Market Definition

The market includes the design and development of hardware and software systems that mimic the structure and functioning of the human brain. It focuses on creating processors using spiking neural networks and advanced algorithms to enable low-power, real-time data processing.

Applications include robotics, autonomous vehicles, smart sensors, and edge AI devices. The scope spans brain-inspired architectures, sensory processing, and adaptive learning mechanisms. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Neuromorphic Computing Market Overview

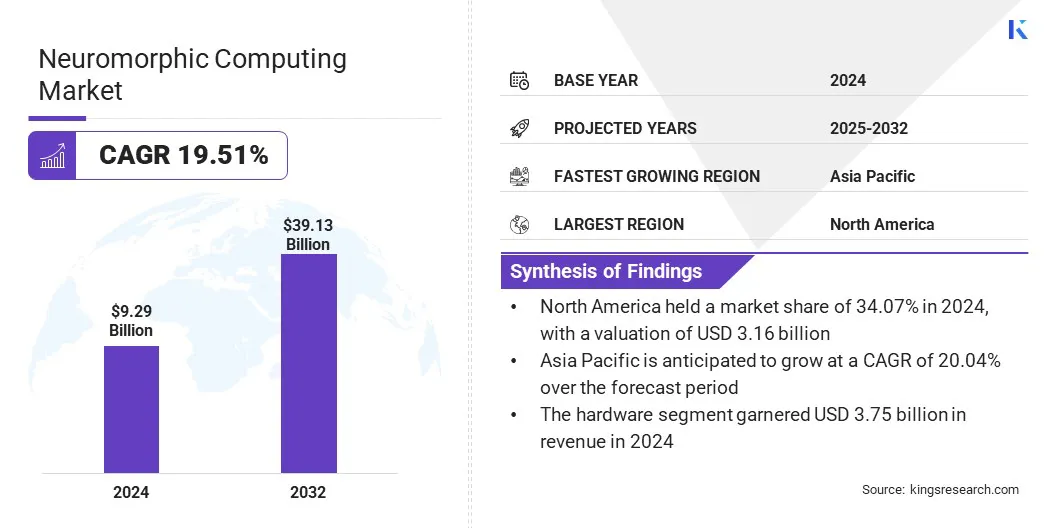

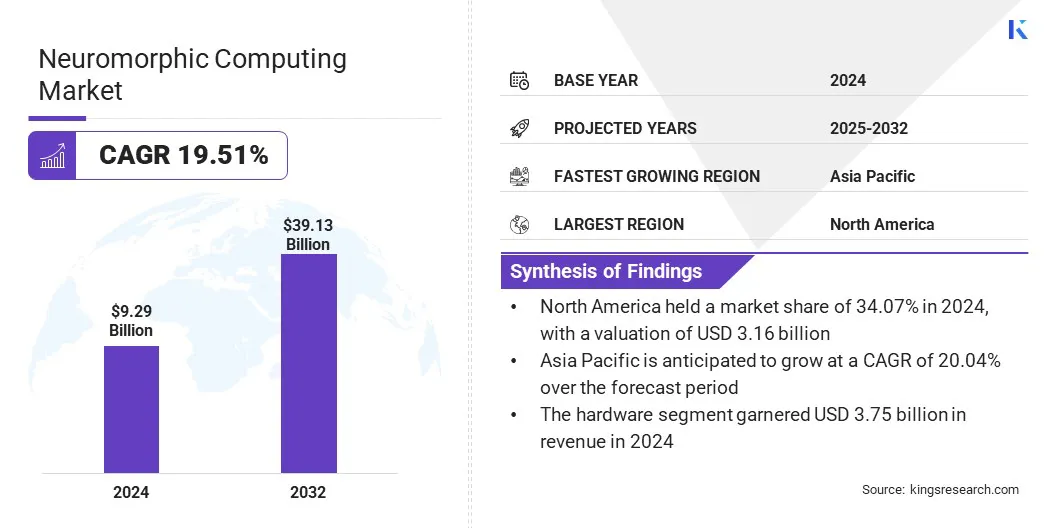

The global neuromorphic computing market size was valued at USD 9.29 billion in 2024 and is projected to grow from USD 11.02 billion in 2025 to USD 39.13 billion by 2032, exhibiting a CAGR of 19.51% during the forecast period.

The growth of the market is driven by expanding applications in edge AI devices and increasing demand for real-time data processing. A notable shift toward brain-machine interfaces and cognitive computing is further accelerating development, as industries explore more efficient, adaptive systems for advanced decision-making and human-like perception.

Major companies operating in the neuromorphic computing industry are Intel Corporation, IBM, BrainChip, Inc., Qualcomm Technologies, Inc., SAMSUNG, Sony Corporation, SynSense, MediaTek Inc., NXP Semiconductors N.V., Advanced Micro Devices, Inc., Hewlett Packard Enterprise Development LP, OMNIVISION, Prophesee S.A., MEMCOMPUTING, and General Vision Inc.

