Market Definition

The market includes technologies that use light to inspect, measure, and analyze physical properties such as dimensions, distances, angles, and surface profiles. It includes methods like laser scanning, interferometry, and photogrammetry.

These systems are used for non-contact, high-precision inspection in quality control, reverse engineering, and surface analysis. Their applications span manufacturing, automotive, aerospace, and healthcare industries. The market also covers software that processes measurement data for evaluation.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Optical Measurement Market Overview

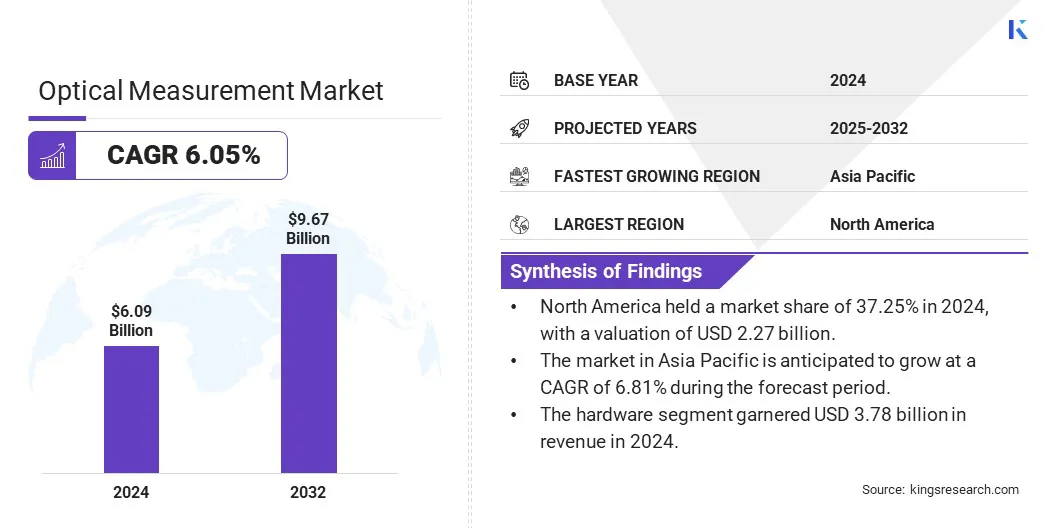

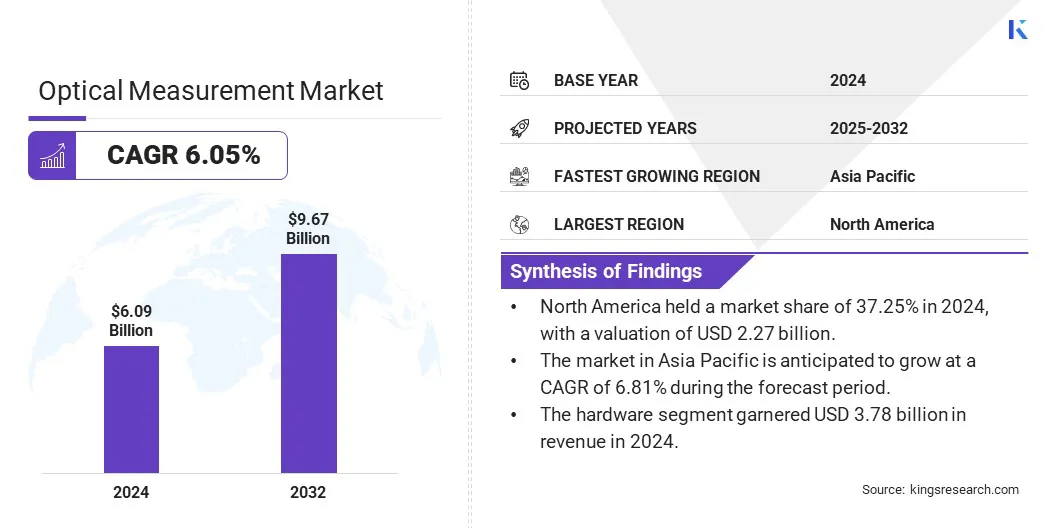

The global optical measurement market size was valued at USD 6.09 billion in 2024 and is projected to grow from USD 6.41 billion in 2025 to USD 9.67 billion by 2032, exhibiting a CAGR of 6.05% during the forecast period.

