Market Definition

The market encompasses a broad range of engineering, maintenance, consulting, and operational services that support the efficient and safe functioning of petroleum refining facilities.

These services include construction and commissioning of refinery units, turnaround and shutdown maintenance, process optimization, environmental compliance management, inspection and monitoring, and emergency response support. Refinery services help facilities maintain uptime, improve throughput, adhere to evolving environmental standards, and reduce safety risks.

Petroleum Refinery Service Market Overview

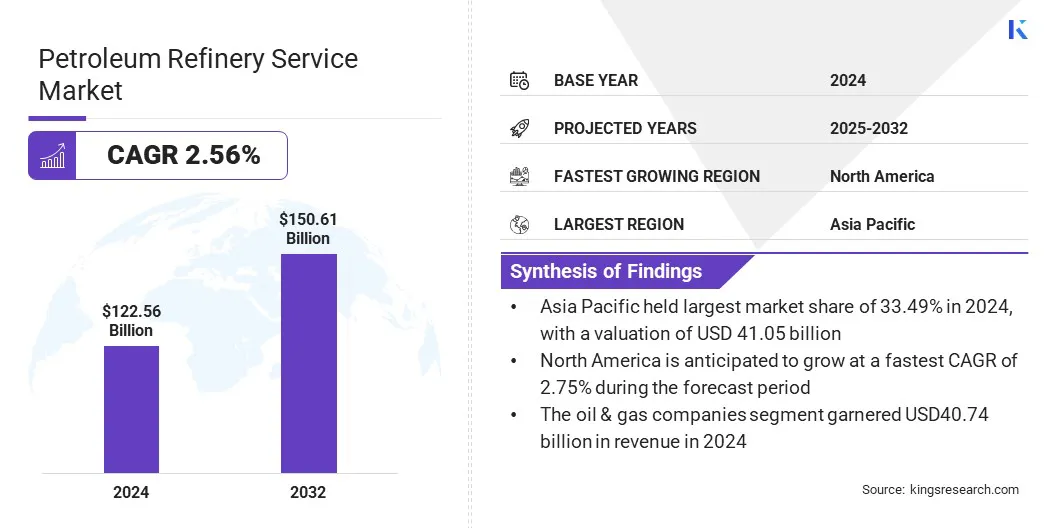

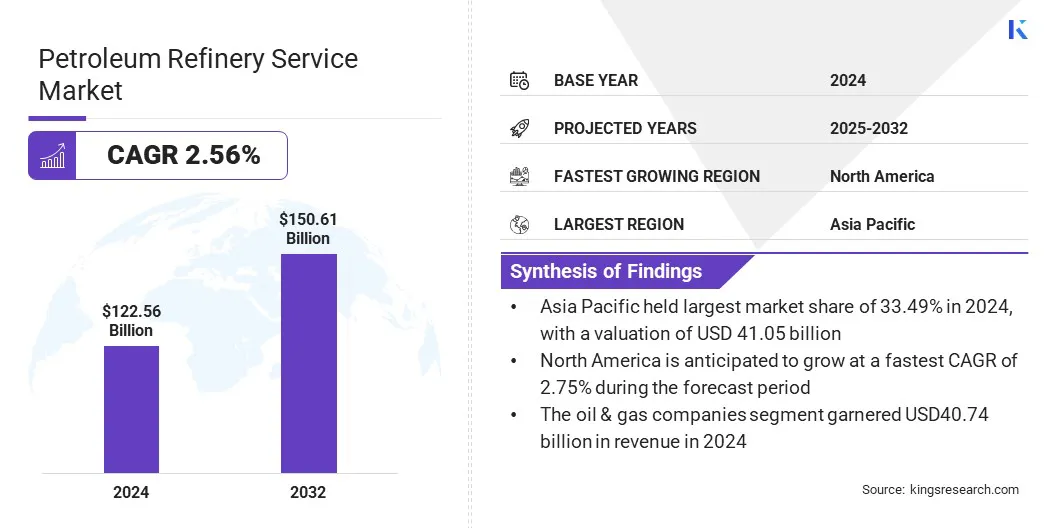

The global petroleum refinery service market size was valued at USD 122.56 billion in 2024 and is projected to grow from USD 125.42 billion in 2025 to USD 150.61 billion by 2032, exhibiting a CAGR of 2.56% over the forecast period.

The global market is witnessing a shift toward sustainability and low-carbon operations, driven by environmental regulations and global decarbonization targets. Growing demand for real-time emissions monitoring and environmental risk assessments is driving the demand for petroleum refinery services to support compliance upgrades, maintenance, and ESG-focused strategies.

Key Market Highlights:

- The petroleum refinery service industry size was recorded at USD 122.56 billion in 2024.

