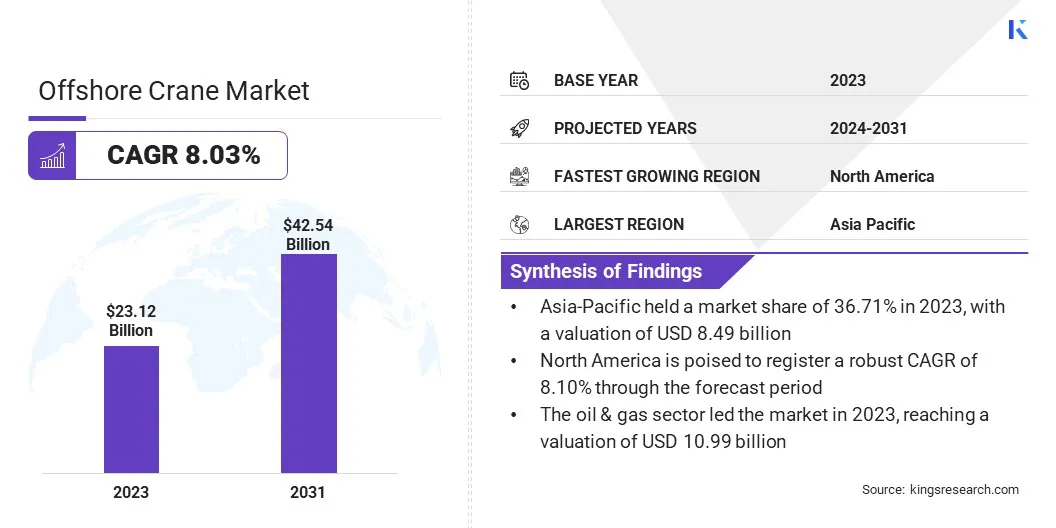

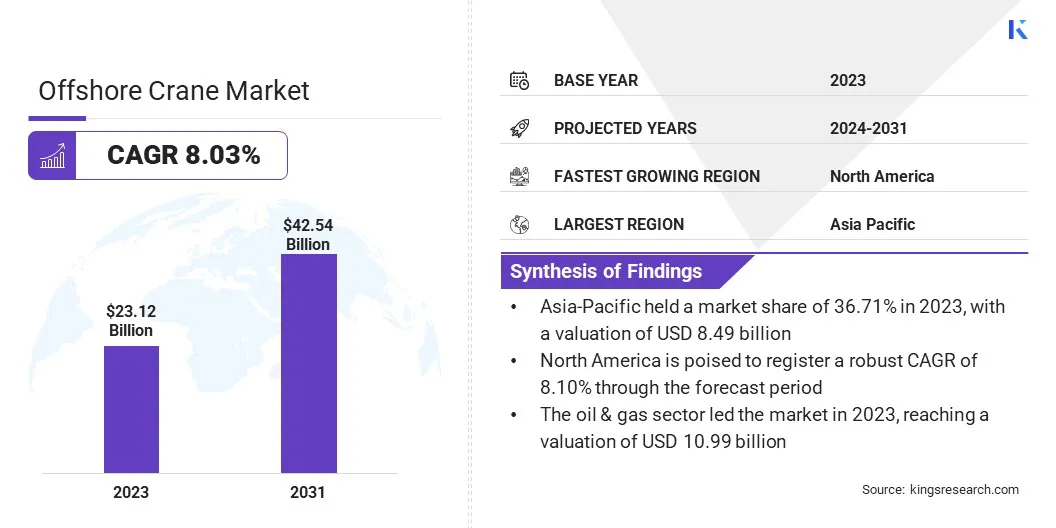

Offshore Crane Market Size

The global Offshore Crane Market size was valued at USD 23.12 billion in 2023 and is projected to grow from USD 24.77 billion in 2024 to USD 42.54 billion by 2031, exhibiting a CAGR of 8.03% during the forecast period. Expansion of offshore oil and gas exploration activities and advancements in crane design and technology are the major drivers for this market.

In the scope of work, the report includes products offered by companies such as Liebherr-International Deutschland GmbH, Heila Cranes SpA, Huisman Equipment B.V., Cargotec Corporation, Altrad Sparrows, Konecranes, The Manitowoc Company, Inc, Seatrax, Inc., NOV, Palfinger AG, and others.

