Nickel Hydroxide Market Size

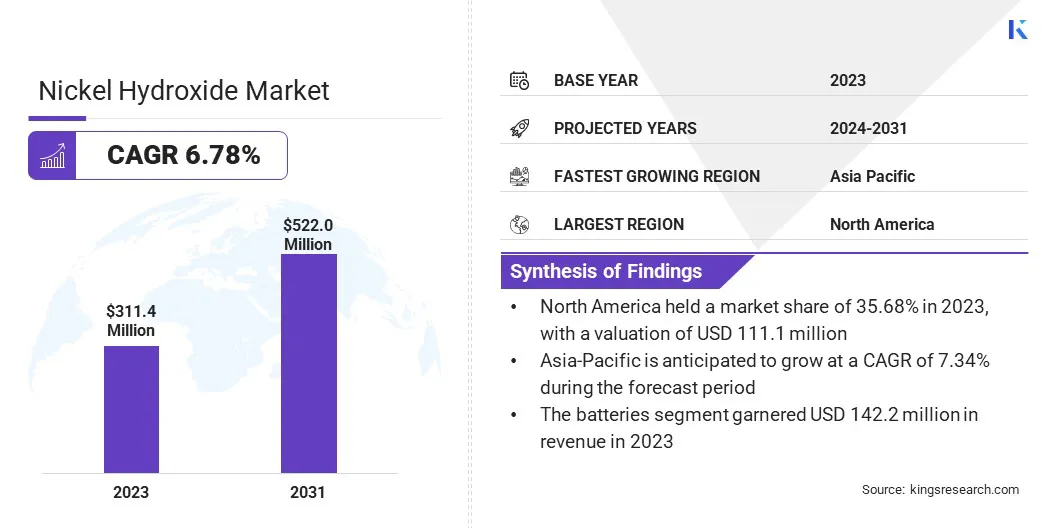

Global Nickel Hydroxide Market size was recorded at USD 311.4 million in 2023, which is estimated to be at USD 329.8 million in 2024 and projected to reach USD 522.0 million by 2031, growing at a CAGR of 6.78% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as American Elements, GFS Chemicals, Inc., Nippy Chemicals., KANSAI CATALYST Co., Ltd., Tanaka Chemical Corporation, Umicore, Sumitomo Metal Mining Co., Ltd., Merck KGaA, Kelong, Jilin Jien, and others.

Key factors driving the growth of the market include the increasing demand for batteries, particularly in electric vehicles and portable electronic devices, along with emerging trends such as the shift toward high-purity nickel hydroxide and a growing emphasis on sustainability and recycling. The nickel hydroxide market is witnessing robust growth, largely attributed to increasing demand from battery manufacturing industries, particularly for electric vehicles and portable electronics.

Nickel hydroxide serves as a crucial component in the production of nickel-metal hydride and nickel-cadmium batteries, which are in high demand due to the global transition to cleaner energy sources and the proliferation of electronic devices. Additionally, the market is experiencing the widespread adoption of high-purity nickel hydroxide to enhance battery performance and longevity. Moreover, rising sustainability concerns are facilitating the development of recycling technologies for nickel hydroxide, thereby bolstering market growth.

With rising investments in research and development and a growing focus on sustainability, the nickel hydroxide market is poised to experience notable expansion in the foreseeable future. Nickel hydroxide is a green crystalline solid that is formed by treating when nickel(II) salts with alkali or ammonia. Nickel hydroxide is commonly used in rechargeable battery electrodes, particularly in nickel-metal hydride (NiMH) and nickel-cadmium (NiCd) batteries, where it serves as an active material. It exhibits excellent electrochemical properties, making it suitable for use in energy storage applications.

Additionally, nickel hydroxide find applications in catalysts, ceramics, and as a precursor for other nickel compounds. The market plays a crucial role in supporting the development of advanced battery technologies and facilitating the transition toward a more sustainable energy future.

Analyst’s Review

The nickel hydroxide market is experiencing significant growth, mainly fueled by burgeoning demand for electric vehicles (EVs), which is further spurred by governmental incentives and increasing environmental consciousness. Additionally, the expanding consumer electronics industry and the growing adoption of energy storage systems in renewable energy applications are contributing to market growth trajectory. Moreover, strategic collaborations and partnerships are being forged to strengthen market presence and maintain competitiveness.

Sustainability has emerged as a pivotal concern, with concerted efforts toward implementing recycling programs and eco-friendly production methods to minimize environmental impact and ensure a sustainable supply chain. The market is estimated to experience robust growth, boosted by evolving market trends and supportive initiatives undertaken by industry players to capitalize on emerging opportunities.

Nickel Hydroxide Market Growth Factors

The burgeoning demand for nickel hydroxide is driven by its application in the battery manufacturing sector, notably in the production of nickel-metal hydride (NiMH) and nickel-cadmium (NiCd) batteries. This surge in demand is primarily propelled by the soaring popularity of electric vehicles (EVs) and the ever-expanding market for portable electronic devices such as smartphones and laptops.

