Market Definition

Oleochemicals are chemicals derived from natural fats and oils, typically from plant or animal sources. These substances are primarily used in the production of various products, including soaps, detergents, lubricants, and plastics.

They are considered more sustainable alternatives to petrochemical-based chemicals because they are renewable, biodegradable, and often have a smaller environmental footprint.

Oleochemicals Market Overview

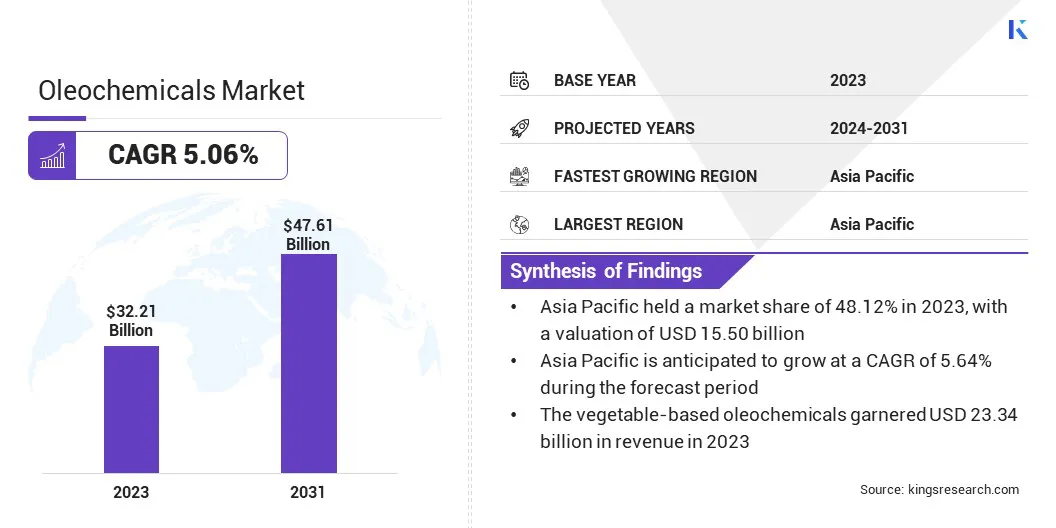

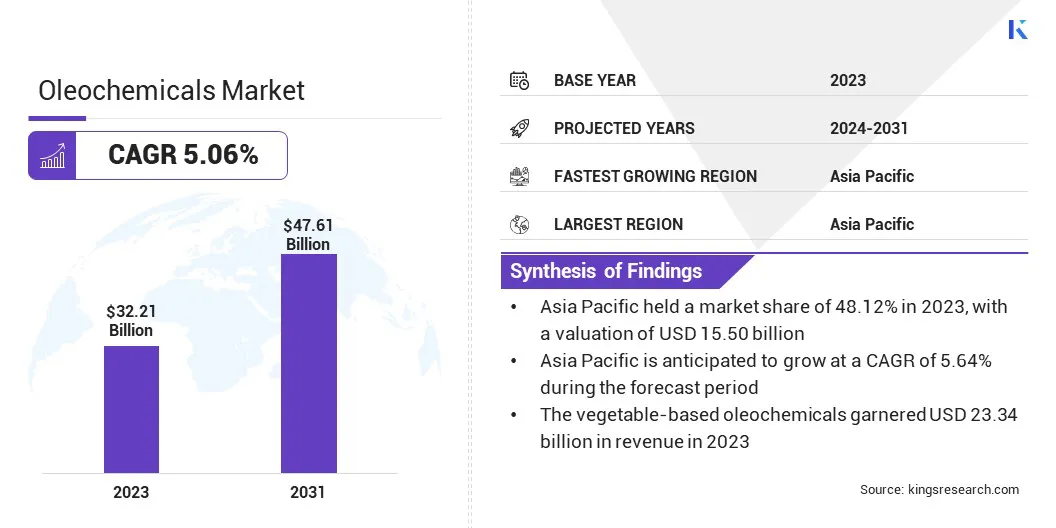

Global oleochemicals market size was valued at USD 32.21 billion in 2023 and is projected to grow from USD 33.70 billion in 2024 to USD 47.61 billion by 2031, exhibiting a CAGR of 5.06% during the forecast period.

