Outage Management System Market Snapshot

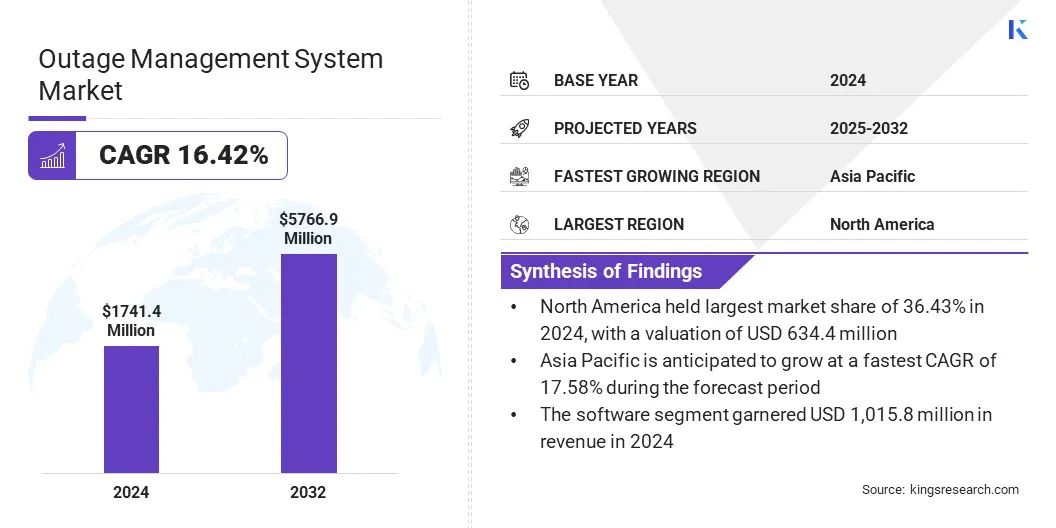

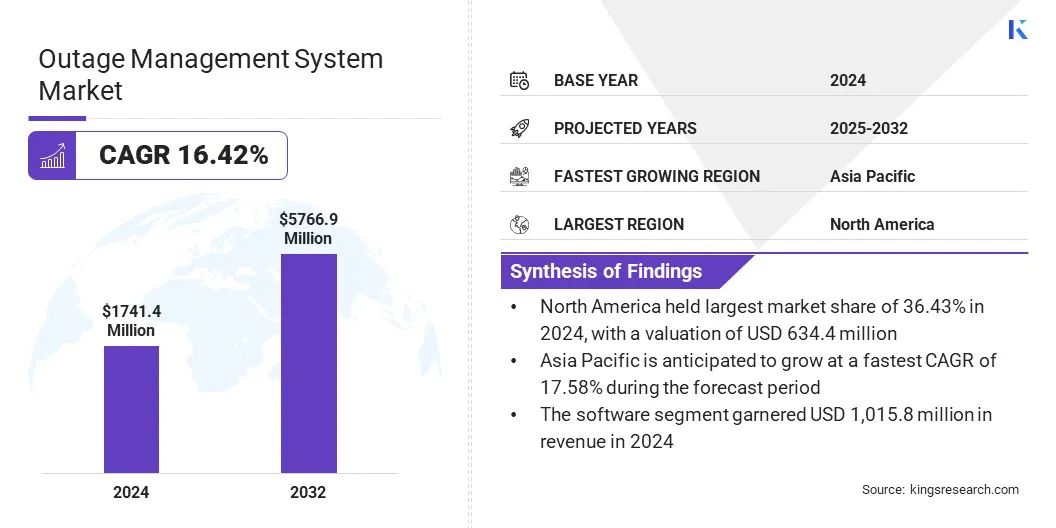

According to Kings Research, the global outage management system market size was valued at USD 1,741.4 million in 2024, which is estimated to be valued at USD 1,990.1 million in 2025 and reach USD 5,766.9 million by 2032, growing at a CAGR of 16.42% from 2025 to 2032.

The market growth is being driven by the growing frequency of extreme weather events, such as storms and hurricanes, which is increasing the need for faster outage detection and restoration.

Key Market Highlights:

- The global market size was recorded at USD 1,741.4 million in 2024.

- The market is projected to grow at a CAGR of 16.42% from 2025 to 2032.

- North America held a market share of 36.43% in 2024, with a valuation of USD 634.4 million.

- The software segment garnered USD 1,015.8 million in revenue in 2024.

