Market Definition

An oat-based beverage is a plant-derived drink made primarily from oats and water, often enriched with vitamins, minerals, and other ingredients to enhance taste and nutritional value. It serves as a dairy-free alternative to milk, catering to consumers seeking lactose-free, vegan, or sustainable beverage options.

The production process typically involves milling oats, mixing them with water, enzymatic treatment to break down starches, and filtration to achieve a smooth texture. Oat based beverage are widely used in coffee, smoothies, cereals, and cooking applications, offering a naturally creamy consistency with a mild, slightly sweet flavor.

Oat Based Beverages Market Overview

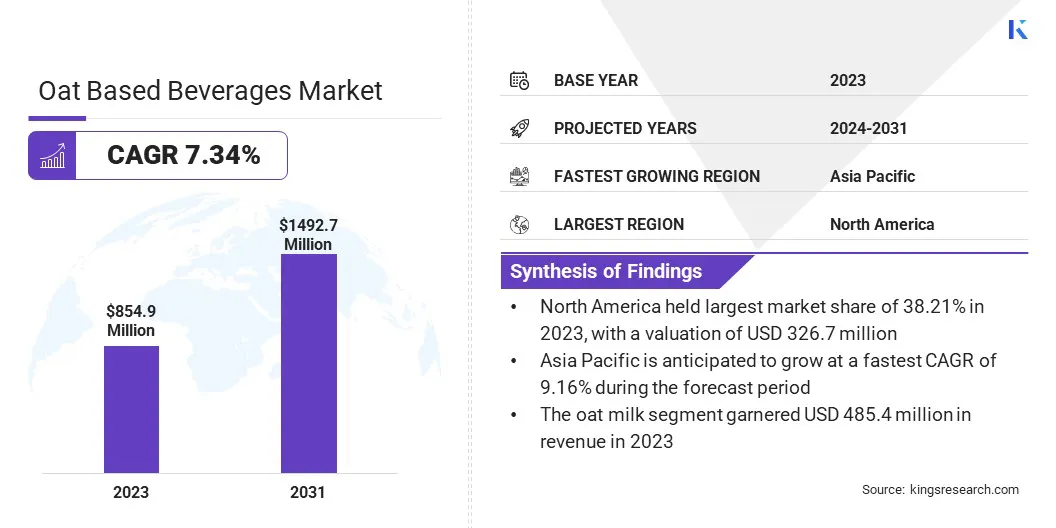

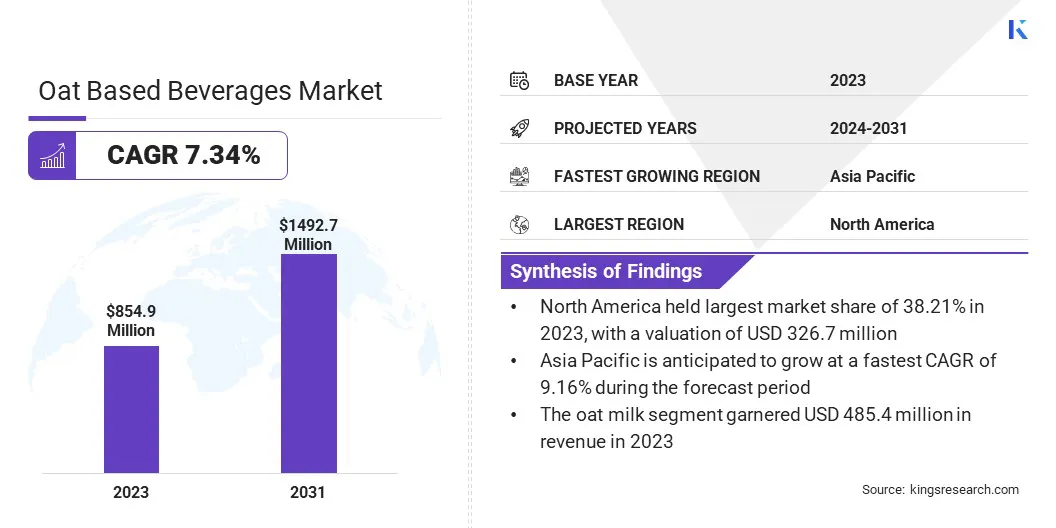

The global oat based beverages market size was valued at USD 854.9 million in 2023 and is projected to grow from USD 909.5 million in 2024 to USD 1,492.7 million by 2031, exhibiting a CAGR of 7.34% during the forecast period.

