Enquire Now

Packaging Adhesives Market Size, Share, Growth & Industry Analysis, By Product Type (Water-Based Adhesives, Solvent-Based Adhesives, Hot Melt Adhesives, Others), By Technology (Acrylic, Polyurethane, Epoxy, Silicone), By Application (Flexible Packaging, Rigid Packaging, Corrugated Packaging, Labels and Tapes), and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: October 2025 | Author: Swati J.

Key strategic points

Packaging adhesives are bonding agents formulated to join, seal, or laminate materials such as paper, cardboard, plastics, foils, and films. They are fundamental in ensuring the integrity, durability, and functionality of packaging across industries such as food and beverages, pharmaceuticals, consumer goods, and e-commerce.

Available in water-based, solvent-based, hot-melt, and reactive systems, their selection depends on performance requirements such as fast curing, heat resistance, flexibility, and recyclability.

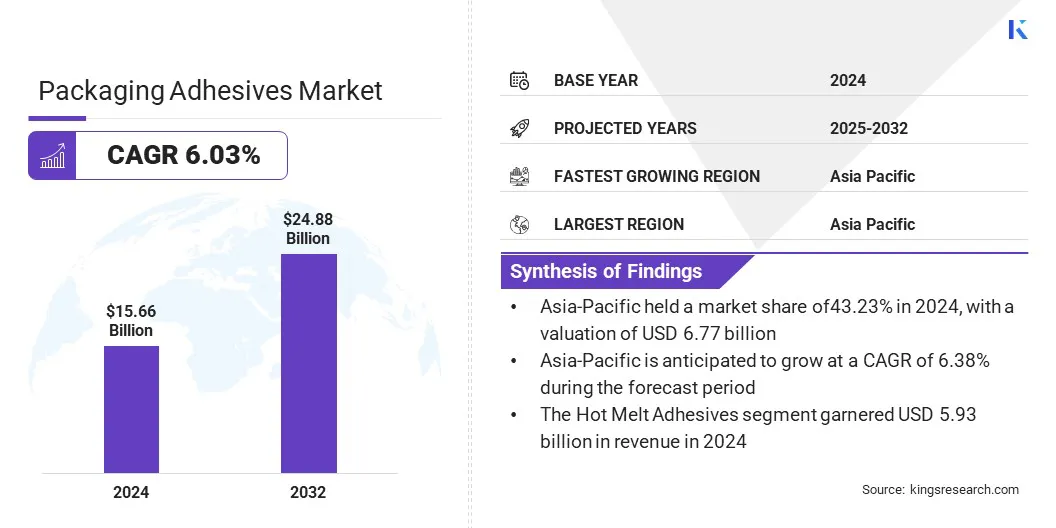

The global packaging adhesives market size was valued at USD 15.66 billion in 2024 and is projected to grow from USD 16.51 billion in 2025 to USD 24.88 billion by 2032, exhibiting a CAGR of 6.03% during the forecast period.

This growth is driven by rising demand for flexible packaging, sustainable solutions, and e-commerce expansion. Advancements in adhesive technologies are enhancing efficiency, recyclability, and performance, reinforcing their critical role in food, beverage, pharmaceutical, and consumer goods industries.

Major companies operating in the packaging adhesives market are Henkel Adhesives Technologies, 3M, Avery Dennison Corporation, Arkema, H.B. Fuller Company., Sika AG, LINTEC Corporation., Huntsman International LLC, ITW, Wacker Chemie AG, Dow, Ashland Inc, Pidilite Industries Limited, Paramelt RMC B.V., and Jowat Corporation.

The rapid growth of e-commerce and modern retail is creating a strong demand for advanced packaging adhesives. Increased parcel volumes and longer supply chains require adhesives that provide strong bonding, tamper resistance, and durability across diverse packaging materials. In response, manufacturers are developing innovative formulations for corrugated boxes, flexible films, and protective labeling to ensure product safety and reduce transit damage.

Expanding online retail channels continue to fuel demand, prompting companies to invest in capacity, technological advancements, and sustainable adhesive solutions to remain competitive.

Expansion of E-Commerce Sector

The rapid expansion of online retail is creating a strong demand for advanced packaging adhesives in e-commerce supply chains.

This upward trajectory in e-commerce transactions strengthens demand for high-performance packaging adhesives leading to secure product handling, efficient logistics, and reliable last-mile delivery. Adhesives capable of meeting higher durability and sustainability standards are expected to foster market expansion over the forecast period.

High Raw Material Costs and Supply Chain Volatility

A key challenge impeding the expansion of the packaging adhesives market is the high cost and volatility of raw materials such as resins, polymers, and solvents. Fluctuations in crude oil prices and disruptions in global supply chains significantly impact production costs and profitability for manufacturers. This dependency increases uncertainty for adhesive producers and packaging converters, particularly in regions heavily reliant on imports.

To address this challenge, companies are investing in bio-based alternatives and recycling technologies to reduce dependence on petrochemical-derived inputs. Additionally, strategic supplier partnerships and localized sourcing strategies are adopted to stabilize supply and mitigate risks associated with raw material price fluctuations.

Growing Emphasis on Sustainable and Eco-Friendly Adhesive Solutions

A notable trend influencing the packaging adhesives market is the increasing shift toward sustainability, with manufacturers investing in eco-friendly and bio-based formulations. Water- and solvent-free, low-VOC adhesives are being developed to comply with stringent environmental regulations while addressing consumer preference for greener packaging solutions.

These innovations reduce environmental impact and support brand commitments to corporate sustainability goals, prompting market players to strengthen compliance and respond to growing demand for sustainable packaging materials.

|

Segmentation |

Details |

|

By Product Type |

Water-Based Adhesives, Solvent-Based Adhesives, Hot Melt Adhesives, Others |

|

By Technology |

Acrylic, Polyurethane, Epoxy, Silicone |

|

By Application |

Flexible Packaging, Rigid Packaging, Corrugated Packaging, Labels and Tapes |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific packaging adhesives market share stood at 43.23% in 2024, valued at USD 6.77 billion. This dominance is reinforced by the rapid expansion of the food, beverage, pharmaceutical, and e-commerce sectors. Rapid urbanization, increasing disposable incomes, and changing consumer lifestyles are fueling demand for packaged goods, which is further supporting higher adoption of advanced adhesive solutions.

Growing preference for flexible and lightweight packaging is increasing the use of adhesives that offer strong bonding, durability, and compatibility with diverse substrates, thereby aiding regional market expansion.

North America packaging adhesives industry is poised for significant growth at a robust CAGR of 5.95% over the forecast period. The market growth in the region is supported by the expansion of e-commerce, food and beverage packaging, and pharmaceutical sectors. Rising consumer demand for convenience, product safety, and tamper-evident packaging is fostering the adoption of advanced adhesive solutions that ensure durability, reliability, and compatibility with diverse packaging materials.

Manufacturers are increasingly investing in sustainable formulations, such as water-based and low-VOC adhesives, to meet regulatory requirements and align with growing environmental awareness among consumers.

Major players operating in the packaging adhesives industry are implementing strategies such as product innovation, capacity expansion, strategic acquisitions, and collaborations to maintain competitiveness.

Companies are developing high-performance and sustainable adhesive formulations tailored for diverse substrates, including flexible films, corrugated boards, and specialty packaging. Investments in research and development are enabling faster-curing, eco-friendly, and multi-functional adhesives that meet evolving regulatory and consumer requirements.

Frequently Asked Questions