The growth of the olechemicls market is driven by shifting consumer preferences, regulatory pressure for sustainability, and increased demand for renewable energy solutions.

Oleochemicals are increasingly utilized in industrial applications such as lubricants, coatings, and adhesives, where their biodegradable properties and superior performance characteristics compared to traditional petroleum-based products make them an attractive alternative.

Major companies operating in the oleochemicals market are SD Guthrie Berhad (emery oleochemicals), Akzo Nobel N.V., Cargill, Incorporated, BASF, Wilmar International Ltd, IOI Corporation Berhad, Kao Corporation, Croda International Plc, Evonik Industries AG, Godrej Industries Group, Corbion NV, Procter & Gamble, Kuala Lumpur Kepong Berhad, PT. Ecogreen Oleochemicals, PTT Global Chemical Public Company Limited, and others.

The expansion of the market is further propelled by the rising demand for environmentally friendly and bio-based products. As consumers become more conscious of sustainability, there has been a notable shift toward natural and biodegradable ingredients, particularly in personal care and cosmetics.

This trend is prompting manufacturers to adapt by incorporating renewable and eco-conscious raw materials into their product offerings, leading to increased demand for oleochemicals.

- In May 2024, Biocatalysts Ltd. launched Lipomod 70MDP, a specialized lipase enzyme designed that enhances the hydrolysis of plant-derived oils. The product improves efficiency in the oleochemical industry, enabling the optimal production of valuable byproducts such as glycerol and fatty acids, offering a sustainable alternative to traditional chemical processing.

Key Highlights:

- The oleochemicals industry size was recorded at USD 32.21 billion in 2023.

- The market is projected to grow at a CAGR of 5.06% from 2024 to 2031.

- Asia-Pacific held a share of 48.12% in 2023, valued at USD 15.50 billion. Also, is anticipated to grow at a CAGR of 5.64% during the forecast period.

- The vegetable-based oleochemicals segment garnered USD 23.34 billion in revenue in 2023.

- The fatty acids segment is expected to reach USD 16.50 billion by 2031.

- The personal care & cosmetics segment is projected to generate revenue of USD 10.29 billion by 2031.

Market Driver

"Sustainability Push and Integration of Circular Economy Practices"

The increasing global emphasis on sustainability is propelling the expansion of the oleochemicals market, as consumers and businesses seeks renewable, bio-based alternatives to petrochemical-derived products, particularly in personal care, cosmetics, and food industries.

Additionally, the adoption of circular economy practices is fueling the demand for oleochemicals, as businesses prioritize resource efficiency, waste reduction, and the use of biodegradable, renewable feedstocks such as plant oils and animal fats. This approach aligns with the industry's shift toward minimizing environmental impact.

- For instance, in January 2024, Asia’s largest compressed biogas plant began production in Langkat regency, North Sumatera, Indonesia. The plant uses palm oil waste to generate biogas, reducing reliance on imported LPG. The biogas will supply industries, including PT Unilever Oleochemical Indonesia, supporting sustainability and promoting a circular economy.

Moreover, the rising demand for high-performance green chemicals, particularly in sectors such as automotive, construction, and industrial manufacturing, is fueling the shift toward oleochemicals. These chemicals offer superior performance, biodegradability, and low toxicity, making them an attractive alternative for companies seeking to meet sustainability targets without sacrificing product efficacy.

Market Challenge

"Fluctuating Raw Material Prices and Competition from Petrochemical-Based Products"

The oleochemicals industry faces several challenges, including fluctuating raw material prices, particularly for feedstocks such as vegetable oils and animal fats, which affect production costs and supply chain stability. To mitigate this, companies can adopt diversified sourcing strategies, invest in sustainable agriculture, and explore alternative feedstocks such as algae-based oils.

Environmental concerns related to raw material sourcing, such as palm oil and its links to deforestation, further complicate the market landscape, but these can be addressed through stringent sustainability certifications, responsible sourcing policies, and investments in deforestation-free supply chains.

Moreover, continuous technological advancements are required to improve production efficiency and meet evolving regulatory standards for environmental sustainability, which can be achieved through research and development in green chemistry, process optimization, and the adoption of bio-based catalysts.