- The cloud segment is expected to reach USD 2,893.8 million by 2032.

- The electric segment is anticipated to witness the fastest CAGR of 17.34% during the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 17.58% during the forecast period.

Major companies operating in the outage management system industry are Hitachi, Ltd., General Electric Company, Oracle, Schneider Electric, Siemens, Hexagon AB, Operation Technology, Inc., Milsoft Utility Solutions., MCG Energy Solutions, IPS, INAVITAS ENERJİ A.Ş., Power System Engineering, Inc., Lepton Software, Harris, and POWERCOM.

Outage Management System Market Overview

The outage management system market is experiencing significant growth due to the rising demand for reliable electricity, increased frequency of extreme weather events, and ongoing advancements in smart grid technologies.

Utilities are investing in OMS solutions to enhance grid resilience, improve outage response times, and reduce customer downtime. Integration with distributed energy resources (DERs), real-time data analytics, and automation are driving innovation in the market, making OMS a critical component in modernizing power distribution and ensuring operational efficiency across utility networks.

- In June 2024, researchers from The University of Texas and the University at Buffalo, New York, introduced a real-time outage management model using reinforcement learning over graph neural networks to enhance the resilience of power distribution networks. Their approach enables smart, self-healing DNs with rapid, adaptive decision-making during outages, integrating both grid-connected and islanding reconfiguration strategies for effective restoration and operational feasibility.

Extreme Weather Events Fuel Growing Market Demand

The market’s growth is strongly influenced by the rising frequency of extreme weather events. According to the World Meteorological Organization, rising global temperatures are contributing to more extreme daily rainfall, which in turn increases the risk of severe storms and flooding.

WMO also reports that each 1°C increase in global temperature is estimated to cause a 7% rise in extreme daily rainfall events. As weather-related disruptions become more frequent, utility companies are prioritizing the deployment of advanced outage management systems (OMS).

These systems leverage real-time data and automation to significantly reduce outage durations and improve operational efficiency. As a result, utilities are investing more in OMS solutions to strengthen grid resilience and maintain reliable power supply amid increasingly severe weather conditions.

- In March 2025, Oracle introduced advanced features in its Utilities Network Management System, enhancing outage management and distributed energy resource (DER) control. Key updates include improved forecasting with a 7-day hourly algorithm, enhanced SCADA integration for real-time device monitoring, and DER orchestration for optimized demand response. These features enable utilities to improve grid reliability, accelerate fault detection and restoration, and efficiently manage both traditional infrastructure and emerging DERs through a flexible, modular platform.

Shortage of Skilled Workforce

The outage management system market faces a significant challenge due to the shortage of skilled personnel required to operate and maintain increasingly sophisticated OMS technologies. Complex systems demand specialized knowledge in both IT and power distribution, which many utilities currently lack.

To address this, companies are investing in comprehensive training programs, forming partnerships with technology providers, and developing user-friendly interfaces to simplify system operation.

Enhanced Outage Response Through Geospatial Data Integration

A growing trend in the market is the integration of geospatial data with operational platforms to improve situational awareness. By combining location-based information with real-time outage and asset data, utilities can better visualize affected areas, optimize crew dispatch, and prioritize restoration efforts.

This enhanced spatial insight allows for faster, more precise decision-making, improving overall outage management efficiency and reducing restoration times, ultimately leading to more resilient and responsive power grids.

- In January 2025, Databricks launched its AI-powered Dispatch Assistant, revolutionizing utility outage response by optimizing crew dispatch and restoration during extreme weather. It combines geospatial and outage data for real-time recommendations, improving decision-making, reducing costs, and enhancing customer satisfaction. This innovative tool supports faster, smarter outage management, boosting grid resilience and paving the way for proactive, data-driven utility operations.

Outage Management System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software (Outage Detection & Analysis Modules, Fault Localization & Isolation Modules, Predictive Analytics & AI/ML Modules, Others), Services (Consulting Services, System Integration Services, Implementation & Deployment Services, Others)

|

|

By Deployment Model

|

On-Premise, Cloud

|

|

By Utility Type

|

Electric, Gas, Water

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Software, and Services): The software segment earned USD 1,015.8 million in 2024 driven by growing demand for advanced outage management solutions and increased digitalization across utilities worldwide.

- By Deployment Model (On-Premise, and Cloud): The on-premise segment held 52.31% of the market in 2024, due to utilities’ preference for secure, controlled environments and existing infrastructure investments.

