Market Definition

Next generation memory (NGM) refers to a class of advanced memory technologies developed to overcome the limitations of conventional memory solutions such as NAND flash and DRAM.

These innovative technologies, including Magnetoresistive RAM (MRAM), Resistive RAM (ReRAM), Phase-Change Memory (PCM), and Ferroelectric RAM (FRAM), are designed to deliver superior performance, higher endurance, faster processing speed, and lower power consumption while also offering non-volatility.

NGM provides enhanced capabilities suited for modern computing demands such as artificial intelligence (AI), big data analytics, cloud computing, and autonomous systems.

Next Generation Memory Market Overview

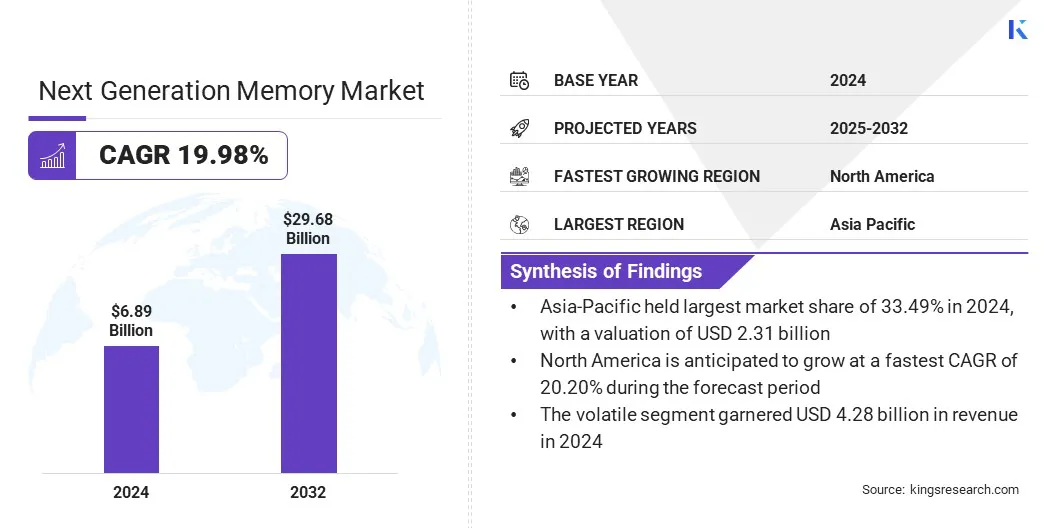

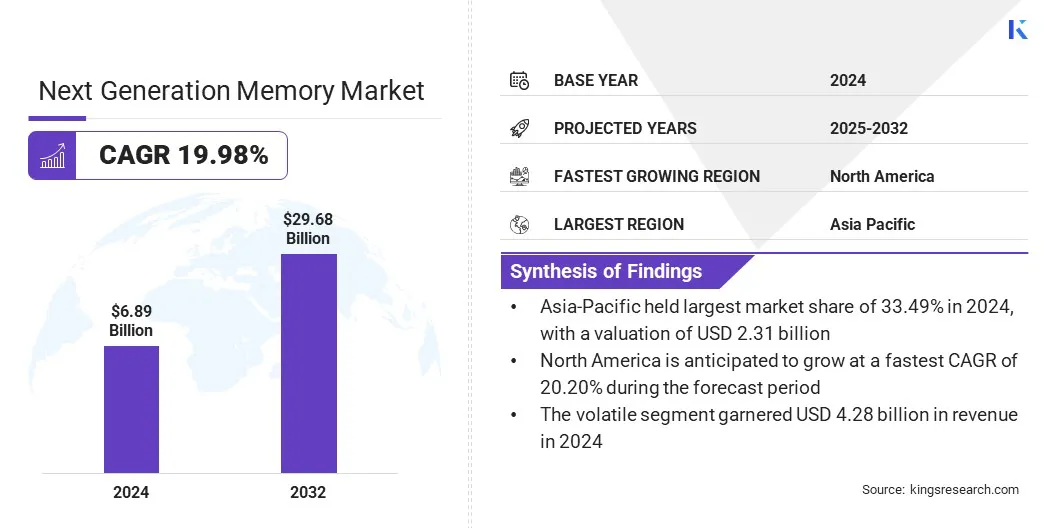

The global next generation memory market size was valued at USD 6.89 billion in 2024 and is projected to grow from USD 8.25 billion in 2025 to USD 29.68 billion by 2032, exhibiting a CAGR of 19.98% over the forecast period.

