Market Definition

Natural dyes are colorants derived from plants, minerals, and animals, used for dyeing textiles, paper, leather, and other materials. These dyes are obtained from sources such as roots, leaves, flowers, bark, fruits, and insects. Unlike synthetic dyes, natural dyes are biodegradable, eco-friendly, and produce soft, muted tones.

Natural Dyes Market Overview

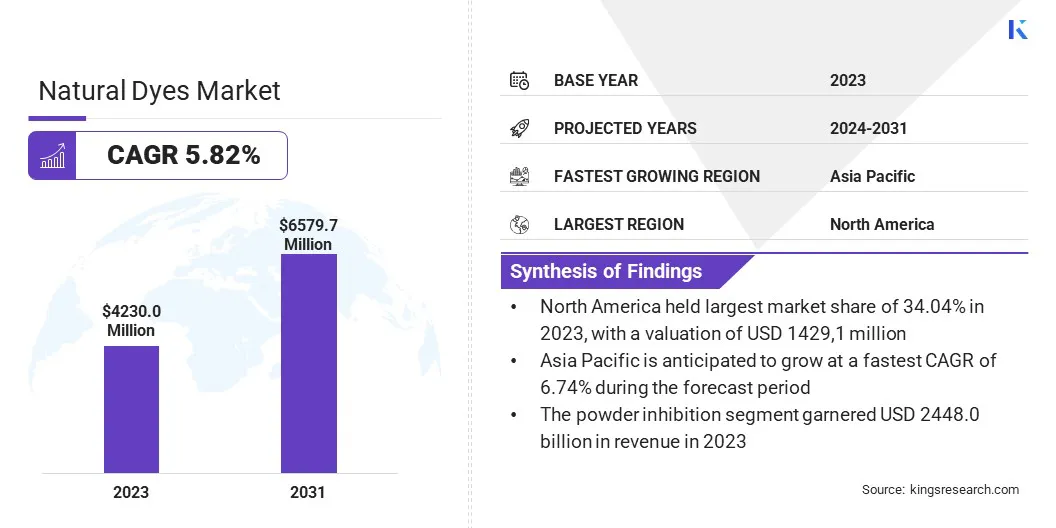

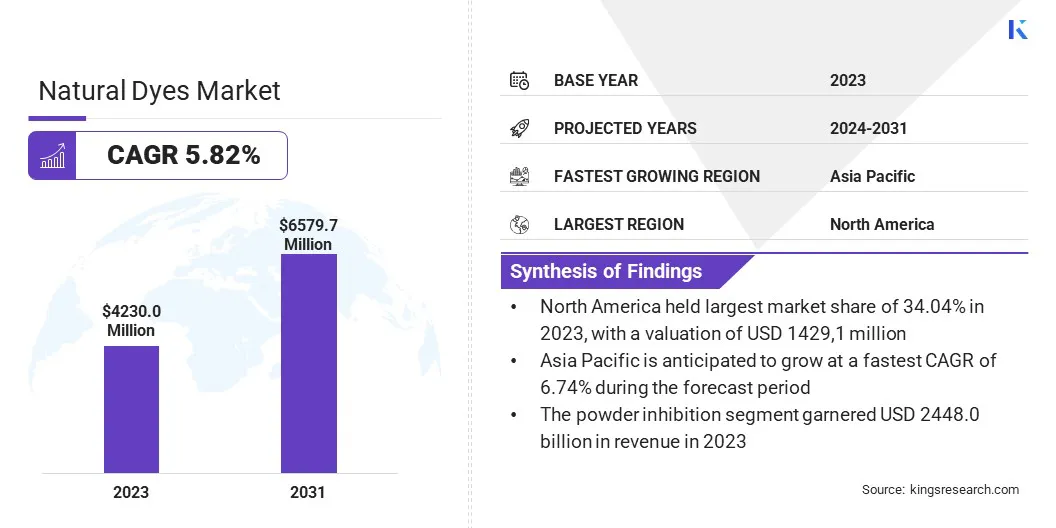

The global natural dyes market size was valued at USD 4230.0 million in 2023 and is projected to grow from USD 4427.3 million in 2024 to USD 6579.7 million by 2031, exhibiting a CAGR of 5.82% during the forecast period.

