Network Infrastructure Market Size

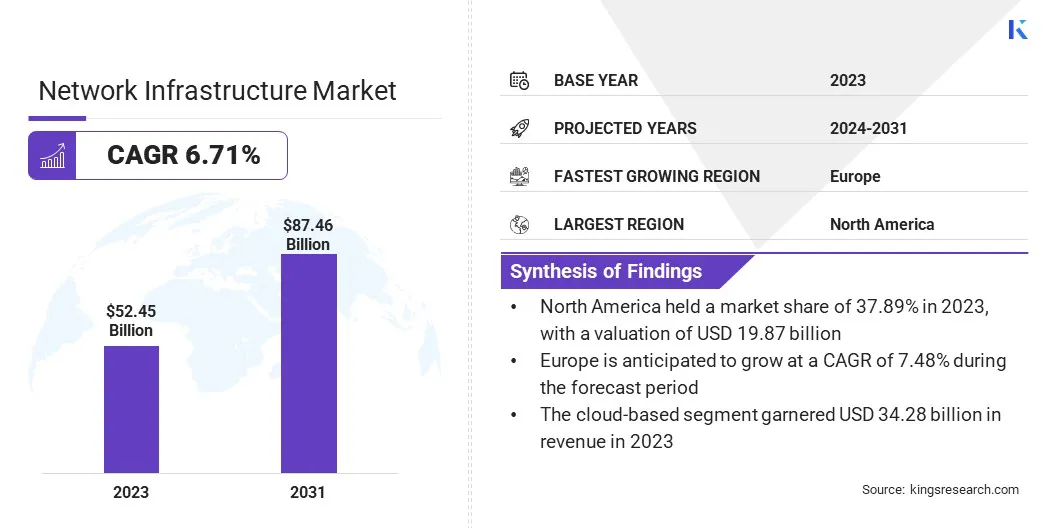

The global Network Infrastructure Market size was valued at USD 52.45 billion in 2023 and is projected to grow from USD 55.51 billion in 2024 to USD 87.46 billion by 2031, exhibiting a CAGR of 6.71% during the forecast period. Rapid increase in data consumption and advancements in network technologies are augmenting market growth.

In the scope of work, the report includes solutions offered by companies such as ALE International, Telefonaktiebolaget LM Ericsson, Arista Networks, Inc., Broadcom, Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Nokia, ZTE Corporation, and others.

The demand for edge computing is growing rapidly as organizations seek to process data closer to the source, reducing latency and enhancing real-time decision-making. Edge computing allows for decentralized processing, where data is analyzed and acted upon near its origin rather than being sent to centralized cloud data centers.

This is particularly beneficial for industries such as autonomous vehicles, healthcare, and manufacturing, where immediate response times are critical. The proliferation of Internet of Things (IoT) devices, which generate vast amounts of data, is highlighting the need for edge computing to minimize data transmission costs and network congestion.

The development of 5G networks further boosts the adoption of edge computing, as high-speed, low-latency communication enables faster and more efficient data processing at the edge.

- For instance, in May 2024, the Government of Ghana, Ascend Digital, K-NET, Radisys, Nokia, Tech Mahindra, AT Ghana, and Telecel Ghana partnered to form Next-Gen InfraCo (NGIC) to deliver affordable 5G services across Ghana. NGIC has secured a 5G license and plans to launch within six months.

This presents a significant opportunity for companies to invest in edge infrastructure, providing new avenues for growth and differentiation in a competitive landscape. As businesses prioritize speed and efficiency, edge computing is expected to become a key component of modern network infrastructure.

Network infrastructure refers to the hardware and software resources that enable network connectivity, communication, and operations in an organization. It forms the backbone of any digital ecosystem by supporting the transmission of data across different devices, systems, and locations.

The key components of network infrastructure include routers, switches, servers, wireless access points, and cabling systems, which collectively ensure seamless data exchange. Network infrastructure can be deployed through different types, including wired (fiber optic, copper) and wireless networks (Wi-Fi, 5G).

