Market Definition

The market involves the design, manufacturing and distribution of compact microchips that integrate multiple photonic components such as lasers, modulators and detectors onto a single platform. These circuits are used to process and transmit information through light (photons) rather than traditional electronic signals.

It serves industries like telecommunications, data centers, and biomedical sensing, leveraging materials like indium phosphide and silicon. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the market.

Photonic Integrated Circuits Market Overview

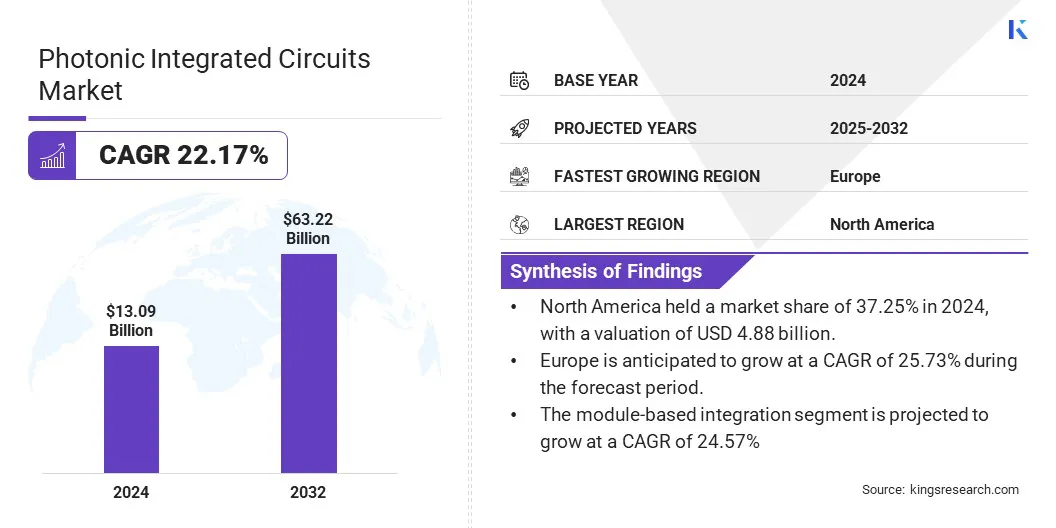

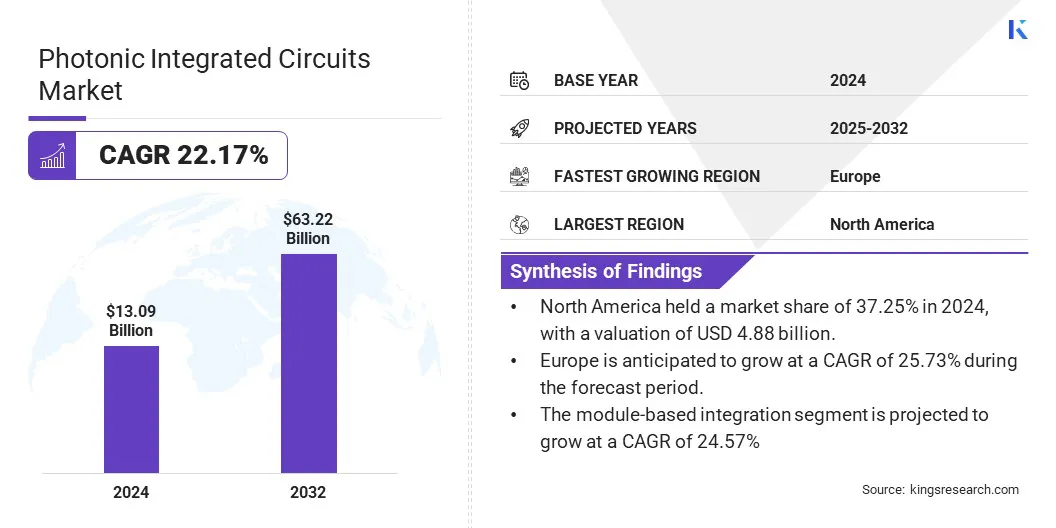

The global photonic integrated circuits market size was valued at USD 13.09 billion in 2024 and is projected to grow from USD 15.56 billion in 2025 to USD 63.22 billion by 2032, exhibiting a CAGR of 22.17% during the forecast period.

