Market Definition

The peracetic acid is a liquid oxidizing agent produced from acetic acid and hydrogen peroxide. It is valued for its strong antimicrobial properties and environmentally safe decomposition into water, oxygen, and carbon dioxide.

The market covers solution grade and distilled grade products in various concentration levels to meet industrial requirements. Key applications include disinfectants, sanitizers, sterilants, and oxidizers across industries such as food and beverage processing, water treatment, pulp and paper, healthcare, agriculture, aquaculture, and chemicals.

Peracetic Acid Market Overview

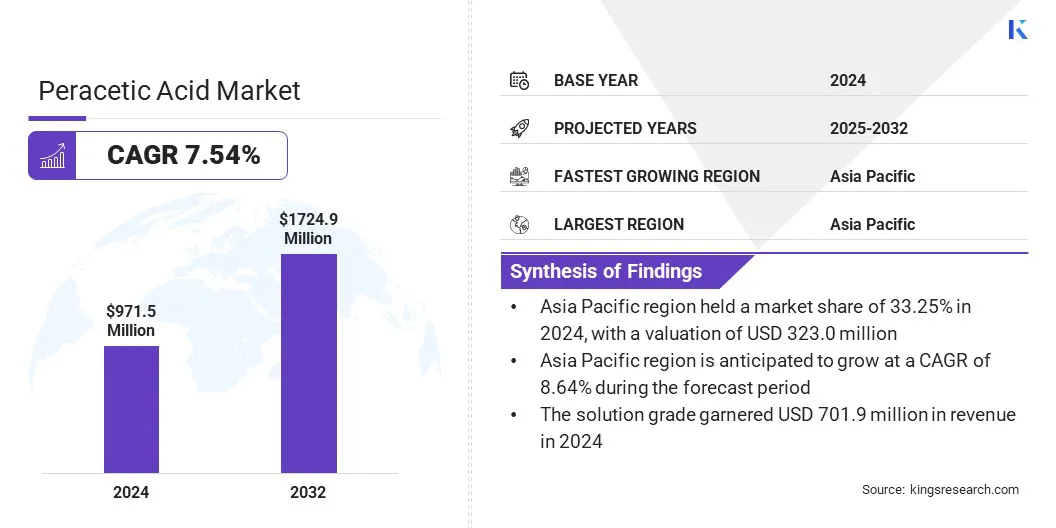

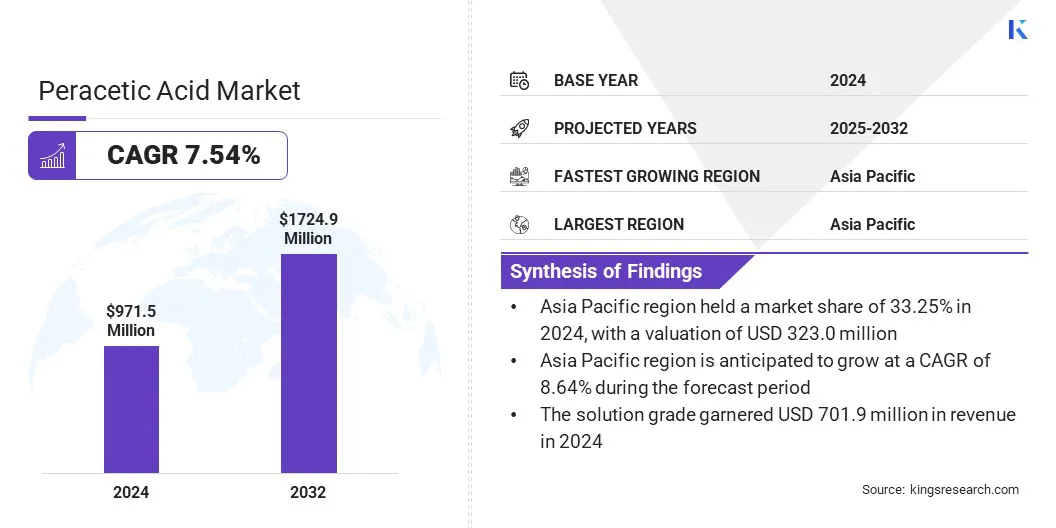

According to Kings Research, the global peracetic acid market size was valued at USD 971.5 million in 2024 and is projected to grow from USD 1,036.8 million in 2025 to USD 1,724.9 million by 2032, exhibiting a CAGR of 7.54% during the forecast period. This growth is driven by the increasing demand for high-efficacy antimicrobial solutions across food processing, healthcare, and water treatment sectors.

