Market Definition

Pet dietary supplements are nutritional products designed to provide pets with essential nutrients that may be missing or insufficient in their regular diet. The market includes a wide range of supplement products for companion animals such as dogs, cats, and small mammals.

These supplements support various health functions, including joint care, digestion, immune health, and skin & coat condition. Manufacturers offer them in different formats like tablets, powders, liquids, and soft chews to suit pet preferences. The market offerings are mainly through veterinary clinics, retail stores, and e-commerce platforms.

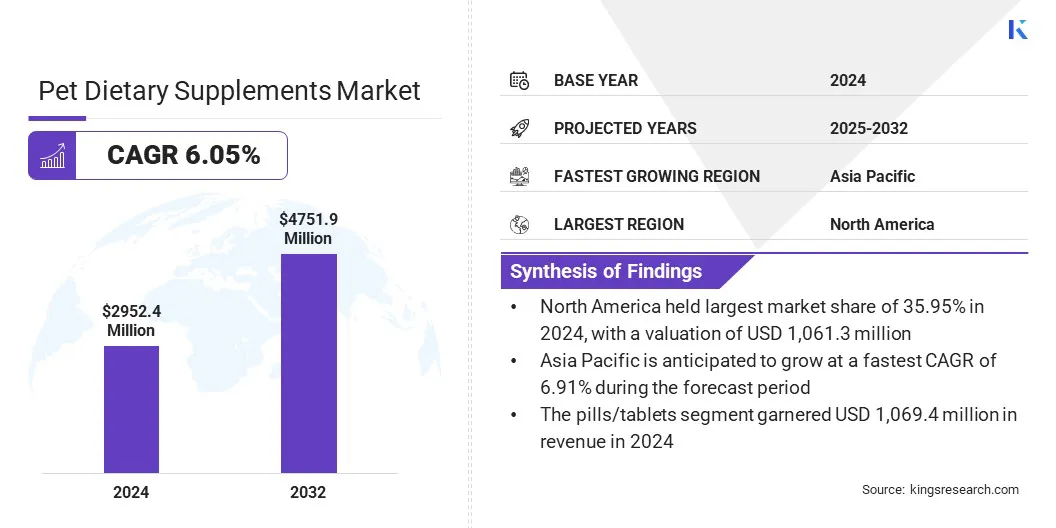

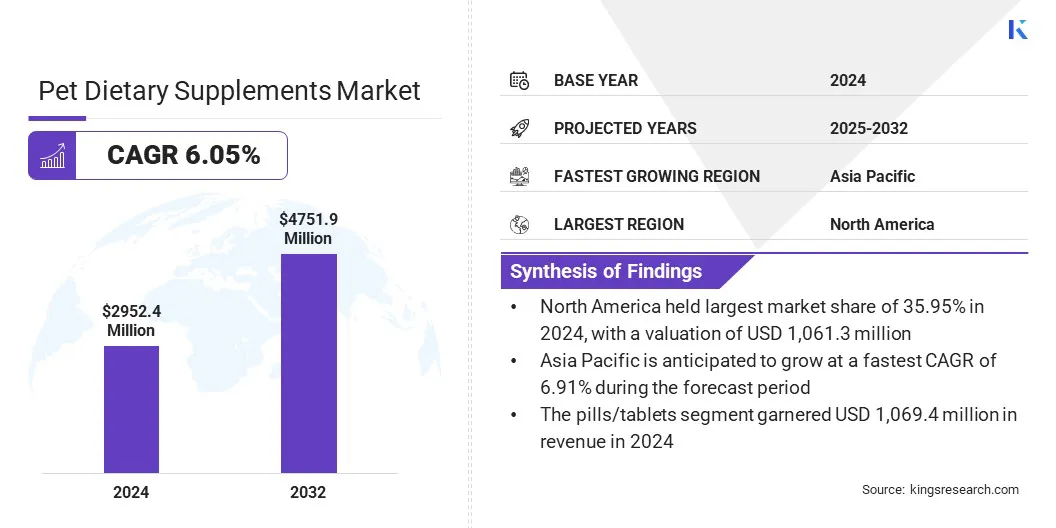

The global pet dietary supplements market size was valued at USD 2,952.4 million in 2024 and is projected to grow from USD 3,121.0 million in 2025 to USD 4,751.9 million by 2032, exhibiting a CAGR of 6.05% during the forecast period.

The market is growing steadily, due to increasing pet humanization and higher awareness of preventive pet health. Pet owners are choosing supplements that target specific issues such as joint health, digestion, anxiety, and skin care. The rise of e-commerce and specialty retail has improved product access and visibility.

Key Market Highlights:

- The pet dietary supplements industry size was valued at USD 2,952.4 million in 2024.

- The market is projected to grow at a CAGR of 6.05% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 1,061.3 million.

- The multivitamins segment garnered USD 734.6 million in revenue in 2024.

- The pills/tablets segment is expected to reach USD 1,716.7 million by 2032.

- The dogs segment is expected to reach USD 1,248.0 million by 2032.