The growing demand for high-speed data transmission is driving the adoption of photonic integrated circuits across data centers and telecommunication networks. These PICs provide faster, more energy-efficient communication solutions essential for supporting expanding digital infrastructure and AI workloads. Rising investments in research and development are supporting innovations in programmable and scalable photonic technologies.

Major companies operating in the photonic integrated circuits industry are Eagle Photonics, LIGENTEC SA, Lumentum Operations LLC, VLC Photonics, Bright Photonics B.V., Intel Corporation, SCINTIL Photonics, VPIphotonics, AEPONYX Inc, Sicoya GmbH, Broadcom, Rockley Photonics, LIGENTEC SA, Freedom Photonics LLC and iPronics.

The rising data traffic driven by cloud computing, video streaming, AI workloads, and IoT applications is accelerating the need for high-speed, energy-efficient communication infrastructure. To handle this surge, data centers and telecom providers are increasingly turning to photonic integrated circuits (PICs), which offer superior bandwidth, lower latency, and reduced power consumption compared to traditional electronic solutions.

- According to the International Telecommunication Union (ITU), about 5.5 billion people or 68% of the global population are using the Internet in 2024, up from 53% in 2019.

Key Highlights:

- The photonic integrated circuits market size was valued at USD 13.09 billion in 2024.

- The market is projected to grow at a CAGR of 22.17% from 2025 to 2032.

- North America held a market share of 37.25% in 2024, with a valuation of USD 4.88 billion.

- The lasers segment garnered USD 3.27 billion in revenue in 2024.

- The indium phosphide (InP) segment is expected to reach USD 31.13 billion by 2032.

- The module-based integration segment is projected to grow at a CAGR of 24.57%

- The telecommunications segment held a market share of 42.15% in 2024.

- Europe is anticipated to grow at a CAGR of 25.73% during the forecast period.

Market Driver

High Data Center Consumption Fuels PICs

The increasing power consumption in traditional data centers is driving the adoption of energy-efficient alternatives such as photonic integrated circuits (PICs). Surging global data traffic is placing strain on conventional electronic systems, which face growing challenges related to energy use and heat dissipation.

PICs address these limitations by leveraging optical signal transmission, offering reduced power consumption and lower thermal output. This efficiency is driving their adoption in high-performance computing and hyperscale data center environments.

- For instance, according to the International Energy Agency (IEA), data centers globally consumed between 300 and 380 terawatt-hours (TWh) of electricity in 2023.

Market Challenge

High Costs from Complex Fabrication

The photonic integrated circuits market is facing a significant challenge due to its complex fabrication processes. Manufacturing PICs requires precise alignment of multiple photonic elements such as lasers, modulators, and detectors on a single chip, which remains technically demanding and time-consuming. This complexity leads to lower yields and higher defect rates, driving up expenses.

To address this challenge, companies are investing in advanced manufacturing technologies like automated alignment and bonding to improve precision and yield. They are developing standardized, modular PIC designs to simplify integration and reduce variability. Additionally, AI-driven design optimization and improved packaging/testing techniques are streamlining manufacturing and reducing overall costs.

Market Trend

Advancing Design Automation in Photonics

The market is experiencing notable progress in design automation tools that streamline the development process. These advanced platforms integrate simulation, layout, and verification into a unified workflow, enabling more efficient and accurate design cycles.

By incorporating real-world data and predictive modeling, they reduce design errors and accelerate prototyping. This shift toward automated design is improving scalability, reducing time-to-market, and supporting the production of more complex and high-performance photonic devices.

- In March 2025, Keysight Technologies launched Photonic Designer, a comprehensive photonic design automation (PDA) software that optimizes photonic integrated circuit performance through advanced physics-based simulation. The solution addresses fragmented workflows and simulation inconsistencies by providing a holistic, accuracy-driven environment from concept to manufacturing.

Photonic Integrated Circuits Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Lasers, Modulators, Detectors, Multiplexers/Demultiplexers, Optical Amplifiers, Others

|

|

By Material Platform

|

Indium Phosphide (InP), Silicon Photonics, Lithium Niobate, Gallium Arsenide (GaAs), Others

|

|

By Integration Technology

|

Hybrid Integration, Monolithic Integration, Module-based Integration

|

|

By End Use Industry

|

Telecommunications, Data Centers, Healthcare & Life Sciences, Industrial, Defense & Aerospace, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Lasers, Modulators, Detectors, Multiplexers/Demultiplexers, and Optical Amplifiers, Others): The lasers segment earned USD 3.27 billion in 2024 due to its critical role in enabling high-speed optical signal generation and transmission, which is essential for data centers and telecommunication networks.

