Pet Monitoring Camera Market Size

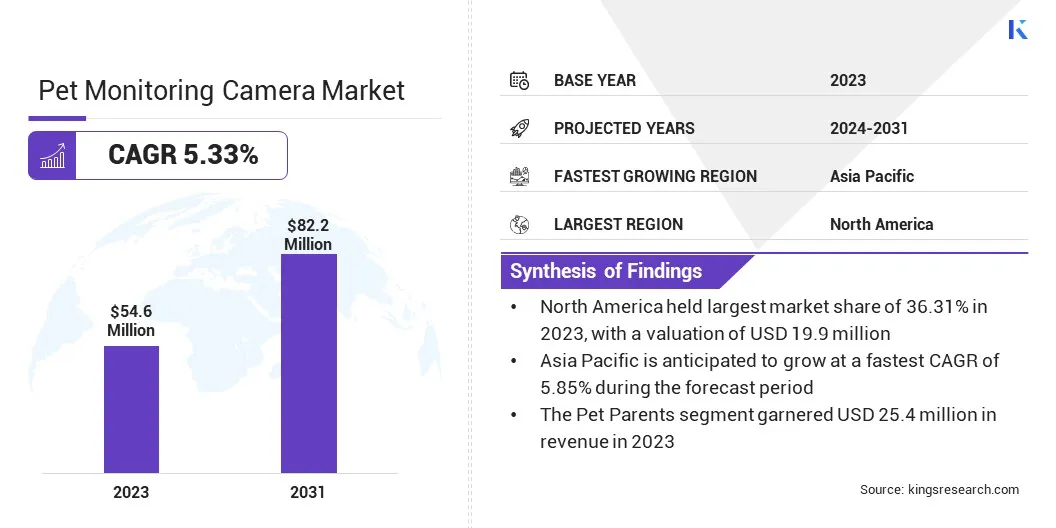

The global pet monitoring camera market size was valued at USD 54.62 million in 2023 and is projected to grow from USD 57.15 million in 2024 to USD 82.22 million by 2031, exhibiting a CAGR of 5.33% during the forecast period. The market is driven by increasing pet ownership, rising demand for smart home devices, growing concerns for pet safety and health, and advancements in camera technology, making it easier to monitor pets remotely.

In the scope of work, the report includes products offered by companies such as PetChatz, Furbo.com, Zmodo, Direct Smart Home, PETKIT, SpotCam Co., Ltd., Wyze Labs, Inc., Xiaomi, Shenzhen Skymee Technonogy Co.,Ltd., Petcube, Inc, and others.

The pet monitoring camera market is growing, due to increasing pet ownership and the desire for pet owners to ensure their pets’ safety and well-being while away from home. City areas are seeing significant growth, due to rising pet adoption and urbanization.

Technological advancements like artificial intelligence (AI), two-way audio, and real-time alerts are driving innovation in the market. Additionally, the rise of smart homes and connected devices is boosting the demand for pet cameras. Regulations related to pet welfare and data privacy influence the development and marketing of these devices, ensuring safer and more responsible usage.

The market is focused on providing solutions for pet owners who want to monitor and interact with their pets remotely. These cameras typically feature live video streaming, two-way audio, and motion detection, allowing owners to check on their pet’s safety and security when they are away.

The market includes a range of products, from simple cameras to advanced systems with AI and pet-specific features. Key players in the market are competing in terms of technology, ease of use, and affordability. The market is influenced by factors like rising pet ownership, increased awareness of pet welfare, and advancements in smart home technology.

Analyst’s Review

The increasing popularity of pet monitoring cameras can be attributed to their growing use for various purposes, including pet interaction, training, monitoring, management, and entertainment. This trend is largely driven by the rise in dual-income households, which allows pet owners to spend more on pet care. The introduction of technologically advanced products and the rising number of marketing campaigns by vendors are further boosting market growth.

Technological innovations such as Wi-Fi and cloud-based cameras for real-time monitoring are expected to continue driving the demand for these devices in the coming years. Manufacturers are focusing on product features like HD video, AI capabilities, and ease of use to stay competitive.

Pet Monitoring Camera Market Growth Factors

The pet monitoring camera market is experiencing growth, due to the rising number of pet owners globally and continuous advancements in camera technology. As pet ownership increases, particularly in dual-income households, more pet owners are seeking solutions to ensure their pet’s safety and well-being when they are away.

Pet monitoring cameras provide a way for owners to stay connected with their pets remotely, boosting demand. Additionally, advancements in camera technology, such as HD video, two-way audio, motion detection, and cloud storage, have enhanced the functionality of these devices, offering more reliable and real-time monitoring.

The integration of AI features, like behavior analysis and automated alerts, makes these cameras smarter and more attractive to consumers, further driving the growth of the market.

