Market Definition

The market involves the production, supply, and utilization of specialized machinery and tools essential for oil and gas exploration, drilling, extraction, and production. The market covers equipment like drilling rigs, pumps, valves, and blowout preventers.

Fueled by technological innovation, it supports critical sectors such as offshore, onshore, and unconventional oil and gas production. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Oilfield Equipment Market Overview

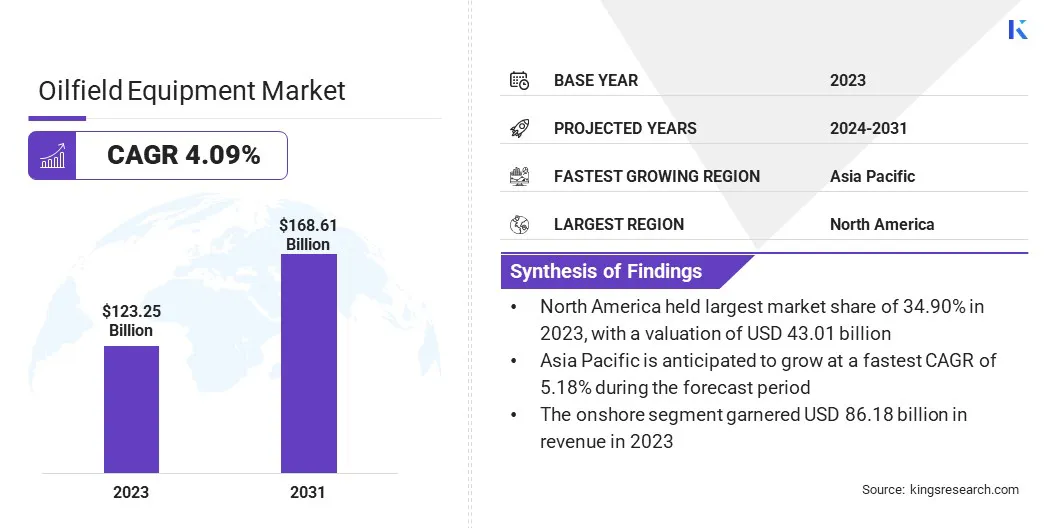

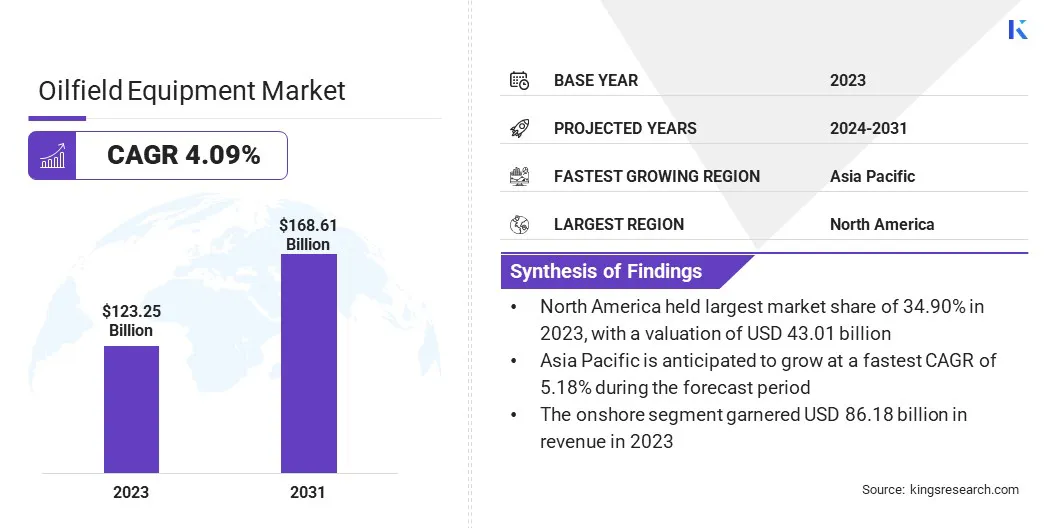

The global oilfield equipment market size was valued at USD 123.25 billion in 2023 and is projected to grow from USD 127.37 billion in 2024 to USD 168.61 billion by 2031, exhibiting a CAGR of 4.09% during the forecast period.