Furthermore, the market faces competition from petrochemical-based alternatives and difficulties in securing a consistent supply of high-quality, renewable feedstocks, challenges that can be tackled by enhancing biorefinery capabilities, fostering industry collaborations, and promoting regulatory incentives for bio-based products.

Market Trend

"Shift to Non-Palm Based Sources and Digitalization of Manufacturing"

A key trend in the oleochemicals market is the shift away from palm oil as a primary feedstock, fueled by increasing environmental concerns and the demand for more sustainable sourcing practices.

Manufacturers are increasingly turning to alternative oils such as soybean, sunflower, and canola, along with innovative feedstocks such as algae and waste oils, to meet both regulatory requirements and consumer demand for responsibly sourced materials.

Moreover, the digitalization of manufacturing is transforming the sector, with the adoption of Industry 4.0 technologies such as IoT, AI, and automation enabling more efficient production, enhanced quality control, and optimized supply chains. These advancements are helping companies reduce operational costs while improving product consistency and meeting sustainability targets.

- For instance, in January 2024, Siemens Indonesia and PT SMART Tbk. signed a Memorandum of Understanding to collaborate on accelerating PT SMART Tbk.'s digital transformation, enhancing the production of palm-based products, oleochemicals, and other vegetable oil products. The collaboration focuses on Industry 4.0 technologies, data exchange, and employee training.

Additionally, geographical shifts in oleochemical production are underway, with traditional hubs in Southeast Asia, primarily focused on palm oil, being joined by emerging centers in North America, Europe, and South America.

Oleochemicals Market Report Snapshot

| Segmentation |

Details |

| By Source |

Vegetable-based Oleochemicals, Animal-based Oleochemicals |

| By Type |

Fatty Acids, Fatty Alcohols, Glycerol (Glycerin), Methyl Esters, Others |

| By Application |

Personal Care & Cosmetics, Consumer Goods, Food Processing, Textiles, Paints & Inks, Industrial, Healthcare & Pharmaceuticals, Polymer & Plastic Additives, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Source (Vegetable-based Oleochemicals and Animal-based Oleochemicals): The vegetable-based oleochemicals segment generated a revenue of USD 23.34 billion in 2023, mainly due to the rising demand for sustainable, bio-based products and environmentally friendly alternatives.

- By Type (Fatty Acids, Fatty Alcohols, Glycerol (Glycerin), and Methyl Esters, and Others): The fatty acids segment held a share of 40.12% in 2023, largely attributed to their widespread use across industries such as personal care, food processing, and detergents, where they are valued for their versatility, cost-effectiveness, and renewable sourcing.

- By Application (Personal Care & Cosmetics, Consumer Goods, Food Processing, and Textiles, Paints & Inks, Industrial, Healthcare & Pharmaceuticals, Polymer & Plastic Additives, and Others): The personal care & cosmetics segment is projected to reach USD 10.29 billion by 2031, largely attributed to the growing consumer demand for natural, sustainable ingredients and the increasing shift toward eco-friendly and biodegradable products in skincare, haircare, and cosmetics.

Oleochemicals Market Regional Analysis

Asia-Pacific oleochemicals market accounted for a substantial share of 48.12% and was valued at USD 15.50 million in 2023. This growth is largely attributed to rapid industrialization, growing consumer demand for sustainable products, and the increasing use of renewable feedstocks in various industries.

This growth is further supported by the region's robust industrial growth. Countries such as China, India, Japan, and South Korea are at the forefront of economic development, which has boosted the demand for oleochemicals. These chemicals are used extensively across several sectors, including personal care, food and beverages, automotive, pharmaceuticals, and textiles.

- For instance, in April 2024, Emery Oleochemicals opened a new Green Polymer Additives lab in Rayong, Thailand, in partnership with PTT Global Chemical. The initiative aims to address the growing demand for renewable polymer additives across in Asia, offering custom formulations and advanced testing for industries such as automotive and construction. This expansion strengthens Emery's commitment to innovation and sustainability.

North America oleochemicals market is poised to grow at a CAGR of 4.47% through the projection period. This growth is primarily stimulated by ongoing technological advancements, increasing consumer demand for sustainable and bio-based products, and a strong industrial base.