- The market is projected to grow at a CAGR of 2.56% from 2025 to 2032.

- Asia Pacific held a market share of 33.49% in 2024, with a valuation of USD 41.05 billion.

- The maintenance and repair segment garnered USD 34.41 billion in revenue in 2024.

- The crude oil refining segment is expected to reach USD 54.41 billion by 2032.

- The independent refineries segment is anticipated to witness the fastest CAGR of 2.85% during the forecast period.

- North America is anticipated to grow at a CAGR of 2.75% during the forecast period.

Major companies operating in the petroleum refinery service market are Intertek Group plc, Savage Services Corporation, CIC GROUP INC, Cleansing Service Group Limited (Willacy Oil Services), Société Générale de Surveillance SA, Bureau Veritas, Baker Hughes Company, Altrad, MedEuropa Refining Group, UL LLC, TÜV Rheinland, Chiyoda Corporation, Applus+, Fluor Corporation, and Saudi Arabian Oil Co.

The expansion of refinery capacities in developing countries is a major growth opportunity for the global petroleum refinery service market. Countries such as India, China, Saudi Arabia, Nigeria, and Indonesia are investing heavily in new refining infrastructure to meet domestic fuel demand, reduce dependency on imports, and capitalize on downstream petrochemical production.

These investments are creating extensive demand for engineering, procurement, construction, commissioning (EPCC), and long-term maintenance services. Moreover, the growing energy consumption in Asia-Pacific and Africa is fueling the need for service support across pre-commissioning, catalytic conversion units, emissions control systems, and automation services.

- As per the U.S. Energy Information Administration’s latest Refinery Capacity Report, operable atmospheric distillation capacity stood at 18.4 million barrels per calendar day (bpcd) as of January 2025.

Market Driver

Growing Demand for Refined Petroleum Products

The growing demand for refined petroleum products such as gasoline, diesel, jet fuel, and petrochemical feedstock is primarily driving the market. Rapid industrialization, urbanization, and expansion of the transportation sector, particularly in emerging regions like India, China, and Southeast Asia, have significantly increased energy consumption.

To meet this demand, refiners are under pressure to increase throughput and enhance operational efficiency. This creates sustained demand for services, including capacity optimization, energy efficiency audits, catalytic cracking unit maintenance, and turnaround management.

Furthermore, aging refineries in developed countries are being upgraded to meet evolving fuel standards, thereby increasing the need for modernization and technical support.

- In May 2025, the Organization of the Petroleum Exporting Countries (OPEC) reported that India is projected to lead global oil demand growth in 2026, with consumption rising from 5.55 million barrels per day (bpd) in 2024 to 5.99 million bpd by 2026.

Market Challenge

Volatility in Crude Oil Prices and Refining

Volatility in crude oil prices and refining margins poses a significant challenge to the petroleum refinery service market. As input costs fluctuate due to geopolitical tensions, OPEC production decisions, and supply chain disruptions, refiners often experience unpredictability in profit margins.

This affects their capital allocation strategies and can lead to delays or cancellations of planned maintenance, upgrades, or capacity expansions. Moreover, volatility impacts long-term contract negotiations, making service planning and resource mobilization more complex.

Service providers mitigate this challenge by offering modular, scalable solutions, embracing digital twins for cost forecasting, and building flexible service models aligned with clients’ operational cycles and market sensitivities.

Market Trend

Rising Adoption of Digital Technologies and Automation in Refinery Operations

The rising adoption of digital technologies and automation in refinery operations is a transformative trend in the global market. As refiners aim to boost efficiency, reduce unplanned downtime, and improve safety, they are adopting solutions such as Industrial IoT (IIoT), digital twins, and AI-driven predictive maintenance.

These technologies enable real-time data collection, performance monitoring, and asset integrity assessments, allowing refiners to optimize operations while minimizing risks. This creates new revenue streams in the form of digital consulting, remote monitoring, software integration, and cybersecurity services.

- In March 2025, Accenture enhanced its AI Refinery platform by introducing an AI agent builder, empowering business users to swiftly create and tailor agents for greater agility. It is also expanding pre-configured industry solutions to help clients rapidly scale AI agent networks enterprise-wide.

Petroleum Refinery Service Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Maintenance and Repair, Inspection, Testing, & Certification, Engineering Services, Equipment Installation & Commissioning, Others

|

|

By Application

|

Crude Oil Refining, Petrochemical Production, Biofuel/Lubricant Refining, Others

|

|

By End User

|

Oil & Gas Companies, Independent Refineries, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Maintenance and Repair, Inspection, Testing, & Certification, Engineering Services, Equipment Installation & Commissioning, and Others): The maintenance and repair segment captured the largest market share of 28.08% in 2024, due to the growing demand for operational efficiency, safety compliance, and asset longevity in aging refinery infrastructure.