Peracetic acid delivers superior disinfection compared to chlorine-based alternatives and complies with strict hygiene standards.

The market is witnessing a shift toward specialized formulations targeting viral infections, including influenza, which expands its applications in healthcare and sanitation. These developments drive broader adoption and higher production of peracetic acid across industrial and commercial segments.

Key Market Highlights:

- The peracetic acid industry size was recorded at USD 971.5 million in 2024.

- The market is projected to grow at a CAGR of 7.54% from 2025 to 2032.

- Asia Pacific held a share of 33.25% in 2024, valued at USD 323.0 million.

- The solution grade segment garnered USD 701.9 million in revenue in 2024.

- The 5 to 15% segment is expected to reach USD 785.2 million by 2032.

- The disinfectant segment is expected to reach USD 551.9 million by 2032.

- North America is anticipated to grow at a CAGR of 7.18% over the forecast period.

Major companies operating in the peracetic acid market are Solvay, Evonik Industries AG, Mitsubishi Gas Chemical Company Inc., Ecolab Inc., Kemira, Jubilant, Enviro Tech Chemical Services, Inc. (Arxada), Airedale Group, Hydrite Chemical, Brainerd Chemical Company, Inc, Spectrum Laboratory Products, Inc., BioSafe Systems, LLC., ACURO ORGANICS LIMITED, STOCKMEIER Group, and RXSOL Group.

Companies are developing solutions that offer consistent concentration, reduce preparation time, and simplify application in industrial, commercial, and healthcare settings. These innovations address the increasing demand for pre-mixed and ready-to-use peracetic acid solutions.

The adoption of convenient and easy-to-apply disinfectants improves operational efficiency and ensures compliance with hygiene standards. This approach supports broader utilization of peracetic acid across multiple sectors and contributes to the expansion of the market.

Growing Demand for High-Efficacy Antimicrobial Solutions

The growth of the peracetic acid market is fueled by the growing demand for disinfectants with higher antimicrobial efficacy than chlorine-based alternatives. Peracetic acid offers rapid, broad-spectrum activity against bacteria, viruses, and spores without leaving harmful residues.

This makes it suitable for industries with strict hygiene standards, including food and beverage processing, healthcare, and water treatment. Its superior performance is boosting adoption and supporting market growth.

- In June 2025, Poultry Science reported that peracetic acid (PAA) exhibits superior antimicrobial and antibiofilm activity against Salmonella Typhimurium on chicken skin and food-contact surfaces. PAA was effective at lower concentrations than chlorine-based disinfectants and maintained effectiveness in organic-rich conditions. The study highlighted PAA’s potential to improve sanitation and food safety in poultry processing.

Corrosive Properties and Handling Risks

A significant challenge impeding the expansion of the peracetic acid market is its highly corrosive nature, which imposes risks in handling, storage, and transportation for manufacturers and end-users. These safety considerations increase operational costs and necessitate strict adherence to regulatory standards and protective protocols.

To mitigate these risks, companies are implementing specialized storage and handling infrastructure, providing comprehensive workforce training, and developing stabilized formulations to ensure safe and efficient application across industries.

Shift Toward Influenza-Specific Solutions

The peracetic acid market is experiencing a notable trend toward developing specialized solutions and formulations targeting influenza. Manufacturers are designing PAA-based products with optimized concentrations and delivery methods to enhance antiviral efficiency in healthcare, food processing, and public facilities.

These targeted solutions increase the reliability and efficiency of disinfection practices, making peracetic acid a preferred choice over traditional chemical disinfectants. Growing focus on influenza-specific formulations is boosting increased adoption in hospitals, laboratories, and food production facilities.

- In March 2025, Enviro Tech, a subsidiary of Arxada, received EPA approval for a label amendment for PeraGuard AH, allowing claims for disinfection against Avian Influenza and other animal viruses. Its patented granular peracetic acid formulation ensures controlled-release sanitation on entryways, boots, and high-traffic areas in poultry facilities.

