Online Home Decor Market Size

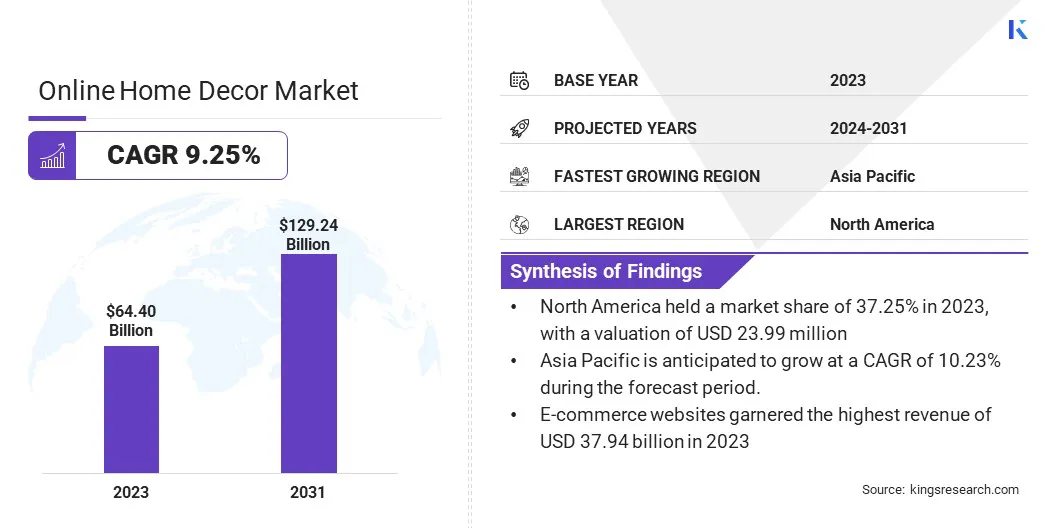

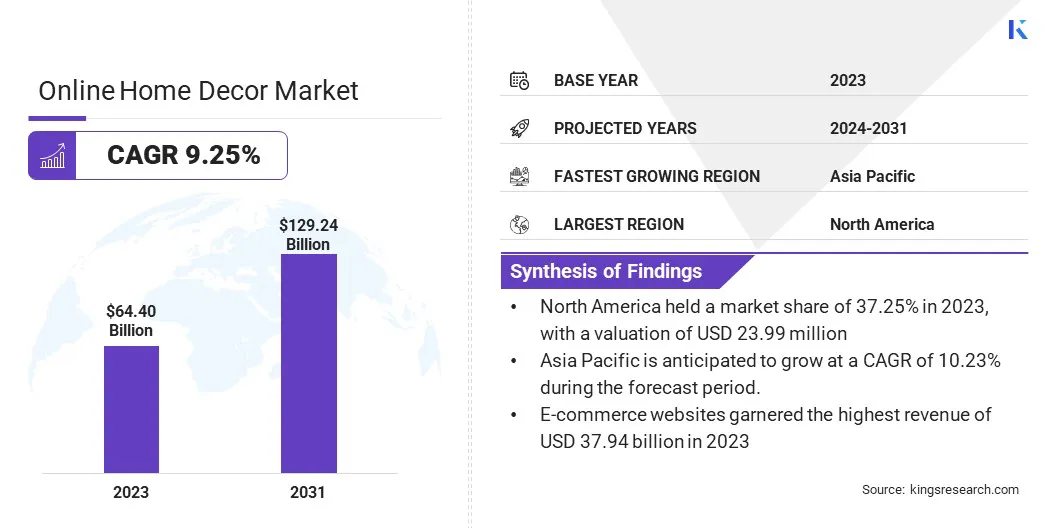

The global Online Home Decor Market size was valued at USD 64.40 billion in 2023 and is projected to grow from USD 69.59 billion in 2024 to USD 129.24 billion by 2031, exhibiting a CAGR of 9.25% during the forecast period. In the scope of work, the report includes services offered by companies such as Inter IKEA Systems B.V., Home Depot Product Authority, LLC, Kimball International, Inc., Herman Miller, Inc., Ashley Global Retail, LLC, Home 24 SE, Lowe’s, Signify Holding., Springs Window Fashions, Pepperfry Limited and others.

Increased internet penetration and growing traction of e-commerce are augmenting market revenue. The rise in e-commerce popularity has significantly impacted the online home decor market.

With the convenience of shopping from home and the ability to browse a wide variety of products at any time, consumers are increasingly turning to online platforms for their home decor needs. This shift is driven by the rapid internet penetration and the proliferation of smartphones, which have made online shopping more accessible than ever before.

Moreover, e-commerce platforms often offer competitive prices, exclusive online discounts, and a more comprehensive selection of products than traditional brick-and-mortar stores. This appeal is further enhanced by user-friendly interfaces, detailed product descriptions, and customer reviews, which help buyers make informed decisions.

Additionally, the integration of technologies such as augmented reality (AR) enables customers to visualize products in their own spaces, reducing the uncertainty associated with online purchases. This growing reliance on e-commerce has prompted home decor retailers to invest heavily in their online presence, optimize their websites for mobile use, and leverage digital marketing strategies to attract and retain customers.

