Market Definition

The market encompasses the design, manufacturing, and integration of seating systems in vehicles, focusing on comfort, safety, and functionality. This market involves advanced engineering processes, including ergonomic design, material innovation, and compliance with safety regulations.

Seats are formulated using high-density foams, reinforced frames, and smart technologies such as climate control and electronic adjustments. Applications extend across various vehicle categories, from economy to luxury and electric vehicles, where seats play a crucial role in enhancing passenger experience and safety.

Continuous advancements in lightweight materials, modular designs, and sensor-based features are shaping the evolution of seating solutions in modern automobiles.

Passenger Car Seat Market Overview

The global passenger car seat market size was valued at USD 44.09 billion in 2023 and is projected to grow from USD 45.24 billion in 2024 to USD 55.23 billion by 2031, exhibiting a CAGR of 2.89% during the forecast period.

The market is experiencing significant growth due to rising consumer demand for enhanced comfort and safety features. Automakers are integrating advanced seating technologies, such as climate-controlled and ergonomic designs, to improve passenger experience.

Additionally, the increasing adoption of electric and luxury vehicles is boosting the need for premium, customizable seating solutions, further contributing to market expansion.

Major companies operating in the passenger car seat industry are Adient plc, Lear, TOYOTA BOSHOKU CORPORATION, Faurecia, Magna International Inc., TS Tech Co., Ltd., NHK Spring Co., Ltd., Freedman Seating Company, Gentherm, GRAMMER AG, RECARO Holding GmbH, Commercial Vehicle Group, Inc., Brose Fahrzeugteile GmbH & Co. KG, AUNDE Group SE (Isringhausen GmbH & Co. KG), Martur Fompak International, and others.

The steady increase in global vehicle production is influencing the market. Automakers are expanding manufacturing capacities to meet rising consumer demand, particularly in emerging economies with improving disposable incomes. The growing preference for personal vehicles and the expansion of ride-hailing services are further boosting market expansion.

The introduction of new car models with advanced interior designs and enhanced comfort features is creating a surge in demand for high-quality seating solutions, fostering innovations and competition among key market players.

- The 2024 Alliance for Automotive Innovation report highlights that global vehicle production reached approximately 94 million units in 2023, up from 65 million in 2004. China's automotive output surged to 30 million vehicles in 2023, reflecting a 297% rise since 2004.

Key Highlights:

- The passenger car seat industry size was recorded at USD 44.09 billion in 2023.

- The market is projected to grow at a CAGR of 2.89% from 2024 to 2031.

