Market Definition

Phosphate fertilizers are agricultural fertilizers that provide phosphorus, an essential nutrient required for plant growth, root development, energy transfer, and flower & fruit production. These fertilizers are primarily derived from phosphate rock and are available in various forms, such as superphosphate, triple superphosphate, and ammonium phosphate.

They play a crucial role in enhancing crop yields by improving nutrient absorption, strengthening plant structures, and supporting metabolic processes.

Phosphate Fertilizer Market Overview

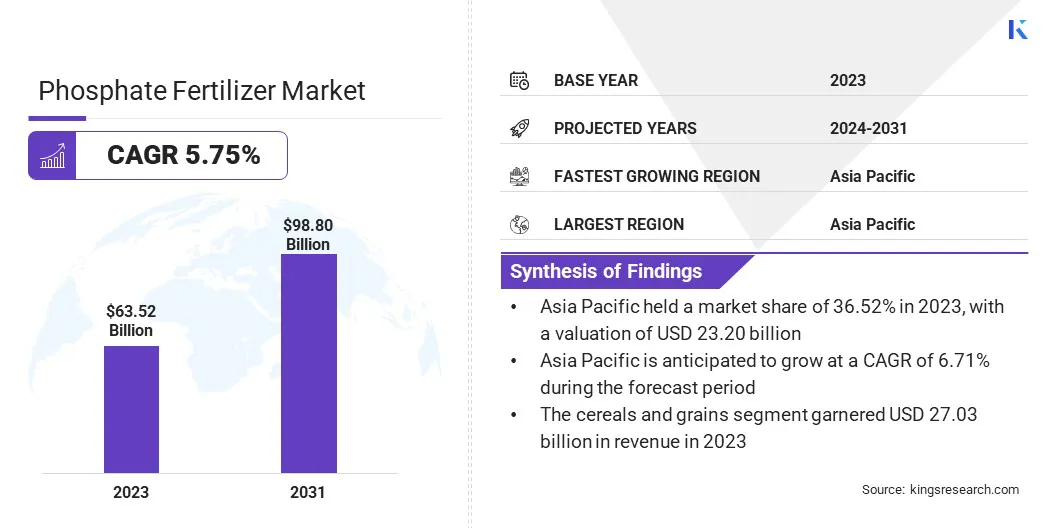

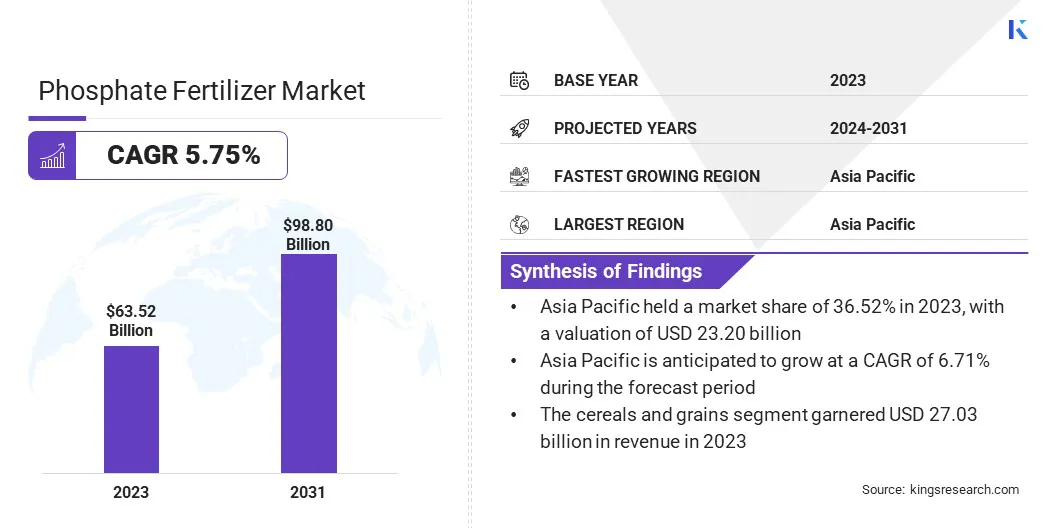

The global phosphate fertilizer market size was valued at USD 63.52 billion in 2023, which is estimated to be valued at USD 66.80 billion in 2024 and reach USD 98.80 billion by 2031, growing at a CAGR of 5.75% from 2024 to 2031.

The market is driven by the increasing demand for agricultural productivity, as growing global food needs push farmers to adopt fertilizers for enhanced crop yields. Additionally, technological advancements in fertilizer production, such as eco-friendly formulations and improved nutrient release systems, are boosting the market.

