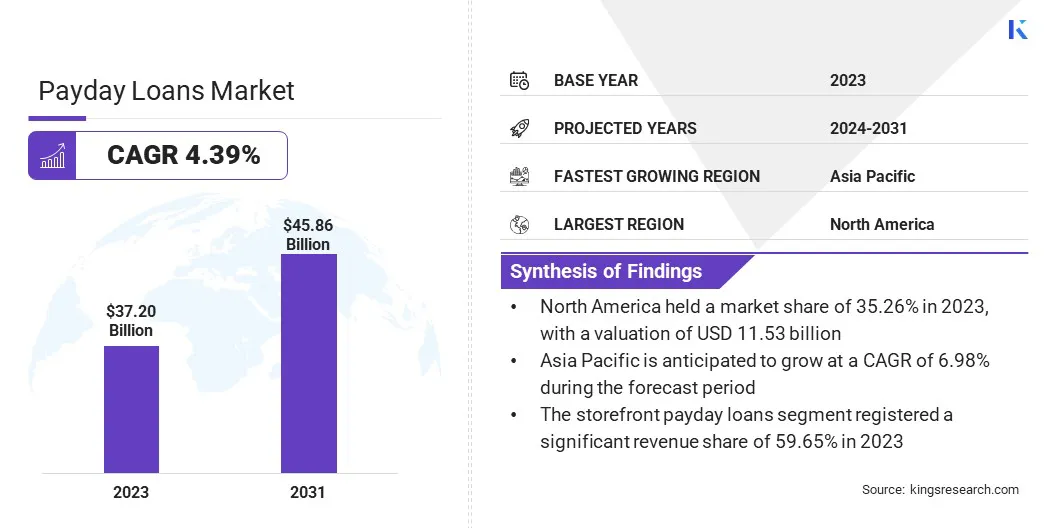

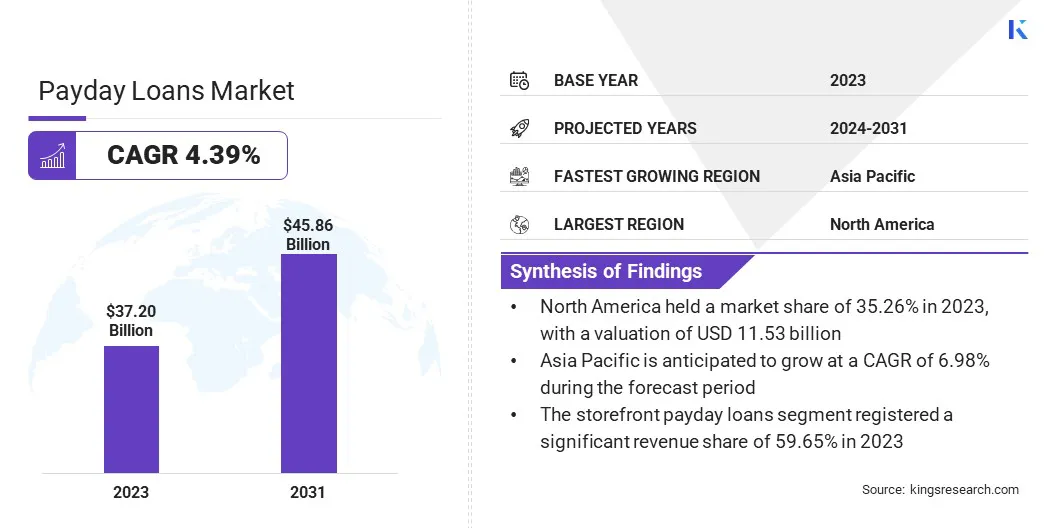

Payday Loans Market Size

The global Payday Loans Market size was valued at USD 32.70 billion in 2023 and is projected to reach USD 45.86 billion by 2031, growing at a CAGR of 4.39% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Cash America International, Check `n Go, MoneyGram, CashNetUSA, Check City Online, Moneytree, Inc., Advance Financial, TMG Loan Processing, LLC, EZ Money, LENDUP.com and Others.