Deployment models vary from traditional on-premise setups to cloud-based and hybrid solutions, depending on organizational needs. End users of network infrastructure include individual consumers requiring residential networks, as well as enterprises, government agencies, and telecom companies needing reliable and secure connectivity.

Given the rise of technologies such as IoT, 5G, and cloud computing, robust and scalable network infrastructures are essential for businesses to remain competitive.

Analyst’s Review

The current landscape of the network infrastructure market is shaped by strategic shifts and evolving priorities among key players, who are navigating through rapid technological advancements and rising data demands.

Companies are focusing on expanding their product portfolios to include next-generation networking solutions such as 5G-enabled devices, software-defined networks (SDN), and edge computing solutions to capture new market opportunities.

- For instance, in May 2024, Tata Communications introduced CloudLyte, an automated edge computing platform designed for future-ready enterprises. By leveraging 5G and IoT drive hyperconnectivity, CloudLyte enables real-time data processing and low-latency applications. Its versatile, cloud-agnostic architecture supports global enterprises.

Moreover, numerous companies are investing heavily in research and development (R&D) to innovate in network virtualization and automation technologies, which help reduce operational costs and increase agility.

Partnerships and acquisitions have become common strategies, with firms seeking to strengthen their market positions by collaborating with cloud providers, hardware manufacturers, and telecom operators. The current growth trajectory is further supported by government-backed initiatives for digital transformation and infrastructure modernization.

However, to maintain their competitive edge, these companies must prioritize scalability, security, and integration, as emerging technologies demands seamless transition and future-proof infrastructure. Maintaining a balance between innovation and cost management remains an imperative for sustained growth.

Network Infrastructure Market Growth Factors

Advancements in network technologies are playing a crucial role in shaping the landscape of communication and data transfer. Innovations such as software-defined networking (SDN), network functions virtualization (NFV), and cloud-based networking are transforming network management and scalability for organizations.

SDN allows for more centralized control, enabling dynamic adjustments and optimized resource allocation, while NFV reduces the dependency on traditional hardware by allowing network functions to be managed virtually.

These advancements enhance flexibility, speed, and cost efficiency, which are essential for handling the ever-growing data traffic resulting from digital transformation initiatives.

Additionally, advancements in fiber optics, Wi-Fi 6, and 5G are improving network performance by offering faster data transmission speeds and lower latency, crucial for supporting IoT, real-time analytics, and high-definition streaming.

As businesses increasingly rely on cloud and edge computing, these technological improvements are critical for network infrastructures to handle future workloads. This offers a competitive advantage for companies that invest early in next-generation networking solutions.

The high cost associated with upgrading and maintaining network infrastructures present a significant challenge for many organizations, especially as technological demands rise. Upgrading to newer technologies such as 5G, edge computing, and SDN requires substantial capital investments in hardware, software, and expertise.

Additionally, the maintenance of these systems involves ongoing expenses for repairs, updates, and skilled personnel to manage the complexity of modern networks. For small and medium-sized businesses, these costs can be prohibitive, hindering their ability to compete with larger firms with greater resources. Legacy systems exacerbate the issue, as integrating new technologies with outdated infrastructure presents technical and financial challenges.

To mitigate this challenge, companies may implement phased upgrades, modernizing in stages, and prioritizing critical areas first. Leveraging cloud-based solutions may further reduce upfront capital expenditure, as these models typically operate on a subscription basis, spreading costs over time.

Outsourcing network management to managed service providers (MSPs) is another cost-effective solution, allowing businesses to focus on core operations while maintaining network efficiency.

Network Infrastructure Market Trends

The rise in 5G network deployments is a major trend transforming the global network infrastructure market. 5G technology offers increased speeds, lower latency, and higher data capacity compared to its predecessors, crucial for the advancement of autonomous vehicles, smart cities, and real-time IoT applications.

Telecom operators across the globe are investing heavily in 5G infrastructure to meet growing consumer and enterprise demand for faster, more reliable connectivity.

- For instance, in August 2024, Ericsson and UScellular announced an infrastructure upgrade involving Ericsson’s Router 6000 portfolio and the new Router 6671. This initiative aims to enhance 5G transport infrastructure and extend high-speed internet access to rural areas in America. This collaboration supports efficient mid-band spectrum deployment for their ongoing 2023 radio access network (RAN) initiatives.

