Market Definition

Polymeric adsorbents are synthetic crosslinked polymers designed to capture and remove specific compounds from liquids or gases. They offer high surface area, chemical stability, and selective adsorption properties that make them effective in purification and separation processes. They are widely applied in pharmaceuticals, food and beverages, chemicals, and cosmetics for purification, solvent recovery, sugar decolorization, and impurity removal.

Polymeric Adsorbents Market Overview

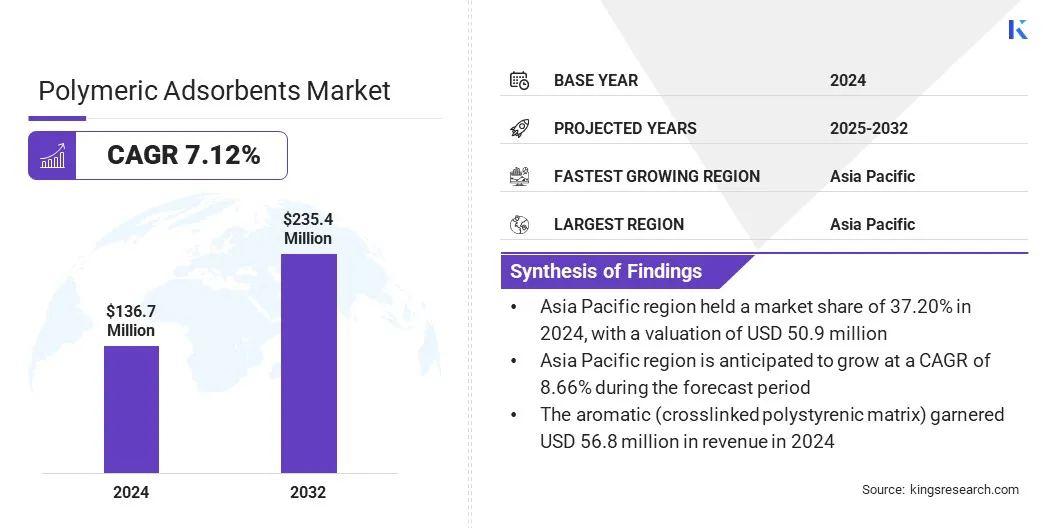

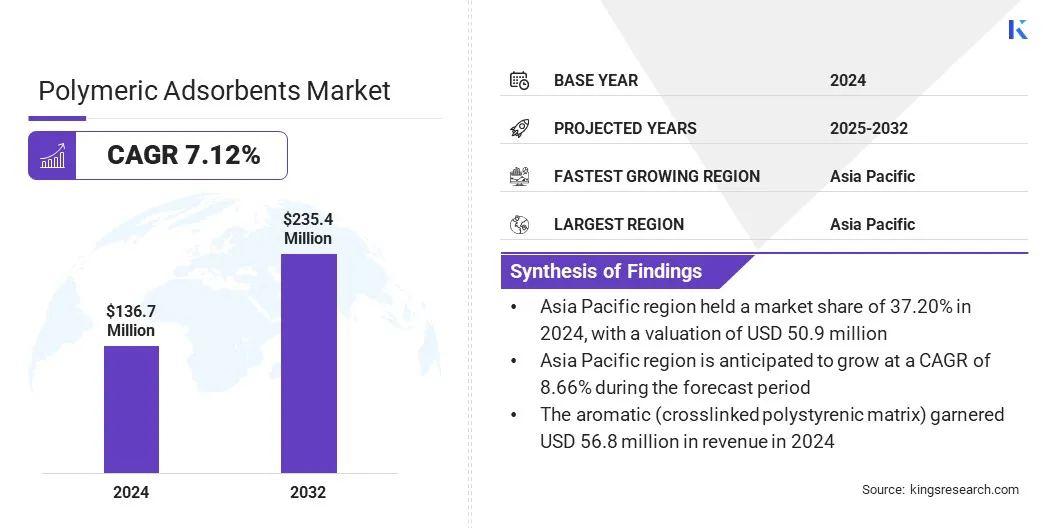

The global polymeric adsorbents market size was valued at USD 136.7 million in 2024 and is projected to grow from USD 145.5 million in 2025 to USD 235.4 million by 2032, exhibiting a CAGR of 7.12% during the forecast period. This growth is driven by the growing demand for food-grade polymeric adsorbents, which are increasingly used in sugar decolorization, beverage purification, and the removal of impurities in food processing.