This market is experiencing significant growth due to increasing consumer preference for eco-friendly and sustainable products. Rising awareness about the environmental impact of synthetic dyes has led to a surge in demand for natural alternatives, particularly in the textile, food, and cosmetics industries.

The expansion of organic and plant-based product lines, along with advancements in dye extraction technologies, is further driving market growth.

Major companies operating in the natural dyes market are IndiDye Natural Color Technology Company Ltd, Stony Creek Colors, Inc, Abbey Color, DyStar Group, GNT Group B.V., Wild Colours natural dyes, Sensient Colors LLC, Maiwa, Dharma Trading Co., Batik Oetoro, AMA Herbal, Green Matters Natural Dye Company, Sodhani Biotech Pvt Ltd, Botanical Colors LLC, and Heenaagrima.

Additionally, the growing popularity of traditional and artisanal dyeing techniques is boosting the adoption of natural dyes in fashion and home decor.

The increasing demand for chemical-free and non-toxic dyes in baby products, personal care items, and food coloring is further fueling market growth. In response, manufacturers are investing in research and development to improve color retention and durability of natural dyes.

- In February 2025, SeaDyes, a start-up developing sustainable seaweed-based dyes, joined the James Hutton Institute as a spin-in company to advance research and commercialization. This partnership grants SeaDyes access to scientific expertise, facilities, and research support, facilitating production scaling and market-ready product development in alignment with Scotland’s growing bioeconomy.

Key Highlights:

- The natural dyes industry size was valued at USD 4230.0 million in 2023.

- The market is projected to grow at a CAGR of 5.82% from 2024 to 2031.

- North America held a share of 33.78% in 2023, valued at USD 1429.1 million.

- The plant-based segment garnered USD 1626.5 million in revenue in 2023.

- The powder segment is expected to reach USD 3803.0 million by 2031.

- The dyeing & coloring segment is expected to reach USD 1763.3 million by 2031.

- The food & beverages segment is estimated to generate a revenue of USD 1798.20 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.74% over the forecast period.

Market Driver

"Growing Consumer Awareness and Sustainability Regulations"

The natural dyes market is witnessing substantial growth, primarily driven by increasing consumer awareness and stringent sustainability regulations.

Concerns over the environmental and health risks of synthetic dyes have increased demand for biodegradable, non-toxic dye alternatives, particularly in industries such as textiles, food and beverages, and personal care. The preference for clean-label and organic products further accelerate this trend, prompting companies to adopt plant-based and chemical-free colorants.

Government regulations and sustainability initiatives are shaping the market landscape. Strict environmental policies targeting pollution from synthetic dyes and industrial wastewater are prompting manufacturers to explore eco-friendly alternatives.

Bans on hazardous chemicals, coupled with financial incentives for sustainable practices further accelerate this shift. Industries are adopting natural dyes to comply with regulatory frameworks, enhance their brand reputation, and meet the growing consumer demand for ethical and sustainable products.

- In February 2025, Westfalia Fruit, a global leader in the avocado industry, introduced a sustainable dye extraction technology from avocado byproducts, reinforcing its commitment to total crop utilization and circular economy principles.

Market Challenge

"High Production Costs and Limited Raw Material Avialbility"

The natural dyes market faces challenges related to limited color fastness, durability, high production costs, and raw material availability. Natural dyes exhibit lower color fastness compared to synthetic alternatives, leading to faster fading due to washing, sunlight exposure, and environmental factors.

Unlike synthetic dyes, which are engineered for strong fiber binding and resistance external elements, natural dyes rely on traditional dyeing techniques that may lack durability. Overcoming this challenge requires innovations in mordanting, eco-friendly fixatives, and dye extraction processes to improve dye-fiber bonding.