- In December 2023, LG introduced its new smart home AI agent, which integrates advanced robotic and AI technologies. This AI agent is capable of moving, learning, and understanding complex conversations, offering a more interactive experience for users. Notably, the AI can also function as a pet monitor, allowing pet owners to remotely monitor and care for their pets. It can send alerts if any unusual activity is detected, adding an extra layer of security.

The use of pet monitoring cameras raises privacy and security concerns, particularly regarding the security of personal data, surveillance footage and data leaks. These cameras are often connected to Wi-Fi and cloud-based storage, posing a risk of unauthorized access to information.

To address this challenge, manufacturers should implement stronger security measures, such as end-to-end encryption and multi-layer authentication, to protect user data. Additionally, providing clear privacy policies can help mitigate concerns. These solutions are essential for gaining consumer trust and ensuring the continued growth of the market.

Pet Monitoring Camera Industry Trends

A key trend driving the growth of the pet monitoring camera market is the increasing demand for customizable features and personalized experiences. Pet owners are looking for devices that can be tailored to meet their unique needs, such as specific camera angles, monitoring schedules, or alert settings.

As a result, manufacturers are integrating advanced functionalities such as adjustable motion detection zones, personalized sound alerts, and pet-specific behavior tracking. These customizable features not only enhance the user experience but also allow pet owners to fine-tune the camera to monitor their pets more effectively.

Additionally, some cameras are offering voice recording and remote treat dispensers as well as public treat dispensers, further personalizing the pet care experience. As pet owners seek more control over their devices, this trend is expected to significantly contribute to the market’s growth.

- In March 2024, Hau-Hau Champion, a brand owned by VAFO Group, a leading European premium pet food producer, launched a vending machine for dogs. This innovative machine provides samples of dog food before sale, using cutting-edge technology. It features AI-powered facial recognition software to identify the dog and customize the food offering. Additionally, the vending machine incorporates disinfectant blue light technology to ensure cleanliness and hygiene. This unique concept showcases how technology is being integrated into the pet care market, offering a more personalized and interactive experience for pet owners and their pets. It highlights the growing trend of innovation in pet products and services.

Awareness about the availability of diverse pet monitoring solutions in the market is increasing. As more consumers become aware of the wide range of pet monitoring cameras, they are increasingly turning to these devices for enhanced pet care.

Social media, online reviews, and marketing campaigns by manufacturers have played a significant role in spreading this awareness, helping pet owners realize the benefits of real-time monitoring, remote interaction, and security features.

Additionally, consumers are more inclined to invest in solutions that improve their pet’s safety and well-being as technology becomes more accessible and affordable. This growing awareness is expected to continue fueling the demand for innovative pet monitoring cameras.

Segmentation Analysis

The global market is segmented based on end users, distribution channel, type, and geography.

By End Users

Based on end users, the pet monitoring camera market is segmented into pet parents, veterinarians and professional trainers. The pet parents segment held the largest revenue share of USD 25.35 million in 2023.

With the rise in pet ownership, especially among younger generations, pet parents are increasingly seeking ways to ensure their pets' safety and well-being. Pet monitoring cameras provide peace of mind by allowing owners to monitor their pets’ activities when away from home.

The growing trend of remote work and flexible schedules further drives demand, as pet owners can check in on their pets more frequently. Additionally, the ability to remotely interact with pets through two-way audio and detect potential security threats aligns with the increasing awareness of pet welfare. These factors make pet parents the primary driver of market growth.

- According to a survey conducted by the American Pet Products Association (APPA) in 2024, 82 million households in the U.S. own pets. Among these, millennials represent the largest share, accounting for approximately 32% of pet owners.

By Distribution Channel

Based on distribution channel, the market is segmented into pet supply stores, online retailers, and others. The pet supply stores segment secured the largest revenue share of 43.54% in 2023.

Pet owners often prefer buying items from pet supply stores rather than online retailers, due to the ability to see and feel products in person, ensuring quality and suitability for their pets. Additionally, in-store shopping allows for immediate purchases, personalized advice from staff, and the convenience of avoiding shipping delays. Many pet owners can quickly resolve issues or return products at the store.

By Type

Based on type, the market is classified into one-way functionality and two-way functionality. The two-way functionality segment is poised for significant growth, expanding at a CAGR of 6.08% through the forecast period.

Two-way functionality allows owners to communicate directly with their pets, offering comfort and soothing them, especially during times of anxiety or distress. It also enhances pet training and behavior correction by enabling remote interaction for positive reinforcement. Additionally, two-way audio strengthens the bond between owners and their pets, even when physically separated, fostering social connection.

As pet owners increasingly seek reassurance, especially during extended absences, this functionality provides peace of mind and enhances overall pet care, driving its demand in the market.