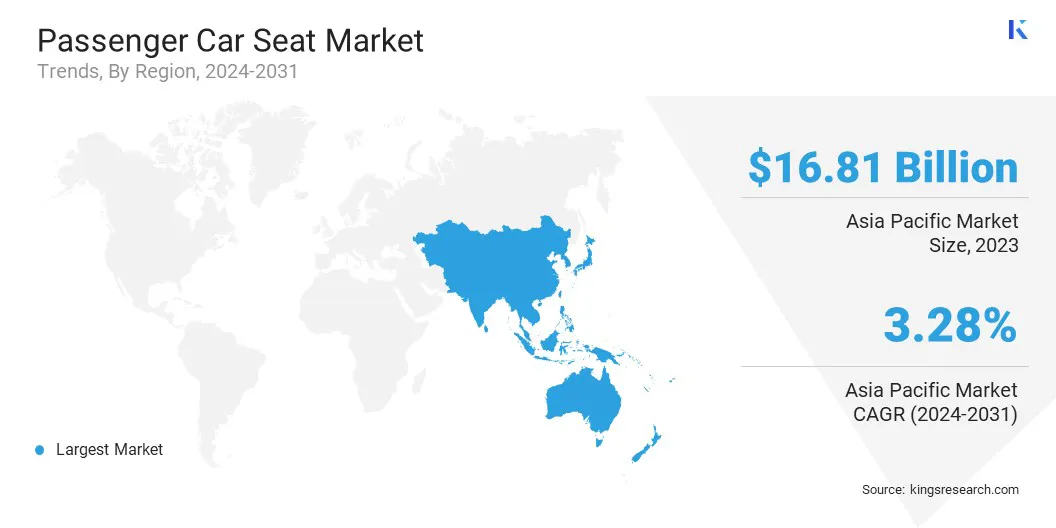

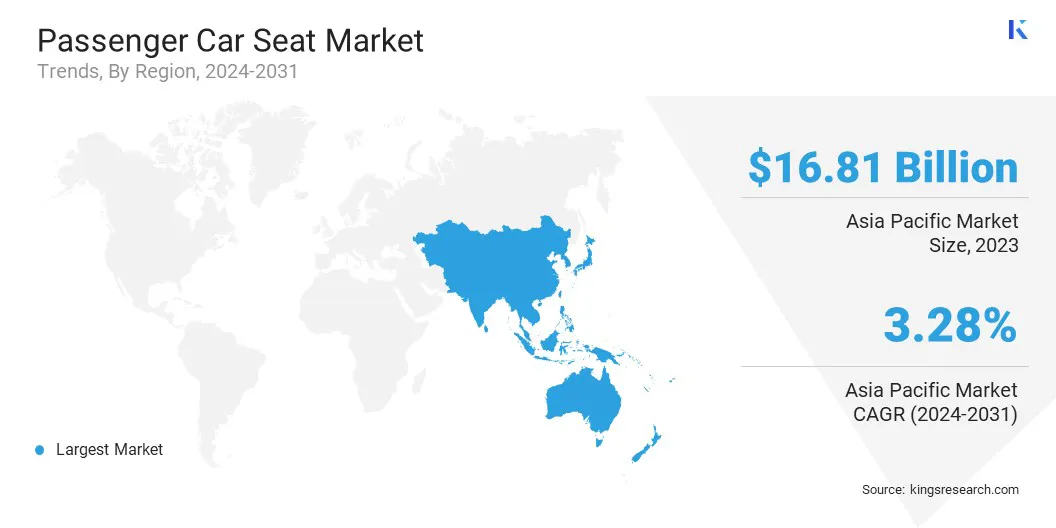

- Asia Pacific held a share of 38.12% in 2023, valued at USD 16.81 billion.

- The standard seats segment garnered USD 23.91 billion in revenue in 2023.

- The fabric seats segment is expected to reach USD 21.59 billion by 2031.

- The passenger sars segment secured the largest revenue share of 54.21% in 2023.

- The bucket seats is set to grow at a CAGR of 3.26% through the forecast period.

- Europe is anticipated to grow at a CAGR of 2.94% through the estimated timeframe.

Market Driver

"Rising Consumer Preference for Luxury and Comfort"

The increasing preference for premium automotive interiors is fueling the growth of the passenger car seat market, with automakers focusing on ergonomically designed, power-adjustable, and multi-functional seating solutions.

Consumers are prioritizing comfort, aesthetics, and advanced upholstery materials, leading to a growing demand for leather, synthetic, and temperature-regulating fabric seats.

Luxury vehicles are incorporating high-end seat features such as reclining capabilities, memory functions, and noise-reducing materials to enhance passenger experience. The shift toward SUVs and high-end sedans, which offer more spacious and luxurious seating arrangements, is further influencing the market.

- In December 2024, Adient, Jaguar Land Rover (JLR), and Dow partnered to create seat foam for JLR vehicles using closed-loop recycled materials. This innovation advances the automotive industry's shift toward a circular economy while lowering the carbon footprint of luxury vehicles.

Market Challenge

"High Production Costs and Pricing Pressure"

The passenger car seat market faces a significant challenge due to high production costs driven by advanced materials, smart technologies, and regulatory compliance. Rising raw material prices and manufacturing expenses exwet pricing pressure, limiting affordability for mass-market vehicles.

To address this challenge, companies are investing in cost-efficient manufacturing processes, including automation and sustainable materials. Strategic collaborations with material suppliers and advancements in modular seat designs are optimizing costs while maintaining quality.

Additionally, manufacturers are focusing on economies of scale and localized production to reduce logistics expenses, ensuring competitive pricing without compromising innovation and safety standards.

Market Trend

"OEM Collaborations and R&D Investments in Seat Innovation"

Automakers and seat manufacturers are engaging in strategic partnerships and investing in R&D to advance seating technology. The passenger car seat market is benefiting from R&D efforts focused on ergonomic improvements, lightweight materials, and smart seating integration.

Companies are collaborating with technology providers, material science firms, and automotive OEMs to develop next-generation seating solutions.

The increasing adoption of AI-powered comfort adjustments, biometric seat recognition, and active posture correction systems is enhancing competitiveness. Investments in smart sensors, predictive maintenance, and connected seat functionalities are positioning manufacturers for future growth.