The adoption of next generation memory is accelerating in AI and IoT devices as NGM offers faster data processing, reduced latency, and improved power efficiency. These memory solutions support continuous learning, enhance predictive analytics, and provide persistent data storage in compact, low-power environments critical for IoT networks and AI-driven platforms.

Key Market Highlights:

- The next generation memory industry was recorded at USD 6.89 billion in 2024.

- The market is projected to grow at a CAGR of 19.98% from 2025 to 2032.

- Asia Pacific held a market share of 33.49% in 2024, valued at USD 2.31 billion.

- The volatile segment garnered USD 4.28 billion in revenue in 2024.

- The 300 mm segment is expected to reach USD 17.51 billion by 2032.

- The automotive segment is anticipated to witness a significant CAGR of 20.01% over the forecast period.

- North America is anticipated to grow at a CAGR of 20.20% through the projection period.

Major companies operating in the next generation memory market are Infineon Technologies AG, Fujitsu, Samsung, Micron Technology, Inc., SK HYNIX INC., STMicroelectronics, Toshiba Corporation, Everspin Technologies Inc., Intel Corporation, Kioxia Corporation, Microchip Technology Inc., CrossBar, Inc., Renesas Electronics Corporation, Sandisk Corporation, and Honeywell International Inc.

Next generation memory is increasingly being adopted in the aerospace sector to address the growing demand for advanced data storage, reliability, and endurance in mission-critical applications. Technologies such as MRAM and ReRAM offer high-speed processing, radiation resistance, and non-volatility.

These features make them well-suited for avionics, satellite systems, and space exploration equipment, where traditional memory often fails under harsh environmental conditions.

This expanding application is driving demand for next generation memory in defense organizations and commercial aerospace companies seeking reliable, high-performance memory solutions to power aircraft, unmanned aerial vehicles, and next-generation satellites.

- In February 2025, Everspin Technologies, Inc. announced the validation of its PERSYST MRAM for configuration across all Lattice Semiconductor Field Programmable Gate Arrays (FPGAs) through the Lattice Radiant software suite. This collaboration underscores MRAM’s reliability for mission-critical applications in industrial, aerospace, military, and automotive sectors.

Market Driver

Growing Use of Advanced Memory in Autonomous Vehicles and ADAS

The market is witnessing strong growth driven by its increasing use in autonomous vehicles and advanced driver-assistance systems (ADAS). These technologies demand real-time data processing, low latency, and efficient power usage to support critical applications such as object detection, navigation, and predictive analytics.

Advanced memory solutions like MRAM, PCM, and ReRAM are being integrated into automotive electronics to enhance processing power while maintaining durability under continuous operation.

- In April 2025, STMicroelectronics launched Stellar with xMemory, an advanced embedded memory within its Stellar automotive microcontrollers, designed to streamline software-defined vehicle development and support evolving electrification platforms, enabling enhanced performance, scalability, and efficiency for next-generation automotive applications.

Market Challenge

High Manufacturing Costs and Complex Production Processes Hindering Large-Scale Adoption

One of the major challenges facing the next generation memory market is the high cost and complexity associated with manufacturing these advanced technologies.

Unlike conventional DRAM and NAND, which benefit from mature production ecosystems, emerging memory types such as MRAM, ReRAM, and PCM require specialized materials, equipment, and process controls, significantly increasing development and production expenses.

Additionally, the need for precision fabrication and testing raises barriers to scalability, limiting widespread adoption and keeping prices higher compared to traditional memory. For many manufacturers, this challenge slows down commercialization and hinders the potential for rapid market penetration, particularly in cost-sensitive consumer electronics.

To overcome this challenge, manufacturers are investing in advanced fabrication techniques, leveraging 200 mm and 300 mm wafer facilities, forming strategic partnerships, and scaling pilot production lines, which collectively reduce costs, improve yields, and accelerate commercialization of next generation memory technologies.

Market Trend

Growing Adoption of MRAM and ReRAM for High-Performance Computing Applications

High-performance computing (HPC) environments demand ultra-fast, reliable, and energy-efficient memory to process large datasets and power workloads like artificial intelligence, simulation, and big data analytics. MRAM and ReRAM are gaining significant traction in this space due to their non-volatility, low latency, and exceptional endurance.

These memory technologies enable faster access to critical datasets while minimizing energy consumption, making them highly suitable for supercomputers, research institutions, and cloud data centers.

- In April 2024, Everspin Technologies announced that IBM selected its PERSYST EMD4E001G 1Gb STT-MRAM for the FlashCore Module 4, citing features such as data integrity, high bandwidth, and non-volatility. The collaboration reflects the growing adoption of STT-MRAM in enterprise storage applications.