- Petcube, Inc. offers the Petcube Cam, a pet monitoring camera with features such as wide-angle view, HD video, and two-way audio. The Petcube Cam can be remotely controlled from smartphones, providing convenience to pet owners. Additionally, it includes smart sound and motion alert features, enhancing the overall monitoring experience. Despite its advanced capabilities, the Petcube Cam is offered at a very reasonable price, making it an attractive option for pet owners seeking an affordable yet feature-rich solution for pet care.

Pet Monitoring Camera Market Regional Analysis

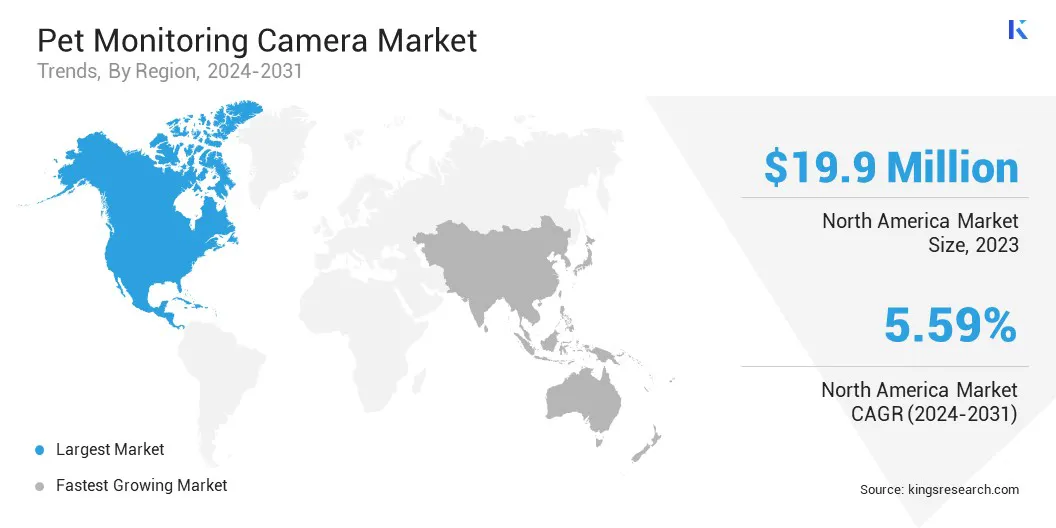

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America emerged as the leading region in the pet monitoring camera market in 2023, attaining a valuation of USD 19.83 million. North America is a dominating region for the market, due to high pet ownership rates, particularly among millennials, a large consumer base for pet care products. This demographic is also tech-savvy, leading to strong adoption of advanced technologies like smart home devices and connected pet monitoring solutions.

Additionally, the well-established pet care industry, coupled with strong consumer spending power and high disposable incomes, drives the demand for innovative pet products, including pet monitoring cameras. These factors collectively contribute to North America's leading position in the market.

- According to the 2024 APPA National Pet Owners Survey, approximately $147 billion was spent on pet sales, with projections of $150.6 billion in 2024, further highlighting North America's dominant market position in pet products.

The market in Asia Pacific is poised for significant growth over the forecast period, expanding at a CAGR of 5.85%. Asia Pacific is the fastest-growing region for the pet monitoring camera market, due to several key factors. Rapidly growing pet ownership, particularly in countries like China and India, is driving the demand for pet care products.

The region's expanding middle class, with increasing disposable income, allows more consumers to invest in innovative pet technologies. Additionally, increasing urbanization is creating a need for smart, space-efficient solutions for pet monitoring. The region's rapid adoption of new technologies, including IoT and AI, is also fueling the growth of advanced pet monitoring cameras. These factors make Asia Pacific the fastest-growing market for pet monitoring cameras.

Competitive Landscape

The global pet monitoring camera market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in Pet Monitoring Camera Market

- PetChatz

- com

- Zmodo

- Direct Smart Home

- PETKIT

- SpotCam Co., Ltd.

- Wyze Labs, Inc.

- Xiaomi

- Shenzhen Skymee Technonogy Co.,Ltd.

- Petcube, Inc

Key Industry Developments

- May 2024 (Launch): Ring launched its Pan-Tilt Indoor Camera, designed to offer enhanced flexibility and coverage. This camera features full HD video and color night vision, providing clear visuals day and night. Its motorized pan-tilt base allows users to remotely control the camera's vertical tilt using the Ring app, offering a comprehensive view of the room. Ideal for pet owners, it enables monitoring from various angles, while also serving as a versatile security solution for covering multiple areas, such as doorways, with a single camera.

The global pet monitoring camera market is segmented as:

By End Users

- Pet Parents

- Veterinarians

- Professional Trainers

By Distribution Channel

- Pet Supply Stores

- Online Retailers

- Others

By Type

- One-way Functionality

- Two-way Functionality

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America