The growth of the market is driven by increasing consumer demand for plant-based alternatives and rising health consciousness. The shift toward dairy-free diets, supported by lactose intolerance and vegan lifestyles, has fueled market expansion.

Additionally, sustainability concerns and the lower environmental impact of oat production compared to dairy farming are driving consumer preference for oat based beverage, supporting market growth.

Major companies operating in the oat based beverages industry are PepsiCo, Danone, The Quaker Oats Company, Oatly Group AB, Pacific Foods, Alpro, Tetra Pak International S.A., Oy Karl Fazer Ab., TOATS OATS COMPANY, Drinks Brokers Ltd, PureHarvest, SIMANDL Spol. s ro, Califia Farms, LLC, and others.

The growing preference for plant-based diets is accelerating market growth. Health-conscious consumers are seeking dairy-free options due to rising concerns about lactose intolerance, cholesterol levels, and digestive issues.

- A 2024 study by the National Center for Biotechnology Information found that following a plant-based diet (PBD) lowers the risk of certain diseases and contributes to environmental sustainability.

The shift is further influenced by ethical considerations related to animal welfare and environmental sustainability. Oat based beverage offer a creamy texture and a naturally sweet taste, making them a desirable alternative to dairy and other plant-based drinks. The market is witnessing increased adoption among vegan and flexitarian consumers, fueling demand across multiple demographics and reinforcing the product’s position in the global beverage industry.

- The 2024 report by the Good Food Institute reveals that plant-based food sales across six European countries reached USD 5.88 billion in 2023, reflecting a 5.5% increase from 2022, while sales volume grew by 3.5% during the same period.

Key Highlights:

Key Highlights:

- The oat based beverages industry size was recorded at USD 854.9 million in 2023.

- The market is projected to grow at a CAGR of 7.34% from 2024 to 2031.

- North America held a share of 38.21% in 2023, valued at USD 326.7 million.

- The oat milk segment garnered USD 485.4 million in revenue in 2023.

- The conventional segment is expected to reach USD 1,028.6 million by 2031.

- The online retail segment is poised to expand at a robust CAGR of 10.69% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.16% over the projection period.

Market Driver

“Increasing Adoption in Foodservice Industry”

The expansion of the foodservice industry is propelling the growth of the oat based beverages market. Coffee chains, cafés, and quick-service restaurants are incorporating oat based beverage into their menus due to strong consumer demand for dairy-free options.

The creamy texture and neutral taste make oat based beverage an ideal choice for lattes and specialty drinks, leading to greater adoption among baristas and consumers. Partnerships between beverage brands and foodservice operators are improving product availability and visibility.

The rising popularity of oat based beverage in urban café cultures and premium coffee outlets is fostering market growth, contributing to higher sales volumes.

- In November 2024, Oatly Group AB partnered with McDonald's Netherlands to introduce Oatly Barista Edition in all 264 McDonald's locations nationwide offering customers a plant-based alternative to premium coffee.

Market Challenge

“High Production Costs and Pricing Constraints”

The growth of the oat based beverages market is hindered by high production costs, fueled by raw material expenses, processing requirements, and supply chain complexities. Oat milk production involves enzymatic processing to achieve the desired texture and nutritional profile, increasing operational costs.

Additionally, premium pricing compared to dairy and other plant-based alternatives limits consumer adoption, particularly in price-sensitive markets.

Companies are optimizing supply chains, investing in large-scale production facilities, and adopting cost-effective processing technologies to enhance efficiency.

Strategic partnerships with oat farmers ensure stable raw material sourcing, while private-label collaborations with retailers enhance affordability and accessibility.

