Market Definition

Pentylene glycol is a multifunctional organic compound used as a humectant, solvent, and preservative across cosmetics, personal care, and pharmaceutical products.

The market scope covers cosmetic grade, industrial grade, and pharmaceutical grade variants tailored to different performance needs. Key applications include personal care and cosmetics, pharmaceuticals, and the food industry, where it enhances product stability, safety, and shelf life.

Pentylene Glycol Market Overview

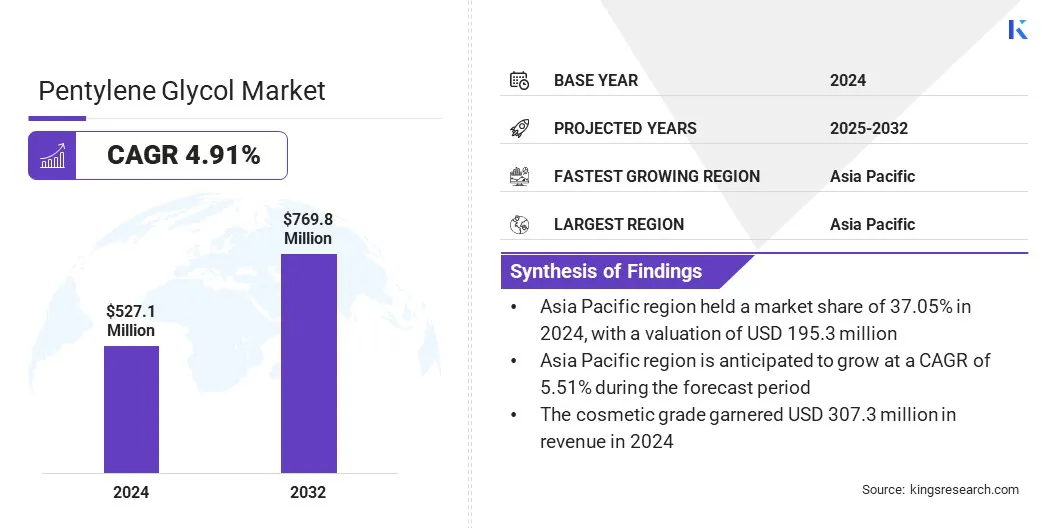

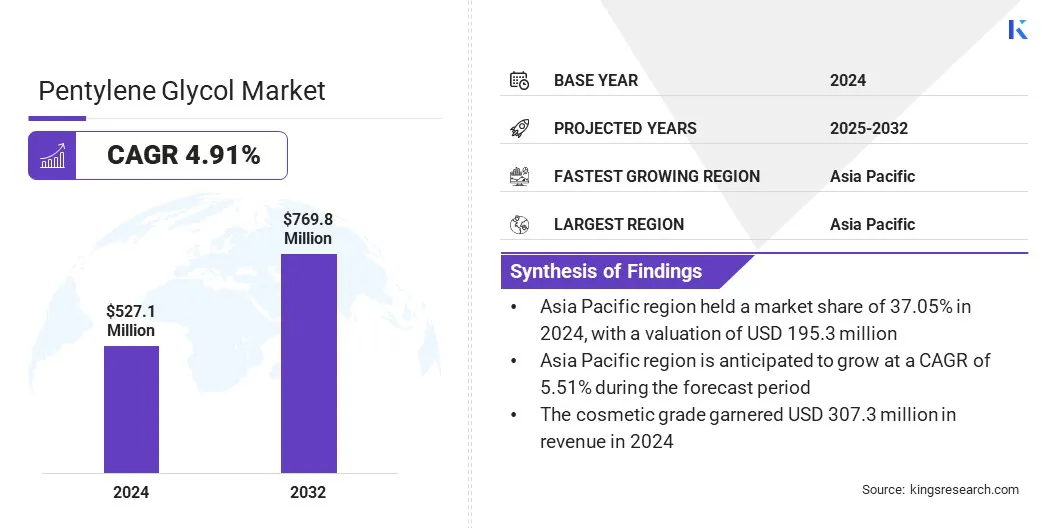

The global pentylene glycol market size was valued at USD 527.1 million in 2024 and is projected to grow from USD 550.3 million in 2025 to USD 769.8 million by 2032, exhibiting a CAGR of 4.91% over the forecast period.