As consumers increasingly opt for EVs due to environmental concerns and government incentives, and as the proliferation of electronic gadgets grows, the market is likely to expand substantially in the forthcoming years.

Nickel hydroxide, with its electrochemical properties and suitability for battery applications, emerges as a critical component in meeting this surging demand. Its ability to facilitate high-performance, long-lasting batteries makes it indispensable in powering the energy-hungry devices of the modern world, thereby supporting market expansion.

- In 2023, almost 14 million new electric cars were registered globally, bringing the total to 40 million, with a year-on-year increase of 35%. Electric cars accounted for 18% of all cars sold in 2023, up from 14% in 2022. This rapid growth of the electric vehicle market leads to the strong demand for nickel hydroxide, a critical component in the batteries of electric cars.

The nickel hydroxide market is the volatility of raw material prices and supply chain disruptions in the market, influenced by global economic conditions and geopolitical tensions is expected to increase the market growth. However, industry players are diversifying their supplier base, establishing long-term agreements with pricing mechanisms, and investing in recycling technologies for sustainable sourcing.

Strategic inventory management and partnerships with suppliers and research institutions are further enhancing resilience and enabling proactive decision-making. These measures aim to minimize the impact of raw material price fluctuations and ensure a consistent supply of nickel hydroxide, thereby supporting market growth.

Nickel Hydroxide Market Trends

In the battery manufacturing industry, there is a notable shift toward the production and utilization of high-purity nickel hydroxide. This shift is further bolstered by battery manufacturers' efforts to enhance product performance and reliability, in response to the growing demand for high-performance batteries across diverse applications. High-purity nickel hydroxide, known for its exceptional purity levels, offers superior conductivity, stability, and energy density compared to standard-grade counterparts.

Furthermore, batteries incorporating high-purity nickel hydroxide demonstrate improved efficiency, longer cycle life, and increased energy storage capacity, thereby meeting the stringent performance requirements of modern applications. This adoption underscores the industry's dedication to innovation and quality enhancement, as manufacturers strive to address the evolving needs of customers in an electrified and sustainable future. This shift is likely to augment market revenue in the coming years.

- In 2023, the surge in electric vehicle (EV) sales resulted in a strong demand for batteries exceeding 750 GWh, marking a 40% increase from 2022. This rising demand is largely attributed to electric cars, which accounted for 95% of this growth. The demand for batteries increased by approximately 5%, driven by the larger average battery size resulting from the rising popularity of SUVs in electric vehicle sales. This trend is significantly boosting the need for nickel hydroxide, a critical material in EV batteries, highlighting its essential role in supporting the expansion of the electric vehicle market.

The nickel hydroxide market is experiencing the growing utilization of nickel-based batteries in renewable energy storage systems, which is contributing to market expansion. With the rapid growth of renewable energy sources such as solar and wind power, there is a pressing need for efficient and reliable energy storage solutions to overcome intermittency challenges.

Nickel hydroxide, known for its high energy density and long cycle life, is emerging as a preferred material for battery energy storage systems (BESS) deployed in conjunction with renewable energy installations. These systems enable the storage of excess energy during periods of high generation and release it during times of low generation or high demand, thereby enhancing grid stability and reliability.

Additionally, advancements in nickel hydroxide battery technology, including improvements in energy efficiency and cost-effectiveness, are leading to their widespread adoption in both utility-scale and distributed energy storage applications. As the demand for renewable energy continues to rise globally, the nickel hydroxide market is poised to witness significant growth due to its integral role in enabling the transition to a sustainable energy future.

Segmentation Analysis

The global market is segmented based on sales channel, form, and geography.

By Application

Based on application, the nickel hydroxide market is categorized into batteries, electronics, chemicals, and others. The batteries segment garnered the highest revenue of USD 142.2 million in 2023. The segment within the market is characterized by its diverse applications across various industries, including automotive, consumer electronics, and renewable energy. With the increasing adoption of electric vehicles globally, there is a rising demand for nickel hydroxide in the manufacturing of rechargeable batteries.

Additionally, the proliferation of portable electronic devices such as smartphones and laptops further fuels the demand for nickel hydroxide batteries due to their high energy density and long cycle life. Moreover, the increasing deployment of renewable energy sources has led to a growing need for energy storage systems, where nickel hydroxide batteries serve as reliable solutions. In addition, the batteries segment is poised to observe significant growth and innovation, propelled by the increasing demand for high-performance batteries across various applications.

By Form

Based on form, the market is divided into spherical and powder. The powder segment captured the largest nickel hydroxide market share of 71.33% in 2023. Nickel hydroxide powder serves as a crucial precursor in battery manufacturing, particularly for rechargeable batteries such as nickel-metal hydride and nickel-cadmium batteries, due to their growing demand across the automotive, consumer electronics, and energy storage sectors.