Market Trend

“Expanding Product Innovation and Flavor Diversification”

The oat based beverages market is benefiting from ongoing product innovation and the introduction of diverse flavors. Companies are developing formulations tailored for different applications, including barista-specific oat milk with enhanced frothing capabilities for coffee shops.

Sugar-free, protein-enriched, and organic variants are gaining traction among consumers with specific dietary preferences. The introduction of oat based beverage infused with flavors such as vanilla, chocolate, and caramel is expanding consumer appeal.

Innovation in packaging, including ready-to-drink formats, is enhancing convenience and boosting retail sales. These developments are supporting market penetration across different regions, supporting long-term industry growth.

- In May 2024, Lactalis Canada, a subsidiary of Lactalis Group, introduced its plant-based brand, Enjoy!, to the Canadian market. The brand introduced 6 high-protein, unsweetened plant-based beverages, including Unsweetened Oat, Unsweetened Oat Vanilla, Unsweetened Almond, Unsweetened Almond Vanilla, Unsweetened Hazelnut, and Unsweetened Hazelnut & Oat.

Oat Based Beverages Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Oat Milk, Oat-based Yogurt Drinks, Oat-based Smoothies and Shake, Others

|

|

By Nature

|

Organic, Conventional

|

|

By Sales Channel

|

Supermarkets/Hypermarkets, Convenience Store, Online Retail

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Oat Milk, Oat-based Yogurt Drinks, Oat-based Smoothies and Shake, and Others): The oat milk segment earned USD 485.4 million in 2023, mainly due to its widespread consumer adoption as a dairy alternative, supported by its creamy texture, nutritional benefits, and versatility in applications such as coffee, smoothies, and cooking.

- By Nature (Organic and Conventional): The conventional segment held a share of 71.10% in 2023, attributed to its lower production costs, widespread availability, and strong consumer preference for affordable, familiar options.

- By Sales Channel (Supermarkets/Hypermarkets, Convenience Store, Specialty Store, and Online Retail): The convenience store segment is projected to reach USD 356.8 million by 2031, propelled by its extensive retail network, on-the-go accessibility, and immediate product availability, catering to the rising consumer demand for ready-to-drink plant-based options.

