Market Definition

Polyethylene glycol (PEG) is a water-soluble substance composed of repeating units of ethylene oxide. Known for its safety, non-toxicity, and versatility, it is widely used in medicines, cosmetics, and industrial productsapplications.

Polyethylene Glycol Market Overview

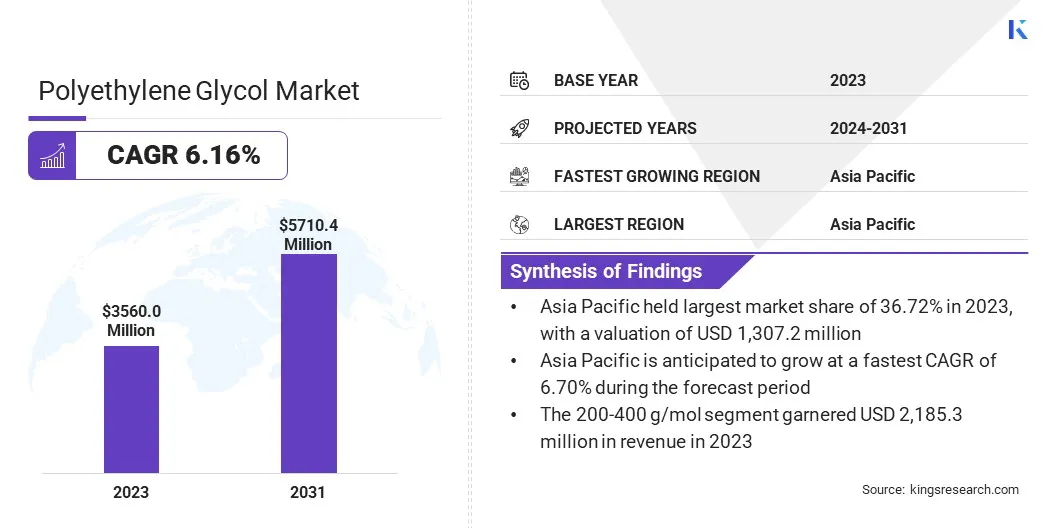

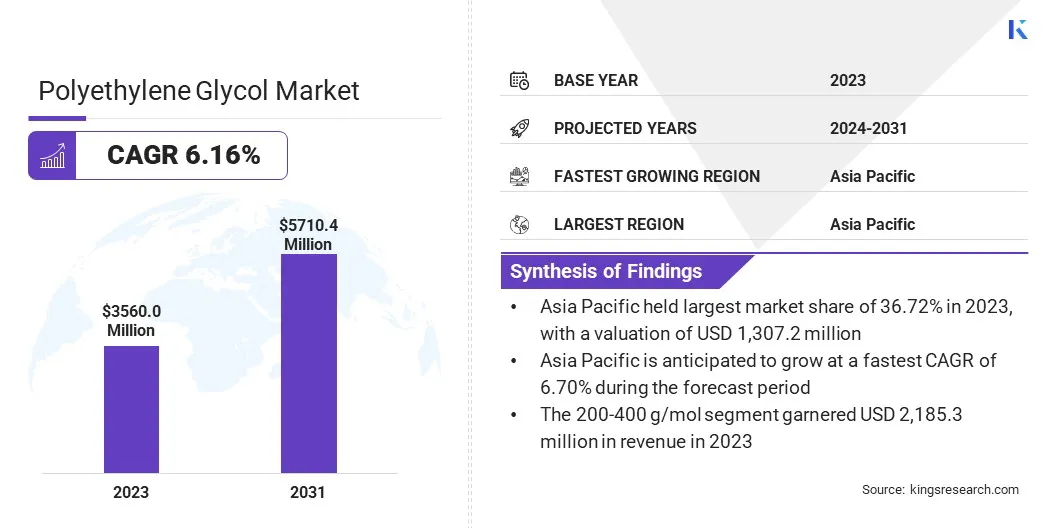

The global polyethylene glycol market size was valued at USD 3,560.0 million in 2023 and is projected to grow from USD 3,757.0 million in 2024 to USD 5,710.4 million by 2031, exhibiting a CAGR of 6.16% during the forecast period. This market is witnessing significant growth, driven by its widespread applications in pharmaceuticals, cosmetics, personal care, and industrial sectors.

The increasing demand for PEG in drug formulations, particularly in laxatives and drug delivery systems, is propelling market expansion. Additionally, the growing preference for PEG-based skin care and cosmetic products, owing to their moisture-retaining and non-toxic properties, is boosting their adoption.

Major companies operating in the global polyethylene glycol Industry are BASF, The Dow Chemical Company, Eastman Chemical Company, Saudi Basic Industries Corporation, INEOS Capital Limited, Sasol Limited, Petroliam Nasional Berhad, Lotte Corporation, CLARIANT, Croda International Plc, Merck KGaA, Polypure AS, SANYO CHEMICAL INDUSTRIES, LTD., Canopus Global Trading Co., and Matangi Industries.