Additionally, there is a growing trend of incorporating metal nanoparticles into polymeric adsorbents. This approach enhances adsorption capacity, improves selectivity, and increases chemical stability, allowing for more efficient contaminant removal in pharmaceuticals, chemicals, and water treatment applications.

Key Highlights:

- The polymeric adsorbents industry size was recorded at USD 136.7 million in 2024.

- The market is projected to grow at a CAGR of 7.12% from 2025 to 2032.

- Asia Pacific held a share of 37.20% in 2024, valued at USD 50.9 million.

- The aromatic (crosslinked polystyrenic matrix) segment garnered USD 56.8 million in revenue in 2024.

- The chlorinated solvents removal segment is expected to reach USD 68.7 million by 2032.

- The pharmaceuticals segment is projected to generate USD 69.6 million by 2032.

- North America is anticipated to grow at a CAGR of 6.35% over the forecast period.

Major companies operating in the polymeric adsorbents market are Purolite, DuPont de Nemours, Inc., Mitsubishi Chemical Group Corporation, Sunresin New Materials Co.Ltd., Thermax Limited, CHEMRA GmbH, IEI, Dynamic Environmental Corporation, SERVA Electrophoresis GmbH, and IPSUM LIFESCIENCES LLP.

Companies are focusing on conducting research to develop bio-based polymeric adsorbents that provide improved biodegradability, efficient contaminant removal, and reduced environmental impact in water treatment and industrial applications.

These solutions address the growing demand for sustainable and eco-friendly adsorbents across pharmaceuticals, chemicals, food and beverages, and wastewater treatment sectors. The adoption of bio-based adsorbents enhances operational efficiency and supports environmentally responsible practices, supporting market expansion.

Market Driver

Growing Demand for Food-Grade Polymeric Adsorbents

The expansion of the polymeric adsorbents market is fueled by growing demand for food-grade polymeric adsorbents, for enhancing purity and quality in sugar, beverages, and other food products.

Food and beverage manufacturers are adopting these adsorbents to maintain product quality, ensure safety, and comply with regulatory standards. This is promoting the development of specialized polymeric resins with enhanced adsorption capacity and selectivity for food applications. Expanding use in the food and beverage sector is strengthening market adoption.

Market Challenge

High Operational Costs

A major challenge impeding the expansion of the polymeric adsorbents market is the high operational costs associated with using adsorbents in industrial and water treatment applications, affecting cost-effective operations and adoption in price-sensitive sectors.

To address this challenge, market players are developing adsorbents with higher durability and reusability. They are also implementing optimized process efficiencies to reduce expenses and ensure consistent performance.

Market Trend

Incorporation of Metal Nanoparticles into Polymeric Adsorbents

The polymeric adsorbents market is witnessing a significant trend toward the incorporation of metal nanoparticles and nanomaterials into polymeric adsorbents. This innovative approach is enhancing adsorption capacity and selectivity, enabling the materials to target specific contaminants with greater efficiency while also improving chemical stability and surface reactivity.

These improvements make polymeric adsorbents more effective for applications in pharmaceuticals, chemicals, and water treatment. It supports the development of next-generation adsorbents that meet stricter industry standards and enable advanced purification processes across multiple sectors such as food and beverages, textiles, and industrial effluents.

Polymeric Adsorbents Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Aromatic (Crosslinked Polystyrenic Matrix), Modified Aromatic (Brominated Aromatic Matrix), Methacrylic (Methacrylic Ester Copolymer), Others

|

|

By Application

|

Chlorinated Solvents Removal, Sugar Decolorization, Heterocyclic Amines Removal, Purification of Alkanolamines, Anthocyanin Removal, Others

|

|

By End-use Industry

|

Pharmaceuticals, Food & Beverages, Chemicals, Industrial, Cosmetics & Personal Care, Textile, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Aromatic (Crosslinked Polystyrenic Matrix), Modified Aromatic (Brominated Aromatic Matrix), Methacrylic (Methacrylic Ester Copolymer), and Others): The aromatic (crosslinked polystyrenic matrix) segment earned USD 56.8 million in 2024, mainly due to its strong performance in removing organic impurities and its widespread use in chemical and pharmaceutical purification processes.