Market expansion is fueled by the need for low-power, high-performance hardware. Traditional AI systems consume substantial energy during data processing. Neuromorphic chips, designed to mimic brain-like efficiency, offer reduced power consumption for complex tasks.

This makes them ideal for applications such as mobile devices, autonomous systems, and edge computing. As industries focus on sustainable computing, demand for neuromorphic solutions is rising across multiple sectors.

- In April 2024, Intel unveiled Hala Point, the world's largest neuromorphic computer designed to mimic the human brain. The system integrates 1,152 Loihi 2 chips, totaling 1.15 billion artificial neurons and 128 billion synapses distributed across 140,544 neuromorphic processing cores. Hala Point supports advnaced brain-inspired AI research, improving efficiency and adaptability in AI systems.

Key Highlights

- The neuromorphic computing market size was valued at USD 9.29 billion in 2024.

- The market is projected to grow at a CAGR of 19.51% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 3.16 billion.

- The hardware segment garnered USD 3.75 billion in revenue in 2024.

- The cloud segment is expected to reach USD 23.07 billion by 2032.

- The signal processing segment secured the largest revenue share of 28.08% in 2024.

- The consumer electronics segment is set to grow at a robust CAGR of 20.04% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 20.04% over the forecast period.

Market Driver

Expanding Applications in Edge AI Devices

The market is growing rapidly due to its compatibility with edge AI requirements. These systems need localized processing with minimal latency and low energy usage.

Neuromorphic chips offer fast decision-making capabilities, making them suitable for real-time applications such as smart cameras, IoT sensors, and autonomous drones. Their ability to learn and adapt at the edge without cloud reliance enhances their value, particularly in remote or resource-constrained environments.

- In January 2025, BrainChip Holdings Ltd launched its Akida neural processor in the compact M.2 form factor. Approximately the size of a stick of gum, this design offers low-cost, high-speed, and low-power consumption options for developers building edge AI solutions. The AKD1000-powered boards can be easily integrated into M.2 slots, enabling efficient AI processing in space-constrained environments such as industrial automation, factory service centers, and network access devices.

Market Challenge

Complex Hardware Integration and Standardization

A significant challenge hindering the growth of the neuromorphic computing market is the complexity of hardware integration and the lack of standardization. Designing chips that mimic neural behavior while ensuring compatibility with existing systems remains technically demanding.

To address this challenge, key players are collaborating with research institutions to develop open architectures and modular platforms. Significant investments are being made in hybrid systems that integrate neuromorphic and traditional computing to facilitate adoption.

Industry groups are also pushing for common frameworks to accelerate development and reduce fragmentation. These initiatives aim to streamline deployment and make neuromorphic solutions more accessible across different applications.

Market Trend

Shift Toward Brain-Machine Interfaces and Cognitive Computing

Increasing focus on cognitive computing is contributing to the expansion of the market. Research in brain-machine interfaces and neural prosthetics depends on processors that can handle synapse-level interactions.

Neuromorphic hardware enables real-time simulation of neural activities, supporting advanced applications in neuroscience and human augmentation. These technologies are gaining traction in both academic research and commercial development, leading to the increased demand for neuromorphic platforms.

- In March 2025, researchers at the University of Hong Kong, in collaboration with Tsinghua University and Tianjin University, developed a memristor-based adaptive neuromorphic decoder for brain-computer interfaces. This innovative approach allows for energy-efficient, real-time decoding of brain signals, achieving precise drone flight control with significantly lower energy consumption compared to traditional systems.

Neuromorphic Computing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Deployment

|

Edge, Cloud

|

|

By Application

|

Signal Processing, Image Processing, Data Processing, Object Detection, Others

|

|

By End User

|

Consumer Electronics, Automotive, Healthcare, Military & Defense

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 3.75 billion in 2024, mainly due to increasing demand for specialized chips that enable faster, energy-efficient processing across edge devices and AI-driven systems.

- By Deployment (Edge and Cloud): The cloud segment held a share of 59.85% in 2024, fueled by its ability to support large-scale processing, flexible infrastructure, and cost-effective deployment for complex AI workloads across industries.

- By Application (Signal Processing, Image Processing, Data Processing, Object Detection, and Others): The signal processing segment is projected to reach USD 11.00 billion by 2032, propelled by its critical role in enabling fast, energy-efficient interpretation of complex data streams in real-time across industries such as defense, automotive, and industrial automation.

- By End User (Consumer Electronics, Automotive, Healthcare, Military & Defense, and Others): The consumer electronics segment is set to grow at a staggering CAGR of 20.04% through the forecast period, largely attributed to rising demand for energy-efficient, real-time processing in smart devices such as wearables and smartphones, leading to widespread adoption.

Neuromorphic Computing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America neuromorphic computing market share stood at around 34.07% in 2024, valued at USD 3.16 billion. North America houses several leading developers such as Intel, IBM, and BrainChip, which are actively commercializing neuromorphic processors.