The introduction of hybrid and electric cranes provides a significant opportunity within the offshore crane market, driven by the growing emphasis on sustainability and the reduction of carbon emissions from industrial operations.

As the global energy landscape shifts toward greener alternatives, the offshore industry is increasingly adopting environmentally friendly technologies. Hybrid cranes, which combine traditional diesel engines with electric power, offer a reduction in fuel consumption and lower operational costs, making them attractive for offshore operations where efficiency and sustainability are critical.

- In June 2024, Port Houston received six hybrid-electric rubber-tired gantry (RTG) cranes, increasing its total to 26 RTGs since December 2023. These cranes, deployed at Barbour’s Cut and Bayport Container Terminals, reflect the port’s commitment to sustainability and operational efficiency.

Electric cranes, powered entirely by electricity, present an even more significant leap toward achieving zero-emission operations at par with global environmental goals. These cranes reduce the environmental footprint by offering operational benefits such as lower noise levels and maintenance costs due to fewer moving parts.

The development and deployment of hybrid and electric offshore cranes are creating new market opportunities, particularly in regions where governments and industry players are investing in clean energy projects and are keen on minimizing the environmental impact of offshore activities.

An offshore crane is a specialized piece of equipment designed for lifting and moving heavy loads in offshore environments, such as oil rigs, wind farms, and marine vessels. These cranes are engineered to operate in challenging conditions, including high winds, rough seas, and corrosive saltwater environments. Offshore cranes are categorized into various types based on their design and function, including pedestal cranes, knuckle boom cranes, and lattice boom cranes.

Pedestal cranes are commonly used for general lifting purpose on offshore platforms, while knuckle boom cranes are known for their flexibility and are often used where precise load handling is required. Lattice boom cranes, with their high lifting capacity, are ideal for large-scale operations such as installing heavy equipment or wind turbine components.

The lifting capacity of offshore cranes can range from a few tons to several thousand tons, depending on the application. These cranes are essential in offshore oil and gas exploration, where they are used to lift and position drilling equipment, as well as in the growing offshore wind energy sector, where they play a crucial role in the installation and maintenance of wind turbines.

Analyst’s Review

The offshore crane market is experiencing strategic innovation and growth as key players are focused on expanding their market presence and enhancing their product offerings.

Companies in this sector are increasingly investing in research and development to introduce advanced technologies, such as digitalization, automation, and hybrid-electric systems, in their crane offerings. This shift is aimed at improving operational efficiency and meeting the stringent environmental and safety standards imposed by regulatory bodies.

The current growth trajectory of the market supported by the expansion of offshore oil and gas exploration activities and the rising investment in renewable energy projects, particularly offshore wind farms.

- For instance, in March 2024, Hiab, a part of Cargotec, secured a EUR 5 million order for custom-designed loader cranes, the HIAB SWP, for offshore wind turbines. This significant order, booked in Q1 2024, highlights the growing demand for specialized cranes in the renewable energy sector.

However, to maintain and enhance their competitive edge, companies are adopting mergers and acquisitions, partnerships, and expansion of their service portfolios. These strategies are crucial for navigating the challenges posed by high capital expenditure requirements and fluctuating raw material prices.

Moreover, key players are increasingly focusing on offering customized solutions to meet the specific needs of clients in different regions, thereby solidifying their position in the global market.

Offshore Crane Market Growth Factors

The growth in offshore wind energy projects is a significant driver for the offshore crane market, as these projects require specialized lifting equipment for the installation, maintenance, and decommissioning of wind turbines. Offshore wind farms are expanding rapidly, particularly in Europe, Asia, and North America, with countries seeking to increase their renewable energy capacity to meet climate goals.

The complexity of these projects, often located in deep waters far from shore, necessitates the use of advanced offshore cranes capable of handling heavy components like turbine blades, nacelles, and tower sections in challenging marine environments. The demand for such cranes is expected to rise as governments and private investors commit substantial funds to the development of large-scale offshore wind farms.

- According to the Global Wind Energy Council (GWEC), the global offshore wind market is poised for significant growth in 2023, targeting a 3 GW capacity, a 16% annual increase. By 2030, the global offshore wind capacity is expected to reach 271 GW, with 14 GW of floating wind power under construction or installed.