Technological advancements and increased investment in oil exploration & production are driving the market, with innovations such as automation and AI improving operational efficiency and recovery rates, while strategic capital allocation supports the development of new reserves and enhances overall production capabilities. These factors are positioning the market for sustained growth and improved performance.

Major companies operating in the oilfield equipment industry are Baker Hughes Company, Halliburton, SLB., Weatherford, NOV., China Oilfield Services Limited, Superior Energy Services., TechnipFMC plc, Trican., Delta Corporation, Tenaris., Vallourec, SAIPEM SpA, Nabors Industries Ltd., and Transocean Ltd.

The market is fueled by innovations in offshore drilling technologies and technological advancements in oilfield equipment. Breakthroughs such as automated drilling systems, AI-powered optimization, and advanced offshore drilling techniques enhance operational efficiency, reduce costs, and improve safety, driving higher demand for cutting-edge oilfield equipment and boosting productivity across onshore and offshore operations.

- In February 2024, Oil States, a provider of offshore systems, downhole perforating and completion technologies, and wellsite rental services, unveiled a new portfolio of completions technology and offshore drilling innovations for the Saudi Arabian market at the International Petroleum Technology Conference. This includes the Stage Frac Tool, designed for wellhead isolation. The tool allows operators to run wireline tools, perforating guns, plugs, and other downhole operations without the need to remove isolation equipment when transitioning between frac and wireline operations.

Key Highlights:

Key Highlights:

- The oilfield equipment market size was valued at USD 123.25 billion in 2023.

- The market is projected to grow at a CAGR of 4.09% from 2024 to 2031.

- North America held a market share of 34.90% in 2023, with a valuation of USD 43.01 billion.

- The drilling equipment segment garnered USD 54.19 billion in revenue in 2023.

- The onshore segment is expected to reach USD 116.55 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.18% during the forecast period.

Market Driver

Investment in oil exploration & production

The global market is propelled by the growing energy demand and limited supply, prompting increased investments in oil exploration & production.

Energy companies are channeling funds into discovering new reserves, optimizing output from mature fields, and leveraging advanced drilling technologies. Additionally, geopolitical dynamics and strong commodity prices are encouraging upstream development, making exploration and production a vital driver of the market.

- In February 2025, Earth.org reported that British Petroleum Company unveiled a “strategic reset” aimed at enhancing performance and lowering net debt. As part of this revised strategy, the company plans to increase its oil & gas investment by approximately 20%, reaching USD 10 billion annually, with a production target of USD 2.3 to 2.5 million barrels of oil equivalent per day.

Market Challenge

Oil Price Volatility Challenges Market Stability

The oilfield equipment market is significantly impacted by the volatility of crude oil prices, creating a challenging environment for stakeholders. Fluctuating oil prices directly affect investment stability, leading to uncertainty in long-term planning and decision-making. As a result, companies in this market face difficulties in maintaining consistent supply chains, which, in turn, delays project timelines and hampers the timely deployment of new infrastructure and equipment.

Many organizations are adapting by implementing more flexible contract models that allow for quicker adjustments to changing market conditions. Additionally, the emphasis on advanced inventory management techniques is growing to ensure that resources are available when needed without overcommitting capital.

Furthermore, companies are increasingly investing in digital technologies, such as automation, data analytics, and cloud-based solutions, to enhance operational efficiency, reduce costs, and improve resilience.

These technological advancements help streamline processes, increase predictive maintenance capabilities, and provide real-time insights into market trends, ultimately strengthening the overall adaptability and competitiveness of oilfield equipment providers in a fluctuating market landscape.

Market Trend

Technological Advancements

The global market is rapidly evolving, with technological innovations driving efficiency and performance. Automation technologies, including automated drilling systems, real-time data analytics, and AI-powered control mechanisms, are central to this transformation.

These advancements enable precise, efficient operations, reducing downtime and minimizing human error. Automated drilling improves the speed and accuracy of well completion, while real-time analytics provide actionable insights, enabling proactive decision-making and maintenance.

AI-based control systems optimize workflows and predict potential failures, further enhancing reliability. This shift toward automation lowers operational costs, increases productivity, and supports more sustainable exploration and production strategies, making automation a critical factor in upstream investment and long-term planning.

- In February 2025, Halliburton and Sekal AS launched the world’s first fully automated on-bottom drilling system by integrating Halliburton’s LOGIX automation, Sekal’s Drilltronics, and a rig automation control system. The team delivered a well for Equinor on the Norwegian Continental Shelf using a closed-loop system that enables autonomous directional drilling, automated wellbore hydraulics, and dynamic surface rig equipment control.

