Market Definition

A permanent magnet is a material that produces a consistent magnetic field without the need for external power and maintains its magnetism indefinitely. The market encompasses the manufacturing and distribution of key magnet types, including neodymium, ferrite, and samarium-cobalt, along with their assemblies utilized across industries such as automotive, electronics, renewable energy, and healthcare.

Permanent Magnet Market Overview

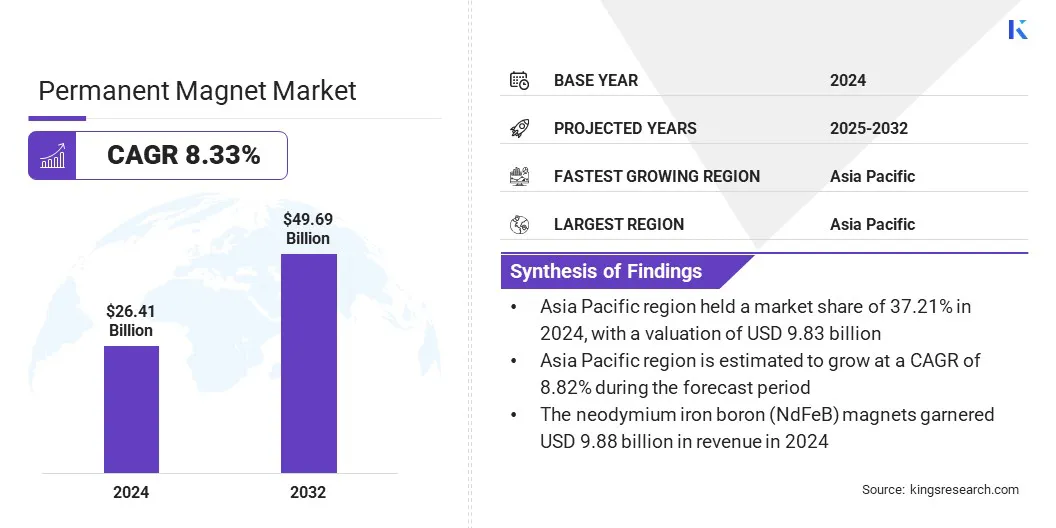

The global permanent magnet market size was valued at USD 26.41 billion in 2024 and is projected to grow from USD 28.38 billion in 2025 to USD 49.69 billion by 2032, exhibiting a CAGR of 8.33% during the forecast period.

The market growth is attributed to the increasing demand for electric vehicles, which is accelerating the adoption of high-performance permanent magnets for motor applications. Additionally, market growth is supported by advancements in magnet materials, which are driving increased adoption across automotive, electronics, and renewable energy sectors.

Key Highlights:

- The permanent magnet industry size was recorded at USD 26.41 billion in 2024.

- The market is projected to grow at a CAGR of 8.33% from 2025 to 2032.

- Asia Pacific held a market share of 37.21% in 2024, with a valuation of USD 9.83 billion.

- The neodymium iron boron (NdFeB) magnets segment garnered USD 9.88 billion in revenue in 2024.

- The automotive segment is expected to reach USD 18.76 billion by 2032.

- North America is anticipated to grow at a CAGR of 8.60% during the forecast period.

Major companies operating in the Permanent Magnet market are Arnold Magnetic Technologies, Dexter Magnetic Technologies, Inc., ZHAOBAO MAGNET, Adams Magnetic Products, LLC, Eclipse Magnetics, Goudsmit Magnetics, Magnequench International, LLC, Thomas & Skinner, Ningbo Tongchuang Magnetic Materials Co., Ltd, VACUUMSCHMELZE GmbH & Co. KG, Stanford Magnets, XHMAG Inc, Tapariatools, Shin-Etsu Chemical Co., Ltd., and TDK Corporation.

Defense modernization and space exploration are fueling demand for high-performance permanent magnets used in guidance systems, radar, and propulsion units that require exceptional strength and reliability.

The need to meet strict performance standards drives innovation in magnet technology, broadening applications within military and aerospace equipment. This growing utilization of advanced magnets in defense and aerospace sectors directly accelerates the expansion of the market.