The payday loans market is a financial sector that provides short-term, high-interest loans to individuals in need of immediate cash. The industry has grown significantly over the past few decades, fueled by the surging demand from individuals facing financial emergencies or cash shortages.

The payday loans industry has faced scrutiny and regulation from policymakers and consumer advocacy groups due to growing concerns regarding predatory lending practices. Many jurisdictions have implemented laws and regulations to protect consumers, including interest rate caps, limits on fees, and requirements for lenders to assess borrowers' ability to repay.

Despite regulatory efforts, the payday loans market continues to evolve. Online payday lending has become increasingly prevalent, allowing borrowers to access loans conveniently from their computers or mobile devices. Additionally, some lenders have introduced installment loans, which allow borrowers to repay the loan over a longer period through smaller and more manageable installments.

Analyst’s Review

Technology is playing an increasingly important role in the payday lending process, from loan application and approval to repayment. Automated underwriting systems, artificial intelligence, and machine learning algorithms are being widely used to streamline operations and improve decision-making. These advancements have made the payday lending process more efficient and convenient for both lenders and borrowers.

Borrowers can now apply for loans online or through mobile apps, reducing the time and effort required to access funds. Additionally, automated repayment systems make it easier for borrowers to make timely payments, reducing the risk of default and late fees. Overall, technology has revolutionized the payday loans industry, making it more accessible and user-friendly.

Market Definition

Payday loans are typically short-term, high-interest loans that are due on the borrower's next payday. These loans are usually for relatively small amounts, ranging from a few hundred to a few thousand dollars, and are sought by individuals facing immediate financial needs or emergencies. Borrowers generally provide proof of income, such as pay stubs or bank statements, to qualify for payday loans.

The defining characteristic of payday loans is their high cost, often resulting in triple-digit annual percentage rates (APRs). Lenders charge fees and interest rates that can make these loans expensive for borrowers, particularly if they are unable to repay the loan on time. Critics argue that the high cost of payday loans can trap borrowers in cycles of debt, as they struggle to repay the loan along with hefty fees and interest charges.

Payday loans are commonly used by individuals who have difficulty accessing traditional forms of credit due to poor credit scores, limited credit history, or immediate financial needs. While payday loans can provide a quick source of cash for those in need, they have faced scrutiny and regulation from policymakers and consumer advocacy groups due to concerns regarding predatory lending practices and the potential for borrower exploitation.

Payday Loans Market Dynamics

The streamlined application process for payday loans is driving market growth. Compared to traditional loans, payday loans typically have simpler and more streamlined application processes. Borrowers are usually required to provide proof of income and identification, and approval decisions are often made quickly, allowing borrowers to receive funds within a short timeframe.

Additionally, the online nature of many payday loan companies has made the application process even more convenient for borrowers. With just a few clicks, individuals can complete their application, submit necessary documents, and receive approval without needing to leave their homes. This ease of access and quick turnaround time has contributed to the increasing popularity of payday loans among consumers in need of fast cash.

Furthermore, the flexible repayment options offered by numerous payday loan companies make them an attractive choice for individuals facing financial emergencies. Borrowers can choose from various repayment plans, allowing them to select the one that aligns best with their budget and financial situation.

This level of customization and convenience offered by payday loans sets them apart from traditional bank loans, which often impose stricter repayment terms and requirements. As a result, an increasing number of people are turning to payday loans as a viable solution for their short-term financial needs.

Many critics argue that payday loans can trap borrowers in a cycle of debt. Due to the short repayment terms and high costs, borrowers may find it difficult to repay the full amount of the loan on time. As a result, they may roll over the loan or take out another loan to cover the initial one, leading to a cycle of borrowing and indebtedness. This cycle can be extremely challenging to break free from, as interest rates and fees continue to accumulate with each new loan.

Borrowers may find themselves in a never-ending cycle of debt that can have serious financial consequences. It is important for individuals to carefully consider their options and seek alternative forms of financial assistance before resorting to payday loans. For instance, a borrower who takes out a payday loan to cover unexpected medical expenses may struggle to repay the loan in full by the due date.

