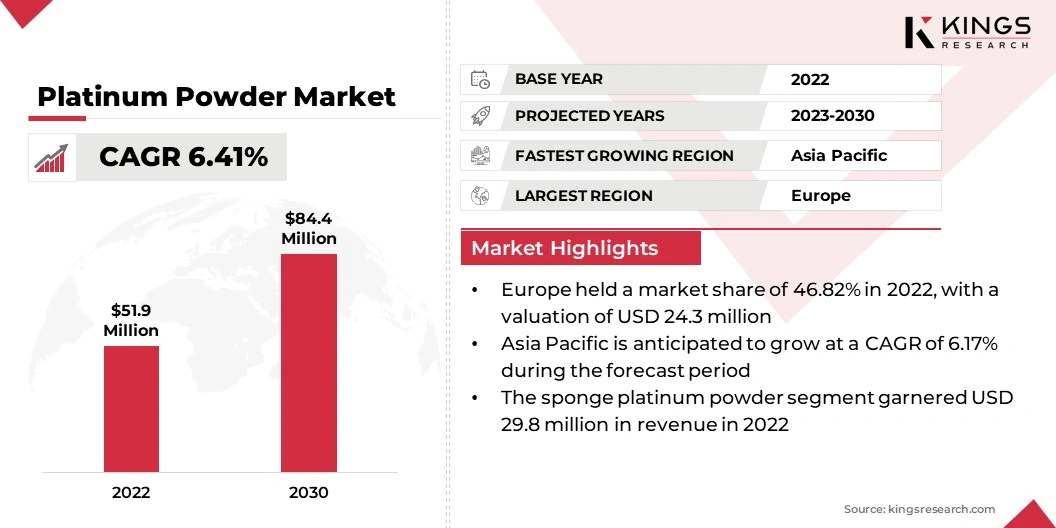

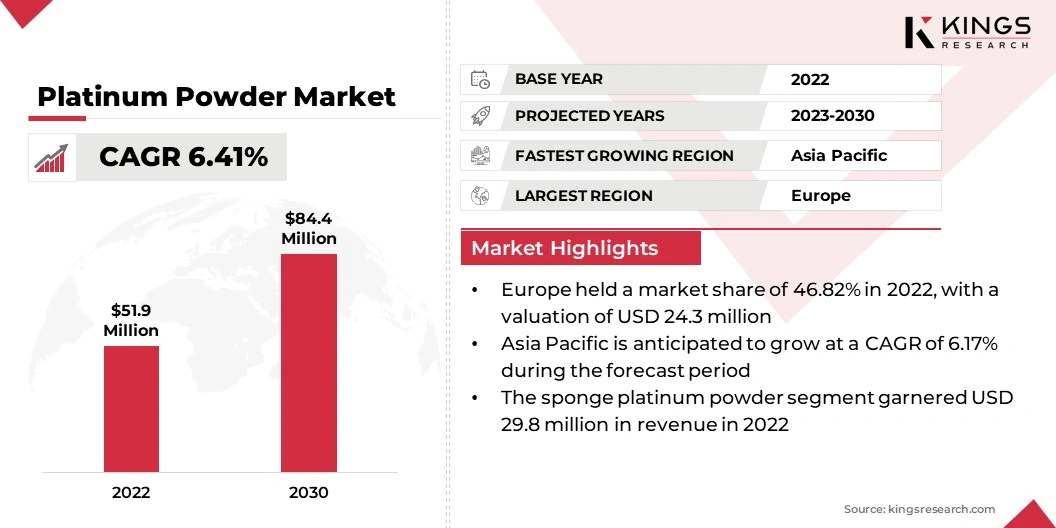

Platinum Powder Market Size

The global Platinum Powder Market size was valued at USD 51.9 million in 2022 and is projected to reach USD 84.4 million by 2030, growing at a CAGR of 6.41% from 2023 to 2030. In the scope of work, the report includes products offered by companies such as Johnson Matthey, Heraeus Holding, Tanaka Holdings, Sino-Platinum Metals Co., Ltd., Anglo American Platinum Limited, American Elements, Umicore, Triveni Interchem Pvt. Ltd., Materion Corporation, BASF SE and Others.