Additionally, larger turbines, which generate more power, require more robust lifting solutions. This further amplifies the need for high-capacity offshore cranes. Crane manufacturers are innovating to meet the specific requirements of the growing offshore wind industry, creating opportunities for market expansion and technological advancements.

Stringent regulatory requirements present a significant challenge in the offshore crane market, as companies must comply with numerous international, national, and industry-specific standards to ensure safety, environmental protection, and operational efficiency. These regulations cover various aspects, including design, manufacturing, and operation of offshore cranes, and often require rigorous certification processes.

Compliance with these standards is critical, as any failure to meet them can result in legal penalties, project delays, and reputational damage. For instance, offshore cranes must adhere to stringent safety regulations that govern load handling, stability, and emergency systems, which necessitates continuous investments in advanced technologies and regular maintenance.

Moreover, environmental regulations aimed at reducing emissions and minimizing the ecological impact of offshore activities are becoming increasingly stringent, driving the need for greener technologies such as hybrid and electric cranes. Mitigating this challenge requires continuous monitoring of regulatory changes, investing in research and development to innovate compliant technologies, and collaborating with regulatory bodies to ensure adherence to the latest standards.

Offshore Crane Market Trends

The expansion of offshore oil and gas exploration activities is a key trend driving the offshore crane market, as companies increasingly venture into deep and ultra-deepwater regions to tap into new reserves.

With onshore and shallow water oil fields maturing, the industry is pushing further offshore, where substantial untapped reserves exist. This trend will generate the demand for sophisticated offshore cranes capable of handling the heavy and complex equipment required for deepwater drilling operations. The growing demand for energy, particularly from emerging economies, is fueling this expansion, leading to increased investments in offshore exploration projects.

Additionally, advancements in drilling technology and the development of floating production, storage, and offloading (FPSO) units are making deepwater exploration more feasible, further boosting the need for high-capacity offshore cranes. These cranes play a crucial role in the installation, maintenance, and decommissioning of offshore platforms, rigs, and subsea equipment, making them indispensable for the oil and gas industry.

Segmentation Analysis

The global market has been segmented on the basis of type, lifting capacity, application, and geography.

By Type

Based on type, the market has been categorized into knuckle boom cranes, telescopic boom cranes, lattice boom cranes, and others. The knuckle boom cranes segment captured the largest offshore crane market share of 45.25% in 2023, largely due to their versatility and efficiency in offshore operations. Knuckle boom cranes are highly valued for their unique design, which allows the boom to articulate and fold, allowing precise load handling in confined spaces.

This makes them particularly well-suited for tasks on offshore platforms where space is limited and maneuverability is critical. Their ability to operate in harsh marine environments, combined with their enhanced safety features, is also driving their widespread adoption across various offshore applications, including oil and gas exploration, wind farm installations, and subsea operations.

- In October 2023, Huisman introduced a new series of subsea Knuckle Boom Cranes, designed for offshore construction. These cranes, ranging from 85mt to 350mt, offer energy-efficient, automated, and safe operations, aligning with the latest industry trends for modern offshore vessels.

Additionally, knuckle boom cranes are favored for their ability to reduce the pendulum effect when lifting loads, which enhances stability and safety during operations, especially in rough seas. Therefore, the growing demand for efficient and reliable lifting solutions in the expanding offshore energy segment, coupled with advancements in knuckle boom crane technology, has further solidified this segment’s position in the market.

By Lifting Capacity

Based on lifting capacity, the market has been classified into up to 500 MT, 500-3000 MT, and above 3000 MT. The 500-3000 MT segment is poised to record a staggering CAGR of 8.83% over the forecast period due to the increasing need for high-capacity cranes in complex offshore projects.

As offshore oil and gas exploration and wind energy installations move into deeper waters, the demand for cranes with substantial lifting capacities will also witness growth. The 500-3000 MT range of cranes offers the ideal balance between power and versatility, making them essential for a wide array of offshore applications, from installing heavy subsea infrastructure to lifting large wind turbine components.

The segment's growth is also supported by the construction of larger offshore platforms and floating production, storage, and offloading (FPSO) units, which require cranes capable of handling heavier loads. Furthermore, advancements in crane technology, including enhanced safety features and automation, have increased the efficiency and reliability of these high-capacity cranes, making them more attractive to operators.