Online home decor refers to the purchasing of home decoration items through internet-based platforms rather than traditional physical stores. This market encompasses a wide range of products, including furniture, lighting, textiles, wall art, and decorative accessories, designed to enhance the aesthetics and functionality of living spaces.

Applications of online home decor products vary from furnishing and decorating residential homes to outfitting commercial spaces such as offices, hotels, and restaurants. The convenience of online shopping allows consumers to easily explore diverse styles and trends, which enables them to personalize their interiors with unique and stylish pieces.

Distribution in the online home decor market typically involves direct-to-consumer models, where manufacturers and retailers ship products directly to customers' doorsteps. Additionally, many online platforms offer extensive logistical support, including easy returns and exchange policies, to address consumer concerns about purchasing home decor items without physical inspection.

The availability of detailed product descriptions, high-resolution images, customer reviews, and virtual try-on features like augmented reality further enhances the online shopping experience, making it a preferred choice for many consumers looking to upgrade their home interiors.

Analyst’s Review

The online home decor market is characterized by dynamic strategies and significant growth driven by the innovative approaches adopted by key players. Companies in this sector are increasingly focusing on enhancing their online presence through advanced digital marketing, user-friendly websites, and mobile applications.

- For instance, in April 2024, IKEA launched the BRÄNNBOLL collection, designed to meet the diverse and evolving needs of gamers and their households. This collection features 20 versatile items aimed at helping gamers create a comfortable and engaging setup.

These strategies are aimed to provide an intuitive and seamless shopping experience, catering to the evolving preferences of tech-savvy consumers. Furthermore, the integration of cutting-edge technologies such as artificial intelligence, machine learning, and augmented reality is revolutionizing the way customers interact with products online, allowing for personalized recommendations and virtual try-ons.

The growth of the market is also bolstered by strategic partnerships and collaborations with social media influencers and interior designers, which enhance brand visibility and credibility.

To stay competitive, companies are investing in logistics and supply chain efficiencies, ensuring timely deliveries and excellent customer service. Additionally, sustainability is becoming a core imperative, with many players incorporating eco-friendly materials and practices to appeal to environmentally conscious consumers.

Online Home Decor Market Growth Factors

Increased internet penetration has been a major driver of online home decor market growth. With more people gaining access to the internet, particularly in emerging markets, the potential customer base for online home decor retailers has expanded significantly.

The proliferation of affordable smartphones and improved network infrastructure have made it easier for consumers to shop online, even in remote areas. This accessibility allows consumers to browse a wide range of products from the comfort of their homes, compare prices, and read reviews before making a purchase.

Additionally, higher internet penetration enables retailers to implement sophisticated digital marketing strategies, targeting potential customers through social media, email campaigns, and personalized ads. The convenience of online shopping, coupled with the ability to access a diverse array of home decor options, has led to increased consumer spending in this market.

Retailers are also leveraging data analytics to understand consumer preferences better and optimize their offerings, further driving market growth. Challenges related to logistics and delivery pose significant hurdles in the online home decor market. Unlike smaller, more manageable products, home decor items such as furniture and large decorative pieces require careful handling, packaging, and transportation.

Ensuring that these items reach customers without damage is a complex and costly process. Delays in delivery can also frustrate customers, leading to negative reviews and a potential loss of business. Additionally, the logistics of managing returns and exchanges for bulky items are complicated and expensive, further impacting the profitability of online home decor retailers.

Shipping costs for large items can be substantial, and absorbing these costs to remain competitive can strain a retailer’s margins. Moreover, coordinating deliveries to accommodate customers’ schedules adds another layer of complexity.

To address these challenges, companies are investing in advanced logistics solutions, such as real-time tracking, improved packaging materials, and partnerships with reliable delivery services. Despite these efforts, logistics and delivery remain a critical challenge that companies must continuously navigate to maintain customer satisfaction and operational efficiency.

Online Home Decor Market Trends

The growing trend of sustainable and eco-friendly home decor products is reshaping the online home decor market. Consumers are becoming increasingly aware of environmental issues and are seeking products that reflect their values of sustainability and responsible consumption. This trend is evident in the rising demand for home decor items made from recycled, upcycled, or natural materials.

Brands are responding by offering a wider range of eco-friendly products, including furniture crafted from reclaimed wood, textiles made from organic fibers, and decor items produced through sustainable manufacturing processes. This shift caters to environmentally conscious consumers differentiates brands in a competitive market.

Marketing strategies are evolving to highlight the sustainable attributes of products, thereby attracting a growing segment of eco-minded shoppers. Additionally, certification labels and third-party endorsements are becoming important as they provide assurance of a product’s environmental credentials.

Segmentation Analysis

The global market is segmented based on product type, end user, distribution channel, and geography.

By Product Type

Based on product type, the market is categorized into furniture, home textile, home decor, kitchenware & bathware, and others. The furniture segment captured the largest online home decor market share of 36.25% in 2023. Furniture represents a significant investment for consumers looking to enhance their living spaces, leading to higher spending compared to smaller decor items.