The rise in industrial applications, including lubricants, coatings, and chemical processing, further supports market growth. Technological advancements and on-going research are exploring biodegradable and more sustainable alternatives to conventional PEG.

While PEG itself is not eco-friendly, these efforts are creating new market opportunities by addressing environmental concerns and regulatory demands. Increasing investments in advanced manufacturing techniques and the expanding application of PEG in biotechnology, adhesives, and surfactants further enhance its market potential on a global scale.

Key Highlights:

- The global polyethylene glycol market size was USD 3,560.0 million in 2023.

- The market is projected to grow at a CAGR of 6.16% from 2024 to 2031.

- Asia Pacific held a share of 36.72% in 2023, valued at USD 1,307.2 million.

- The 200-400 g/mol segment garnered USD 1,296.6 million in revenue in 2023.

- The pharmaceuticals segment is expected to reach USD 1,972.6 million by 2031.

- North America is anticipated to grow at a CAGR of 6.11% over the forecast period.

Market Driver

"Expanding Applications in Pharmaceuticals and Personal Care"

The polyethylene glycol market is witnessing steady growth, primarily fuled by its expanding applications in pharmaceuticals, healthcare, and personal care industries. In the pharmaceutical sector, PEG plays a crucial role in drug formulations as an excipient, enhancing the solubility and stability of active pharmaceutical ingredients (APIs).

It is widely used in injectable medications, as well as in laxatives and topical ointments, due to its generally non-toxic and biocompatible properties for medical applications. Additionally, PEG is a key component in advanced drug delivery systems, improving the controlled release and absorption of drugs, making treatments more effective.

In the personal care and cosmetics industry, PEG’s multifunctional properties, including its ability to act as a moisturizer, emulsifier, and solubilizer, are boosting its demand. It is commonly found in skincare products, shampoos, conditioners, and hygiene items, where it retains moisture, improves texture, and enhances the stability of formulations.

Its ability to dissolve both water- and oil-based ingredients makes it a preferred choice for manufacturers looking to create high-performance cosmetic and hygiene products. As consumer demand for high-quality and multifunctional personal care items rises, the PEG market is expected to expand substantially.

- In October 2024, Clariant launched its latest health care product portfolio in Italy. The company unveiled Polyglykol 1450 S, an advanced polyethylene glycol (PEG) solution that complies with the latest USP-NF monograph and FDA guidelines, ensuring superior quality and ease of handling in pharmaceutical formulations.

Market Challenge

"Regulatory Restrictions and Supply Chain Disruptions"

The polyethylene glycol market faces significant challenges, including regulatory restrictions, environmental concerns, supply chain disruptions, and fluctuating raw material prices.

PEG’s widespread use in pharmaceuticals, cosmetics, and industrial applications has led to increased regulatory scrutiny due to surging concerns regarding its biodegradability and potential toxicity. Stricter regulations from agencies such as the FDA and ECHA demand safer, eco-friendly alternatives.

To address this, manufacturers are developing bio-based and biodegradable PEG variants utilizing green chemistry techniques to ensure compliance while maintaining product effectiveness.

Additionally, the market is impacted by volatile raw material prices, particularly ethylene oxide, and supply chain disruptions due to geopolitical tensions and economic instability.

To counteract these risks, companies are diversifying raw material sourcing, securing long-term supplier agreements, and investing in localized production facilities to stabilize supply and reduce dependency on specific suppliers. These strategies support sustainability, regulatory compliance, and long-term market growth.

Market Trend

"Sustainable Innovations and Advancements in PEGylation"

The polyethylene glycol market is evolving with a major focus on sustainability and advancements in pharmaceutical applications. Manufacturers are developing sustainable and biodegradable PEG variants to meet stringent environmental regulations and rising consumer preference for greener chemicals. This has led to innovations in bio-based PEG production, reducing environmental impact while maintaining its functional properties.

- For instane in June 2024, researchers from Johannes Gutenberg University Mainz (JGU) introduced rPEG, a new class of polyethylene glycols (PEGs) designed to enhance medical applications by evading immune system detection. The rPEG polymer, developed by combining ethylene oxide with glycidyl methyl ether (GME), retains the advantages of traditional PEGs while overcoming immune recognition issues that have emerged in recent years.

Additionally, advancements in PEGylation technology are transforming the biopharmaceutical industry. PEGylation, the process of attaching PEG molecules to therapeutic proteins and drugs, enhances drug bioavailability, stability, and controlled release.

This technology is playing a critical role in improving the efficacy of biologics, including targeted drug delivery systems, reducing immunogenicity, and extending drug half-life. As the demand for PEGylated drugs grows, the market is set to witness notable expansion in the healthcare and biotechnology sectors.

Polyethylene Glycol Market Report Snapshot

|

Segmentation

|

Details

|

|

By Molecular Weight

|

200-400 g/mol, 400-600 g/mol, 600-1000 g/mol, Others (1000-2000 g/mol, Above 2000 g/mol)

|

|

By End-Use Industry

|

Pharmaceuticals, Cosmetics and Personal Care, Industrial Solvents, Food and Beverages, Others (Textile Finishing, Medical Devices, Pharmaceutical Packaging, Lubricant Additives)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Molecular Weight (200-400 g/mol, 400-600 g/mol, 600-1000 g/mol, and Others (1000-2000 g/mol, Above 2000 g/mol)): The 200-400 g/mol segment earned USD 1,296.6 million in 2023 due to its extensive use in pharmaceutical formulations, personal care products, and industrial applications.