This growth is fueled by the growing demand for antimicrobial agents in cosmetics, which increases its incorporation in skincare and personal care products. The market is further shaped by the shift toward naturally derived innovative formulations, where the ingredient is used in products combining moisturizing, preservative, and solvent properties. These properties support broader applications in cosmetics, personal care, and pharmaceuticals.

Key Highlights:

- The pentylene glycol industry size was recorded at USD 527.1 million in 2024.

- The market is projected to grow at a CAGR of 4.91% from 2025 to 2032.

- Asia Pacific held a share of 37.05% in 2024, valued at USD 195.3 million.

- The cosmetic grade segment garnered USD 307.3 million in revenue in 2024.

- The moisturizer segment is expected to reach USD 342.1 million by 2032.

- The personal care & cosmetics segment is projected to reach USD 472.4 million by 2032.

- Europe is anticipated to grow at a CAGR of 4.82% over the forecast period.

Major companies operating in the pentylene glycol market are Symrise, Cosroma, Cefa-Cilinas Biotics, Yantai Aurora Chemical Co., LTD., Prod'Hyg, Novaphene, DKSH Performance Materials International Ltd., Jiangsu Suoteng New Material Technology Co., Ltd., Uniproma, and Shengqing Materials Co., Ltd.

Companies are formulating products that leverage pentylene glycol’s inherent antimicrobial, humectant, solvent, and emollient properties to address the increasing demand for multifunctional solutions in cosmetics, personal care, and pharmaceuticals.

Its inclusion enhances product hydration, preservation, and texture while reducing the need for additional ingredients. This approach enables the development of efficient, high-performance products that deliver multiple benefits within a single application.

Market Driver

Growing Demand for Antimicrobial Agents in Cosmetics

The expansion of the pentylene glycol market is driven by the growing demand for antimicrobial agents in cosmetics. Pentylene glycol acts as an effective preservative, preventing the growth of bacteria, mold, and yeast in personal care and skincare products.

According to the article “Mechanism of action of preservatives in cosmetics” published in the Journal of Dermatologic Science and Cosmetic Technology, December 2024, pentylene glycol belongs to the class of 1,2-alkanediols, which exert antimicrobial effects through membrane disruption.

Its amphiphilic nature allows it to integrate into microbial cell membranes, destabilizing their structure and inhibiting microbial growth. Rising consumer awareness of product safety and hygiene is prompting manufacturers to include pentylene glycol in formulations, supporting market growth.

Market Challenge

High Production Costs

A major challenge impeding the expansion of the pentylene glycol market is the high cost of production due to complex synthesis processes and the requirement for high-purity raw materials. These costs limit adoption in personal care, cosmetics, and pharmaceutical applications.

To address this challenge, companies are investing in energy-efficient manufacturing technologies and process optimization. Market players are also expanding production facilities and exploring alternative raw material sources to reduce costs and maintain a consistent supply.

Market Trend

Shift Toward Naturally Derived Innovative Formulations

The pentylene glycol market is experiencing a shift toward innovative formulations using 100% naturally derived ingredients in personal care, cosmetics, and pharmaceutical products.

Manufacturers are focusing on combining moisturizing, preservative, and solvent properties in a single ingredient to enhance product performance. This trend is driving the development of high-performance, safe, and natural formulations, influencing product development and formulation strategies across the market.