- By Material Platform (Indium Phosphide (InP), Silicon Photonics, Lithium Niobate, and Gallium Arsenide (GaAs)): The indium phosphide (InP) segment held 42.00% of the market in 2024, due to its superior performance in high-frequency and high-power applications, making it ideal for telecommunications and data center solutions.

- By Integration Technology (Hybrid Integration, Monolithic Integration, Module-based Integration): The hybrid integration segment is projected to reach USD 31.12 billion by 2032, owing to its ability to combine the best properties of different materials and components, offering enhanced functionality and scalability.

- By End-Use Industry (Telecommunications, Data Centers, Healthcare & Life Sciences, Industrial, Defense & Aerospace, Others): The telecommunications segment held a market share of 42.15% in 2024 due to the increasing demand for faster, more reliable network infrastructure driven by 5G rollout and expanding internet usage worldwide.

Photonic Integrated Circuits Market Regional Analysis

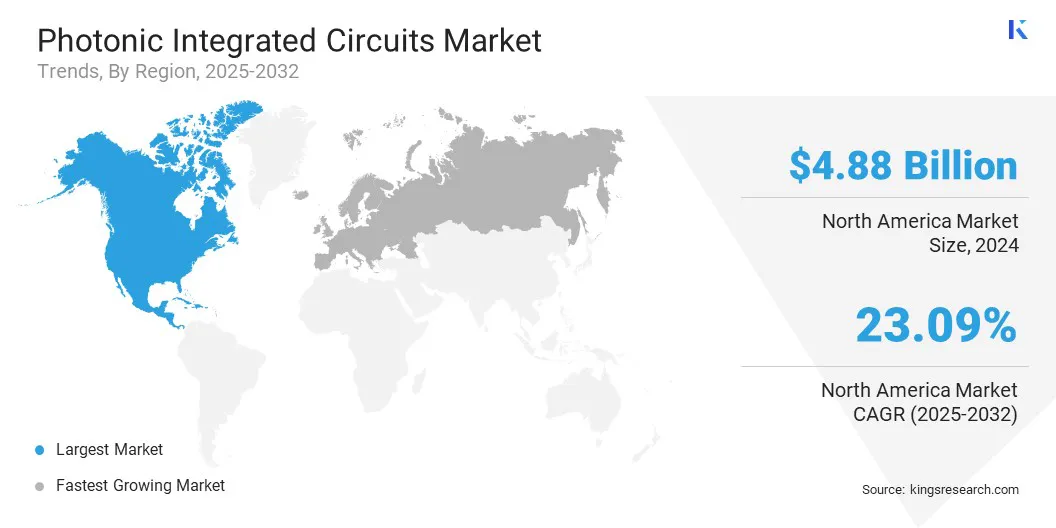

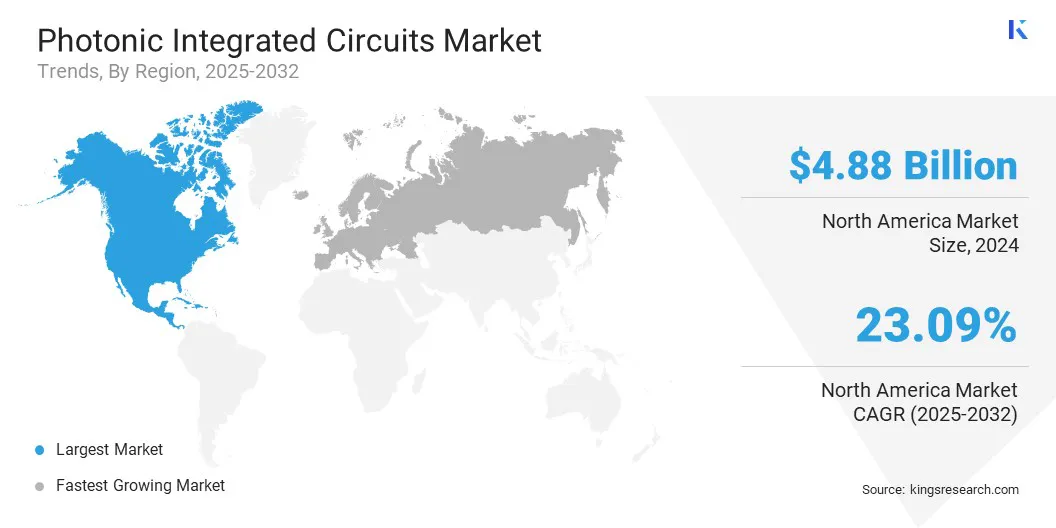

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America photonic integrated circuits market accounted for a share of around 37.25% in 2024, with a valuation of USD 4.88 billion. This dominance is attributed to the rising innovation in optical networking.

