Market Definition

The market involves the design, construction, installation, and maintenance of pipelines that transport oil, gas, and other fluids across seabed from offshore production facilities to onshore terminals or processing plants. These pipelines are vital to the offshore energy sector, ensuring the efficient and safe transfer of resources extracted from underwater reserves.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Offshore Pipeline Market Overview

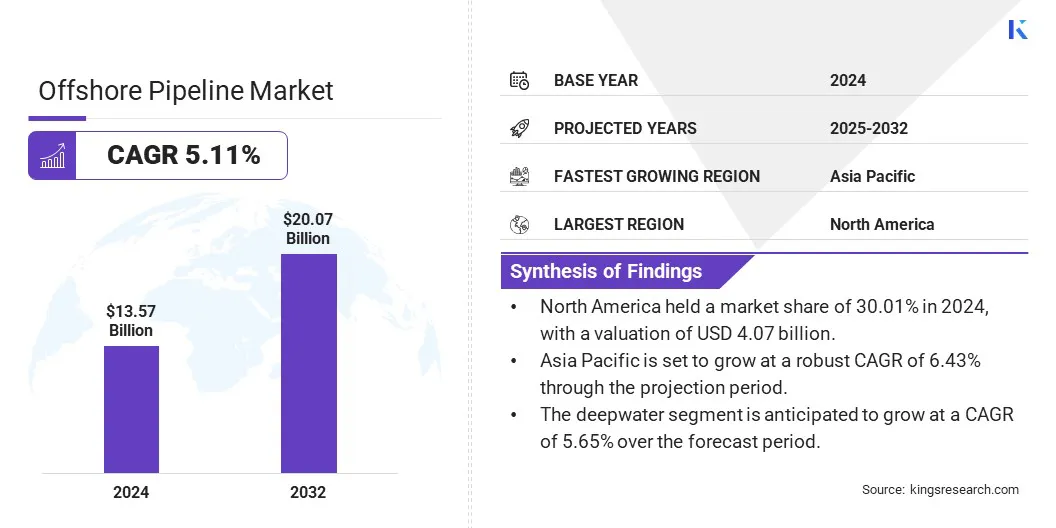

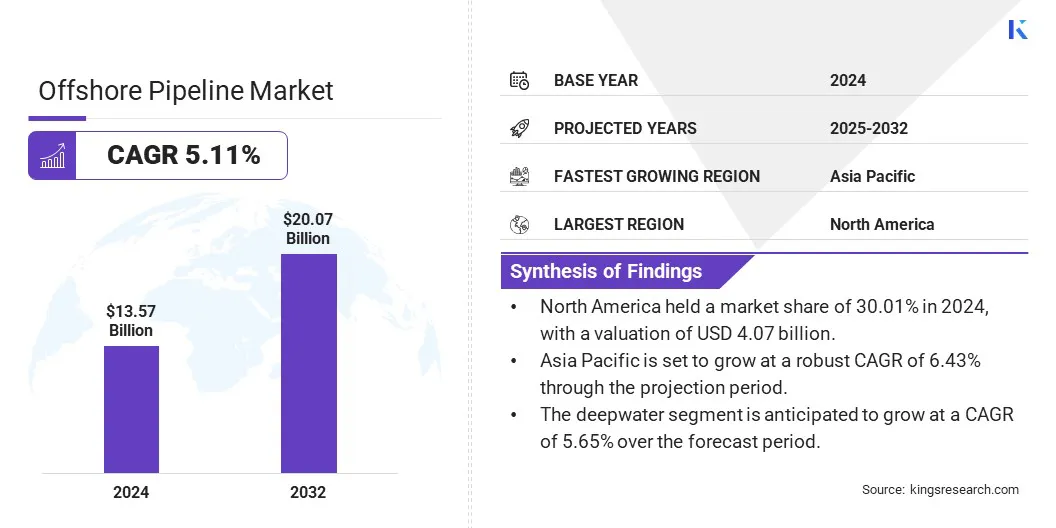

The global offshore pipeline market size was valued at USD 13.57 billion in 2024 and is projected to grow from USD 14.16 billion in 2025 to USD 20.07 billion by 2032, exhibiting a CAGR of 5.11% during the forecast period.

Market growth is driven by the need to meet growing energy demands in rapidly developing economies, prompting expanded offshore oil and gas exploration and production. Additionally, the need for advanced pipeline technologies that enhance durability and performance in harsh offshore environments is supporting market growth.

Major companies operating in the offshore pipeline industry are Enbridge Inc, CNPC, McDermott, Saipem, Tenaris, Baker Hughes Company, LARSEN & TOUBRO LIMITED, TechnipFMC plc, TMK, MEED MEDIA FZ LLC, Vallourec, Worley, Allseas Group S.A, Ace Pipeline, and Sapura Energy Berhad.