- In June 2024, Magna secured its first contract a Chinese OEM to supply a reconfigurable seating system, redefining in-cabin vehicle design. This cutting-edge technology features fully rotating front seats with extended rails for a more adaptable cabin layout and increased interior space. Additionally, a universal magnetic interface on the seatback enables connectivity with external devices, enhancing functionality and passenger entertainment.

Passenger Car Seat Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Standard Seats, Heated Seats, Massage Seats, Reclining Seats, Sport Seats

|

|

By Material

|

Fabric Seats, Leather Seats, Vinyl Seats, Other Materials

|

|

By Vehicle Type

|

Passenger Cars, SUVs and Crossovers, Luxury Vehicles, Electric Vehicles (EVs)

|

|

By Seat Type

|

Bucket Seats, Bench Seats, Captains Chairs

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Standard Seats, Heated Seats, Massage Seats, Reclining Seats, and Sport Seats): The standard seats segment earned USD 23.91 billion in 2023 due to its cost-effectiveness, widespread adoption across all vehicle categories, and compliance with essential safety and comfort standards, making it the preferred choice for mass-market and economy vehicles.

- By Material (Fabric Seats, Leather Seats, Vinyl Seats, and Other Materials): The fabric seats segment held a share of 40.12% of the market in 2023,

- benefiting from its lightweight properties, superior breathability, and improved durability. Automakers favor fabric seats for their versatility in design, cost efficiency, and ability to enhance passenger comfort in varying climates, making them a preferred choice in economy and mid-range vehicles.

- By Vehicle Type (Passenger Cars, SUVs and Crossovers, Luxury Vehicles, and Electric Vehicles (EVs)): The Passenger Cars segment are projected to reach USD 29.17 billion by 2031, owing to the rising global demand for personal mobility, increasing production of sedans and SUVs, and the continuous integration of advanced seating technologies to enhance comfort, safety, and customization.

- By Seat Type (Bucket Seats, Bench Seats, Captains Chairs): The bucket seats segment is likely to grow at a CAGR of 3.26% through the forecast period, largely attributed to its superior ergonomic design, enhanced comfort, and integration of advanced features such as memory settings and climate control, aligning with the growing demand for premium and performance-oriented vehicles.

Passenger Car Seat Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific passenger car seat market captured a share of around 38.12% in 2023, valued at USD 16.81 billion. Asia Pacific is at the forefront of the electric vehicle revolution, with China leading global EV production and sales, followed by India, Japan, and South Korea.

The transition to EVs and hybrid vehicles is increasing the demand for lightweight, energy-efficient, and sustainable seating solutions, boosting tregional market expansion.

- The International Energy Agency report highlights that new electric car registrations in China reached 8.1 million in 2023, marking a 35% rise from the previous year. Additionally, China exported over 4 million vehicles, including 1.2 million electric vehicles, solidifying its position as the world's leading auto exporter.

Additionally, the booming ride-hailing and mobility-as-a-service (MaaS) sector in Asia Pacific is reshaping the market, with fleet operators demanding durable, easy-to-maintain, and high-comfort seating solutions.

Companies such as DiDi, Ola, and Grab are expanding operations, creating a robust demand for wear-resistant upholstery, stain-proof fabrics, and antimicrobial seating materials to enhance passenger experience. The rise of subscription-based vehicle ownership and car-sharing platforms is further stimulating demand for long-lasting, ergonomic, and easily replaceable seating components.

Europe passenger car seat industry is poised grow at a CAGR of 2.94% over the forecast period. Europe’s strong presence in the luxury and premium car segment is fueling the demand for high-end automotive seating solutions.

Leading automakers such as Mercedes-Benz, BMW, Audi, and Porsche are continuously innovating to provide customized, ventilated, massaging, and memory-function seats that enhance passenger comfort. The rising preference for handcrafted leather, high-quality upholstery, and personalized seating is influencing product development.

Additionally, the growing adoption of luxury electric vehicles, particularly in Germany, Sweden, and the Netherlands, is fueling the demand for advanced seating technologies.

Furthermore, the European Union's sustainability initiatives are are supporting regional market expansion, increasing demand for environmentally friendly seating solutions. Automakers are prioritizing recyclable materials, plant-based leather alternatives, and closed-loop production systems to align with carbon neutrality goals.