The convenience of browsing extensive collections of furniture online, combined with detailed product descriptions, high-quality images, and customer reviews, makes the purchasing process more accessible and appealing to customers.

Additionally, many online retailers offer customization options, allowing consumers to tailor furniture pieces to their specific needs and tastes. This customization capability is adding significant value, encouraging more purchases within this segment.

- For instance, in February 2024, Havenly acquired The Citizenry to enhance its portfolio of home brands and technologies, appealing to next-generation shoppers and expanding its offerings for digital-first consumers.

The integration of augmented reality (AR) tools is further aiding consumers visualize how furniture would fit and look in their homes, reducing uncertainty and boosting confidence in online purchases. Moreover, the growing trend of remote work and home-based activities has bolstered the demand for functional and aesthetically pleasing home office furniture, thereby propelling market development.

By End User

Based on end user, the online home decor market is classified into residential and commercial. The commercial segment is poised to record a staggering CAGR of 9.33% through the forecast period. This segment includes the furnishing and decorating of offices, hotels, restaurants, and other commercial spaces, which have seen increasing investments in enhancing aesthetic appeal and functionality.

The growing emphasis on creating appealing and productive work environments has led businesses to invest significantly in modern, stylish, and ergonomic furniture and decor. Additionally, the hospitality industry's expansion, with new hotels and restaurants opening continuously, has fueled the demand for high-quality, visually-appealing decor to attract and retain customers.

The rising popularity of co-working spaces and the flexible workspace trend also contribute to the demand for versatile and durable commercial decor solutions. Furthermore, e-commerce platforms specializing in B2B transactions have made it easier for businesses to procure large quantities of decor items efficiently and cost-effectively, which is positively impacting the segment outlook.

By Distribution Channel

Based on distribution channel, the market is divided into company-owned websites and e-commerce websites. E-commerce websites garnered the highest revenue of USD 37.94 billion in 2023, mainly fueled by the superior convenience e-commerce platforms offer, allowing consumers to shop from anywhere at any time. This ease of access, combined with extensive product ranges and competitive pricing, makes online shopping highly attractive.

Additionally, advanced technologies such as personalized recommendations, augmented reality (AR) for virtual product placement, and seamless mobile integration are enhancing user experience, facilitating higher conversion rates and repeat purchases. The effectiveness of digital marketing strategies, including targeted advertising, social media campaigns, and influencer partnerships, has also significantly boosted visibility and sales for e-commerce websites.

Furthermore, the COVID-19 pandemic accelerated the shift toward online shopping, with consumers increasingly preferring contactless purchasing options. E-commerce platforms have responded by improving their logistics networks to ensure timely deliveries and offering flexible return policies, further building consumer trust and satisfaction, which is aiding segmental expansion.

Online Home Decor Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America online home decor market share accounted for 37.25% and valued at USD 23.99 million in 2023, reflecting its leadership in this dynamic sector. This dominance is primarily driven by several factors, including high disposable income, a strong culture of home ownership, and a well-established e-commerce infrastructure.

Consumers in North America have shown a preference for purchasing home decor items online due to the convenience, variety, and competitive pricing offered by e-commerce platforms. The region also benefits from advanced logistics networks, ensuring efficient delivery and return processes, which enhances customer satisfaction.

Furthermore, the popularity of home improvement shows and social media influencers in the United States and Canada has significantly influenced consumer preferences, driving up the demand for stylish and trendy home decor products. Additionally, technological advancements such as augmented reality (AR) tools for visualizing home decor in one's space have been readily adopted in this region, further boosting online sales.

Asia-Pacific online home decor market is poised to grow at the highest CAGR of 10.23% over 2024-2031 on account of notable economic growth, rising urbanization, and increasing internet penetration across the region.

Countries such as China, India, and Southeast Asian nations are experiencing rapid urbanization leading to a surge in the demand for home decor products as more people move into new homes and apartments. The expanding middle class in these countries, with growing disposable incomes, is also fueling the market as consumers invest more in enhancing their living spaces.

The proliferation of smartphones and improved internet access across the region have made online shopping more accessible, thereby contributing to the booming e-commerce sector.

Additionally, local and international online retailers are increasingly targeting the Asia-Pacific market with tailored marketing strategies, diverse product offerings, and localized customer service. The trend toward Western lifestyles and the influence of global design trends, often propagated through social media, are further driving the demand for contemporary and stylish home decor.

Competitive Landscape

The online home decor market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Online Home Decor Market

Key Industry Development

- June 2024 (Launch): EnduraFlood, the creator of EnduraFlood Waterproof Drywall Systems, unveiled expanded design options for its decorative panel system, intended to be distributed among customers in flood-prone regions of Florida. EnduraFlood’s latest offerings encompass a diverse range of visually appealing and highly functional waterproof drywall panels, enhanced with sophisticated window frame molding.

The global online home decor market is segmented as:

By Product Type

- Furniture

- Home Textile

- Home Decor

- Kitchenware & Bathware

- Others

By End User

By Distribution Channel

- Company-Owned Websites

- E-Commerce Websites

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.