The platinum powder market is experiencing significant growth due to various factors and ample opportunities. One of the main driving factors is the growing demand for platinum in multiple industrial sectors, such as catalytic converters, fuel cells, and the electronics industry. Platinum possesses unique properties, including exceptional catalytic activity and corrosion resistance, making it indispensable in these fields.

Moreover, the automotive industry's shift towards environmentally friendly technologies and stricter emissions regulations has led to increased demand for platinum in catalytic converters. This trend is expected to continue in the coming years. Additionally, the expanding renewable energy sector, particularly hydrogen fuel cells, presents a substantial opportunity for platinum powder which catalyzes these clean energy technologies. Overall, the market is set for significant growth in the near future due to its versatile applications and its crucial role in promoting sustainability.

Analyst’s Review

The platinum powder market is poised to witness significant trends that will shape the industry from 2023 to 2030. There will be a surge in research and development activities aimed at improving the efficiency and cost-effectiveness of platinum powder making it more accessible for various applications. Sustainability concerns will continue to drive demand, particularly in the automotive and renewable energy sectors. Platinum's ability to reduce emissions and facilitate clean energy production will be crucial in meeting these sustainability goals.

Additionally, market players will prioritize recycling and refining processes to minimize disruptions in the supply chain and ensure the stable availability of platinum powder. Geopolitical factors and trade policies will play a crucial role in shaping the market dynamics, highlighting the rising need for diversification in sourcing platinum resources. These trends collectively indicate a promising future for the platinum powder market in the forecast years.

Market Definition

Platinum powder is finely ground platinum metal with high purity that is used in various industries due to its exceptional properties. It is known for its catalytic activity, electrical conductivity, and corrosion resistance. One of its main applications is in catalytic converters, where it helps reduce harmful emissions from vehicles, playing a vital role in the automotive industry's efforts to comply with strict environmental regulations.

Additionally, platinum powder is crucial in the electronics industry, where it is used in the production of electrical contacts, sensors, and fuel cells. Different regions and industries have different regulations regarding the use of catalytic converters, with a particular emphasis on environmental regulations. Complying with these regulations is crucial for market players to ensure product quality and environmental responsibility.

Platinum Powder Market Dynamics

The increasing adoption of hydrogen fuel cell technology is a significant driver for the platinum powder market growth. Platinum acts as a catalyst in fuel cells, enabling the conversion of hydrogen and oxygen into electricity, with water as the only byproduct. As the world prioritizes clean and sustainable energy sources, fuel cells are increasingly gaining popularity in various sectors, including transportation and stationary power generation. This growing interest in fuel cells is expected to boost the demand for platinum powder in the forthcoming period.

Another exciting market opportunity lies in the expanding use of platinum powder in the medical field. Platinum-based drugs are employed in chemotherapy, and ongoing research is exploring new therapeutic possibilities. As medical science progresses, the demand for platinum powder in pharmaceutical applications is anticipated to increase, offering a promising avenue for market expansion.

However, one of the key challenges for the market expansion is its high cost. Platinum is a rare and precious metal, and its extraction and refinement processes require significant resources, leading to its elevated price. This cost factor can restrict its adoption in certain applications where lower-cost alternatives may be preferred, posing a hurdle to market growth.

Moreover, geopolitical uncertainties and trade restrictions can pose challenges to the platinum powder market development. As a globally sourced commodity, disruptions in the supply chain due to political tensions or trade disputes can result in fluctuations in availability and pricing, affecting market stability.

Segmentation Analysis

The global market is segmented based on product type, purity, particle size, application, and geography.

By Product Type

Based on product type, the platinum powder market is segmented into sponge platinum powder, chemical precipitation platinum powder, and electrolytic platinum powder. The sponge platinum powder segment dominated the market in 2022 by asserting the highest valuation of USD 29.8 million. This dominance can be attributed to the exceptional purity and superior catalytic properties of sponge platinum powder, making it highly suitable for vital applications such as fuel cells and chemical processes.