Additionally, rising global consumption of natural gas is creating a demand for offshore pipeline. As economies transition to cleaner energy sources, natural gas is emerging as a key fuel for power generation, heating, and industrial applications. This increasing demand is prompting energy companies to invest in offshore exploration and expand pipeline networks to transport gas efficiently from offshore reserves to onshore processing facilities and end-users.

- According to the International Energy Agency (IEA), global natural gas demand increased by 115 billion cubic metres (bcm) in 2024, representing a 2.7% year-on-year growth. This surge significantly exceeds the average annual growth of approximately 75 bcm over the past decade.

Key Highlights:

- The offshore pipeline industry size was recorded at USD 13.57 billion in 2024.

- The market is projected to grow at a CAGR of 5.11% from 2025 to 2032.

- North America held a market share of 30.01% in 2024, with a valuation of USD 4.07 billion.

- The greater than 24 inches segment garnered USD 8.16 billion in revenue in 2024.

- The oil segment is expected to reach USD 10.37 billion by 2032.

- The export lines segment is anticipated to witness the fastest CAGR of 5.77% over the forecast period.

- The s-lay segment held a share of 39.94% in 2024.

- The deepwater segment is anticipated to grow at a CAGR of 5.65% over the forecast period.

- Asia Pacific is set to grow at a robust CAGR of 6.43% through the projection period.

Market Driver

Increasing Demand for Natural Gas

The increasing demand for natural gas is a fueling the growth in the offshore pipeline market. As countries around the world shift toward cleaner energy sources to reduce carbon emissions, natural gas is recognized as a transitional fuel. This growing reliance on natural gas is leading to a surge in offshore exploration and production activities.

To efficiently transport extracted gas from offshore fields to onshore processing facilities and end users, extensive pipeline infrastructure is required. This rising need for safe, reliable, and cost-effective transportation systems is surging the demand for offshore pipelines.

- According to the Gas Exporting Countries Forum (GECF), global natural gas demand is projected to reach approximately 5,360 bcm by 2050.

Market Challenge

Risk of Pipeline Leaks and Failures

The risk of pipeline leaks and failures present a major challenge to the expansion of the offshore pipeline market. Corrosion from seawater exposure, mechanical stress from underwater currents, and damage from marine activities can compromise pipeline integrity.

Additionally, errors during installation or inadequate maintenance practices increase the possibility of system failures. Such incidents disrupt operations and lead to serious environmental threats, including oil spills and marine pollution.

To address this challenge, companies are investing in advanced corrosion resistant materials and adopting smart pipeline monitoring technologies such as sensors and real-time data analytics. They are also implementing stricter quality control during installation and enhancing maintenance protocols to detect early signs of damage.

Subsea inspections, using remotely operated vehicles (ROVs) and autonomous underwater drones, are conducted to assess pipeline condition, detect faults, and ensure structural integrity.

Market Trend

Advancements in Corrosion-Resistant Materials

The growing use of corrosion-resistant materials is transforming the offshore pipeline market by enhancing the durability and longevity of subsea infrastructure. Advanced composites, specialized polymers, and metal alloys designed to withstand harsh marine environments are increasingly adopted to combat challenges such as stress corrosion cracking and chemical degradation.

These materials reduce maintenance frequency and operational risks, ensuring safer and more cost-effective pipeline performance. Innovations focus on lightweight, high-strength materials resistant to fatigue and corrosion, ensuring reliable pipeline performance in deeper, harsher offshore environments. This trend supports the industry's shift toward sustainable and resilient energy transport systems.

- In May 2025, TechnipFMC partnered with Petrobras to accelerate the development and commercialization of Hybrid Flexible Pipe (HFP), targeting stress corrosion cracking caused by CO2 in flexible pipe systems. The HFP combines conventional flexible pipe benefits with corrosion-resistant composite materials, including carbon fiber and PEEK thermoplastic polymer. Designed for ultra-deepwater corrosive environments, HFP aims to reduce pipe replacements and set new industry standards.

Offshore Pipeline Market Report Snapshot

|

Segmentation

|

Details

|

|

By Diameter

|

Below 24 Inches, Greater Than 24 Inches

|

|

By Product

|

Oil, Gas, Refined Products

|

|

By Line Type

|

Transport Lines, Export Lines, Other Lines

|

|

By Installation Type

|

S-lay, J-lay, Tow-in

|

|

By Depth

|

Shallow Water, Deepwater

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Diameter (Below 24 Inches and Greater Than 24 Inches): The greater than 24 inches segment earned USD 8.16 billion in 2024 due to increasing deployment in long-distance, high-capacity offshore pipeline projects supporting deepwater and ultra-deepwater operations.

- By Product (Oil, Gas, and Refined Products): The oil segment held a share of 51.12% in 2024, fueled by sustained offshore crude production and the ongoing development of new oilfields to meet global energy demand.

