Power Equipment Batteries Market Size

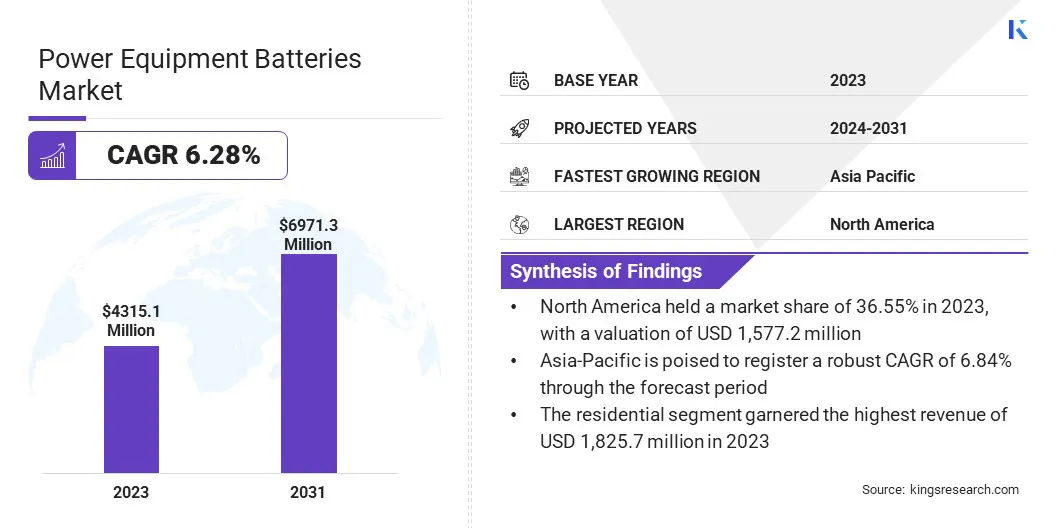

The global Power Equipment Batteries Market size was valued at USD 4,315.1 million in 2023 and is projected to grow from USD 4,550.8 million in 2024 to USD 6,971.3 million by 2031, exhibiting a CAGR of 6.28% during the forecast period. Rising development of longer-lasting batteries and expansion of IoT-enabled devices are driving the expansion of the market.

In the scope of work, the report includes products offered by companies such as Stanley Black & Decker, Inc., Bosch Limited, Hitachi, Ltd., Techtronic Industries Co. Ltd., Makita, Atlas Copco, Hilti, Husqvarna AB, EMBS, CHERVON and others.

The rising frequency of power outages globally is a significant factor propelling the growth of the power equipment batteries market. Unreliable power supply, often caused by aging infrastructure, extreme weather events, and growing energy demand, has increased the need for reliable backup power solutions. This trend is especially prominent in regions with unstable grids, where frequent blackouts disrupt businesses, healthcare services, and daily life.

Batteries for power equipment offer a dependable alternative, ensuring continuity of operations during outages. These batteries are used in a wide array of applications, including residential backup systems, commercial facilities, and critical infrastructures such as hospitals and data centers.

The growing adoption of renewable energy sources, which are intermittent, necessitates efficient energy storage solutions to maintain a consistent power supply. Moreover, the demand for robust and scalable battery solutions is rising, as they provide a buffer against power disruptions, enhance energy security, and support the seamless integration of renewable energy into the grid.

Power equipment batteries are energy storage devices designed to provide reliable and efficient power to various types of equipment. These batteries are integral to a wide range of applications, from industrial machinery and construction tools to backup systems for residential and commercial buildings.

Typically, these batteries include lead-acid, lithium-ion, nickel-cadmium, and other advanced chemistries, each offering specific advantages in terms of energy density, lifespan, and cost-effectiveness.

Power equipment such as forklifts, cranes, drills, and other heavy-duty tools rely heavily on these batteries for uninterrupted operation, particularly in off-grid or emergency scenarios.

Additionally, power equipment batteries are crucial for backup power solutions in critical applications such as hospitals, data centers, and telecommunications infrastructure, where power continuity is vital. They further play a significant role in renewable energy systems, storing excess energy generated from solar panels and wind turbines for later use.

Analyst’s Review

The power equipment batteries market is witnessing significant growth, propelled by the increasing demand for energy storage solutions across diverse sectors. Key market players are focusing on strategic initiatives to enhance their market position and capitalize on emerging opportunities.

Companies are investing heavily in research and development to innovate and improve battery technologies, aiming to offer products with higher energy density, longer lifespans, and enhanced safety features.

- For instance, in April 2024, Panasonic Group Company setup a development facility at Suminoe factory in Osaka, Japan. This new facility aims to enhance manufacturing competitiveness, expand global production capacity, and serve as a hub for advanced production process technology development.

Strategic partnerships and collaborations are further playing a pivotal role, enabling companies to expand their technological capabilities and market reach. Additionally, mergers and acquisitions are common strategies to consolidate market presence and gain competitive advantages. The growth trajectory is supported by government incentives and policies promoting renewable energy and energy storage solutions.