Another major challenge in the market is the high production cost and fluctuating availability of raw materials, which significantly impact scalability and affordability. Natural dyes are primarily sourced from plants, minerals, and insects, making their supply highly dependent on agricultural conditions, climate patterns, and harvesting cycles.

Factors such as droughts, excessive rainfall, pests, and soil degradation can affect the yield of dye-producing plants, leading to inconsistent availability and price fluctuations. To mitigate this challenge, companies are investing in sustainable farming practices, vertical integration of supply chains, and alternative sources such as microbial and lab-grown dyes.

Market Trend

"Innovative Technologies and Sustainable Fashion"

The natural dyes market is influenced by their adoption in luxury and sustainable fashion, along with advancements in extraction and application technologies. High-end brands and sustainable designers are incorporating naturally dyed fabrics into their collections as part of their commitment to ethical production and environmental responsibility.

Growing consumer demand for sustainability is fueling interest in slow fashion, emphasizing traditional dyeing techniques, artisanal craftsmanship, and biodegradable materials. This shift enhances fashion's aesthetic and cultural value while promoting eco-friendly alternatives to synthetic dyes.

Advancements in dye extraction and application technologies are influencing the market. Innovations such as microbial fermentation, enzymatic extraction, and nanotechnology-based dyeing processes are improving color fastness, efficiency, and overall performance.

These developments are making natural dyes more viable for large-scale industrial applications, addressing traditional limitations related to durability and color range. As industries continue to invest in research and sustainable solutions, natural dyes are being adopted across a wider range of applications, including textiles, food, cosmetics, and packaging, contributing to long-term market growth.

- For instance, in January 2025, Spinnova and ASK Scandinavia collaborated to launch the Nova tote, a naturally dyed tote bag made with 30% wood-based SPINNOVA fibres and 70% cotton. The initiative aligns with Spinnova’s strategy to expand the fibre market and explore premium handbags and natural dyeing applications, advancing sustainability in textile production.

Natural Dyes Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Plant-based, Animal-based, Mineral-based

|

|

By Form

|

Powder, Liquid

|

|

By Application

|

Tanning, Printing Inks, Paints & Coating, Dyeing & Coloring, Others

|

|

By End-Use

|

Food & Beverages, Pharmaceutical, Packaging, Paper & Pulp, Cosmetics and Personal Care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Plant-based, Animal-based, and Mineral-based): The plant-based segment earned USD 1626.5 million in 2023 due to its widespread use in textiles, cosmetics, and food applications, supported by consumer preference for natural and sustainable ingredients.

- By Form (Powder and Liquid): The powder segment held a share of 57.87% in 2023, attributed to its longer shelf life, ease of storage, and higher concentration, making it a preferred choice for manufacturers.

- By Application (Tanning, Printing Inks, Paints & Coating, Dyeing & Coloring, and Others): The dyeing & coloring segment is projected to reach USD 1763.3 million by 2031, owing to the growing demand for eco-friendly textiles and increasing adoption of natural dyes in the fashion industry.

- By End-Use (Food & Beverages, Pharmaceutical, Packaging, Paper & Pulp, Cosmetics and Personal Care, and Others): The food & beverages segment is projected to reach USD 1798.2 million by 2031, as a result of the rising preference for clean-label products and the growing use of natural colorants in organic and plant-based food products.

Natural Dyes Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America natural dyes market is accounted for a substantial share of 33.78% in 2023, valued at USD 1429.1 million. This dominance is attributed to the strong presence of sustainable fashion brands, increasing consumer preference for eco-friendly products, and environmental regulations promoting the use of natural alternatives.

The growing demand for organic textiles, natural food colorants, and clean-label personal care products is further fueling regional market expansion. Additionally, advancements in natural dye extraction technologies and the presence of key industry players investing in research and development are supporting market expansion.