- By Application (Crude Oil Refining, Petrochemical Production, Biofuel/Lubricant Refining, and Others): The biofuel/lubricant refining segment is poised to record a CAGR of 2.89% through the forecast period due to the global push toward low-emission fuels and sustainable energy alternatives.

- By End User (Oil & Gas Companies, Independent Refineries, Government, and Others): The oil & gas companies segment is anticipated to grow at a CAGR of 2.44% over the forecast period as major upstream and downstream players increasingly invest in optimizing their refinery operations for profitability and sustainability.

Petroleum Refinery Service Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific petroleum refinery service share accounted for 33.49% and was valued at USD 41.05 billion in 2024. This dominance is primarily attributed to the region's increasing energy demand, rapid industrialization, and large-scale infrastructure development in countries like China, India, South Korea, and Indonesia.

These countries are expanding and upgrading their refining capacities to meet growing domestic fuel needs, which in turn fuels demand for refinery services ranging from construction and commissioning to maintenance, emissions control, and digital monitoring.

- In 2024, India witnessed significant growth in petroleum product exports over the past decade, driven by its robust refining capacity exceeding 250 MMTPA, positioning the country as a key supplier to the international energy sector.

North America is projected to grow at the highest CAGR of 2.75% in the petroleum refinery service market over the forecast period, driven by factors such as infrastructure modernization, energy transition initiatives, and advanced technology adoption.

The U.S. hosts a vast network of aging refineries that require continuous maintenance, retrofitting, and process optimization services to maintain efficiency and regulatory compliance.

Furthermore, the region is actively integrating low-carbon technologies, including hydrogen production units, renewable diesel systems, and carbon capture solutions into existing refinery operations, which are driving demand for specialized engineering and consulting services.

Additionally, Canada's oil sands and refining sector, along with increasing export-oriented production, are fueling investment in turnaround services, automation, and environmental compliance programs. The presence of leading oil & gas players, EPC contractors, and service providers with strong technological capabilities is expected to sustain this growth in the coming years.

- In March 2023, ExxonMobil announced the commencement of operations at its Beaumont refinery expansion, adding 250,000 barrels per day of capacity. Supported by rising Permian Basin output, it represents the largest U.S. refinery expansion in over a decade and is intended to meet growing demand for energy.

Regulatory Frameworks

- In the U.S., the Clean Air Act (CAA) standards, including NSPS (New Source Performance Standards) and NESHAP (National Emission Standards for Hazardous Air Pollutants), set strict emission limits for volatile organic compounds, sulfur oxides, nitrogen oxides, and hazardous air toxics in refinery operations.

- Germany implements EU-wide regulations in its refinery sector, such as the Industrial Emissions Directive, REACH (chemical registration and labelling), and national hazardous substance rules. German authorities enforce rigorous permitting for air, water, and waste, and oversee safety through both federal bodies and industry-specific oversight aligned with EU frameworks.

- In China, the Pollutant Discharge Permit System (effective March 2021) requires petrochemical facilities to obtain integrated permits before discharging pollutants, covering VOC emissions, wastewater, and hazardous release protocols.

Competitive Landscape

Key players in the global petroleum refinery service market are adopting strategic approaches to strengthen their market presence, enhance profitability, and align with evolving industry demands.

One of the primary strategies involves expanding digital capabilities by integrating AI, IoT, and advanced analytics into service portfolios to deliver predictive maintenance, real-time monitoring, and asset performance optimization.

Companies are also focusing on geographic expansion, particularly targeting high-growth regions such as Asia-Pacific, the Middle East, and Africa, through joint ventures, long-term contracts, and strategic collaborations with national oil companies and regional refiners.

- In May 2025, IndianOil undertook over 140 refinery capacity expansion projects across various scales, with a total investment exceeding USD 30 billion. These strategic initiatives aim to enhance operational efficiency, boost refining capacity, and align with the evolving energy demand and sustainability goals.

Key Companies in Petroleum Refinery Service Market:

- Intertek Group plc

- Savage Services Corporation

- CIC GROUP INC

- Cleansing Service Group Limited (Willacy Oil Services)

- Société Générale de Surveillance SA

- Bureau Veritas

- Baker Hughes Company

- Altrad

- MedEuropa Refining Group

- UL LLC

- TÜV Rheinland

- Chiyoda Corporation

- Applus+

- Fluor Corporation

- Saudi Arabian Oil Co

Recent Developments (Agreements)

- In July 2025, Applus+ secured a long-term contract from ADNOC Refining in the UAE to deliver condition monitoring services for critical rotating equipment at the Ruwais Industrial Area and Mussafah Storage Terminal. This aims to enhance operational reliability and maintenance efficiency of ADNOC Refining.

trajectory