Major companies operating in the phosphate fertilizer industry are Eurochem Group, IFFCO, CF Industries Holdings Inc., Coromandel International Ltd., Mosaic, Yara, ICL, Nutrien, PhosAgro Group, Hubei Xingfa Chemicals Group Co. Ltd., OCP, Ma’aden, Koch Industries, Inc., Haifa Negev technologies LTD, and Jordan Phosphate Mines Co. PLC.

The increasing global population is driving the need for higher agricultural output to meet the rising food demand. Farmers are adopting phosphate fertilizers to enhance soil fertility and maximize crop yields. Limited arable land and the need to improve productivity have intensified the reliance on efficient fertilizers.

The shift to high-yield farming techniques further accelerates the market growth. Governments and agricultural bodies are implementing policies to ensure sustainable food production, reinforcing the demand for nutrient-rich fertilizers.

- The USDA’s Economic Research Service (ERS) reported in its October 2024 International Food Security Assessment (IFSA) that global food demand is projected to increase at an annual rate of 2.8% over the next ten years. In low- and middle-income nations, food consumption is expected to grow from 800.2 million metric tons in 2024 to 1,050.9 million metric tons by 2034.

Key Highlights:

- The phosphate fertilizer industry size was valued at USD 63.52 billion in 2023.

- The market is projected to grow at a CAGR of 5.75% from 2024 to 2031.

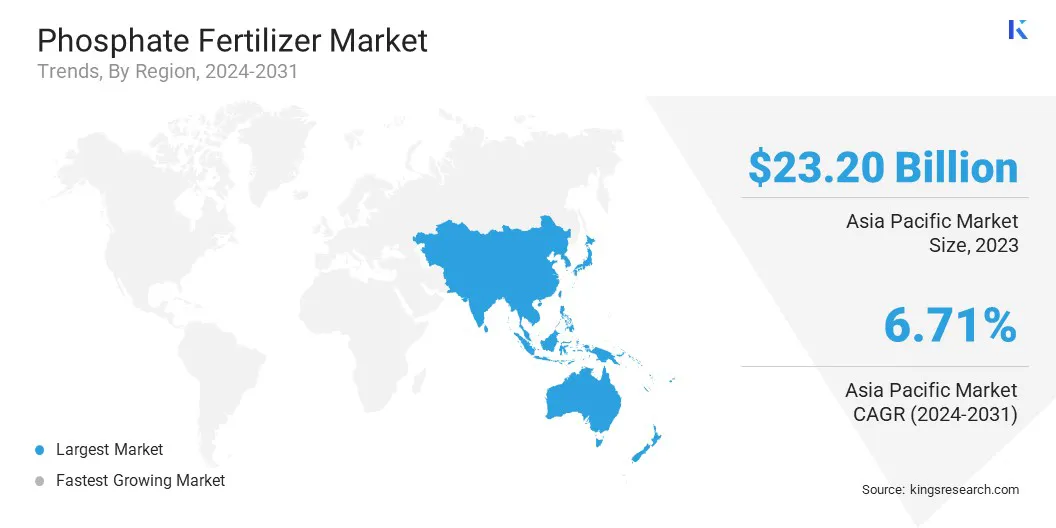

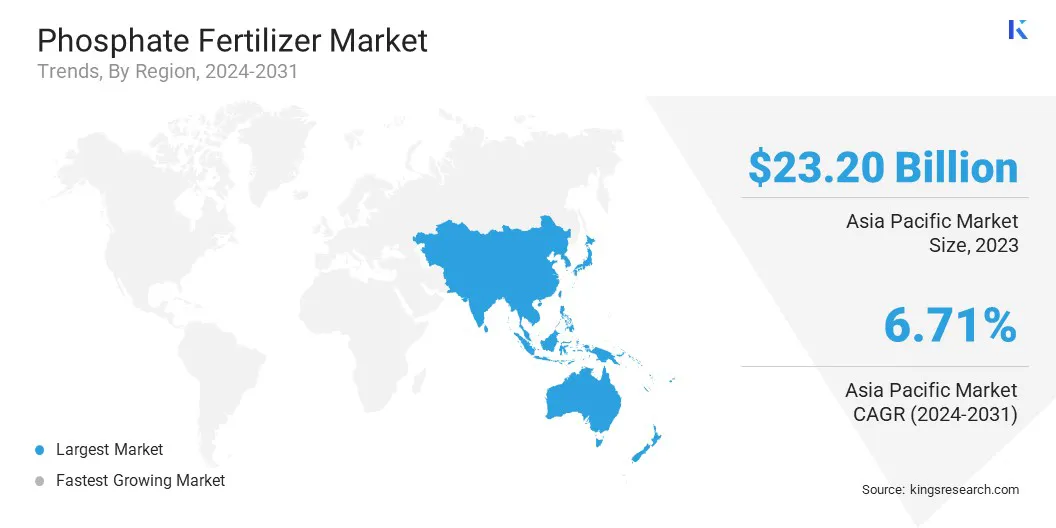

- Asia Pacific held a market share of 36.52% in 2023, with a valuation of USD 23.20 billion, and the market in the region is anticipated to grow at a CAGR of 6.71% during the forecast period.