The market is driven by the expansion of the semiconductor and electronics industries, where precise inspection and quality control are critical. Additionally, advancements in 3D metrology technologies are enhancing accuracy and efficiency in measurement processes, driving greater adoption across manufacturing and industrial applications.

Major companies operating in the optical measurement industry are Hexagon AB, ZEISS Group, Mitutoyo Corporation, Nikon Corporation, KEYENCE CORPORATION, FARO, KLA Corporation, Renishaw plc, Vision Engineering Ltd., Micro-Vu, Quality Vision International, Inc., GOM GmbH, Zygo Corporation, Creaform Inc., and Lasertec Corporation.

The market is driven by the rising need for high-precision inspection and measurement in advanced manufacturing. Industries such as automotive, electronics, and aerospace are relying on non-contact optical systems to ensure product accuracy and consistency.

This demand for quality assurance in tight-tolerance production environments is leading to the wider adoption of optical measurement solutions across global manufacturing units.

- In October 2024, ZEISS introduced the ZEISS Crossbeam 550 Samplefab, a focused ion beam scanning electron microscope (FIB-SEM) specifically designed for fully automated preparation of transmission electron microscopy (TEM) samples, including lamellae. TEM imaging plays a key role in identifying semiconductor device defects and enhancing process yield. The system features an entirely redesigned user interface, built to support fast learning and intuitive use for both beginners and experienced users.

Key Highlights

- The optical measurement market size was valued at USD 6.09 billion in 2024.

- The market is projected to grow at a CAGR of 6.05% from 2025 to 2032.

- North America held a market share of 37.25% in 2024, with a valuation of USD xx.xx billion.

- The hardware segment garnered USD 3.78 billion in revenue in 2024.

- The 3D optical measuring systems segment is expected to reach USD 3.35 billion by 2032.

- The distance measurement segment secured the largest revenue share of 34.11% in 2024.

- The industrial manufacturing segment is poised for a robust CAGR of 8.92% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.81% during the forecast period.

Market Driver

Expansion of Semiconductor and Electronics Industry

The market is gaining momentum with the ongoing growth of the semiconductor and electronics sector. Optical systems are essential for inspecting wafers, photomasks, and microelectronic components.

Manufacturers require highly accurate metrology tools as chip architectures become more compact and complex, which is fueling continuous investment in optical measurement technologies to ensure performance and yield.

- In November 2024, Nikon introduced the NEXIV VMF-K Series, a new video measuring system tailored for the semiconductor and electronics industries. This system offers enhanced measurement speeds and accuracy, addressing the growing demand for precise inspection tools in high-volume manufacturing environments.

Market Challenge

High Cost of Advanced Optical Measurement Systems

A key challenge limiting the growth of the optical measurement market is the high cost of advanced systems. These technologies often require substantial investment, which can be difficult for small and mid-sized manufacturers to justify.

Key players in the market are introducing more modular and scalable solutions that allow gradual adoption based on specific needs. Some are also developing compact, portable devices that reduce infrastructure and maintenance expenses.

Additionally, flexible financing options and software-based upgrades are helping reduce the overall cost burden, making high-precision measurement systems more accessible to a wider range of industries.

Market Trend

Advancements in 3D Metrology Technologies

Continuous innovations in 3D optical measurement techniques, including laser scanning, structured light, and photogrammetry, are contributing to the growth of the market.