Oilfield Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Drilling Equipment, Production Equipment, Other Equipment Types

|

|

By Application

|

Onshore, Offshore

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K. , Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE , Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Drilling Equipment, Production Equipment, Other Equipment Types): The drilling equipment segment earned USD 54.19 billion in 2023, due to its critical role in efficient resource extraction, supported by advancements in automation and technology that enhance operational performance and reduce costs.

- By Application (Onshore, Offshore): The onshore segment held 69.92% share of the market in 2023, due to its lower operational costs, easier accessibility to resources, and the increasing number of onshore exploration and production projects driven by stable infrastructure and favorable regulatory environments.

Oilfield Equipment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.90% share of the oilfield equipment market in 2023, with a valuation of USD 43.01 billion.This market dominance is attributed to ongoing advancements in lift systems, driven by technological innovation and substantial investment in oil & gas production.

North America accounted for 34.90% share of the oilfield equipment market in 2023, with a valuation of USD 43.01 billion.This market dominance is attributed to ongoing advancements in lift systems, driven by technological innovation and substantial investment in oil & gas production.

The region’s strong infrastructure and emphasis on optimizing operational efficiency support the development and implementation of advanced lift technologies.

- In August 2024, SPM Oil & Gas introduced its enhanced SPM Seaboard artificial lift system solutions. The updated engineering and quality processes enable customers and resellers across North America to efficiently meet their equipment needs.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 5.18% over the forecast period. This is attributed to the rising energy demand, expanding exploration efforts, and substantial investments in both offshore and onshore oil & gas projects.

The region’s emphasis on infrastructure development, along with advancements in drilling technologies, accelerates the adoption of modern oilfield equipment, positioning it as a major growth hub in the global market.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces regulations aimed at reducing environmental impact, including air and water quality standards, waste disposal, and emissions control. Key legislations such as the Clean Air Act and the Clean Water Act play a crucial role in shaping these environmental standards.

- In Asia Pacific, offshore regulations are strictly enforced in coastal countries like Australia and Southeast Asian nations, with organizations such as the Australian Petroleum Production & Exploration Association (APPEA) and Malaysia's Petronas establishing standards for exploration, drilling, and safety.

Competitive Landscape

The market is highly competitive, driven by factors like constant innovation and technological advancements. Key players are focusing on automation, high-speed intelligent telemetry, AI-driven solutions, and enhanced equipment to improve operational efficiency and reduce costs.

Strategic partnerships and ongoing product development are crucial as companies aim to meet the rising demand for more efficient, reliable, and cost-effective solutions in the market.

- In November 2024, SLB introduced Stream high-speed intelligent telemetry to enhance drilling confidence and performance in complex wells. Designed to address the limitations of traditional mud pulse telemetry, Stream integrates proprietary AI algorithms with SLB’s TruLink definitive dynamic survey-while-drilling service. This solution delivers continuous high-speed, high-fidelity real-time subsurface measurements without data constraints even at great depths and in the most challenging conditions.

List of Key Companies in Oilfield Equipment Market:

- Baker Hughes Company

- Halliburton

- SLB

- Weatherford

- NOV.

- China Oilfield Services Limited

- Superior Energy Services.

- TechnipFMC plc

- Trican.

- Delta Corporation

- Tenaris.

- Vallourec

- SAIPEM SpA

- Nabors Industries Ltd.

- Transocean Ltd.

Recent Developments (Partnership)

- In April 2024, Deep Well Services (DWS) and CNX Resources Corp. announced a joint venture to establish AutoSepSM Technologies (AutoSep), a new oilfield service company aimed at significantly improving conventional flowback operations. The venture will leverage CNX’s technological expertise and DWS’s high service quality standards.

Key Highlights:

Key Highlights: North America accounted for 34.90% share of the oilfield equipment market in 2023, with a valuation of USD 43.01 billion.This market dominance is attributed to ongoing advancements in lift systems, driven by technological innovation and substantial investment in oil & gas production.

North America accounted for 34.90% share of the oilfield equipment market in 2023, with a valuation of USD 43.01 billion.This market dominance is attributed to ongoing advancements in lift systems, driven by technological innovation and substantial investment in oil & gas production.