This notable growth is further aided by the rising demand for renewable and environmentally friendly products. As consumers and industries increasingly prioritize sustainability, there has been a notable shift toward bio-based alternatives to petroleum-based chemicals.

Regulatory Framework:

- The U.S. Environmental Protection Agency (EPA), the Consumer Product Safety Commission (CPSC), and the Occupational Safety and Health Administration (OSHA) regulate the production and distribution of commercial and industrial chemicals.

- In the European Union, the European Chemicals Agency (ECHA) oversees chemical regulation. ECHA is responsible for implementing the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation.

- In China, the Ministry of Ecology and Environment (MEE) regulates the chemical market, while the National Registration Center of Chemicals (NRCC) handles the registration of hazardous chemicals.

- In Japan, the Ministry of Economy, Trade and Industry (METI), the Ministry of Labor and Welfare (MHLW), and the Ministry of the Environment (MOE) govern chemicals under the Chemical Substances Control Law (CSCL).

- In India, the Indian National Chemical Authority (INCA) regulates chemicals, with. the Chemicals (Management and Safety) Rules (ICMSR), also known as India REACH, serving as the primary regulations.

- Globally, chemicals are regulated by organizations such as the United Nations, the European Union, and the Organization for Economic Cooperation and Development (OECD).

Competitive Landscape:

The global oleochemicals industry is characterized by a large number of participants, including both established corporations and rising organizations. The competitive landscape of this market is shaped by a diverse range of players that operate across different segments, including raw material production, manufacturing, and the distribution of oleochemical derivatives.

Technological innovation is another key factor that differentiates companies within the oleochemical market. There is a strong emphasis on research and development to improve the efficiency of production processes and create new, high-value products.

In addition to innovation and sustainability, mergers, acquisitions, and strategic partnerships are common tactics employed by market players to enhance their competitiveness. Consolidation helps companies expand their product portfolios, strengthen their market presence, and gain access to new geographies and customer bases.

- For instance, in February 2024, Caldic and Edenor formed a partnership to strengthen the European oleochemicals market by offering high-quality, sustainable solutions. This collaboration aims to foster innovation and expand both companies' reach in Europe, aligning their strategic goals to enhance customer value.

List of Key Companies in Oleochemicals Market:

- SD Guthrie Berhad (Emery oleochemicals)

- Akzo Nobel N.V.

- Cargill, Incorporated

- BASF

- Wilmar International Ltd

- IOI Corporation Berhad

- Kao Corporation

- Croda International Plc

- Evonik Industries AG

- Godrej Industries Group

- Corbion NV

- Procter & Gamble

- Kuala Lumpur Kepong Berhad

- PT. Ecogreen Oleochemicals

- PTT Global Chemical Public Company Limited

Recent Developments:

- In November 2024, Oleon, a subsidiary of Avril, launched Qloe, a brand offering plant-based immersion cooling liquids to address energy and environmental challenges in data center cooling. The biobased liquids provide efficient heat management, are non-toxic, biodegradable, and have zero global warming potential, setting a new standard in sustainable cooling solutions for the digital infrastructure.

- In October 2024, Oleon, a subsidiary of Avril, acquired a majority stake in Brazilian company A.Azevedo Óleos. This expands Oleon’s presence in South America, particularly in Brazil, and aligns with Avril's strategy for sustainable growth. The acquisition strengthens Oleon’s product portfolio and supports local farmers, contributing to environmental responsibility and rural community development.

- In July 2024, Ingevity announced plans to consolidate its oleo-based and crude tall oil refining within its North Charleston, South Carolina, facility, closing its Crossett, Arkansas, site. This move is expected to save USD 20 million to USD 25 million annually starting in 2025, supporting the company's strategy to improve profitability in its Performance Chemicals segment.

- In May 2024, ResourceWise launched a new oleochemicals analysis tool within its OrbiChem360 platform, offering cross-commodity pricing, data, and insights. The tool focuses on renewable feedstocks such as palm, coconut, and soybean, providing industries, including personal care and food with valuable insights to navigate low-carbon targets and market trends.

- In May 2024, LEHVOSS Functional Fluids partnered exclusively with Emery Oleochemicals to distribute biogenic esters in Europe. The partnership, which covers products used in lubricants, greases, EV fluids, and metalworking fluids, aims to enhance sustainability efforts for both companies.