Additionally, nickel hydroxide powder finds applications as catalysts in chemical processes and electroplating, catering to industries such as petrochemicals, pharmaceuticals, and electroplating.

Moreover, it is utilized in ceramics production both as a colorant and additive. The segment is witnessing technological advancements to optimize production processes and meet specific application requirements. Furthermore, sustainability initiatives are gaining significant traction, with a major focus on eco-friendly production methods and waste reduction. The powder segment is set to witness steady growth, driven by diverse industrial applications and evolving market trends.

Nickel Hydroxide Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Nickel Hydroxide Market share stood around 35.68% in 2023 in the global market, with a valuation of USD 111.1 million. This considerable growth is primarily propelled by robust industrial demand and evolving regulations. Diverse industries such as agriculture, manufacturing, and chemicals rely heavily on nitrogen hydroxide for various applications.

In agriculture, it enhances soil fertility and crop productivity, while in manufacturing, it is used in cleaning agents and chemical synthesis. The region's growing emphasis on sustainability is fostering innovations in production processes to minimize environmental impact.

Additionally, stringent safety regulations and a focus on green chemistry are fostering investments in sustainable practices. As the region prioritizes environmental initiatives, the nitrogen hydroxide market is projected to experience growth, with a notable shifts toward cleaner production methods.

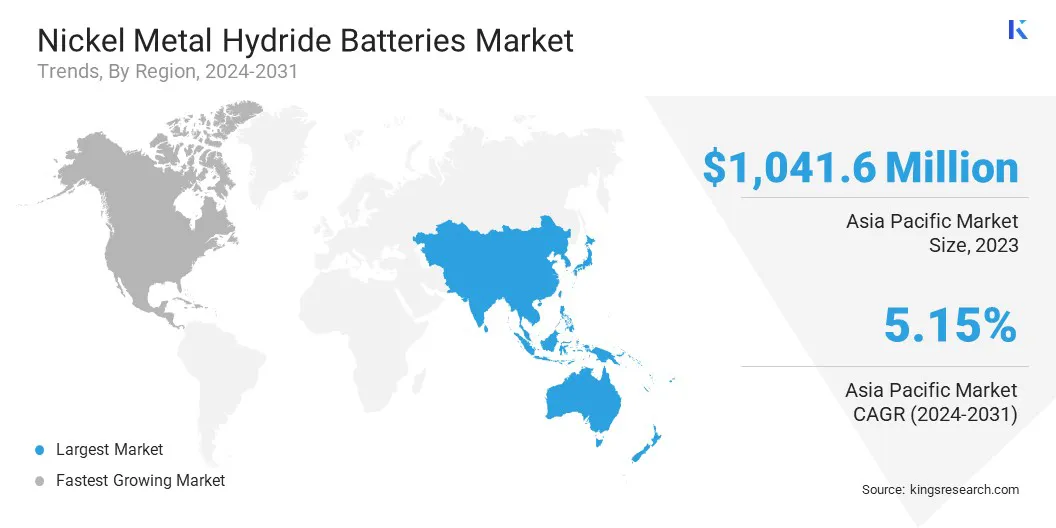

Asia- Pacific is anticipated to witness a signifiant growth, registering a CAGR of 7.34% over the forecast period. The Asia Pacific region stands as a pivotal hub within the nickel hydroxide market, characterized by dynamic industrial growth, burgeoning technological advancements, and increasing demand for energy storage solutions. In Asia Pacific, the demand for nickel hydroxide is mainly bolstered by the rapid expansion of the electric vehicle (EV) market due to favorable government initiatives, infrastructure development, and growing environmental awareness.

Additionally, the thriving consumer electronics sector, including smartphones, laptops, and wearable devices, contributes significantly to the demand for nickel hydroxide batteries. Furthermore, the region's emphasis on renewable energy and sustainability initiatives supports the increased adoption of energy storage systems, thereby boosting the Asia-Pacific market progress.

Competitive Landscape

The global nickel hydroxide market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Nickel Hydroxide Market

- American Elements

- GFS Chemicals, Inc.

- Nippy Chemicals.

- KANSAI CATALYST Co., Ltd.

- Tanaka Chemical Corporation,

- Umicore

- Sumitomo Metal Mining Co., Ltd.

- Merck KGaA

- Kelong

- Jilin Jien

Key Industry Development

- October 2023 (Expansion): Umicore expanded its EV battery materials production capabilities by constructing a 35 GWh equivalentCAM and pCAM plant in Loyalist, Ontario, targeting the North American market. This development significantly boosted the demand for nitrogen hydroxide, essential in battery production. This project received substantial financial backing from the Governments of Canada and Ontario, highlighting the increasing significance of nitrogen hydroxide in the evolving EV battery ecosystem.

The global nickel hydroxide market is segmented as:

By Application

- Batteries

- Electronics

- Chemicals

- Others

By Form

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America