Pay TV Market Size

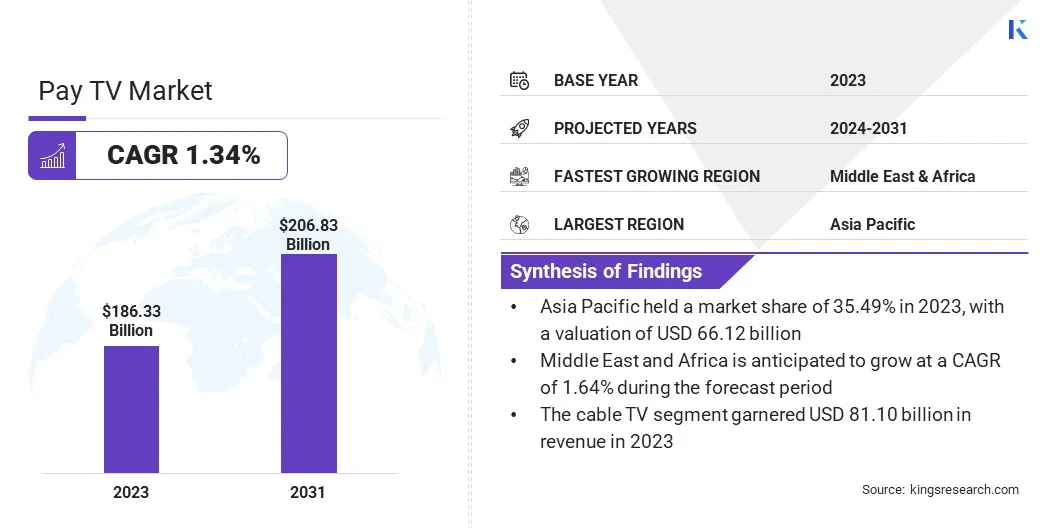

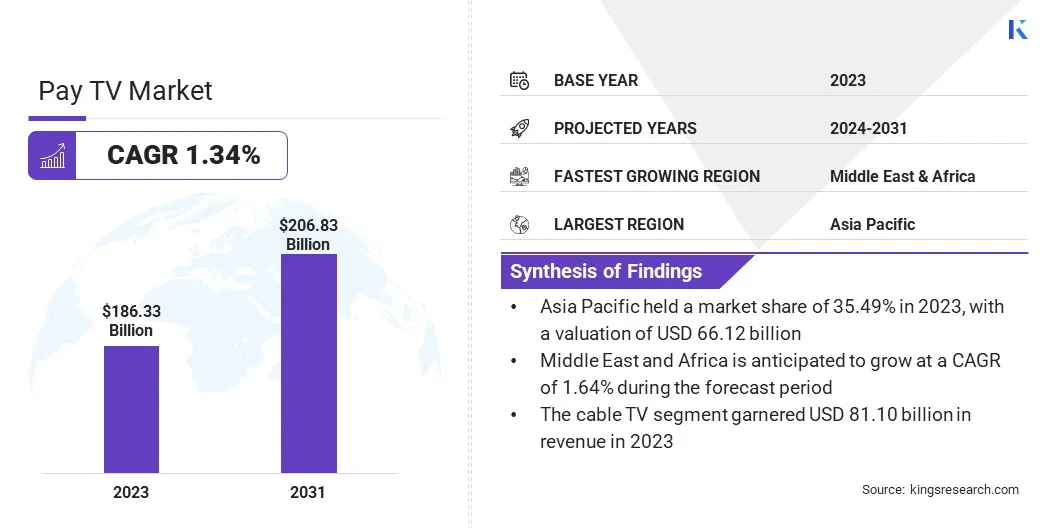

The global Pay TV Market size was valued at USD 186.33 billion in 2023 and is projected to grow from USD 188.46 billion in 2024 to USD 206.83 billion by 2031, exhibiting a CAGR of 1.34% during the forecast period. Pay TV providers offer tailored content packages to cater to diverse demographic groups, enhancing customer retention.

This focus on exclusive content fosters user engagement and attracts new subscriptions, significantly contributing to the expansion of the market. In the scope of work, the report includes services offered by companies such as Comcast (Xfinity), DIRECTV, DISH Network L.L.C., Dish TV, Sky TV, Tricolor TV, Charter Communications, Airtel India., Verizon, Cox Communications, Inc., and others.