To remain competitive, companies must prioritize sustainability by addressing environmental concerns related to battery production and disposal. Emphasizing efficient recycling processes and developing eco-friendly batteries are crucial imperatives.

Power Equipment Batteries Market Growth Factors

The rising demand for renewable energy storage solutions is a significant factor contributing to the growth of the power equipment batteries market. As the world shifts toward cleaner energy sources such as solar and wind power, the need for efficient and reliable energy storage has become paramount.

Renewable energy generation is inherently variable and intermittent, presenting challenges in maintaining a stable power supply. Batteries provide a viable solution by storing excess energy produced during peak generation periods and releasing it when energy production is low or demand is high. This capability ensures a steady and reliable energy supply, facilitating the seamless integration of renewable energy into the power grid.

Moreover, advancements in battery technology have led to improved energy density, longer life cycles, and reduced costs, making battery storage systems more accessible and attractive for both utility-scale and residential applications.

High initial costs represent a significant challenge to the expansion of the market. The substantial upfront investment required for battery systems, including the costs of the batteries, installation, and associated infrastructure, is a considerable barrier for many potential users.

This financial barrier is particularly impactful for small businesses and residential consumers who may find it difficult to justify the initial expenditure despite the long-term benefits of energy storage solutions.

Furthermore, the cost of advanced battery technologies, such as lithium-ion, is significantly higher compared to traditional energy storage methods. To mitigate this challenge, governments and financial institutions offer subsidies, tax incentives, and low-interest loans to reduce the financial burden on consumers.

Additionally, as the technology matures and economies of scale are achieved through increased production and demand, the cost of batteries is expected to decrease. Companies further focus on developing more cost-effective solutions and innovative financing models, such as leasing and pay-as-you-go systems, to make energy storage more accessible and affordable.

Power Equipment Batteries Market Trends

The expansion of IoT-enabled devices and smart grids is leading to rising demand for efficient energy storage solutions. IoT devices, ranging from smart home systems to industrial automation, require consistent and reliable power to operate effectively.

Moreover, smart grids, which incorporate digital technology to manage and distribute electricity more efficiently, rely heavily on advanced energy storage systems to balance supply and demand.

Batteries play a crucial role in these systems by providing the necessary backup power and enabling the smooth operation of interconnected devices and systems. As the adoption of IoT technology continues to grow, the complexity and energy demands of these networks are increasing, thereby necessitating robust and efficient energy storage solutions.

Additionally, smart grids benefit from energy storage by reducing transmission losses, improving grid stability, and facilitating the integration of renewable energy sources.

This trend underscores the importance of developing high-performance batteries that meet the evolving needs of smart technologies and contribute to a more efficient and resilient energy infrastructure.

Segmentation Analysis

The global market is segmented based on type, equipment, voltage, application, and geography.

By Type

Based on type, the market is categorized into lithium-ion, nickel-cadmium, and others. The lithium-ion segment captured the largest power equipment batteries market share of 45.61% in 2023, largely attributed to its superior characteristics and widespread application.

Lithium-ion batteries offer high energy density, which allows for longer operation times and more compact storage solutions compared to other battery types. This high energy efficiency makes them the preferred choice for a variety of applications, including consumer electronics, electric vehicles (EVs), and industrial power equipment.

Additionally, lithium-ion batteries exhibit a lower self-discharge rate, which allows them to retain their charge longer when not in use, thereby enhancing their reliability and performance in critical applications. Their longer lifespan and faster charging capabilities contribute to their dominance in the market.

Moreover, ongoing advancements in lithium-ion technology have led to cost reductions, making them more accessible and economically viable for a broader range of uses. The increasing demand for clean energy solutions and the rapid growth of the EV market have further significantly boosted the adoption of lithium-ion batteries, consolidating their leading position in the market.

By Equipment

Based on equipment, the market is classified into drills & drivers, lawnmowers, chainsaws & power saws, and others. The lawnmowers segment is poised to record a staggering CAGR of 7.68% through the forecast period.

The growing shift toward battery-powered lawnmowers, away from traditional gasoline-powered models, is a major factor contributing to this growth. Battery-powered lawnmowers offer significant advantages, including lower emissions, reduced noise pollution, and easier maintenance. These benefits align with growing consumer preferences for environmentally friendly and convenient lawn care solutions.

Additionally, advancements in battery technology have led to the development of more powerful and longer-lasting batteries, thereby enhancing the performance and appeal of battery-powered lawnmowers.

The increasing adoption of smart home technologies and IoT devices plays a pivotal role, as modern battery-powered lawnmowers aims to integrate into smart home ecosystems by offering features such as remote operation and automated mowing schedules.

Furthermore, rising disposable incomes and increased spending on home improvement and landscaping activities are boosting the demand for high-quality lawn care equipment.

By Application

Based on application, the power equipment batteries market is divided into residential, commercial, and industrial. The residential segment garnered the highest revenue of USD 1,825.7 million in 2023, propelled by the increasing consumer demand for reliable home energy solutions and the widespread adoption of smart home technologies.

Homeowners are increasingly investing in battery backup systems to ensure uninterrupted power supply during outages due to the rising frequency of power disruptions and the need for energy security.