- The monoammonium phosphate (MAP) segment garnered USD 22.94 billion in revenue in 2023.

- The cereals & grains segment is expected to reach USD 40.06 billion by 2031.

Market Driver

"Government Support and Subsidies Boost Market"

Governments globally are implementing policies and financial incentives to promote the use of phosphate fertilizers. Subsidies on fertilizers, tax benefits for agricultural inputs, and initiatives supporting sustainable farming practices are encouraging the adoption of higher phosphate fertilizers. Regulatory frameworks aimed at improving food security are driving investments in modern fertilizers.

- In January 2025, the government of India extended the one-time special subsidy on Diammonium Phosphate (DAP) fertilizer at a rate of approximately USD 42 per metric ton, effective from January 1, 2025, until further notice.

Countries with strong agricultural economies are focusing on increasing domestic fertilizer production to reduce import dependency. Public-private partnerships in fertilizer Research and Development (R&D) are fostering innovations in phosphorus-based products.

The expansion of rural credit facilities and farmer awareness programs is further accelerating the growth of the phosphate fertilizer market.

Market Challenge

"Environmental Impact and Sustainability Concerns Hinders Market"

A critical challenge facing the phosphate fertilizer market is the environmental impact, particularly related to nutrient runoff and soil degradation. Excessive use of phosphate fertilizers can lead to water pollution, affecting aquatic ecosystems and causing eutrophication.

In response, companies are focusing on developing sustainable and eco-friendly solutions, such as controlled-release fertilizers (CRFs) and biodegradable coatings that reduce nutrient loss.

Additionally, companies are investing in research to enhance the efficiency of phosphate fertilizers, ensuring better absorption by plants and minimizing environmental damage. These measures are essential to addressing regulatory pressures and promoting sustainable agricultural practices.

Market Trend

"Technological Advancements in Fertilizer Production Fuels Growth"

Innovations in fertilizer manufacturing are driving the phosphate fertilizer market, particularly with the integration of controlled release fertilizer (CRF) technology. Advanced coating techniques, including polymer and biodegradable materials, are enhancing the efficiency of phosphate fertilizers by ensuring a gradual and sustained nutrient release.

These formulations reduce phosphorus fixation in the soil, improving plant uptake and minimizing environmental losses. Companies are investing in R&D to introduce CRF-based phosphate fertilizers that optimize nutrient efficiency while supporting sustainable agricultural practices.

- In August 2024, Nousbo launched an eco-friendly CRF with biodegradable resin coatings and applied for a domestic patent. This breakthrough technology addresses the limitations of traditional biodegradable coated fertilizers, which need specific conditions for decomposition. The newly developed CRF is versatile, supporting various fertilization techniques, such as side-dressing and row application, thereby improving its effectiveness and usability.

Phosphate Fertilizer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), Others

|

|

By Application

|

Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), and Others): The Monoammonium Phosphate (MAP) segment earned USD 22.94 billion in 2023, due to its high nutrient content, effective performance in enhancing crop yields, and widespread adoption in various agricultural applications.

- By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others): The cereals & grains segment held 42.55% share of the market in 2023, due to the high demand for increased crop yields to meet global food requirements, driving the extensive use of phosphate fertilizers for improved plant growth and productivity.

Phosphate Fertilizer Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 36.52% phosphate fertilizer market share in 2023, with a valuation of USD 23.20 billion. Asia Pacific is home to over 60% of the global population. Thus, the demand for food has increased with urbanization and population growth. Governments are focusing on enhancing food production to ensure food security.

The use of fertilizers, particularly phosphate fertilizers, plays a key role in improving crop yields. The growing population in the region is driving the need for higher agricultural productivity, boosting the market.

The demand for rice continues to rise in the region, due to population growth, urbanization, and changing dietary patterns. Rice farmers are increasing productivity through advanced agricultural practices, including the use of fertilizers, to meet this growing demand.

- According to the International Potash Institute (IPI), rice is the staple food in Asia, representing about 90% of global production and consumption. China is the top producer, growing one-third of Asia's total rice on 29 million hectares, while India contributes almost a quarter of the global output from 43 million hectares. Other prominent rice producers in the region include Indonesia, Bangladesh, Vietnam, Thailand, Myanmar, the Philippines, and Japan.