By Purity

Based on purity, the platinum powder market is bifurcated into high purity and standard purity. The high purity segment is anticipated to lead the market over the forecast period, exhibiting a CAGR of 6.94% between 2023 and 2030. The segment is projected to experience high demand due to its suitability for critical applications, ensuring reliable performance. This has made it a preferred choice for industries such as aerospace, defense, and medical. The high demand for the purest form of platinum powder is further driven by its ability to withstand extreme temperatures and harsh environments without compromising its performance.

By Particle Size

Based on particle size, the platinum powder market is classified into microparticles, submicron particles, nanoparticles, and macroscopic particles. The microparticles segment is likely to account for the highest valuation of USD 45.9 million by 2030. The features of microparticles such as versatility make them the most commonly utilized particle size in various industries. The small size of microparticles allows them to be easily dispersed in liquids, making them ideal for applications in chemical reaction catalysts, personal care, and other industries.

By Application

Based on application, the market is categorized into catalysts, jewelry & personal care, glass manufacturing, chemical processing, electronics, medical devices, and others. The dominance of platinum powder as a catalyst in the market is driven by its pivotal role in various industries. With a remarkable 83.30% market share in 2022, platinum-based catalysts are indispensable in automotive applications, petrochemical processes, and renewable energy, particularly hydrogen fuel cells. As industries prioritize sustainability and efficiency, the demand for platinum powder as a catalyst is expected to remain robust over the review period.

Geographical Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Platinum Powder Market share stood around 46.82% in 2022 in the global market, with a valuation of USD 24.3 million, mainly driven by its robust automotive industry and strict emissions regulations. The region's dedication to reducing vehicle emissions has resulted in a significant demand for platinum powder in catalytic converters. Additionally, Europe's investments in renewable energy technologies, such as hydrogen fuel cells, are boosting the demand for platinum powder in the region.

The Asia-Pacific region is depicting the highest growth rate in the platinum powder market, with a projected CAGR of 6.17% between 2023 and 2030. This remarkable growth can be attributed to the region's rapid industrialization, expanding automotive sector, and increasing adoption of clean energy technologies. As countries in Asia-Pacific prioritize environmental sustainability and aim to reduce emissions, the demand for platinum powder, particularly in catalytic converters and fuel cells, is expected to increase. Furthermore, the rise of electric vehicles and the need for efficient energy storage solutions are driving the use of platinum in the region, positioning Asia-Pacific as a crucial catalyst for market expansion over the forecast period.

Competitive Landscape

The platinum powder market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments involve a range of strategic initiatives including investments in R&D activities, new manufacturing facilities, and supply chain optimization which could pose new opportunities for the market.

List of Key Companies in Platinum Powder Market

- Johnson Matthey

- Heraeus Holding

- Tanaka Holdings

- Sino-Platinum Metals Co., Ltd.

- Anglo American Platinum Limited

- American Elements

- Umicore

- Triveni Interchem Pvt. Ltd.

- Materion Corporation

- BASF SE

Key Industry Development

- May 2021 (Product Launch): PPG introduced Coraflon platinum powder coatings, specifically designed for architectural metals. These coatings offer superior durability, weather resistance, and color retention, making them ideal for exterior applications. With this launch, PPG aimed to provide architects and builders with a high-performance solution for enhancing the aesthetics and longevity of architectural metal surfaces.

The global Platinum Powder Market is segmented as:

By Product Type

- Sponge Platinum Powder

- Chemical Precipitation Platinum Powder

- Electrolytic Platinum Powder

By Purity

- High Purity

- Standard Purity

By Particle Size

- Microparticles

- Submicron Particles

- Nanoparticles

- Macroscopic Particles

By Application

- Catalysts

- Jewelry & Personal Care

- Glass Manufacturing

- Chemical Processing

- Electronics

- Medical Devices

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America