Next Generation Memory Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Volatile, Non-Volatile

|

|

By Wafer Size

|

200 mm, 300 mm

|

|

By Application

|

Consumer Electronics, Automotive, Industrial Automation, Government, IT & Telecommunications, Aerospace & Defense, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Volatile and Non-Volatile): The volatile segment held 62.15% of the market in 2024 due to the extensive reliance on DRAM and SRAM across computing, smartphones, and data centers, where high-speed and low-latency memory are critical.

- By Wafer Size (200 mm and 300 mm): The 200 mm segment is anticipated to grow at a CAGR of 20.34% over the forecast period, owing to increasing demand for cost-effective semiconductor fabrication for next generation memory technologies.

- By Application (Consumer Electronics, Automotive, Industrial Automation, Government, IT & Telecommunications, Aerospace & Defense, Healthcare, and Others): The consumer electronics segment is projected to reach USD 6.83 billion by 2032, owing to rising demand for energy-efficient, high-performance memory in smartphones, wearables, tablets, and gaming devices.

Next Generation Memory Market Regional Analysis

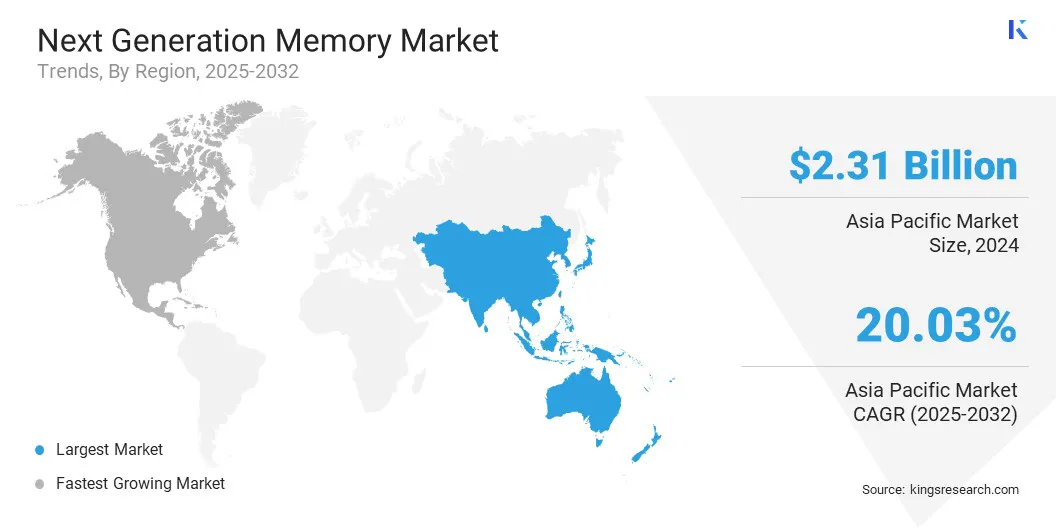

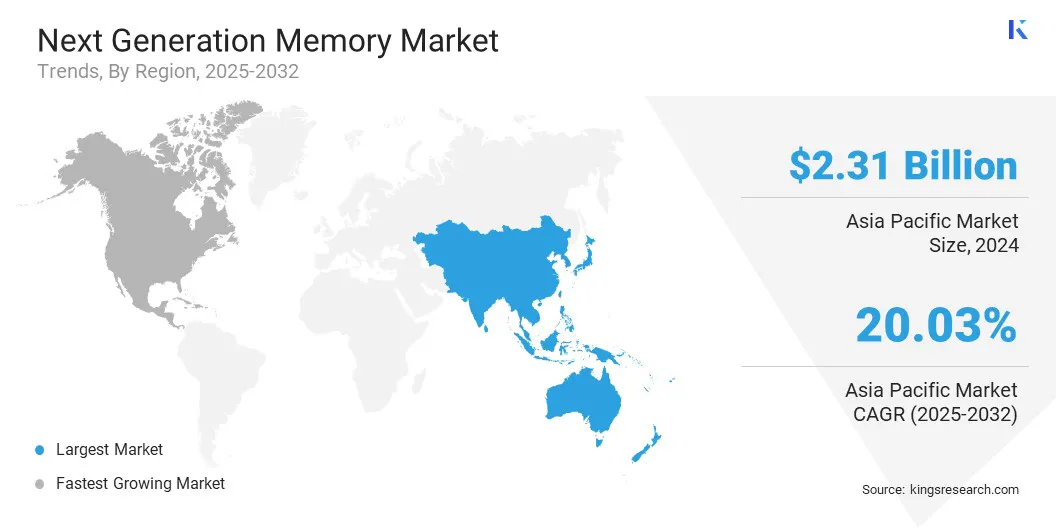

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific next generation memory market stood at 33.49% in 2024 in the global market, with a valuation of USD 2.31 billion, reflecting the region’s pivotal role in the semiconductor ecosystem.