Pentylene Glycol Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Cosmetic Grade, Industrial Grade, Pharmaceutical Grade

|

|

By Function

|

Moisturizer, Solvent, Preservative, Others

|

|

By End Use Industry

|

Personal Care & Cosmetics, Pharmaceuticals, Food Industry, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Cosmetic Grade, Industrial Grade, and Pharmaceutical Grade): The cosmetic grade segment earned USD 307.3 million in 2024, mainly due to its extensive use in skincare and haircare formulations.

- By Function (Moisturizer, Solvent, Preservative, and Others): The moisturizer segment held a share of 42.55% in 2024, fueled by rising demand for hydrating ingredients in personal care products.

- By End Use Industry (Personal Care & Cosmetics, Pharmaceuticals, Food Industry, and Others): The personal care & cosmetics segment is projected to reach USD 472.4 million by 2032, owing to increasing consumer focus on premium and multifunctional formulations.

Pentylene Glycol Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific pentylene glycol market share stood at 37.05% in 2024, valued at USD 195.3 million. This dominance is reinforced by the rapid expansion of pharmaceutical sector and increasing consumer spending on personal care and cosmetic products.

High demand from countries such as China, India, and Japan is driven by a growing middle-class population and rising disposable incomes. The region’s expanding pharmaceutical sector further contributes to regional market growth, as pentylene glycol is used in various pharmaceutical formulations.

The Europe pentylene glycol industry is poised to grow at a significant CAGR of 4.82% over the forecast period. This growth is propelled by the private-sector investments in new production facilities aimed at increasing manufacturing capacity for multifunctional ingredients.

These investments support the personal care and cosmetics industry by ensuring a reliable supply of high-quality pentylene glycol. The expanded production capabilities enable companies to meet rising regional demand efficiently while adhering to sustainability standards, strengthening Europe’s market position.

- In February 2025, Symrise opened a new production unit for Hydrolite 5 Green at its Granada, Spain facility. The plant expands capacity for biobased pentylene glycol, providing a shorter supply chain for European customers and supporting consistent product quality. It features continuous production, on-site hydrogen recycling, and high automation to improve efficiency and reduce environmental impact.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) oversees cosmetic ingredients, including pentylene glycol, under the Federal Food, Drug, and Cosmetic Act. It ensures that products are safe and properly labeled before marketing.

- In Europe, pentylene glycol is subject to Regulation (EC) No 1223/2009 on cosmetic products. This regulation mandates that cosmetic ingredients be assessed for safety and prohibits the use of certain substances in cosmetic products.

- In Japan, the Ministry of Health, Labour, and Welfare (MHLW) regulates cosmetic ingredients under the Pharmaceutical and Medical Devices Act (PMD Act), ensuring product safety and proper labeling.

- In India, cosmetic products are regulated under the Drugs and Cosmetics Act, 1940, and the New Cosmetics Rules, 2020, requiring safety and efficacy testing before products reach the market.

Competitive Landscape

Key players in the pentylene glycol industry are expanding their production capabilities by establishing new manufacturing facilities in key regions. These investments aim to meet the growing demand for sustainable and multifunctional ingredients, ensuring a reliable supply chain and reduced transportation emissions.

Additionally, firms are introducing innovative formulations of pentylene glycol to cater to evolving consumer preferences for eco-friendly and high-performance products. These efforts are designed to strengthen market presence and align with industry trends favoring natural and effective ingredients.

Top Key Companies in Pentylene Glycol Market:

- Symrise

- Cosroma

- Cefa-Cilinas Biotics

- Yantai Aurora Chemical Co., LTD.

- Prod'Hyg

- Novaphene

- DKSH Performance Materials International Ltd.

- Jiangsu Suoteng New Material Technology Co., Ltd.

- Uniproma

- Shengqing Materials Co., Ltd.

Recent Developments

- In June 2025, Uniproma launched Uniprotect-1,2-PD (Natural), a 100% plant-derived pentylene glycol for sustainable beauty formulations. The ingredient combines moisturizing, preservative-boosting, and solubilizing functions, supporting natural, clean, and sensitive skin care products.