Companies such as Jaguar Land Rover, Volvo, and Stellantis are actively integrating vegan leather, ocean-recycled plastics, and bio-based foams in seating components. The shift toward sustainable automotive interiors is gaining traction as consumer awareness of eco-friendly materials and ethical manufacturing rises.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) oversees vehicle safety standards. A notable regulation, the Federal Motor Vehicle Safety Standard No. 207, sets performance requirements for seating systems to minimize occupant injury in crashes. In July 2024, NHTSA issued an advanced notice of proposed rulemaking to enhance seat performance in rear-impact collisions. Additionally, from September 1, 2027, all new cars and light trucks sold in the U.S. must include rear passenger seatbelt alert systems to improve rear-seat passenger safety.

- The European Union enforces stringent regulations to ensure vehicle safety and environmental protection. UNECE Regulation No. 17 mandates seat strength, head restraints, and anchorage requirements for occupant protection. The General Safety Regulation further requires seatbelt reminders for all seats to improve passenger safety.

- China China Compulsory Certification (CCC) imposes mandatory safety standards for vehicle components, including seats, ensuring compliance before market entry .

- Japan's Ministry of Land, Infrastructure, Transport and Tourism (MLIT) regulates vehicle safety regulations under the Japanese Industrial Standards (JIS) and has adopted several UNECE regulations, including Regulation No. 17, fos seating system safety.

- South Korea's Ministry of Land, Infrastructure and Transport (MOLIT) follows multiple UNECE regulations, including Regulation No. 17 for seating system safety. Additionally, South Korea has implemented its own Motor Vehicle Management Act, which includes specific provisions for the safety and performance of vehicle seats.

Competitive Landscape

Prominent players operating in the passenger car seat industry are adopting strategies focused on the development of advanced, user-friendly, and customizable seats for passenger cars, enhancing comfort, safety, and convenience.

Automakers and seat manufacturers are integrating innovative materials, ergonomic designs, and smart technologies, such as adjustable lumbar support, climate-controlled seating, and memory foam cushions, to cater to evolving consumer preferences.

Additionally, the demand for premium and personalized seating solutions is prompting companies to offer modular designs and AI-powered seat adjustments. These advancements are strengthening brand differentiation and customer loyalty, contributing to the growth of the market.

- In February 2025, Graco, a prominent baby gear brand in the U.S., launched the EasyTurn 360° 2-in-1 Convertible Car Seat, marking its debut in the 360° rotating car seat category. Engineered for seamless rear-facing and forward-facing access, it adapts from infancy to toddlerhood. Its compact design maximizes back seat space while ensuring comfort and safety.

List of Key Companies in Passenger Car Seat Market:

- Adient plc

- Lear

- TOYOTA BOSHOKU CORPORATION

- Faurecia

- Magna International Inc.

- TS Tech Co., Ltd.

- NHK Spring Co., Ltd.

- Freedman Seating Company

- Gentherm

- GRAMMER AG

- RECARO Holding GmbH

- Commercial Vehicle Group, Inc.

- Brose Fahrzeugteile GmbH & Co. KG

- AUNDE Group SE (Isringhausen GmbH & Co. KG)

- Martur Fompak International

Recent Developments (Partnerships/New Product Launch)

- In February 2025, Lear announced a strategic engineering partnership with General Motors, scheduled to launch in the second quarter of the year. This collaboration introduces the ComfortMax Seat, the first in the industry to integrate advanced thermal comfort technologies directly into trim covers. The innovation enhances occupant comfort, optimizes thermal regulation, and improves production efficiency.

- In August 2024, MG launched its third electric vehicle in the Indian market, featuring the Windsor model, inspired by the Cloud EV, and introducing its first-ever rear seat package. It features the brand’s first rear seat package, a refined black and beige cabin with quilt-patterned seats, and a 135-degree reclining seat with an extended base for enhanced passenger comfort.

- In January 2025, Evenflo unveiled the SensorySoothe, a car seat designed to calm crying infants through integrated lights, sounds, and music. This seat connects to a mobile app, allowing parents to control its handle, which is equipped with soothing lights, gentle sounds, and melodiesfor a more comfortable travel experience.

- In January 2025, UPPAbaby launched the next-generation Rove convertible car seat, incorporating the advanced QuickGuard installation system for a streamlined three-step setup. Wighing 25.2 lb., the seat is designed for extended use, offering enhanced comfort with soft fabrics and cushioning to support child's growth.