- By Utility Type (Electric, Gas, and Water): The electric segment is projected to reach USD 2,921.0 million by 2032, owing to rising investments in grid modernization and increasing renewable energy integration.

Outage Management System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America outage management system market share stood around 36.43% in 2024 in the global market, with a valuation of USD 634.4 million. North America remains the dominant region in the market, driven by advanced infrastructure, significant investments in smart grid technologies, and increasing adoption of renewable energy sources.

The region’s utilities focus heavily on enhancing grid reliability and resilience, fueled by rising demand for efficient outage detection and restoration solutions. Strong regulatory support and growing awareness of the benefits of digitalization also contribute to market growth.

Additionally, increasing extreme weather events in North America further accelerates the deployment of sophisticated outage management systems to minimize downtime and improve customer satisfaction.

- In June 2024, ABB launched the ReliaHome Smart Panel, its first residential energy management platform in the U.S. and Canada, co-developed with Lumin. This innovative solution offers homeowners real-time energy optimization and valuable insights via a user-friendly app. The platform also ensures seamless functionality during power and network outages with a local-first network backup, maintaining consistent connectivity independent of the cloud.

Asia Pacific is poised for a significant CAGR of 17.58% over the forecast period. The Asia Pacific region is the fastest growing region for the outage management system industry, driven by rapid urbanization as a result there is an increasing demand for electricity and smart grid initiatives.

Governments and utilities in countries like China, India, Japan, and Australia are investing heavily in advanced grid infrastructure to improve reliability and resilience against frequent extreme weather events.

Additionally, the rising adoption of renewable energy sources and digital technologies further fuels the demand for efficient outage detection, restoration, and management solutions across the region.

Regulatory Frameworks

- In India, the Electricity (Amendment) Act, 2007, strengthens rural electrification by assigning joint responsibility to Central and State Governments. It updates regulations on electricity supply, theft penalties, tariff reforms, and enforces compliance to ensure reliable electricity access and promote efficient energy use nationwide.

- In the U.S., the Federal Energy Regulatory Commission (FERC) enforces mandatory electric reliability standards established under the Energy Policy Act of 2005. These standards enhance grid stability and help prevent outages, ensuring a more resilient power system.

- In the European Union (EU), the General Data Protection Regulation (GDPR) enforces data privacy and security compliance for utility data management systems, safeguarding consumer information and ensuring regulatory adherence.

Competitive Landscape

Companies in the outage management system market are increasingly focusing on integrating advanced technologies such as AI, IoT, and GIS to enhance real-time monitoring, predictive analytics, and automated response capabilities. They are investing in user-friendly platforms that improve customer communication through personalized alerts and interactive maps.

- In June 2024, Duquesne Light Company (DLC) launched a new Outage Management System (OMS) featuring an interactive outage map on its website and app. The OMS enhances outage restoration with real-time updates, personalized alerts, and improved communication, boosting transparency and operational efficiency. Built on geographic information system (GIS) technology, it provides detailed outage insights, helping DLC quickly dispatch crews and better serve customers.

Additionally, strategic partnerships and collaborations are common to expand solution offerings and improve grid resilience. These initiatives collectively aim to optimize outage restoration times, reduce operational costs, and support the transition toward smarter, more sustainable energy grids globally.

Key Companies in Outage Management System Market:

- Hitachi, Ltd.

- General Electric Company

- Oracle

- Schneider Electric

- Siemens

- Hexagon AB

- Operation Technology, Inc.

- Milsoft Utility Solutions.

- MCG Energy Solutions

- IPS

- INAVITAS ENERJİ A.Ş.

- Power System Engineering, Inc.

- Lepton Software

- Harris

- POWERCOM

Recent Developments (Product Launch/Partnership)

- In February 2025, GOCare launched OutageIQ with Ellijay Telephone Company to enhance network monitoring and automate real-time outage notifications, improving customer experience, reducing contact center calls, and supporting all broadband technologies across fiber and hybrid networks.

- In February 2025, Alabama Power advanced its storm management capabilities by launching SPEAR and RAMP applications, powered by Databricks’ cloud analytics platform. These tools support real-time outage forecasting and optimize resource deployment, contributing to improved grid reliability. By utilizing big data and predictive analytics, the utility is positioned to respond more efficiently to severe weather, reduce operational costs and improve service for over 1.5 million customers across its U.S. network.