Oat Based Beverages Market Regional Analysis

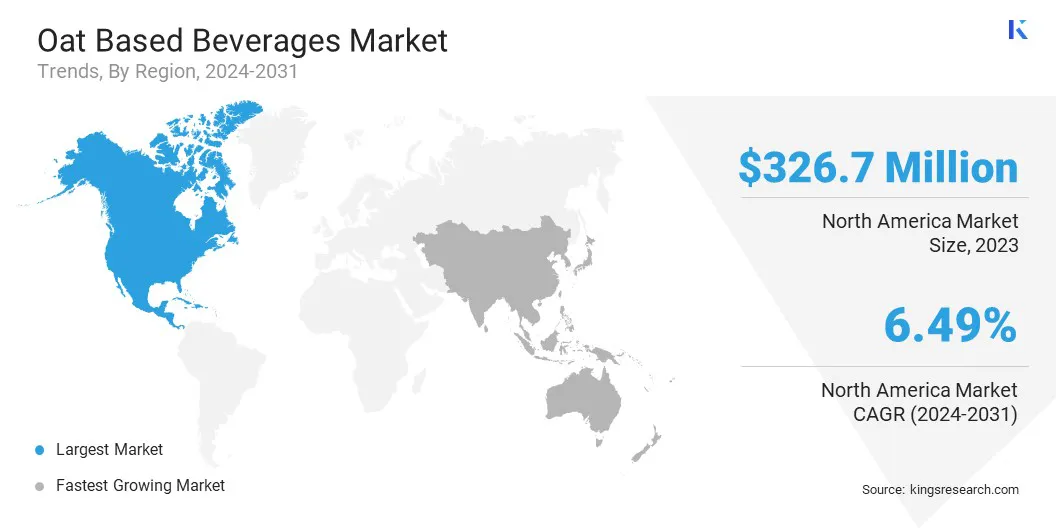

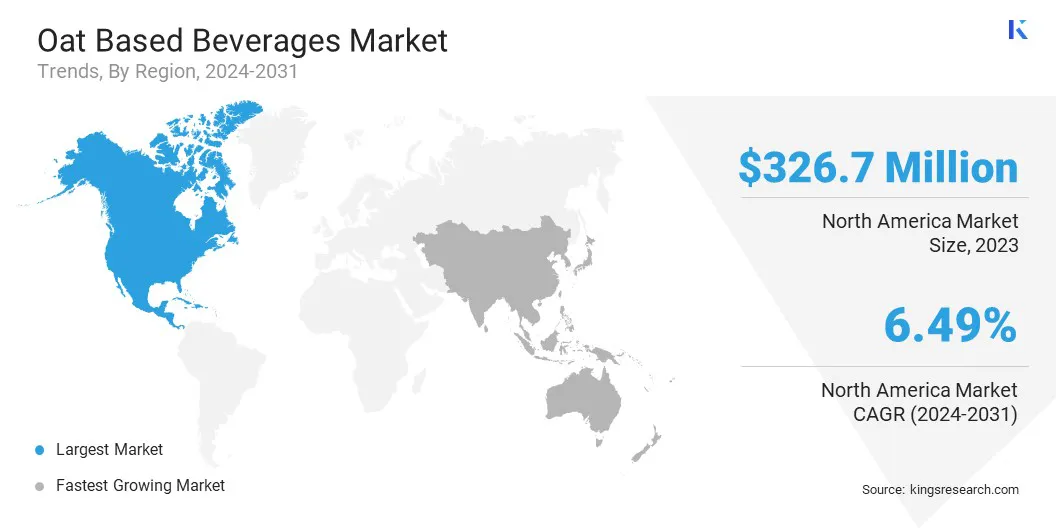

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America oat based beverages market captured a share of around 38.21% in 2023, valued at USD 326.7 million. The widespread adoption of oat based beverage in the region’s coffee and foodservice industry is accelerating this growth.

Leading coffee chains, including Starbucks and Dunkin’, have incorporated oat milk into their menus, enhancing mainstream acceptance. Its superior frothing ability and neutral taste make it a preferred dairy alternative for lattes and specialty drinks.

Leading coffee chains, including Starbucks and Dunkin’, have incorporated oat milk into their menus, enhancing mainstream acceptance. Its superior frothing ability and neutral taste make it a preferred dairy alternative for lattes and specialty drinks.

Quick-service restaurants and premium cafés are capitalizing on this trend by offering oat based beverage, strengthening their presence in urban and suburban markets.

Environmental concerns are further boosting the growth of the North America industry. Compared to dairy and other plant-based alternatives such as almond milk, oat beverages have a lower carbon footprint and require less water for production.

Consumers are actively choosing sustainable food and beverage options, prompting companies to invest in eco-friendly packaging and carbon-neutral production processes.

- In January 2025, U.S.-based Minus Coffee introduced a new beanless coffee alternative, the Minus Instant Vanilla Oat Milk Latte. The company claims that the product produces 86% fewer carbon emissions than traditional coffee while using 92% less land and 94% less water. It is non-GMO, gluten-free, and free from gums and artificial sweeteners.

Asia Pacific oat based beverages industry is likely to grow at a CAGR of 9.16% over the forecast period. This growth is attributed to increasing consumer awareness of health and wellness. A growing number of individuals are shifting toward plant-based diets to manage cholesterol levels, improve digestion, and support heart health.

Additionally, lactose intolerance is prevalent among a significant portion of the Asian population, creating a strong demand for dairy alternatives.

Oat based beverage offer a nutritious and easily digestible option, positioning them as a preferred choice among health-conscious consumers. The focus on preventive healthcare and functional nutrition is further bolstering regional market growth.