- The skin & coat segment is expected to reach USD 1,185.2 million by 2032.

- The supermarkets/hypermarkets segment is expected to reach USD 1,335.8 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.91% over the forecast period.

Major companies operating in the pet dietary supplements market are Nutramax Laboratories Consumer Care, Inc., Nestlé, Mars, Incorporated, Ark Naturals, Elanco, Zoetis Services LLC, VETOQUINOL S.A., Virbac, Nutri-Pet Research, Inc., Swedencare AB, Only Natural Pet, Kemin Industries, Inc., Boehringer Ingelheim International GmbH, NOW Foods, and NWC Naturals Inc.

Pet Dietary Supplements Market Report Scope

|

Segmentation

|

Details

|

|

By Type

|

Multivitamins, Probiotics & Prebiotics, Antioxidants, Proteins & peptides, Glucosamine, Others

|

|

By Product

|

Pills/Tablets, Chewable, Powders, Others

|

|

By Pet

|

Dogs, Cats, Birds, Fish, Others

|

|

By Function

|

Skin & coat, Hip & joint, Digestive health, Calming/stress/anxiety, Weight management, Others

|

|

By Distribution Channel

|

Supermarkets/Hypermarkets, Pet Specialty Stores, Veterinary Clinics, Pharmacy, Online

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Pet Dietary Supplements Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for a substantial pet dietary supplements market share of 35.95% in 2024, with a valuation of USD 1,061.3 million. The regional market growth is attributed to the strong consumer demand for advanced and targeted pet health solutions. Pet owners in the U.S. actively seek specialized supplements for conditions such as joint health, anxiety, and digestion.

This demand encourages manufacturers to focus on product innovation and expand their offerings. Companies invest in research and collaborate with veterinary professionals to develop science-backed formulations. Established brands benefit from high consumer trust and consistent spending on pet wellness.

Widespread product availability through veterinary clinics, retail stores, and e-commerce channels supports market reach and reinforces the region’s leading position.

- In February 2025, Elanco Animal Health launched Pet Protect, a veterinarian-formulated supplement line for dogs and cats. Backed by science and quality standards, the range includes products for joint health, digestion, calming, skin care, and overall wellness. The launch expands Elanco’s footprint in the growing U.S. pet supplements market.

Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 6.91% over the forecast period. The market growth in this region is largely supported by the expanding presence of domestic and international pet nutrition brands that are localizing product offerings.

Companies are introducing supplement formulations tailored to regional pet breeds, dietary habits, and climate-related health needs. Moreover, the increasing investments in localized manufacturing and targeted marketing have improved product accessibility and consumer trust.

As a result, the demand for condition-specific supplements, such as those for skin health and digestive support, is accelerating across urban and semi-urban areas. This region-specific approach is strengthening brand relevance and driving the market.

Pet Dietary Supplements Market Overview

High pet ownership contributes to the growth of the pet dietary supplements market. The rising number of companion animals, particularly in urban households, increases the demand for health-focused products.

Owners are inclined to invest in supplements that support mobility, digestion, immunity, and overall well-being. This expanding pet population strengthens the customer base and supports consistent market demand.

- In 2025, the American Pet Products Association reported that 94 million U.S. households owned a pet, up from 86.9 million households in 2023–2024 and 90.5 million households in 2022, indicating a steady upward trend in pet ownership across the U.S.

Market Driver

Increasing Demand for Condition-specific and Natural Pet Supplements

The market is registering growth, due to the rising consumer demand for targeted and natural wellness solutions. Pet owners are selecting supplements that support specific health areas such as digestion, joint health, skin care, and immunity.

This reflects a shift toward preventive and personalized pet care. Consumers increasingly prefer clean-label products with natural ingredients over synthetic formulations. These expectations are shaping product development and encouraging manufacturers to focus on transparency, functionality, and safety.

The growing preference for condition-specific and naturally sourced supplements continues to drive the market and influence purchasing decisions across key regions.

- In October 2024, iHerb expanded its pet wellness offerings with a range of dietary supplements targeting gut health, joint support, and dental care. The company highlighted the increased demand for natural, high-quality pet health products and announced global availability through its e-commerce platform, along with plans to build partnerships with leading pet care brands.

Market Challenge

Lack of Supplement Solutions for Homemade Pet Diets

A major challenge in the pet dietary supplements market is the limited availability of products suited for pets on homemade diets. Most supplements are formulated for pets that consume commercial pet food. These products often do not address the specific nutrient gaps found in home-prepared meals.

As a result, they may not provide adequate support when used with non-commercial diets. Companies are developing veterinarian-formulated supplements that align with the nutritional profile of homemade meals. These products include bioavailable nutrients and clear dosing instructions to ensure safe and effective use by pet owners.

- In December 2024, NutriFusion partnered with Whole Dogg to launch Canada’s first veterinary nutritionist-formulated dog supplement. The product uses naturally sourced, whole-food-based nutrients to support balanced homemade diets and is now available across North America, including the U.S., through veterinary clinics and online platforms.