- By End-Use Industry (Pharmaceuticals, Cosmetics and Personal Care, Industrial Solvents, and Food and Beverages): The pharmaceuticals segment held a major share of 35.35% in 2023, attributed to the widespread application of PEG in drug formulations, excipients, and advanced drug delivery systems, particularly in injectable medications and laxatives.

Polyethylene Glycol Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific polyethylene glycol market accounted for a substantial share of 36.72% in 2023, valued at USD 1,307.2 million. This dominance is reinforced by the strong presence of pharmaceutical, personal care, and industrial manufacturing industries in countries such as China, India, and Japan.

The rising demand for PEG in drug formulations, cosmetics, and industrial applications, coupled with increasing investments in research and development, is further fueling this expansion.

Additionally, the growing focus on bio-based and sustainable PEG variants is bolstering this expansion. This growth is further , supported by expanding healthcare infrastructure, rising disposable income, and increasing adoption of advanced pharmaceutical and personal care products.

North America polyethylene glycol Industry is expected to register the fastest growth, with a CAGR of 6.11% over the forecast period. This growth is primarily propelled by the rising demand for PEG in pharmaceutical applications, particularly in drug formulations and drug delivery systems.

The strong presence of leading pharmaceutical and biotechnology companies, along with increasing investments in PEGylation technology, is further bolstering this expansion.

Additionally, the growing demand for PEG in personal care and cosmetics, along with advancements in green chemistry for sustainable PEG production, is contributing to this growth. The U.S. at the forefront of this growth, supported by regulatory approvals for PEG-based drugs and the increasing focus on innovative drug delivery solutions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates polyethylene glycol (PEG) for pharmaceutical, cosmetic, and food applications, ensuring its safety for human use. The Environmental Protection Agency (EPA) oversees its environmental impact, in industrial applications.

- In Europe, the European Chemicals Agency (ECHA) governs polyethylene glycol under the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation to ensure safe usage. The European Food Safety Authority (EFSA) assesses its safety in food and pharmaceutical applications, while the European Medicines Agency (EMA) regulates its use in drug formulations.

- In China, the National Medical Products Administration (NMPA) oversees polyethylene glycol's use in pharmaceuticals and cosmetics, ensuring compliance with safety standards.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) monitors polyethylene glycol in pharmaceuticals, cosmetics, and food industries under the Pharmaceutical and Medical Device Act (PMDA).

- In India, the Food Safety and Standards Authority of India (FSSAI) oversees polyethylene glycol in food and beverage applications, the Central Drugs Standard Control Organization (CDSCO) monitors its use in pharmaceuticals, and the Bureau of Indian Standards (BIS) establishes guidelines for industrial and cosmetic applications of PEG.

Competitive Landscape

The global polyethylene glycol market is characterized by a large number of participants, including both established corporations and emerging players. These companies are prioritizing product innovation, pricing strategies, expansion into emerging markets, and advancements in production technologies to increase their market share.

They further focus on enhancing product quality, purity, and sustainability to cater to the growing demand across pharmaceutical, personal care, and industrial applications.

Geographical expansion is another major strategy, with companies strengthening their presence in high-growth regions through partnerships, mergers, and acquisitions. The increasing adoption of PEG in emerging markets provides significant opportunities for industry players to expand their customer base.

Additionally, strategic collaborations with end-use industries, including pharmaceuticals, cosmetics, and food processing, enable companies to co-develop innovative solutions and gain a competitive edge.

- In December 2024, Ampersand Capital Partners acquired Nektar Therapeutics’ PEGylation reagent manufacturing business and launched Gannet BioChem as a newly branded company. Gannet BioChem, a specialty CDMO with 30+ years of expertise, specializes in developing and manufacturing polyethylene glycol reagents for biopharmaceuticals.

List of Key Companies in Polyethylene Glycol Market:

- BASF

- The Dow Chemical Company

- Eastman Chemical Company

- Saudi Basic Industries Corporation

- INEOS Capital Limited

- Sasol Limited

- Petroliam Nasional Berhad

- Lotte Corporation

- CLARIANT

- Croda International Plc

- Merck KGaA

- Polypure AS

- SANYO CHEMICAL INDUSTRIES, LTD.

- Canopus Global Trading Co.

- Matangi Industries

Recent Developments

- In February 2024, Evonik and Johannes Gutenberg University of Mainz entered a license agreement to commercialize randomized polyethylene glycols (rPEGs), a new class of PEGs designed to enhance immunogenicity profiles in nucleic acid drug delivery. Evonik will integrate rPEGs into its specialized lipid platform and offer technical-grade rPEG-lipids starting in the second half of 2024.