- In February 2024, the Defence Research and Development Organisation (DRDO) of India inaugurated a Rare Earth Permanent Magnet (REPM) manufacturing plant at Indian Rare Earths Limited (IREL) in Visakhapatnam. This facility aims to enhance India’s defense capabilities by producing high-performance permanent magnets. These magnets are essential components in various defense systems, including missile guidance mechanisms and radar technology.

Market Driver

Electric Vehicle Demand Driving Permanent Magnet Adoption

The rising demand for electric vehicles (EVs) is a key driver of the permanent magnet market. Neodymium-iron-boron (NdFeB) magnets are widely used in electric motors due to their high efficiency and power density. Increasing electric vehicle (EV) production and adoption is driving demand for high-performance magnets that improve motor efficiency and power density.

These magnets play a critical role in meeting the performance requirements of modern EV drivetrains. Manufacturers are scaling production and advancing magnet technology to meet this demand. As the EV market expands globally, the permanent magnet sector is positioned for robust growth, driven by continuous innovation and increasing motor requirements.

- In April 2025, the International Energy Agency (IEA) reported a 6–8% rise in rare-earth demand in 2024, largely driven by electric vehicles (EVs), with permanent magnet (PM) use rising sharply in EV traction motors.

Market Challenge

Supply Chain Constraints of Rare Earth Materials

The limited availability of rare earth materials, especially neodymium and dysprosium, is a key challenge for the permanent magnet market. These materials face supply risks due to geopolitical tensions, export controls, and regional concentration, leading to price fluctuations and procurement delays.

This affects production efficiency and increases manufacturing costs across key application sectors. In response, manufacturers are adopting diversified sourcing, enhancing recycling capabilities, and advancing material alternatives. These measures support supply stability and reinforce long-term market resilience.

Market Trend

Advancements in Magnet Materials

A major trend reshaping the permanent magnet market is the advancement of next-generation magnetic materials that offer superior strength, thermal stability, and energy efficiency. Innovations in magnet design and composition are enabling enhanced performance in compact, high-efficiency systems, particularly in electric vehicles, wind turbines, and advanced electronics.

As industries increasingly demand smaller, more powerful components, the focus is shifting toward novel formulations and processing techniques. This wave of material innovation is broadening application possibilities and reinforcing the market’s long-term growth trajectory.

- In January 2025, MP Materials announced the start of neodymium and praseodymium (NdPr) metal production at its Independence facility in Fort Worth, Texas. This development represents the first domestic refinement of NdFeB magnet materials in the United States, supporting efforts to reduce dependence on foreign supply chains.

Permanent Magnet Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Neodymium Iron Boron, Ferrite Magnets, Samarium Cobalt (SmCo) Magnets, Alnico Magnets

|

|

By End-Use Industry

|

Automotive, Consumer Electronics, Environment & Energy, Aerospace & Defense

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material Type (Neodymium Iron Boron (NdFeB) Magnets, Ferrite Magnets, Samarium Cobalt (SmCo) Magnets, and Alnico Magnets): The neodymium iron boron (NdFeB) magnets segment earned USD 9.88 billion in 2024 due to its superior magnetic strength, high energy density, and widespread use in advanced applications such as electric vehicles, wind turbines, and industrial automation.

- By End-Use Industry (Automotive, Consumer Electronics, Environment & Energy, and Aerospace & Defense): The automotive segment held 35.05% of the market in 2024, due to the rising integration of permanent magnets in electric powertrains, sensors, and motors to enhance vehicle efficiency and support the global shift toward electrification.