This shift is further fostering innovation in networking hardware, with companies developing 5G-enabled routers, switches, and antennas to support the new standard.

The deployment of 5G is expected to fuel digital transformation across multiple sectors, including healthcare, manufacturing, and logistics, by enabling technologies such as augmented reality (AR), virtual reality (VR), and machine-to-machine (M2M) communication.

However, widespread 5G deployment requires significant investment in upgrading existing network infrastructure, particularly in rural and underdeveloped areas with limited connectivity. The trend is expected to accelerate over the next few years, fueling the growth of the market.

Segmentation Analysis

The global market has been segmented based on type, component, deployment, organization size, end user, and geography.

By Type

Based on type, the market has been segmented into personal area network (PAN), local area network (LAN), metropolitan area network (MAN), and wide area network (WAN). The wide area network (WAN) segment captured the largest network infrastructure market share of 44.87% in 2023, largely due to its critical role in connecting geographically dispersed networks and enabling communication between remote offices, data centers, and users.

The growing demand for global connectivity among enterprises, particularly those operating across multiple regions, has fueled the adoption of WAN solutions. WANs provide the infrastructure for efficient data transfer, collaboration, and access to cloud-based resources, which are crucial for modern business operations.

Additionally, with the rise of cloud computing, hybrid work models, and remote access requirements, businesses are increasingly reliant on secure and scalable WAN solutions to ensure uninterrupted operations. Technologies such as software-defined networking (SDN) have further boosted segmental growth by offering more flexible, cost-effective, and optimized network performance compared to traditional WANs.

The need for enhanced security, scalability, and network efficiency in managing distributed IT environments has made WAN the preferred choice for enterprises, contributing significantly to its dominance.

By Component

Based on component, the market has been categorized into hardware, software, and network services. The network services segment is set to grow at a robust CAGR of 7.90% through the forecast period, mainly due to the increasing demand for managed and professional services across various industries.

As businesses increasingly adopt digital transformation, the complexity of network infrastructure grows, prompting organizations to seek external expertise to manage, optimize, and secure their networks. Managed services, such as network monitoring, troubleshooting, and security, are favored for their cost-effectiveness compared to maintaining in-house teams.

Furthermore, the rise of cloud computing, software-defined networking (SDN), and edge computing is contributing to the expansion of the network services segment, as companies require specialized services to implement and maintain these advanced technologies.

Additionally, network services provide scalability and flexibility, allowing businesses to adapt quickly to changing technological environments. The shift toward hybrid and remote work models has increased the reliance on network services to ensure seamless connectivity and cybersecurity, thereby augmenting the growth of the segment.

By Deployment

Based on deployment, the market has been classified into on-premises and cloud-based. The cloud-based segment led the network infrastructure market in 2023, reaching a valuation of USD 34.28 billion, propelled by the rapid adoption of cloud computing across various industries.

As organizations shift their IT infrastructure and applications to the cloud, the demand for cloud-based network infrastructure has surged, providing more scalable, flexible, and cost-effective solutions.

Cloud-based infrastructures enable businesses to manage and store data more efficiently, reducing the need for costly on-premises hardware and allowing for more agile operations. The increasing adoption of hybrid cloud models, integrating both public and private cloud environments, has further fueled the demand for cloud-based networking solutions to optimize performance, security, and flexibility.

Additionally, the growing reliance on software-as-a-service (SaaS), infrastructure-as-a-service (IaaS), and Platform-as-a-service (PaaS) solutions highlights the need for robust, cloud-based networks capable of supporting large-scale, dynamic workloads.