- By Line Type (Transport Lines, Export Lines, and Other Lines): The transport lines segment is projected to reach USD 9.88 billion by 2032, owing to expanding offshore infrastructure and rising interconnection needs between offshore fields and onshore processing facilities.

- By Installation Type (S-lay, J-lay, and Tow-in): The s-lay segment held a share of 39.94% in 2024, fostered by its cost-effectiveness, speed of installation, and widespread use in shallow to moderate water depths.

- By Depth (Shallow Water and Deepwater): The deepwater segment is anticipated to grow at a CAGR of 5.65% over the forecast period, propelled by new field discoveries, technological advancements, and increasing investment in subsea exploration at greater depths.

Offshore Pipeline Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America offshore pipeline market accounted for a share of around 30.01% in 2024, valued at USD 4.07 billion. This dominance is reinforced by increasing investments in deepwater offshore projects, with major industry players advancing subsea developments and expanding pipeline infrastructure.

Pipelines are sanctioned to support large-scale oil and gas fields, strengthening transportation networks for increased production. Projects involving floating production facilities and some of the deepest gas pipelines globally demonstrate strong commitments to technological innovation and operational excellence.

These initiatives are backed by strategic contract awards to specialized engineering and construction firms, enhancing pipeline capacity, safety, and reliability across the region's offshore sector.

- In May 2025, Shell Offshore and Shell Pipeline Company increased their working interest in the Ursa platform in the Gulf of America from 45.38% to 61.34%. The acquisition supports Shell’s strategy to expand its portfolio of profitable and carbon-competitive oil and gas projects. The trasaction also includes increased ownership in the Ursa Oil Pipeline Company and related assets.

The Asia Pacific offshore pipeline industry is set to grow at a CAGR of 6.43% over the forecast period. This growth is fueled by rising energy demand, leading to increased offshore oil and gas exploration and production activities.

Technological advancements in subsea engineering and the use of corrosion-resistant and flexible pipeline materials are improving project efficiency and extending pipeline lifespan. Additionally, the development of innovative solutions designed for harsh offshore environments supports the growth of complex and large-scale offshore projects across the region.

Regulatory Frameworks

- In the U.S., Bureau of Safety and Environmental Enforcement (BSEE) is the primary regulatory authority for offshore market. (BSEE) is responsible for ensuring the safety and environmental protection of offshore oil and gas activities, including pipelines.

- In the UK, the North Sea Transition Authority (NSTA) oversees offshore oil and gas pipelines, including those related to hydrogen, carbon dioxide, and other energy infrastructure.

- In India, the Petroleum and Natural Gas Regulatory Board (PNGRB) monitors offshore pipelines, ensuring safety, efficiency, and fair pricing in the oil and gas sector. It regulates activities such as pipeline construction, operation, and maintenance, including offshore pipelines.

Competitive Landscape

Prominent players in the offshore pipeline industry are focusing on forming strategic mergers, expanding their offshore engineering and construction fleets, and consolidating global operations. They are aligning their service portfolios across subsea and pipeline segments and increasing their presence in high-growth offshore regions. Additionally, companies are integrating their project management and engineering teams, unifying technology platforms, and standardizing installation processes.

- In February 2025, Italy’s Saipem and global energy player Subsea7 signed a memorandum of understanding (MoU) for a potential merger to create a leading entitiy in subsea and offshore engineering and construction. The proposed company, Saipem7, is projected to have a combined backlog of USD 45.5 billion, annual revenue of around USD 21 billion, and a workforce exceeding 45,000 across more than 60 countries.

List of Key Companies in Offshore Pipeline Market:

- Enbridge Inc

- CNPC

- McDermott

- Saipem

- Tenaris

- Baker Hughes Company

- LARSEN & TOUBRO LIMITED

- TechnipFMC plc

- TMK

- MEED MEDIA FZ LLC

- Vallourec

- Worley

- Ace Pipeline

- Subsea7

- Sapura Energy Berhad

Recent Developments (Partnerships/Agreements)

- In February 2025, Strohm and UNITECH Offshore signed a memorandum of understanding (MoU) to co-develop a fully integrated subsea pipeline system for fluid and gas transport. The collaboration combines Strohm’s thermoplastic composite pipe (TCP) technology with UNITECH Off shore’s UH-500 Series subsea connectors to create a flange-less, end-to-end jumper connection. The solution aims to reduce leak risks, simplify offshore installation, and deliver long-term, high-pressure performance for dynamic subsea applications such as jumpers, flowlines, and risers.

- In December 2024, Tenaris partnered with IGI Poseidon to advance offshore hydrogen transportation via ultra-deep pipelines. The collaboration focuses on overcoming key challenges, including hydrogen embrittlement and cost-efficient transmission. By conducting qualification testing for high-pressure offshore pipelines, the partnership seeks to support the development of safe, economically viable hydrogen infrastructure critical to the low-carbon energy transition.