Major companies in optical networking and photonic integration industry are accelerating product development to meet the increasing demand for high-speed data transmission in AI-driven data centers. Strategic acquisitions of players in data centers are enhancing capabilities in optical communication technologies, allowing faster response to evolving network and power demands.

This collaborative ecosystem, supported by advanced R&D on next-generation data infrastructure, is supporting the region in scaling photonic technologies for commercial and enterprise-level applications.

- In February 2025, Nokia acquired the Infinera Corporation, a U.S.-based optical networking solutions provider. The acquisition combines the innovation capabilities of both companies, supported by Nokia Bell Labs, to accelerate product development and better serve the growing demands of AI-driven data centers.

The Europe photonic integrated circuits industry is set to grow at a robust CAGR of 25.73% over the forecast period. This growth is fueled by strong innovation and investment in reconfigurable optical technologies. Emerging companies based on europe are securing significant funding to expand teams and develop next-generation products that address increasing demand in AI-driven data centers.

Additionally, the market is benefiting from the adoption of technologies that enable energy-efficient, high-bandwidth communication across adaptable and scalable network architectures, significantly contributing to market growth..

- In January 2025, iPronics, a Spanish startup from the Technical University of Valencia, Spain, raised USD 20.7 million to accelerate the deployment of its software-defined optical networking engine (ONE) in data centers. iPronics ONE addresses the growing demand for reconfigurable, high-bandwidth, and energy-efficient communication by enabling on-the-fly topology adaptation.

Regulatory Frameworks

- In the UK, the Department for Science and Innovation oversees policies and initiatives related to the development and manufacturing of chips, including PICs.

- In China, the Ministry of Industry and Information Technology (MIIT) is the regulatory authority overseeing the development and production of photonic integrated circuits (PICs). They set policies, standards, and regulations related to the industry, including PICs.

- In India, the Ministry of Electronics and Information Technology (MeitY) regulates electronics and information technology, including photonic integrated circuits. They are responsible for formulating and implementing policies related to t photonic chips in India.

Competitive Landscape

Major players in the photonic integrated circuits market are adopting advanced simulation technologies and leveraging cloud-based high-performance computing platforms to accelerate design workflows. By integrating powered tools, they are optimizing chip designs more efficiently and minimizing development errors.

The strategic use of scalable cloud infrastructure is supporting faster, more accurate design iterations and strengthening their position in an increasingly demanding market landscape.

- In October 2024, Ansys, TSMC, and Microsoft collaborated to accelerate silicon photonic integrated circuit (PIC) simulations using Microsoft Azure NC A100v4-series virtual machines. Leveraging Nvidia A100 GPUs on Azure’s cloud platform, Ansys sped up its Lumerical FDTD photonics simulation by over 10 times, enabling faster optimization of complex chip designs.

List of Key Companies in Photonic Integrated Circuits Market:

- Eagle Photonics

- LIGENTEC SA

- Lumentum Operations LLC

- VLC Photonics

- Bright Photonics B.V.

- Intel Corporation

- SCINTIL Photonics

- VPIphotonics

- AEPONYX Inc

- Sicoya GmbH

- Broadcom

- Rockley Photonics

- LIGENTEC SA

- Freedom Photonics LLC

- iPronics

Recent Developments (M&A/Partnerships/Agreements)

- In March 2025, Teradyne entered an agreement to acquire Quantifi Photonics, a New Zealand-based provider of test solutions for high-volume manufacturing of photonic integrated circuits (PICs), co-packaged optics, and pluggable optics. The acquisition aims to enhance Teradyne’s capabilities in delivering scalable, cost-effective test solutions for the rapidly evolving high-performance computing market.

- In January 2024, Infleqtion acquired two integrated silicon photonics companies, SiNoptiq Inc. and Morton Photonics Inc., to accelerate the chip-scale integration of lasers and photonic and atomic systems essential for commercializing quantum technologies. These acquisitions strengthen Infleqtion’s ability to scale manufacturing and enhance the quantum supply chain, particularly in the U.S.