These technologies offer enhanced speed, accuracy, and flexibility in capturing complex geometries. Their ability to deliver real-time data and reduce inspection time is encouraging more industries to shift from traditional contact-based systems to advanced optical alternatives.

- In April 2024, InnovMetric introduced PolyWorks 2024, an all-in-one 3D metrology software platform developed to optimize dimensional measurement workflows. The latest version offers a more intuitive user interface for inspection tasks, improved handling of large point cloud datasets via cloud storage, and smooth integration with Microsoft Excel and Power BI for detailed reporting and analysis. These updates are designed to lower operational costs and support real-time data collaboration between engineering and manufacturing teams.

Optical Measurement Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Hardware, Software, Services

|

|

By Equipment Type

|

3D Optical Measuring Systems, Laser Scanners, Interferometers, Micrometers, Profile Projectors, Others

|

|

By Measurement Technique

|

Distance Measurement, Displacement Measurement, Surface Topography, Thickness Measurement, Vibration Analysis

|

|

By End-use Industry

|

Automotive, Aerospace & Defense, Electronics & Semiconductors, Industrial Manufacturing, Energy & Utilities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Hardware, Software, and Services): The hardware segment earned USD 3.78 billion in 2024, due to the high demand for advanced scanners, sensors, and systems that form the core of precision measurement solutions across industrial applications.

- By Equipment Type (3D Optical Measuring Systems, Laser Scanners, Interferometers, Micrometers, Profile Projectors, and Others): The 3D optical measuring systems segment held 34.09% share of the market in 2024, due to its ability to deliver high-speed, non-contact, and highly accurate measurements, meeting the precision demands of advanced manufacturing and quality control processes.

- By Measurement Technique (Distance Measurement, Displacement Measurement, Surface Topography, Thickness Measurement, and Vibration Analysis): The distance measurement segment is projected to reach USD 3.39 billion by 2032, owing to its wide range of applications across industries such as aerospace, automotive, and construction.

- By End-use Industry (Automotive, Aerospace & Defense, Electronics & Semiconductors, Industrial Manufacturing, and Energy & Utilities): The industrial manufacturing segment is poised for significant growth at a CAGR of 8.92% through the forecast period, due to the increasing demand for precise measurement and quality control in production processes.

Optical Measurement Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 37.25% share of the optical measurement market in 2024, with a valuation of USD 2.27 billion. North America is a leader in technological innovation, with ongoing research and development in optical measurement technologies. The region's investment in advanced 3D scanning, laser metrology, and optical inspection systems is contributing to the growth of the market.

These innovations enable industries to improve efficiency, reduce errors, and speed up inspection processes, driving their widespread adoption. Moreover, the shift toward Industry 4.0 in North America is accelerating the adoption of optical measurement technologies.

Optical measurement systems are being used to provide real-time data, streamline quality control, and enable predictive maintenance as manufacturing facilities increasingly integrate smart technologies. The automation and connectivity enabled by optical systems support the growth of the market in the region.

The optical measurement industry in Asia Pacific is poised for significant growth at a robust CAGR of 6.81% over the forecast period. Asia Pacific is a global hub for electronics and semiconductor manufacturing, which rely heavily on optical measurement technologies.

Manufacturers require high-precision tools for tasks like wafer inspection, photomask alignment, and chip quality control as the demand for smaller, more powerful devices increases.

- In March 2024, Hitachi High-Tech Corporation introduced the LS9300AD, an advanced system for inspecting both the front and backside of non-patterned wafer surfaces. The system integrates dark-field laser scattering detection with Differential Interference Contrast (DIC) inspection, enabling the identification of irregular and shallow microscopic defects. This development enhances the capability to detect surface defects early in the manufacturing process.

Furthermore, the demand for advanced optical measurement solutions grows as industries in the region explore new materials, processes, and technologies. These systems are used in R&D activities for material testing, quality control, and the development of new manufacturing techniques.

