Market Definition

Network attached storage refers to a dedicated file storage server connected to a network that provides organized, centralized data access for multiple users and devices. These storage systems offer scalable capacity and enhanced data management capabilities. The market encompasses centralized storage solutions for organizations of all sizes. These systems support functions such as file sharing, backup, archiving, and collaboration across multiple sectors.

Network Attached Storage Market Overview

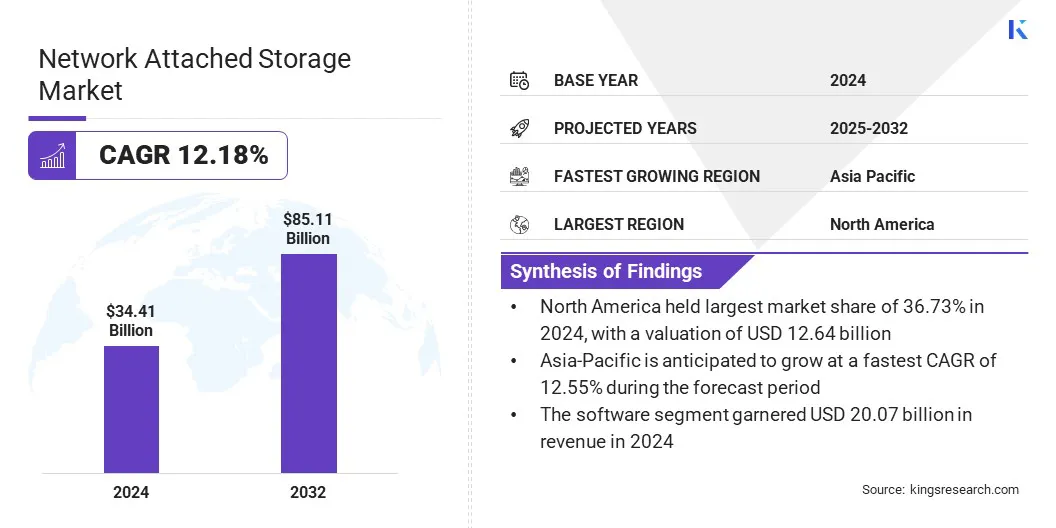

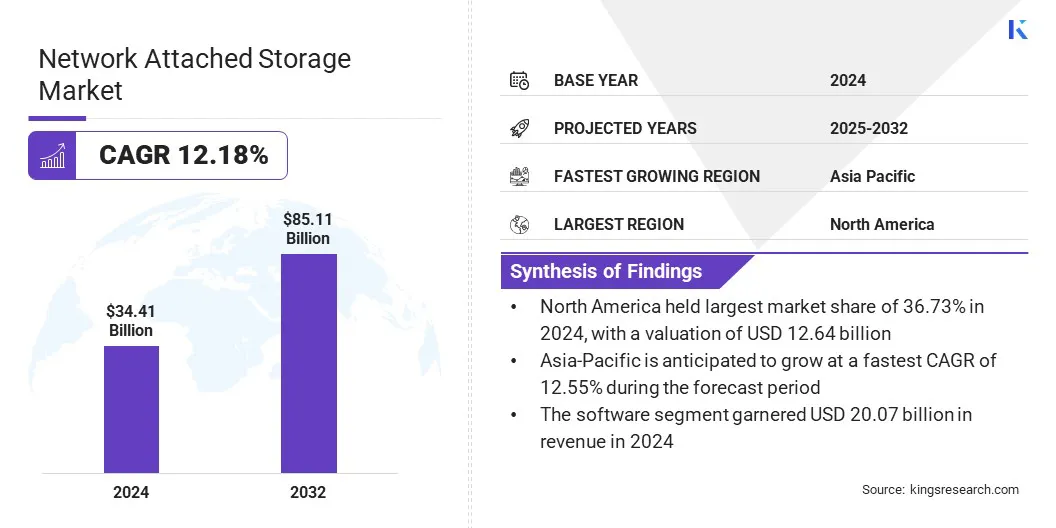

The global network attached storage market size was valued at USD 34.41 billion in 2024 and is projected to grow from USD 38.06 billion in 2025 to USD 85.11 billion by 2032, exhibiting a CAGR of 12.18% during the forecast period.

Market growth is propelled by the rising need for efficient data storage and management across enterprises generating vast amounts of digital information. The increasing adoption of remote work, cloud-based applications, and data-driven decision-making is creating a demand for scalable and centralized storage solutions.

Major companies operating in the network attached storage industry are Synology Inc., Dell Inc., QNAP Systems, Inc., ASUSTOR Inc., Western Digital Corporation, IBM, Hitachi Vantara LLC, Zyxel, NETGEAR, NetApp, TerraMaster, Seagate Technology, NEC Corporation, Buffalo Inc., and Huawei Technologies Co., Ltd.