Network Infrastructure Market Regional Analysis

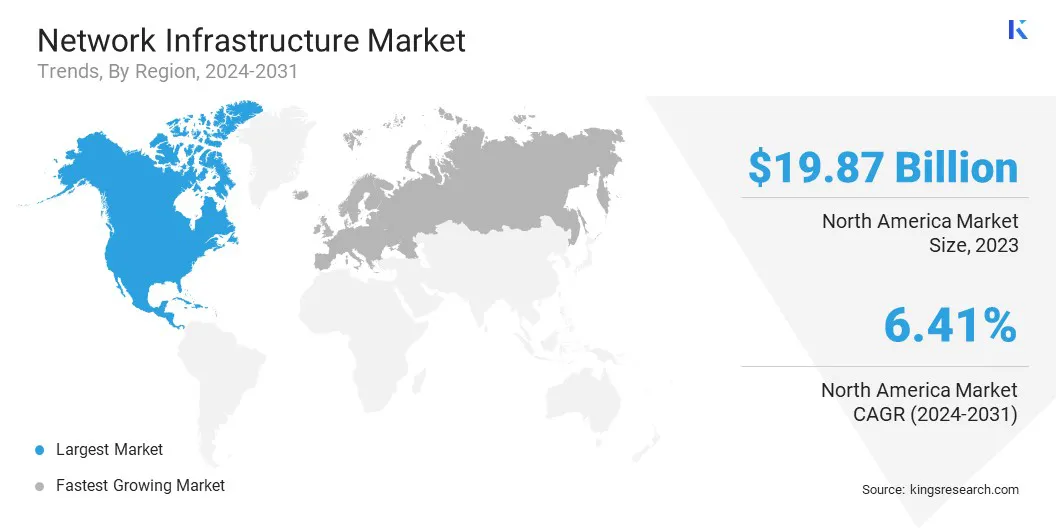

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America network infrastructure market accounted for a considerable share of 37.89% and was valued at USD 19.87 billion in 2023. This domiance is reinforced by the region’s advanced technological landscape, early adoption of cutting-edge networking technologies such as 5G, and the presence of major global players.

The robust digital infrastructure high demand for advanced connectivity solutions has increased investments in advanced network infrastructure. Key industries, including IT, healthcare, and financial services, are supporting this growth through ongoing digital transformation initiatives and the adoption of cloud computing, software-defined networking (SDN), and edge computing.

Furthermore, government initiatives to strengthen cybersecurity and promote broadband connectivity in underserved regions have boosted infrastructure investments. The growing shift to remote and hybrid work models has further spurred the demand for secure and scalable network solutions across the region.

As digitalization progresses, North America is expected to maintain its leading position due to ongoing investments in networking technologies and infrastructure upgrades.

Europe network infrastructure industry is poised to grow at the highest CAGR of 7.48% in the forthcoming years. This growth is largely attributed to the region's aggressive digital transformation initiatives, leading to increased investment in advanced network technologies.

European governments and enterprises are prioritizing the development of high-speed internet connectivity, particularly with the widespread rollout of 5G networks across the continent.

The European Union's Digital Strategy, designed to position Europe as a global leader in digital innovation, is supporting this growth. Additionally, the region's focus on smart city projects, IoT adoption, and the integration of edge computing into business operations is further propelling the demand for sophisticated network infrastructures.

Europe's diverse industrial base, which includes automotive, manufacturing, healthcare, and finance sectors, is increasingly relying on robust network infrastructures to support digitalization and automation efforts. Moreover, Europe's emphasis on sustainability and green technologies is influencing regional market, with companies investing in energy-efficient data centers and eco-friendly networking solutions.

Competitive Landscape

The global network infrastructure market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Network Infrastructure Market

Key Industry Development

- February 2024 (Expansion): Fujitsu Network Communications, Inc. announced that digital infrastructure investor Ubiquity is leveraging Fujitsu's carrier-class Network Operations Center (NOC) in Texas. This partnership aims to provide managed services to support last-mile fiber broadband infrastructure in four major U.S. markets, thereby enhancing Ubiquity's network performance and operational efficiency.

The global network infrastructure market is segmented as:

By Type

- Personal Area Network (PAN)

- Local Area Network (LAN)

- Metropolitan Area Network (MAN)

- Wide Area Network (WAN)

By Component

- Hardware

- Software

- Network Services

By Deployment

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End User

- IT and Telecommunications

- BFSI

- Healthcare

- Manufacturing

- Government

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America