Countries such as China, South Korea, Japan, and Taiwan dominate memory manufacturing and have established themselves as global leaders in R&D and large-scale production of DRAM, NAND, and emerging memory technologies like MRAM and ReRAM. The region benefits from significant government support, expanding fabrication facilities, and strong demand across consumer electronics, data centers, and automotive sectors.

The rising adoption of AI, IoT, and 5G-enabled devices further accelerates next generation memory integration. Moreover, the presence of leading players like Samsung, SK hynix, and Kioxia that are actively launching next generation memory solutions is driving the maket across the Asia Pacific.

North America is poised for significant growth at a robust CAGR of 20.20% over the forecast period. This growth is primarily fueled by the rapid adoption of advanced memory solutions in AI, big data analytics, and cloud computing, particularly within large hyperscale data centers located in the U.S.

Additionally, the region benefits from strong investments in R&D, collaborations between semiconductor firms and technology giants, and early adoption of memory technologies in sectors such as defense, aerospace, and autonomous vehicles. The presence of key innovators like Micron Technology, IBM, and emerging startups further drives advancements in MRAM, ReRAM, and PCM.

- In August 2025, SanDisk Corporation signed a strategic MOU with SK hynix to co-develop High Bandwidth Flash, a next-generation memory technology aimed at enhancing AI inference performance.

Regulatory Frameworks

- In the U.S., the CHIPS and Science Act regulates semiconductor manufacturing and innovation. It provides funding and incentives to boost domestic chip production, boosting research and development for next generation memory technologies critical to AI, defense, and advanced computing.

- In the European Union, the EU Chips Act regulates semiconductor capacity building and supply chain resilience. It aims to enhance Europe’s technological sovereignty, supporting investments in next generation memory to strengthen regional competitiveness and reduce dependence on external suppliers.

- In China, the National Integrated Circuit Industry Development Guidelines regulate semiconductor industry development. It prioritizes large-scale investment, infrastructure expansion, and talent cultivation, ensuring strong domestic progress in next generation memory technologies such as MRAM and ReRAM.

- In Japan, the Semiconductor Strategy Promotion Guidelines regulate technology advancement and industrial competitiveness.

- In South Korea, the K-Semiconductor Belt Strategy regulates semiconductor cluster development.

Competitive Landscape

Key players in the next generation memory market are pursuing multifaceted strategies to strengthen their competitive positions and capture growth opportunities. Market players are focusing heavily on research and development (R&D) to accelerate commercialization of advanced technologies such as MRAM, ReRAM, and Phase-Change Memory, ensuring improvements in scalability, durability, and power efficiency.

Strategic collaborations and partnerships are being pursued with semiconductor foundries, cloud service providers, and automotive technology firms to expand applications in data centers, AI, IoT, and autonomous vehicles.

- In October 2023, Everspin Technologies, Inc. expanded its EMxxLX STT-MRAM product family, targeting applications requiring data persistence, low latency, energy efficiency, and security. The solution is designed for industrial IoT, enterprise infrastructure, automation, aerospace, medical, gaming, and FPGA configuration, strengthening its position in the market.

Top Companies in Next Generation Memory Market:

- Infineon Technologies AG

- Fujitsu

- Samsung

- Micron Technology, Inc.

- SK HYNIX INC.

- STMicroelectronics

- Toshiba Corporation

- Everspin Technologies Inc.

- Intel Corporation

- Kioxia Corporation

- Microchip Technology Inc.

- CrossBar, Inc.

- Renesas Electronics Corporation

- Sandisk Corporation

- Honeywell International Inc.

Recent Developments (Launch)

- In June 2025, SK hynix showcased advanced next-generation memory solutions for AI servers, PCs, and mobile devices at COMPUTEX Taipei 2025.

- In February 2025, Kioxia Corporation and SanDisk Corporation introduced advanced 3D flash memory technology, achieving a 4.8Gb/s NAND interface speed, enhanced power efficiency, and higher density. They aim to deliver capital-efficient, high-performance, and low-power next-generation memory solutions by integrating new CMOS with existing memory cell technology.