Additionally, rapid urbanization and improved living standards have increased demand for home entertainment, positioning pay TV as a preferred luxury. This socio-economic shift presents significant growth opportunities for Pay TV providers targeting emerging markets through tailored content and affordable packages.

Pay TV is a subscription-based television services where users pay a recurring fee to access premium content that is not available on free-to-air channels. These services are delivered via cable, satellite, or internet-based platforms (IPTV), offering a wide range of exclusive programming such as live sports, movies, original series, and international channels.

Pay TV provides viewers with features such as video-on-demand (VOD), high-definition (HD) content, and multi-device streaming. Unlike traditional broadcasting, Pay TV typically offers more diverse and higher-quality content, tailored to specific audience preferences through various package options and add-on services.

Analyst’s Review

The introduction of high-definition (HD), 4K, and lutra high definition HD (UHD) content is enhancing the viewing experience and attracting more users to pay TV services. Providers are integrating interactive features such as video-on-demand (VOD), catch-up TV, and cloud DVR, allowing customers greater control over their viewing choices.

- In January 2024, The Walt Disney Company partnered with Apple Vision Pro to enhance entertainment and storytelling. By leveraging Apple’s state-of-the-art augmented reality (AR) technology, Disney seeks to redefine audience engagement and immersive storytelling.

These advancements elevate user experience, differentiating pay TV from traditional broadcasting and free platforms. Ongoing innovations in streaming technology, mobile apps, and multi-device compatibility further boost market growth, enabling users to access premium content across multiple screens.

Pay TV Market Growth Factors

Pay TV operators are increasingly adopting hybrid business models that integrate traditional cable with satellite delivery with OTT services, thereby fueling the growth of the pay TV market. These models allow providers to cater to changing consumer preferences, especially the growing demand for on-demand and streaming services.

By integrating OTT platforms such as Netflix, Disney+, and Amazon Prime Video within their packages, pay TV operators offer more comprehensive content options. This hybrid approach retains traditional subscribers while attracting younger, tech-savvy consumers. The shift further enhances the flexibility of service offerings, leading to increased customer satisfaction and market penetration.

- In April 2024, Dish TV unveiled the ‘Dish TV Smart+,’ offering subscribers seamless access to both traditional TV and over-the-op (OTT) content on any screen, anywhere, and at any time.

Moreover, consumers increasingly seek exclusive, high-quality content, such as live sports events, blockbuster films, and original TV series. Pay TV platforms offer specialized programming not readily available on free-to-air channels. The growing preference for premium content, including international and local shows, fuels subscription growth.

Pay TV providers deliver customized content packages tailored to the preferences of various demographic groups, which strengthens customer loyalty. By focusing on exclusive content, providers keep users engaged and also attract new subscribers, positioning this strategy as a key driver for the growth of the market.

However, the global trend of "cord-cutting," wherein consumers cancel traditional Pay TV subscriptions in favor of internet-based streaming services, poses a significant challenge to the development of the market. This shift is supported by a growing preference for on-demand content and greater flexibility, particularly among younger, tech-savvy consumers.

To address this challenge, pay TV providers are integrating hybrid models that combine live TV with streaming services, offering customizable subscription options. They are further investing in exclusive, high-quality content to attract and retain viewers. Additionally, enhancing multi-device compatibility allows consumers to access content seamlessly across various platforms, meeting rising customer demands and sustaining market growth.

Pay TV Market Trends

The rapid expansion of broadband and fiber-optic networks globally has made pay TV more accessible to a larger population. High-speed internet enables the delivery of IPTV and OTT content to regions previously underserved by traditional cable or satellite TV services.

The development of digital infrastructure in emerging economies provides millions of new potential subscribers access to premium TV services. This infrastructural growth, particularly in rural areas and developing nations, is boosting demand for pay TV. Providers capitalize on these advancements to offer high-quality services to untapped markets, fostering pay TV market growth.

Additionally, pay TV remains a dominant platform for live sports broadcasting, contributing to the growth of the market. Securing exclusive rights to major sports events, including international tournaments like the FIFA World Cup and regional leagues, attracts a vast audience. Sports fans are willing to pay a premium for live, high-definition coverage of their favorite games.

Segmentation Analysis

The global market has been segmented based on technology, application, revenue model, and geography.

By Technology

Based on technology, the market has been segmented into cable TV, satellite TV, and internet protocol TV (IPTV). The cable TV segment led the pay TV market in 2023, reaching a valuation of USD 81.10 billion.