The need for sustained rice production in Asia Pacific is fueling the market, as it supports the food security needs of the expanding population in the region.

The phosphate fertilizer industry in North America is poised for significant growth at a robust CAGR of 4.92% over the forecast period. Amid growing environmental concerns, a significant shift has been registered toward sustainable farming practices in North America.

This has prompted the adoption of fertilizers that enhance nutrient efficiency while minimizing environmental impact. The growing demand for eco-friendly fertilizers, such as controlled-release and slow-release phosphate fertilizers, is driving the market. The U.S. and Canada are also focused on reducing nutrient runoff into water bodies, creating favorable conditions for phosphate fertilizer innovations.

The push for sustainability aligns with market expansion as farmers seek fertilizers that improve crop productivity without harming the environment. According to the Fertilizer Institute, the U.S. has registered a significant increase in the adoption of precision agriculture techniques, improving nutrient use efficiency by up to 20% over the past decade.

Regulatory Frameworks:

- The U.S. regulates phosphate fertilizers under the Environmental Protection Agency (EPA) through the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) and the Clean Water Act. These regulations aim to control the environmental impact of fertilizers, ensuring safe use and addressing nutrient runoff, promoting sustainable agricultural practices.

- The EU governs phosphate fertilizers through the Fertilizers Regulation (EC) No 2003/2003, which sets standards for their composition, marketing, and usage. Additionally, the EU enforces environmental directives addressing nutrient runoff and promoting sustainable agriculture, aiming to reduce the environmental footprint of fertilizer use across member states.

- Fertilizer regulation in Germany is governed by the Fertilizer Ordinance (DüMV), which aligns with EU standards. The Federal Office for Consumer Protection and Food Safety (BVL) monitors fertilizer quality and approvals. Environmental regulations target nutrient runoff reduction and promote sustainable fertilizer use to safeguard the environment.

- In China, phosphate fertilizers are regulated by the Ministry of Agriculture and Rural Affairs (MARA). The country has stringent standards for fertilizer production, quality, and usage. The government enforces guidelines to ensure safety and sustainability in the agricultural sector. Recent developments include export restrictions on fertilizers, including phosphate-based products, to stabilize domestic supply and prices, as well as encourage efficient use in farming.

- In India, the Fertilizer Control Order (FCO) under the Essential Commodities Act, regulates the manufacture, sale, and distribution of fertilizers, including phosphate-based products. The Department of Agriculture and Farmers Welfare (DAFW) oversees the implementation of these regulations, ensuring that fertilizers meet prescribed quality standards and are available to farmers at subsidized prices.

- In South Korea, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) is responsible for regulating fertilizers, including phosphate fertilizers, under the Fertilizer Control Act. This regulation ensures that fertilizers are of high quality, appropriately labeled, and used safely in farming practices.

Competitive Landscape:

The phosphate fertilizer industry is characterized by a large number of participants, including established corporations and rising organizations. Companies in the market are increasingly adopting strategies focused on product innovations and R&D to fuel the market.

Companies aim to meet the evolving demands of sustainable agriculture by investing in the development of advanced technologies for processing phosphate rock, enhancing nutrient efficiency, and producing eco-friendly fertilizers. These innovations help improve fertilizer performance, reduce environmental impact, and address challenges related to nutrient runoff and soil degradation.

Furthermore, increasing R&D initiatives to explore new applications and formulations enables companies to strengthen their product portfolios, positioning themselves as leaders in the competitive market.

- In April 2024, EuroChem initiated a new research program focused on advancing technology for processing complex ores and enhancing the recovery of valuable components from phosphate rock. The program will be carried out under EuroChem Phosphate University, an institution established to foster expertise in phosphate rock, its products, and processing technologies. Expanding the phosphate fertilizer portfolio is a key priority in its R&D efforts.

List of Key Companies in Phosphate Fertilizer Market:

- Eurochem Group

- IFFCO

- CF Industries Holdings Inc.

- Coromandel International Ltd.

- Mosaic

- Yara

- ICL

- Nutrien

- PhosAgro Group

- Hubei Xingfa Chemicals Group Co. Ltd.

- OCP

- Ma’aden

- Koch Industries, Inc.

- Haifa Negev technologies LTD

- Jordan Phosphate Mines Co. PLC

Recent Developments (Expansion)

- In March 2024, EuroChem inaugurated its new phosphate fertilizer production plant in Serra do Salitre, Brazil. The facility features advanced integrated production technology, characterized by low water usage, a completely closed water circuit, and a clean energy generation system.

- In July 2023, PhosAgro Group announced plans to double its fertilizer exports to Africa within the next three years. Over the past year, the company had already boosted its exports to Africa by 25%.