Advancements in storage technologies, including improved data deduplication, faster access speeds, and enhanced security features, are expanding the capabilities of network attached storage systems. Organizations across sectors such as media, healthcare, education, and manufacturing are leveraging these solutions to ensure reliable data access, backup, and collaboration, accelerating global adoption.

- In June 2025, Other World Computing (OWC) announced major updates to its Jellyfish network attached storage (NAS) solutions, including enhanced performance, improved collaboration features, and greater compatibility with creative workflows. These upgrades aim to support high-demand content creation environments with scalable and reliable storage capabilities.

Key Highlights

- The network attached storage market size was valued at USD 34.41 billion in 2024.

- The market is projected to grow at a CAGR of 12.18% from 2025 to 2032.

- North America held a share of 36.73% in 2024, valued at USD 12.64 billion.

- The software segment garnered USD 20.07 billion in revenue in 2024.

- The cloud-based NAS/hybrid NAS segment is expected to reach USD 43.22 billion by 2032.

- The healthcare segment is anticipated to witness the fastest CAGR of 14.78% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 12.55% through the projection period.

Market Driver

Rising Data Volumes Across Enterprises

The progress of the network attached storage market is propelled by the rapid growth of enterprise data driven by digital transformation, e-commerce, and connected device ecosystems. Organizations are generating large volumes of data from customer transactions, operational systems, and IoT (Internet of Things) platforms, leading to increased demand for reliable, high-capacity storage infrastructure.

More enterprises are deploying network attached storage systems to streamline data management, enable seamless access, and support cross-functional collaboration. This shift is further supported by the need to integrate with cloud environments and meet regulatory requirements for data security and retention. The rising emphasis on data availability, efficiency, and scalability is reinforcing the strategic role of network attached storage in enterprise IT architecture.

Market Challenge

Network Dependency

Network dependency presents a significant challenge to the effective deployment of network attached storage systems, particularly in data-intensive and latency-sensitive environments. The performance and reliability of network attached storage solutions are directly affected by network stability and speed, making them vulnerable to issues such as bandwidth limitations, network congestion, and unexpected outages.

Inadequate network performance can lead to delayed data access, interrupted workflows, and reduced productivity, particularly during large file transfers or remote access scenarios. In virtualized and cloud-integrated setups, even minor network disruptions may cause critical delays in data availability, impacting real-time collaboration and operational continuity.

These limitations are prompting enterprises to invest in higher-capacity network hardware, redundant connections, and optimized traffic management to maintain consistent network attached storage performance. Vendors are also enhancing network attached storage systems with advanced caching, load balancing, and multi-path support to mitigate the risks of network-related performance degradation.

As businesses scale their data infrastructure, addressing network dependency remains essential for ensuring seamless access and storage efficiency.

Market Trend

Advancements in Hybrid Storage Integration

Advancements in hybrid storage integration are transforming the network attached storage market by enhancing scalability, flexibility, and operational efficiency across diverse enterprise environments. The ability to seamlessly combine on-premises network attached storage with public and private cloud platforms allows organizations to optimize data management, support remote access, and balance cost-effective storage allocation.

These hybrid models enable dynamic data tiering where frequently accessed data remains on local network attached storage while archival or less critical data is moved to the cloud, ensuring efficient resource utilization.

Integration with cloud-native disaster recovery, backup, and synchronization services further strengthens business continuity and data protection strategies. Additionally, hybrid network attached storage solutions support global collaboration by providing secure, consistent access to data across geographically dispersed teams.

- In March 2025, QNAP Systems, Inc. released QuTScloud2, the latest version of its cloud network attached storage (NAS) operating system, featuring enhanced security with a new Security Center and improved management tools for better system monitoring and configuration. The update reflects QNAP’s continued focus on delivering secure, efficient, and user-friendly storage solutions for hybrid and cloud-based environments.

Network Attached Storage Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Software (NAS Operating Systems, Backup & Recovery Software, Media Server Software, Others (File Sync & Share Software, Virtualization Support Software)), and Services (Professional Services, Managed Services, Support & Maintenance Services, Consulting Services)

|

|

By Deployment Type

|

On-Premises NAS, and Cloud-based NAS/Hybrid NAS

|

|

By Industry Vertical

|

IT & Telecommunications, Media & Entertainment, BFSI (Banking, Financial Services, and Insurance), Healthcare, and Others (Government & Public Sector, Retail, Education)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Software (NAS Operating Systems, Backup & Recovery Software, Media Server Software, Others (File Sync & Share Software, Virtualization Support Software)), and Services (Professional Services, Managed Services, Support & Maintenance Services, Consulting Services)): The software segment earned USD 20.07 billion in 2024, mainly due to rising demand for advanced data management, backup, and virtualization support across enterprise storage environments.