Cable TV has significant coverage, especially in urban and suburban areas where providers have developed robust networks over decades. This existing infrastructure allows cable operators to deliver a broad range of content at competitive prices, enhancing accessibility for households compared to satellite or IPTV options.

Additionally, cable TV packages offer extensive channel lineups, often bundled with broadband services, providing consumers with convenience and cost savings.

By Application

Based on application, the market has been classified into commercial, residential, and others. The commercial segment secured the largest revenue share of 81.09% in 2023.

Businesses in hospitality, entertainment, retail, and public spaces rely on pay TV services to enhance customer experience by offering a variety of premium content, including sports, news, and entertainment, to engage viewers. Additionally, the demand for high-quality, real-time content, such as live sports and events, makes pay TV an essential feature in commercial settings, thereby stimulating segmental growth.

By Revenue Model

Based on revenue model, the market has been divided into subscription-based, pay-per-view (PPV), and hybrid. The hybrid segment is poised to witness significant growth at a CAGR of 2.60% through the forecast period. Viewers increasingly seek the flexibility and content variety offered by OTT services while still valuing the live programming, sports, and news that traditional pay TV offers.

The hybrid model addresses this growing demand by combining live and on-demand content, thus attracting a broader audience. This approach allows pay TV operators to retain traditional subscribers while appealing to younger, tech-savvy customers who prefer streaming.

Additionally, hybrid models typically offer tiered pricing options, enabling companies to monetize both premium live TV and OTT subscriptions, thereby optimizing revenue across diverse consumer segments.

Pay TV Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific pay TV market held a substantial share of around 35.49% in 2023, with a valuation of USD 66.12 billion. Rapid urbanization in the region is progressing at an unprecedented rate, which leads to the increase in demand for entertainment.

- According to the United Nations, by 2030, nearly 60% of the region's population is anticipated to reside in urban areas. This urban migration is contributing to the growth of the middle class, which is projected to reach over 3.5 billion by 2030.

With rising disposable incomes, consumers in urban centers are increasingly willing to spend on premium entertainment, including pay TV services, thereby fueling the growth of the Aia Pacific market. Additionally, regional players such as Hotstar (Disney+ Hotstar) in India and K-Pop-focused services in South Korea are setting trends by producing local content that resonates with their audiences.

The success of original series and films on platforms such as Netflix and Amazon Prime Video in the region highlights the surging demand for premium content. This demand is prompting pay TV operators to invest heavily in unique programming to differentiate their services and retain subscribers, thus fostering regional market progress.

The Middle East and Africa pay TV market is set to experience significant growth at a CAGR of 1.64% over the forecast period. Countries in the region are increasingly prioritizing local content to cater to diverse audiences, augmenting regional market growth.

- For instance, Saudi Arabia's Vision 2030 initiative aims to develop the entertainment sector through substantial investments in local film and television production.

Platforms such as Shahid, owned by MBC Group, are expanding their libraries with original Arabic content, drawing in subscribers who prefer culturally relevant programming, which is supporting domestic market expansion. Moreover, governments across the region are making concerted efforts to boost digital broadcasting and improve media infrastructure.

- For instance, the African Union's Agenda 2063 emphasizes the need for enhanced connectivity and technology in the media sector.

Recent initiatives, including Egypt’s launch of a digital television platform, highlight the commitment to developing a robust digital broadcasting ecosystem. This support facilitates the rollout of pay TV services, and improves access for consumers, and drives growth in subscription rates, thereby bolstering industry growth.

Competitive Landscape

The global pay TV market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Pay TV Market

Key Industry Developments

- May 2024 (Product Launch): Comcast introduced Xfinity StreamSaver, a bundled streaming package that includes Peacock, Netflix, and Apple TV+ for both new and existing Xfinity Internet and TV customers. This offering provides customers with savings of over 30%, or nearly USD 100 annually.

- September 2024 (Partnership): Sky and UKTV announced a multi-year extension of their long-standing partnership, ensuring continued availability of UKTV’s popular pay channels, Alibi and Gold, across Sky platforms in both the UK and Ireland.

The global pay TV market has been segmented as:

By Technology

- Cable TV

- Satellite TV

- Internet Protocol TV (IPTV)

By Application

- Commercial

- Residential

- Others

By Revenue Model

- Subscription-Based

- Pay-Per-View (PPV)

- Hybrid

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America