Panel (NPIAP). Introduced in 2023, SPIPP 2.0 builds on the original guidelines based on the International Clinical Practice Guidelines 2019. This integration underscores PIPPA's advanced capabilities in transforming the prevention and management of hospital-acquired pressure injuries (HAPIs).

The global pressure relief devices market has been segmented:

By Product Type

- Low-tech Devices

- Foam-based Mattress

- Gel-based Mattress

- Air Filled Mattress

- Fluid Filled Mattress

- Others

- Hi-tech Devices

- Kinetic Beds

- Air Therapy Beds

By Application

- Pressure Ulcers

- Burns

- Surgical Wounds

- Others

By End User

- Hospitals

- Home Care

- Long-term Care Centers

- Rehabilitation Centers

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America