Market Trend

Growing Focus on Breed-specific Nutritional Solutions

The market is registering a shift toward the development of breed-specific supplements. Companies are creating formulations that address the distinct health needs and genetic traits of different dog breeds. This enables more targeted nutritional support for issues such as joint health, digestion, and skin sensitivity.

Pet owners are choosing specialized products that match their animal’s breed characteristics rather than using general-purpose options. This trend reflects a broader focus on personalized pet care. It is influencing how companies select ingredients, position products, and defines product categories within supplements.

- In August 2024, NaturVet launched Breed Specific Soft Chew Supplements for dogs, offering five tailored formulations for toy, sport, doodle, giant, and bully breeds. The vet-formulated supplements address breed-related health concerns such as joint, heart, gut, and dental health, and are available online.

Market Segmentation

- By Type (Multivitamins, Probiotics & Prebiotics, Antioxidants, Proteins & peptides, Glucosamine, Others): The multivitamins segment earned USD 734.6 million in 2024, due to the rising demand for general wellness supplements that support immunity, metabolism, and overall vitality in pets.

- By Product (Pills/Tablets, Chewable, Powders, and Others): The pills/tablets segment held 36.22% share of the market in 2024, due to their precise dosing, extended shelf life, and veterinarian-preferred format.

- By Pet (Dogs, Cats, Birds, Fish, and Others): The dogs segment is projected to reach USD 1,248.0 million by 2032, owing to high global dog ownership rates and increased spending on preventive canine healthcare.

- By Function (Skin & coat, Hip & joint, Digestive health, Calming/stress/anxiety, Weight management, and Others): The skin & coat segment is estimated to reach USD 1,185.2 million by 2032, owing to the growing awareness of dermatological health and increased demand for supplements that improve fur quality and manage allergies.

- By Distribution Channel (Supermarkets/Hypermarkets, Pet Specialty Stores, Veterinary Clinics, Pharmacy, and Online): The supermarkets/hypermarkets segment is anticipated to reach USD 1,335.8 million by 2032, owing to wide in-store product visibility and growing consumer preference for convenient, one-stop pet supply shopping.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) oversees pet dietary supplements under the Federal Food, Drug, and Cosmetic Act. The FDA’s Center for Veterinary Medicine (CVM) monitors safety, labeling, and manufacturing standards for animal supplements that fall under feed or food categories.

- In Europe, the European Food Safety Authority (EFSA) evaluates the safety and efficacy of pet dietary ingredients, while the European Commission authorizes their use. National authorities ensure compliance with labeling, safety, and marketing requirements.

- In China, the Ministry of Agriculture and Rural Affairs (MARA) regulates pet food products, including supplements, under national feed hygiene and safety regulations. All pet dietary supplements must be registered, and imported products require additional testing and approval from authorized agencies.

- In Japan, the Ministry of Agriculture, Forestry and Fisheries (MAFF) oversees the regulation of pet food, including dietary supplements. The Japan Pet Food Association (JPFA) provides voluntary standards for labeling and safety, which are widely followed by market players. Supplements must not make therapeutic claims unless approved as veterinary drugs.

Competitive Landscape

Key companies in the pet dietary supplements market are focusing on strategic acquisitions and partnerships to strengthen their position. Acquisitions enable firms to expand product portfolios, enhance manufacturing capabilities, and access established distribution networks.

This supports entry into new product segments and improves operational efficiency. Additionally, companies are forming partnerships with veterinary networks and retail distributors to increase product credibility and extend market reach.

These collaborations assist in the development of clinically supported formulations and ensure effective distribution across multiple channels. Adopting the multi-pronged strategy of acquisitions and partnerships allows companies to expand their presence, address changing consumer needs, and support long-term growth in a competitive market.

- In November 2024, Morgan Stanley Capital Partners acquired FoodScience, a provider of pet and human human nutritional, from Wind Point Partners. The acquisition aims to support the company’s growth through product expansion and strategic acquisitions in the pet health sector.

Key Companies in Pet Dietary Supplements Market:

- Nutramax Laboratories Consumer Care, Inc.

- Nestlé

- Mars, Incorporated

- Ark Naturals

- Elanco

- Zoetis Services LLC

- VETOQUINOL S.A.

- Virbac

- Nutri-Pet Research, Inc.

- Swedencare AB

- Only Natural Pet

- Kemin Industries, Inc.

- Boehringer Ingelheim International GmbH

- NOW Foods

- NWC Naturals Inc.

Recent Developments (Acquisition/Investment)

- In April 2025, FoodScience, LLC acquired Natural Dog Company, marking its first acquisition since becoming part of Morgan Stanley Capital Partners’ portfolio. The deal aims to strengthen FoodScience’s role in the pet supplements market by combining operational capabilities with a brand known for high-quality dog wellness products.

- In March 2025, Kradle secured USD 4 million to expand its pet supplement product line and distribution network. The company focuses on natural daily supplements for pet wellness and plans to use the investment to support innovation and strengthen retail partnerships.