Permanent Magnet Market Regional Analysis

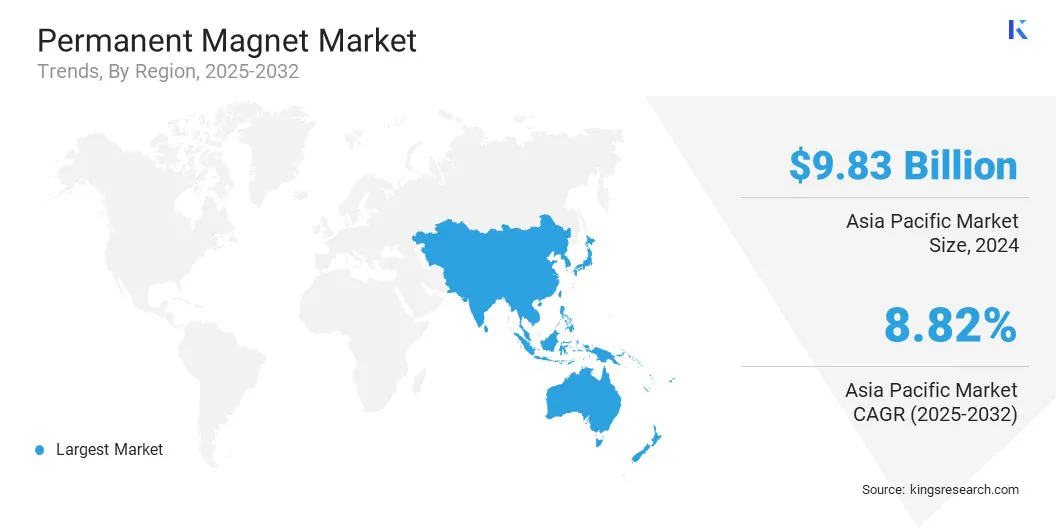

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific permanent magnet market share stood at 37.21% in 2024 in the global market, with a valuation of USD 9.83 billion. This dominance is attributed to the expanding electric vehicle production and adoption across Asia Pacific. This drives the sustained demand for permanent magnets used in high-efficiency traction motors.

Strong government policies, rising investments in EV manufacturing, and large-scale deployment of charging infrastructure further accelerate magnet consumption in this region. Additionally, continuous expansion of domestic magnet production capacity is supporting supply availability, thereby driving market growth.

- In May 2025, TATA.ev launched its first 10 MegaChargers in collaboration with ChargeZone and Statiq, as part of its plan to expand charging points to over 400,000 by 2027. Such developments reflect the region’s accelerating e-mobility ecosystem, increasing the need for reliable magnet supply.

North America permanent magnet industry is poised for a significant CAGR of 8.60% over the forecast period. This growth is driven by the growing aerospace and defense sector across North America, which continues to generate strong demand for high-performance permanent magnets. Increased defense spending by government agencies and rising investments from major aerospace and defense contractors are accelerating the use of magnetic components in advanced systems.

Moreover, ongoing government initiatives focused on military modernization and aerospace innovation are contributing to the expanded use of permanent magnets in advanced defense and aviation systems.

Regulatory Frameworks

- In China, the Ministry of Industry and Information Technology (MIIT) oversees rare earth production by setting output quotas, issuing export licenses, and formulating industrial policies for permanent magnet manufacturing.

- In the U.S., the Environmental Protection Agency (EPA) enforces environmental regulations related to the mining, processing, and manufacturing of materials used in permanent magnet production, ensuring sustainable industry practices.

Competitive Landscape

The permanent magnet industry is witnessing strategic expansion initiatives as key participants increase production capacities and establish new manufacturing facilities. These efforts aim to strengthen supply chain capabilities, address rising demand from automotive and renewable energy sectors, and secure regional market presence. Additionally, companies are investing in technological upgrades and optimizing resource availability to enhance operational efficiency.

- In April 2025, Solvay expanded its rare earths production capacity in Europe. The launch of Solvay’s new production line in France initiates rare earth manufacturing for permanent magnets, strengthening Europe’s strategic independence.

Key Companies in Permanent Magnet Market:

- Arnold Magnetic Technologies

- Dexter Magnetic Technologies, Inc.

- ZHAOBAO MAGNET

- Adams Magnetic Products, LLC

- Eclipse Magnetics

- Goudsmit Magnetics

- Magnequench International, LLC

- Thomas & Skinner

- Ningbo Tongchuang Magnetic Materials Co., Ltd

- VACUUMSCHMELZE GmbH & Co. KG

- Stanford Magnets

- XHMAG Inc

- Tapariatools

- Shin-Etsu Chemical Co., Ltd.

- TDK Corporation

Recent Developments (Expansion/Partnership)

- In October 2024, Arnold Magnetic Technologies increased the capacity of its manufacturing plant in Thailand to produce a diverse range of permanent magnet assemblies, catering to customers throughout Asia Pacific, Europe, and the U.S.

- In July 2024, Electron Energy Corporation partnered with Magnetic Holdings, LLC to deliver advanced samarium cobalt-based solutions across multiple applications in the magnetics industry. The collaboration aims to enhance material performance and expand capabilities within specialized magnet segments.

nited