Subsequently, they might roll over the loan, accruing additional fees and interest and ultimately leading them to resort to taking out multiple payday loans in an attempt to stay financially afloat. This can result in a vicious cycle of borrowing and indebtedness that can quickly spiral out of control, resulting in financial hardship and a potential default on the loans.

Segmentation Analysis

The global payday loans market is segmented based on type, marital status, age group, and geography.

By Type

By type, the payday loans market is bifurcated into storefront payday loans and online payday loans. The storefront payday loans segment registered a significant revenue share of 59.65% in 2023. This dominance is mainly attributed to the convenience and accessibility of storefront locations for customers in need of quick cash.

Additionally, storefront payday loans provide a more personal touch and face-to-face interaction for those who prefer traditional banking methods. On the other hand, online payday loans have gained significant popularity due to their ease of use and ability to apply for a loan from the comfort of one's own home.

The competition between storefront and online payday loans continues to drive innovation and improvements in the industry, thereby contributing to the growth of the payday loans market.

By Marital Status

By marital status, the payday loans market is bifurcated into married, single, and others. The single segment recorded the highest revenue share of 44.25% in 2023. This growth is primarily driven by the fact that single individuals may be more likely to seek payday loans as they lack a second income to rely on.

Furthermore, single individuals may have a higher likelihood of facing unexpected expenses or emergencies without the financial cushion provided by a dual income household. This makes payday loans a more attractive option for single individuals in need of quick cash.

By Age Group

By age group, the payday loans market is bifurcated into young adults, middle-aged individuals, and seniors. The middle-aged individuals segment accounted for a significant revenue share of 48.65% in 2023. This age group is generally considered to have greater financial security, which could be associated with a higher utilization of payday loans in response to unforeseen expenses or emergencies.

Additionally, middle-aged individuals may have a higher income level compared to younger age groups, allowing them to qualify for larger loan amounts. As a result, the middle-aged segment is a crucial demographic for payday loan companies to target and tailor their services towards.

Payday Loans Market Regional Analysis

Based on region, the global payday loans market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Payday Loans Market share stood around 35.26% in 2023 in the global market, with a valuation of USD 11.53 billion. This growth is mainly driven by the high demand for quick and easy access to cash among consumers in the region. Additionally, the well-established financial infrastructure and regulations in North America have contributed to the growth of the market.

With the increasing use of online lending platforms and the convenience they offer, the market is expected to continue to expand in the coming years. Furthermore, the rise of financial technology companies in the region has played a significant role in driving the growth of the payday loan market.

However, Asia Pacific is projected to experience a rapid growth rate of 6.98% over the forecast period. The regional market is witnessing considerable growth due to the increasing adoption of digital payment methods and the rise of fintech companies. As a growing number of consumers in Asia Pacific become comfortable with online lending platforms, the payday loan market is expected to witness significant expansion.

Additionally, the lack of access to traditional banking services in many parts of Asia Pacific has created a strong demand for alternative financial solutions, thereby driving the growth of the payday loan market in the region. Overall, while North America has been a leading region in the payday loan market, Asia Pacific is poised to experience rapid growth in the coming years.

Competitive Landscape

The global payday loans market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

List of Key Companies in Payday Loans Market

- Cash America International

- Check `n Go

- MoneyGram

- CashNetUSA

- Check City Online

- Moneytree, Inc.

- Advance Financial

- TMG Loan Processing, LLC

- EZ Money

- LENDUP.com

Key Industry Developments

- June 2023 (Partnership) - MoneyGram and the startup Zirtue collaborated to provide a service where individuals without traditional banking access can borrow money from their acquaintances using Zirtue. Subsequently, the borrowed funds can be retrieved in cash from various MoneyGram outlets across the United States. Alternatively, for underbanked borrowers who possess a bank account or debit card, the funds can be accessed through the Zirtue app.

The Global Payday Loans Market is Segmented as:

By Type

- Storefront Payday Loans

- Online Payday Loans

By Marital Status

By Age Group

- Young Adults

- Middle-aged Individuals

- Seniors

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.