The growing popularity of solar energy systems in residential settings further fosters demand for home battery storage solutions, allowing homeowners to store excess solar power for use during non-sunny periods or power outages.

Additionally, the proliferation of IoT-enabled devices and smart home systems, which require consistent and reliable power, fuels the demand for residential battery solutions. Government incentives and subsidies for renewable energy installations and energy storage systems have made these technologies more affordable, leading to their widespread adoption.

Power Equipment Batteries Market Regional Analysis

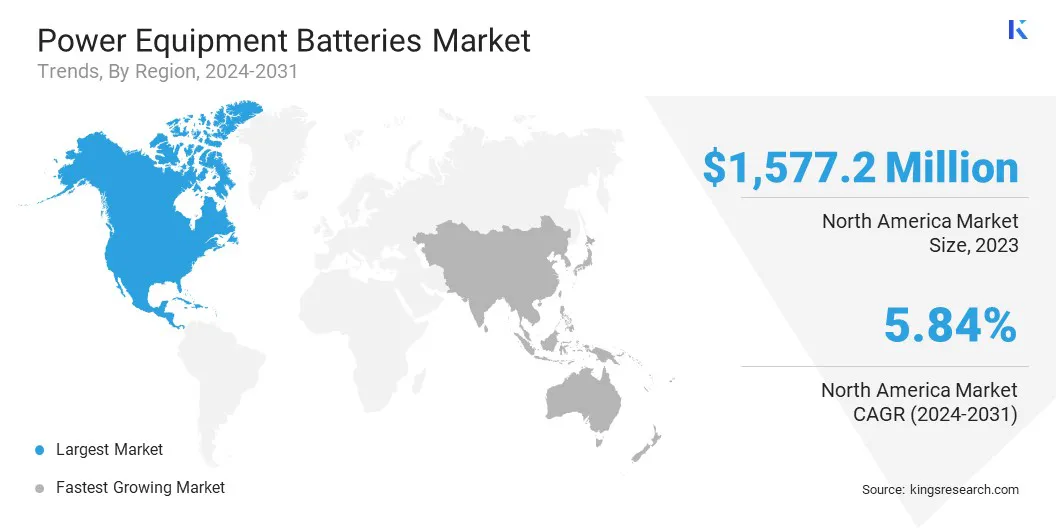

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America power equipment batteries market accounted for a major share of 36.55% and was valued at USD 1,577.2 million in 2023. This dominance is reinforced by several factors, including the region's advanced technological landscape and significant investments in renewable energy projects.

The United States and Canada have been at the forefront of adopting cutting-edge battery technologies, fueled by robust government support and incentives aimed at promoting energy efficiency and sustainability.

The increasing demand for backup power solutions in both residential and commercial sectors, especially in the face of frequent weather-related power outages, has boosted the growth of the regional market. Additionally, the growing penetration of electric vehicles in North America has spurred the development and deployment of high-performance battery systems.

Moreover, the region's well-established infrastructure for research and development in battery technology, coupled with strong industrial and economic growth, has played a crucial role in maintaining its leading market position.

Asia-Pacific is set to grow at a robust CAGR of 6.84% in the forthcoming years, fostered by rapid industrialization and urbanization across the region. The companies are making substantial investments in renewable energy projects and energy storage solutions to meet their increasing energy demands and reduce dependence on fossil fuels.

The increasing middle-class population and rising disposable incomes in these countries are fueling the demand for residential backup power solutions and electric vehicles, thereby propelling the market expansion.

Moreover, the region's strong manufacturing base, particularly in China, is leading to significant advancements in battery technology and production capabilities. Government initiatives and policies supporting clean energy and sustainable development are further bolstering regional market growth.

- For instance, incentives for electric vehicle adoption and investments in smart grid technologies are creating robust demand for efficient and reliable battery systems.

Competitive Landscape

The global power equipment batteries market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Power Equipment Batteries Market

Key Industry Developments

- May 2024 (Launch): Makita U.S.A. launched a new battery-only version of its 40V max ConnectX 1,200Wh Portable Power Supply (model PDC1200). This configuration provides an on-board power source for ConnectX lawn mowers, backpack blowers, and power stations without requiring a harness.

- August 2023 (Launch): Hilti Corporation introduced Nuron, an advanced cordless platform designed to enhance productivity, safety, and sustainability for construction professionals in India. This innovative platform features a cohesive range of tools, batteries, and chargers that operate seamlessly within a unified ecosystem, all powered by a single battery voltage.

- August 2023 (Launch): DEWALT, a Stanley Black & Decker brand, introduced the 21 inch 60V MAX Single-Stage Snow Blower. Engineered for superior performance, this snow blower meets professional demands by efficiently clearing up to 16 parking spaces on a single charge.

The global power equipment batteries market is segmented as:

By Type

- Lithium-ion

- Nickel-cadmium

- Others

By Equipment

- Drills & Drivers

- Lawnmowers

- Chainsaws & Power Saws

- Others

By Voltage

- Less than 15 V

- 15V- 36 V

- Above 36 V

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America