- By Deployment Type (On-Premises NAS and Cloud-based NAS/Hybrid NAS): The on-premises NAS segment held a share of 52.63% in 2024, largely attributed to greater control over data security, faster local access, and compliance with internal IT policies in enterprise environments.

- By Industry Vertical (IT & Telecommunications, Media & Entertainment, BFSI (Banking, Financial Services, and Insurance), Healthcare, and Others (Government & Public Sector, Retail, Education): The IT & telecommunications segment is projected to reach USD 27.31 billion by 2032, owing to increasing data traffic, widespread adoption of cloud services, and the need for scalable, high-performance storage infrastructure to support digital operations.

Network Attached Storage Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America network attached storage market share stood at 36.73% in 2024, valued at USD 12.64 billion. This dominance is attributed to the presence of advanced IT infrastructure, widespread adoption of digital transformation initiatives, and significant investments in cloud integration across enterprises.

Additionally, the regional market benefits from a strong presence of leading network attached storage vendors and early implementation of emerging technologies such as artificial intelligence, edge computing, and IoT (Internet of Things).

Favorable data privacy and cybersecurity regulations are boosting the adoption of secure, compliant storage solutions. Furthermore, the region’s focus on innovation, coupled with increasing enterprise reliance on data analytics and remote collaboration tools, is fueling demand for advanced network attached storage systems.

- In March 2025, Western Digital announced expanded its network attached storage (NAS) solutions in North America with high-capacity G-RAID and G-DRIVE models tailored for creative professionals. The launch also includes a new 26 TB WD Red Pro HDD optimized for 24/7 multi-user NAS environments, addressing rising storage needs in media production, AI workflows, and collaborative projects.

The Asia-Pacific network attached storage industry is set to grow at a CAGR of 12.55% over the forecast period. This growth is propelled by the rapid expansion of digital infrastructure and the increasing adoption of advanced data management solutions across industries. The region’s growing small and medium enterprise sector, coupled with rising investments in cloud services and smart city initiatives, is boosting demand for network attached storage systems.

Government programs supporting digital transformation and the development of data centers are further fueling regional market growth. Moreover, increased focus on data security, real-time analytics, and seamless remote access is accelerating the adoption of network attached storage solutions across diverse industries.

Regulatory Frameworks

- In the U.S., the Federal Information Security Modernization Act (FISMA) regulates information systems used by federal agencies. It mandates the implementation of risk-based security measures for data storage and transmission, making it relevant to network attached storage systems used in government and contractor environments.

- In the European Union, the General Data Protection Regulation (GDPR) regulates personal data storage and processing. It imposes strict requirements on the way organizations store, access, and secure personal data, directly influencing the design and management of network attached storage systems within the region.

- In India, the Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011 regulate the storage and protection of sensitive personal data. It requires organizations using network attached storage solutions to implement adequate security controls and data protection policies to ensure compliance.

Competitive Landscape

The network attached storage industry is characterized by the presence of several established players and emerging companies competing based on scalability, cloud integration, and data security capabilities. Key market participants are focusing on strategies such as product innovation, support for hybrid storage architectures, and enhanced data management features to meet the growing demands of enterprise and consumer users.

Companies are also investing in research and development to deliver solutions optimized for AI workloads, edge deployments, and seamless interoperability with virtualization platforms. Furthermore, strategic collaborations with cloud service providers and data center operators, along with mergers and acquisitions, are being leveraged to expand global presence, strengthen channel partnerships, and broaden solution offerings across diverse industry verticals.

- In May 2023, Arcitecta and Spectra Logic Corporation launched a high-performance, scale-out network attached storage (NAS) and object storage solution that integrates Mediaflux software with Spectra BlackPearl hardware. The system supports network file system (NFS) and server message block (SMB) protocols, offering automated tiering, enterprise data protection, and low-latency access for large-scale file management.

List of Key Companies in Network Attached Storage Market:

- Synology Inc.

- Dell Inc.

- QNAP Systems, Inc.

- ASUSTOR Inc.

- Western Digital Corporation

- IBM

- Hitachi Vantara LLC

- Zyxel

- NETGEAR

- NetApp

- TerraMaster

- Seagate Technology

- NEC Corporation

- Buffalo Inc.

- Huawei Technologies Co., Ltd.

Recent Developments (Launches)

- In June 2025, 7STARLAKE launched rugged airborne network attached storage (NAS) servers, THOR200-U8-D and THOR200-U8-SP, designed for defense and aerospace use. Built to withstand extreme conditions, these systems offer up to 64 TB capacity, RAID-10 support, and real-time data processing for mission-critical operations in SWaP-sensitive environments.

- In June 2023, Cobalt Iron introduced new features to enhance network attached storage (NAS) protection within its Compass enterprise backup platform, including faster file identification, flexible restores, and policy-based data management. The update improves backup efficiency across traditional and cloud-based systems.