By Application

Based on application, the market has been divided into oil & gas, renewable energy, marine, and others. The oil & gas sector led the offshore crane market in 2023, reaching a valuation of USD 10.99 billion, propelled by the continued expansion of offshore exploration and production activities.

With the rise in the global energy demand, oil and gas companies are increasingly investing in offshore projects, particularly in deep and ultra-deepwater regions with significant untapped reserves. These projects require high-capacity offshore cranes to handle the heavy lifting and precise load placement needed for drilling and production operations.

- In December 2023, Petrotec, a subsidiary of Al Mahhar Holding Company Q.P.S.C., partnered with Seatrax UK LTD in an OEM Equipment Refurbishment and Sales Agreement, advancing Qatar’s offshore energy sector and enhancing capabilities in the pedestal crane market.

The revenue growth in this segment is also driven by the ongoing development of new offshore platforms, subsea systems, and floating production, storage, and offloading (FPSO) units, all of which depend on reliable crane solutions. Additionally, the oil & gas industry’s focus on enhancing operational efficiency and safety has led to the adoption of advanced crane technologies, further boosting market revenue.

Offshore Crane Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific offshore crane market share stood around 36.71% in 2023 in the global market, with a valuation of USD 8.49 billion. This market share can be attributed to the robust growth in offshore oil and gas exploration and rapid expansion of offshore wind energy projects.

Countries like China, India, Japan, and South Korea are leading the charge in offshore energy development, driven by their increasing energy demands and strategic initiatives to reduce dependence on imported fossil fuels. Significant investments in large-scale offshore projects, particularly in deep and ultra-deepwater drilling, have fueled the demand for advanced offshore cranes capable of handling complex lifting operations in challenging environments.

- In August 2024, according to Global Flow Control, India is expanding its offshore oil and gas exploration to the Extended Continental Shelf (ECS), extending 200 nautical miles from its coast. This strategic initiative aims to unlock potential energy reserves, enhancing the nation's energy security and resource base.

Moreover, the growing focus on renewable energy, with substantial offshore wind farm installations planned and under development across the region, has further bolstered the market. The presence of major offshore equipment manufacturers and favorable government policies promoting energy security and infrastructure development have also contributed in the global market.

North America is projected to grow at a significant CAGR of 8.10% over the forecast period, driven by the region's continued investment in offshore energy infrastructure and technological advancements in offshore crane systems. The U.S. and Canada are key players in the offshore oil and gas industry, with substantial exploration and production activities in the Gulf of Mexico and the Arctic regions.

As these countries seek to enhance their energy security and capitalize on their offshore resources, the demand for high-capacity and technologically advanced offshore cranes is expected to rise. Additionally, North America's growing focus on renewable energy, particularly offshore wind, is contributing to market growth.

The region is witnessing increased investment in offshore wind farms, particularly along the U.S. East Coast, which requires specialized cranes for the installation and maintenance of wind turbines. Furthermore, the adoption of advanced technologies, such as automation and digitalization in offshore cranes, is improving operational efficiency and safety, making them more attractive to operators.

Competitive Landscape

The global offshore crane market report provides valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Offshore Crane Market

- Liebherr-International Deutschland GmbH

- Heila Cranes SpA

- Huisman Equipment B.V.

- Cargotec Corporation

- Altrad Sparrows

- Konecranes

- The Manitowoc Company, Inc

- Seatrax, Inc.

- NOV

- Palfinger AG

Key Industry Developments

- January 2024 (Launch): Huisman secured a contract from Subsea7 to supply a 500mt electric Offshore Mast Crane featuring advanced heave compensation systems. This crane will be installed on a pipelay vessel for deep-water projects, enhancing operational stability and extending the crane's operational window.

- November 2023 (Expansion): Heila Cranes entered into a service partner agreement with Rusch Offshore Services BV in Medemblik, Netherlands. This collaboration aims to further improve the quality and efficiency of services provided to Heila's customers, reinforcing its commitment to customer satisfaction and service excellence.

The global offshore crane market has been segmented:

By Type

- Knuckle Boom Cranes

- Telescopic Boom Cranes

- Lattice Boom Cranes

- Others

By Lifting Capacity

- Up to 500 MT

- 500-3000 MT

- Above 3000 MT

By Application

- Oil & Gas

- Renewable Energy

- Marine

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America