The increased focus on innovation in sectors such as biotechnology, electronics, and nanotechnology is fostering the growth of the market.

Regulatory Frameworks

- In the U.S., optical measurement devices must comply with the ISO/IEC 17025 standard for testing and calibration laboratories, overseen by the National Institute of Standards and Technology (NIST). For optical measurement devices used in medical applications, the Food and Drug Administration (FDA) enforces regulations ensuring their safety and efficacy. These standards ensure high levels of accuracy, reliability, and safety in measurement systems across industries.

- The Measuring Instruments Directive (MID) 2014/32/EU regulates optical measurement devices across the European Union (EU). This directive ensures that instruments meet uniform standards of accuracy and reliability, supporting the harmonization of measurement practices in member states.

- China enforces the Metrology Law of the People's Republic of China, which regulates the measurement practices for all industries, including optical measurements. This law sets national standards for measurement instruments, ensuring their accuracy and reliability. Additionally, China’s RoHS regulations, formally known as the Administrative Measure on the Control of Pollution Caused by Electronic Information Products, control the use of hazardous substances in electronic devices, including optical measurement tools, to reduce environmental harm.

- South Korea’s Framework Act on National Standards establishes the Korea Research Institute of Standards and Science (KRISS) as the country’s metrology authority. KRISS is responsible for setting national measurement standards and advancing technologies in fields like optical measurement.

Competitive Landscape

Market players are actively focusing on developing advanced 3D scanners and introducing technological innovations to improve scanning accuracy, speed, and ease of use. These strategies are helping companies overcome traditional limitations in optical measurement processes.

Such innovations are supporting higher productivity across industries by reducing manual effort and enabling faster data acquisition. These ongoing efforts are directly contributing to the growth of the optical measurement market, especially as industries demand more precise and efficient quality inspection tools.

- In April 2025, Revopoint introduced the Revopoint Trackit 3D Tracking Scanner, an advanced optical tracking 3D scanner developed to eliminate the productivity challenges linked to marker-based scanning systems. Engineered for high-precision detail capture, the Trackit allows fast and efficient 3D data acquisition without the need for markers. This innovation significantly streamlines workflows across sectors such as aerospace, automotive, and quality inspection, offering a more seamless and flexible approach to complex scanning tasks.

List of Key Companies in Optical Measurement Market:

- Hexagon AB

- ZEISS Group

- Mitutoyo Corporation

- Nikon Corporation

- KEYENCE CORPORATION

- FARO

- KLA Corporation

- Renishaw plc

- Vision Engineering Ltd.

- Micro-Vu

- Quality Vision International, Inc.

- SCANTECH (HANGZHOU) CO., LTD.

- Zygo Corporation

- Creaform Inc.

- Lasertec Corporation

Recent Developments (Product Launches)

- In May 2025, Zygo, a business unit of AMETEK, announced the release of its innovative 0.5X ZWF (Zygo Wide Field) Objective, the widest field-of-view (FOV) interferometric objective currently available in the market. Designed for high-speed and high-precision measurement tasks, the 0.5X ZWF Objective aims to enhance both accuracy and efficiency in sectors such as semiconductors, precision machining, and photonics.

- In April 2025, Scantech unveiled NimbleTrack, an advanced wireless 3D scanning system engineered to transform the measurement and analysis of small to medium-sized components. Its fully wireless and highly agile design allows for seamless operation across various industrial environments, providing engineers, designers, and manufacturers with a versatile and efficient solution for detailed 3D scanning tasks.

- In April 2024, Scantech introduced the AM-CELL C, an optical automated 3D measurement system designed for efficient inspection of small to medium-sized components, including stamped, injection-molded, machined sheet metal, and cast parts. The system integrates a robot, positioner, and tracking station, supporting fully automated workflows. Built with modular units, AM-CELL C offers adaptable layout configurations, flexible installation options, and the capability to operate with multiple positioners, making it suitable for diverse industrial inspection environments.