Peracetic Acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Solution Grade, Distilled Grade

|

|

By Concentration Grade

|

Less than 5%, 5 to 15%, Above 15%

|

|

By Application

|

Disinfectant, Sanitizer, Sterilant, Oxidizer, Others

|

|

By End-user Industry

|

Food & Beverage Processing, Water Treatment, Pulp & Paper, Healthcare, Agriculture & Aquaculture, Chemicals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Solution Grade and Distilled Grade): The solution grade segment earned USD 701.9 million in 2024, largely due to its widespread use in industrial disinfection and sanitation processes.

- By Concentration Grade (Less than 5%, 5 to 15%, and Above 15%): The 5 to 15% segment held a share of 45.25% in 2024, fueled by its optimal balance of effectiveness and safety across multiple applications.

- By Application (Disinfectant, Sanitizer, Sterilant, Oxidizer, and Others): The disinfectant segment is projected to reach USD 551.9 million by 2032, owing to increased demand in healthcare and food processing facilities.

- By End-user Industry (Food & Beverage Processing, Water Treatment, Pulp & Paper, Healthcare, Agriculture & Aquaculture, Chemicals, and Others): The food & beverage processing segment is estimated to grow to USD 524.2 million by 2032, propelled by stricter hygiene regulations and growing production requirements.

Peracetic Acid Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific peracetic acid market share stood at 33.25% in 2024, valued at USD 323.0 million. This dominance is reinforced by the growing focus on wastewater management and strict standards for wastewater treatment.

Industrialization and urbanization have led governments to enforce strict regulations for water safety and environmental protection. This has created strong demand for peracetic acid as an effective oxidizing agent and disinfectant across major economies such as China, India, and Japan.

- In October 2024, the Indian government implemented the Liquid Waste Management Rules, mandating strict wastewater treatment and setting a 60% reuse target for high-use sectors such as textiles and paper mills by 2027. Peracetic acid supported these requirements through effective disinfection and safe breakdown into harmless byproducts, enabling reuse in industrial and agricultural applications.

The North America peracetic acid industry is poised to grow at a CAGR of 7.18% over the forecast period. This growth is fueled by its increasing adoption in the food and beverage processing industry.

Regulatory approval under the latest version of FSIS Directive 7120.1, “Safe and Suitable Ingredients Used in the Production of Meat, Poultry, and Egg Products,” specifies permitted PAA-containing substances and concentrations for specific purposes in meat, poultry, and egg products.

This allows processing facilities to implement effective disinfection practices, ensuring higher usage of peracetic acid and supporting regional market growth.

Regulatory Frameworks

- In the U.S, the Environmental Protection Agency (EPA) governs peracetic acid under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) for its use as a disinfectant and sanitizer in food processing and healthcare applications.

- In Europe, the European Chemicals Agency (ECHA) regulates peracetic acid under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) framework, ensuring safe handling, labeling, and environmental compliance.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) and the Ministry of Economy, Trade and Industry (METI) administer peracetic acid under the Poisonous and Deleterious Substances Control Law for industrial and sanitation use.

Competitive Landscape

Key players in the peracetic acid industry are prioritizing acquisitions and geographic expansion to enhance production capacity and strengthen their market presence. They are acquiring smaller or regional manufacturers to gain access to advanced technologies, optimize production processes, and broaden their customer base.

Companies are expanding into new geographies by establishing manufacturing plants and distribution centers to meet growing demand and reduce logistical costs. Strategic acquisitions and expansion efforts allow companies to consolidate resources, improve supply chain efficiency, and achieve a competitive advantage while ensuring consistent product availability across multiple regions and industries.

Key Companies in Peracetic Acid Market:

- Solvay

- Evonik Industries AG

- Mitsubishi Gas Chemical Company Inc.

- Ecolab Inc.

- Kemira

- Jubilant

- Enviro Tech Chemical Services, Inc. (Arxada)

- Airedale Group

- Hydrite Chemical

- Brainerd Chemical Company, Inc

- Spectrum Laboratory Products, Inc.

- BioSafe Systems, LLC.

- ACURO ORGANICS LIMITED

- STOCKMEIER Group

- RXSOL Group

Recent Developments

- In December 2023, Evonik fully acquired Thai Peroxide Company Limited (TPL) in Thailand by purchasing the remaining 50% stake from Aditya Birla Group. The acquisition expands Evonik’s specialty hydrogen peroxide and peracetic acid business in Asia Pacific, enhancing its presence in microchip and solar cell manufacturing, wastewater treatment, and food safety applications.