- By Application (Chlorinated Solvents Removal, Sugar Decolorization, Heterocyclic Amines Removal, Purification of Alkanolamines, and Anthocyanin Removal, and Others): The chlorinated solvents removal segment held a share of 29.42% in 2024, fueled by rising demand for efficient treatment technologies in industrial wastewater management and stricter environmental regulations.

- By End-use Industry (Pharmaceuticals, Food & Beverages, Chemicals, Industrial, Cosmetics & Personal Care, Textile, and Others): The pharmaceuticals segment is projected to reach USD 69.6 million by 2032, owing to increasing reliance on polymeric adsorbents for drug purification, impurity removal, and high-quality production standards.

Polymeric Adsorbents Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polymeric adsorbents market share stood at 37.20% in 2024, valued at USD 50.9 million. The dominance is reinforced by strong government initiatives in wastewater treatment, supported by stricter regulations and increased funding from national and regional government bodies for advanced water purification projects.

This is facilitating the deployment of polymeric adsorbents in municipal and industrial wastewater treatment plants, enabling industries to adopt efficient contaminant removal technologies. Increased adoption in key sectors such as chemicals, pharmaceuticals, food and beverages, and textiles is further strengthening regional dominance and promoting technological advancements.

- In October 2024, the Indian government introduced the Liquid Waste Management Rules, mandating strict wastewater treatment and a 60% reuse target by 2027. These regulations promote the adoption of polymeric adsorbents and advanced purification technologies in high-use sectors such as textiles and paper mills to ensure efficient contaminant removal and compliance with reuse standards.

The North America polymeric adsorbents industry is poised to grow at a CAGR of 6.35% over the forecast period. This growth is fostered by collaborations between companies and government agencies that accelerate research and development, foster innovation in high-performance polymeric adsorbents, and enable faster commercialization.

These partnerships also strengthen production capabilities and support adoption across pharmaceuticals, chemicals, and industrial sectors, contributing to regional market expansion.

- In July 2025, Puraffinity partnered with the U.S. Army Corps of Engineers under a Cooperative Research and Development Agreement (CRADA) to advance PFAS remediation technologies. The collaboration involves laboratory and field trials of the company’s G400 adsorbent, benchmarked against granular activated carbon and ion exchange resins.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the use of polymeric adsorbents in water and wastewater treatment under the Safe Drinking Water Act and the Clean Water Act.

- In Europe, the European Food Safety Authority (EFSA) evaluates and approves polymeric adsorbents for food contact and purification processes under Regulation (EC) No 1935/2004.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) oversees the use of polymeric adsorbents in food processing and pharmaceutical applications under the Food Sanitation Act.

- In India, the Central Pollution Control Board (CPCB) regulates the application of polymeric adsorbents in industrial effluent treatment under the Environment Protection Act, 1986.

Competitive Landscape

Key players operating in the polymeric adsorbents industry are focusing on developing engineered materials with higher surface area to enhance contaminant removal efficiency. Companies are advancing polymer design and controlled crosslinking processes to create adsorbents with tailored pore structures.

Many firms are expanding their research activities to optimize adsorption capacity through innovative resin formulations. Companies are also entering collaborations with research institutes to accelerate the development of next-generation adsorbents.

Key Companies in Polymeric Adsorbents Market:

- Purolite

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Group Corporation

- Sunresin New Materials Co.Ltd.

- Thermax Limited

- CHEMRA GmbH

- IEI

- Dynamic Environmental Corporation

- SERVA Electrophoresis GmbH

- IPSUM LIFESCIENCES LLP

Recent Developments

- In January 2025, Restek launched its Rezin certified clean SDVB resin for semivolatile organic compound (SVOC) sampling. The product offers exceptionally low contaminant levels, including PAHs, pesticides, PCBs, dioxins, and PFAS, and complies with EPA method TO-13 requirements. It is sieved and homogenized to ensure a free-flowing material ready for use without additional cleaning.