Their R&D efforts, prototype testing, and early-stage deployments are boosting this expansion. Proximity to advanced semiconductor facilities and AI labs accelerates innovation cycles, enhancing product development and practicla applications.

Moreover, North American institutions and universities contribute to a strong knowledge base, skilled workforce, and academic-industry collaborations, sustaining the region’s leadership in neuromorphic innovation and commercialization.

- In March 2025, researchers at UC San Diego Supercomputing Center introduced HiAER-Spike, a modular, reconfigurable, event-driven neuromorphic computing platform. Designed to execute large spiking neural networks with up to 160 million neurons and 40 billion synapses, HiAER-Spike offers efficient, low-latency event-driven inference suitable for both edge and cloud computing applications.

The Asia Pacific neuromorphic computing industry is estimated to grow at a robust CAGR of 20.52% over the forecast period. The region plays a key role in global semiconductor fabrication, with advanced manufacturing clusters supporting chip design and production. This infrastructure is being leveraged for neuromorphic hardware development.

Local firms are entering the market by customizing chips for specific applications such as smart vision and robotics. Access to fabrication facilities is reducing production costs and accelerating deployment.

Furthermore, governments in Asia Pacific are actively supporting research in brain-inspired computing through national AI strategies and funding programs. These initiatives are helping regional startups and semiconductor firms prototype and test neuromorphic systems, which is contributing to early-stage commercialization and regional market growth.

- In January 2025, the Indian Institute of Science hosted the Bangalore Neuromorphic Engineering Workshop 2025 to provide advanced training for emerging researchers in neuromorphic technologies. The workshop focused on topics such as neuromorphic integrated circuits, event-based sensing, and brain-computer interfaces, supporing community development in the Asia-Pacific region.

Regulatory Frameworks

- The neuromorphic computing industry in the U.S. is governed by the National Quantum Initiative Act, which supports quantum and neuromorphic R&D. The Department of Commerce's export control rules restrict the transfer of advanced computing hardware, impacting global neuromorphic supply chains. Additionally, environmental laws such as the Resource Conservation and Recovery Act and the Comprehensive Environmental Response, Compensation, and Liability Act apply to chip development and hardware production processes.

- The UK General Data Protection Regulation, aligned with the European Union’s GDPR, governs the handling of personal data by neuromorphic systems, particularly in surveillance and cognitive AI applications, ensuring legal compliance in data-sensitive deployments.

- China regulates neuromorphic computing under its 2017 Cybersecurity Law and the 2021 Personal Information Protection Law. These laws require that neuromorphic systems handling personal or sensitive data comply with strict data localization and user consent rules.

- South Korea regulates neuromorphic computing through its Personal Information Protection Act, enforced by the Personal Information Protection Commission. This legislation governs the collection and processing of personal data by AI systems, including neuromorphic platforms. The National Artificial Intelligence Committee oversees policy direction, incorporating neuromorphic computing into the country's AI chip development.

Competitive Landscape

Major players in the neuromorphic computing market are adopting strategies such as product innovation and application-specific hardware development. These strategies focus on enhancing processing speed, accuracy, and energy efficiency, aligning with the increasing demand for advanced sensing and real-time decision-making in industrial settings.

Companies are investing in specialized chips tailored for machine vision and inspection, reflecting a notable shift toward domain-focused neuromorphic solutions that offer higher value across automation-driven industries.

- In November 2024, Sony Semiconductor Solutions Corporation announced the release of the IMX925, a new industrial CMOS image sensor featuring a global shutter. This sensor offers high-speed processing at 394 frames per second and a high pixel count of 24.55 effective megapixels, supporting faster recognition and inspection in various industrial applications.

List of Key Companies in Neuromorphic Computing Market:

- Intel Corporation

- IBM

- BrainChip, Inc.

- Qualcomm Technologies, Inc.

- SAMSUNG

- Sony Corporation

- SynSense

- MediaTek Inc.

- NXP Semiconductors N.V.

- Advanced Micro Devices, Inc.

- Hewlett Packard Enterprise Development LP

- OMNIVISION

- Prophesee S.A.

- MEMCOMPUTING

- General Vision Inc.

Recent Developments (Product Launches, Investment)

- In April 2025, BrainChip showcased its event-based vision system at Embedded World 2025, integrating Prophesee's GenX320 event-based vision sensor with BrainChip's Akida neuromorphic processor. This combination enables high-speed, low-latency processing for applications in autonomous vehicles, industrial automation, IoT, security, surveillance, and AR/VR.

- In February 2025, Prophesee announced a USD 2 million investment to develop the next generation of neuromorphic AI dedicated to mobile phones. This initiative aims to enhance mobile imaging capabilities by integrating advanced event-based vision sensors with AI processing.

- In August 2023, SynSense released the Speck Demo Kit, enabling users to rapidly deploy and validate event-based neuromorphic vision applications. This compact development module facilitates the integration of neuromorphic sensors into various vision systems.