Regulatory Framework:

- In the U.S., the Food and Drug Administration (FDA) oversees the regulation of plant-based beverages, including oat-based products. Manufacturers must adhere to the FDA's labeling requirements, ensuring that nutritional information is accurate and that any health claims are substantiated. Additionally, the FDA enforces standards for food safety, including Good Manufacturing Practices (GMP) and Hazard Analysis Critical Control Points (HACCP) systems, to prevent contamination and ensure product quality.

- In Europe, the European Food Safety Authority (EFSA) provides scientific advice on food-related risks and sets regulations that member states must follow. Oat based beverage are subject to the EU's Novel Food Regulation if they contain ingredients not commonly consumed before May 1997. Labeling must comply with the EU Food Information to Consumers Regulation, ensuring transparency regarding allergens and nutritional content.

- In China, the China National Center for Food Safety Risk Assessment (CFSA) regulates food products, including plant-based beverages. Manufacturers must comply with national food safety standards, which include specific criteria for contaminants, additives, and labeling. Importers should be aware of China's stringent import regulations and the necessity for product registration.

- In India, the Food Safety and Standards Authority of India (FSSAI) monitors food products, including oat based beverage. Manufacturers must comply with the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, which outline specifications for various food categories. Labeling requirements mandate the disclosure of nutritional information, ingredient lists, and allergen warnings.

Competitive Landscape

The global oat based beverages market is characterized by a large number of participants, including both established corporations and emerging players. Market participants are implementing strategies such as mergers to enhance scalability, foster innovation, and expand their market presence.

These strategic moves enable companies to strengthen their competitive positioning, leverage synergies, and accelerate product development. By consolidating resources and expertise, businesses can optimize supply chains, reduce operational costs, and improve market penetration.

Additionally, mergers facilitate access to advanced technologies and diversified product portfolios, catering to evolving consumer preferences. This approach drives business growth and contributes to the overall expansion of the market by increasing availability, enhancing product offerings, and fostering industry advancements.

- In November 2024, New Zealand-based oat milk startups Otis and All Good merged to form a new entity, Good & Humble. The new entity combines Otis’s expertise in on-farm provenance verification and enzyme technology with All Good’s strong presence in export sales and distribution. This strategic merger aims to strengthen market positioning and bolster the global expansion of New Zealand’s oat milk industry.

List of Key Companies in Oat Based Beverages Market:

- PepsiCo

- Danone

- The Quaker Oats Company

- Oatly Group AB

- Pacific Foods

- Alpro

- Tetra Pak International S.A.

- Oy Karl Fazer Ab.

- TOATS OATS COMPANY

- Drinks Brokers Ltd

- PureHarvest

- SIMANDL Spol. s ro

- Califia Farms, LLC

Recent Developments (Partnerships/Agreements/New Product Launch)

- In February 2025, Oatly Group AB partnered with Nestlé Nespresso to launch a specialty coffee blend, designed for oat drink enthusiasts. The limited-edition Oatly Barista Edition Coffee is formulated to enhance the flavor and texture of Oatly’s oat-based beverage. It is exclusively compatible with Nespresso Vertuo coffee machines, catering to consumers seeking a high-quality, plant-based coffee pairing.

- In August 2024, UK-based brand Oato introduced a new limited-edition flavor, Caffè Latte by Oato. Developed exclusively for Modern Milkman, a delivery service that modernizes the traditional milk round, this launch aims to offer consumers a convenient and sustainable plant-based beverage option.

- In February 2024, Oatly Group AB introduced Oatly Oatmilk Creamers in the U.S., designed to enhance coffee experiences and foster the adoption of oat-based alternatives. Available in Sweet & Creamy, Vanilla, Caramel, and Mocha, these creamers offer a rich, versatile plant-based option.

Key Highlights:

Key Highlights: Leading coffee chains, including Starbucks and Dunkin’, have incorporated oat milk into their menus, enhancing mainstream acceptance. Its superior frothing ability and neutral taste make it a preferred dairy alternative for lattes and specialty drinks.

Leading coffee chains, including Starbucks and Dunkin’, have incorporated oat milk into their menus, enhancing mainstream acceptance. Its superior frothing ability and neutral taste make it a preferred dairy alternative for lattes and specialty drinks.