Furthermore, the increasing adoption of natural dyes in niche industries, such as artisanal crafts, luxury fashion, and eco-conscious packaging, is broadening the market scope.

Asia Pacific natural dyes industry is expected to register a CAGR of 6.74% over the forecast period. This growth is fostered by the region's strong heritage of natural dye production, increasing industrialization, and the rising adoption of sustainable practices in the textile and food industries.

The expansion of the fashion and textile sectors, along with growing government initiatives promoting eco-friendly manufacturing, is further propelling regional market growth. Additionally, the rising middle-class population and increasing consumer awareness regarding the environmental impact of synthetic dyes are boosting the demand for natural dye-based products.

The regional market benefits from a strong network of raw material suppliers, making natural dye production more cost-effective and accessible. Furthermore, the rise of small and medium-sized enterprises specializing in natural dyes, coupled with the growing influence of e-commerce platforms, is further fueling market penetration.

- In 2025, the European Union and the Indian Ministry of Textiles launched seven new projects to strengthen India's textile and handicraft industry during Bharat Tex. The projects focus on the production and promotion of natural dyes, bamboo craft, handlooms, shawls, traditional handicrafts, and textiles, with an emphasis on enhancing production, branding, and market access.

Regulatory Framework

- In the U.S., the Food and Drug Administration (FDA) regulates natural dyes used in food, cosmetics, and pharmaceuticals to ensure safety and compliance. The Environmental Protection Agency (EPA) oversees their environmental impact, while the Consumer Product Safety Commission (CPSC) ensures safe use in textiles and consumer goods.

- In Europe, the European Chemicals Agency (ECHA) regulates natural dyes under the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) framework. The European Food Safety Authority (EFSA) evaluates their safety in food applications, and the European Commission (EC) sets standards for their use in textiles and cosmetics.

- In China, the National Medical Products Administration (NMPA) regulates natural dyes in pharmaceuticals and cosmetics. The Ministry of Ecology and Environment (MEE) enforces environmental standards, while the State Administration for Market Regulation (SAMR) ensures compliance in textiles and consumer products.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates natural dyes in food, pharmaceuticals, and cosmetics. The Ministry of Economy, Trade and Industry (METI) oversees their industrial use, and the Ministry of the Environment (MOE) ensures environmental safety in dye manufacturing and disposal.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates natural dyes in food and beverages. The Central Pollution Control Board (CPCB) under the Ministry of Environment, Forest and Climate Change (MoEFCC) monitors their environmental impact, while the Bureau of Indian Standards (BIS) sets quality standards for their use in textiles and other industries.

Competitive Landscape

The natural dyes industry is characterized by a large number of participants, including both established corporations and emerging players. Continuous product innovation, strategic collaborations, and increasing investments in research and development are shaping the industry, with a strong focus on enhancing the quality, durability, and application scope of natural dyes.

Companies are expanding their product portfolios to meet growing demand across various industries, including textiles, food and beverages, cosmetics, and packaging.

Businesses are prioritizing sustainable sourcing practices by partnering with local farmers and suppliers to ensure a steady raw material supply. The emphasis on eco-friendly and biodegradable alternatives has led to advancements in dye extraction techniques, improving color fastness and overall performance while maintaining environmental responsibility.

With an increasing preference for organic and clean-label products, manufacturers are securing certifications and adhering to strict regulatory standards, reinforcing consumer trust and product credibility.

- In November 2024, GNT Ventures launched an independent investment firm to accelerate innovation and sustainability in plant-based color solutions. The firm focuses on investing in start-ups specializing in raw materials, fermentation, processing, food ingredients, and upcycling to tranform the industry.

List of Key Companies in Natural Dyes Market:

- IndiDye Natural Color Technology Company Ltd

- Stony Creek Colors, Inc

- Abbey Color

- DyStar Group

- GNT Group B.V.

- Wild Colours natural dyes

- Sensient Colors LLC

- Maiwa

- Dharma Trading Co.

- Batik Oetoro

- AMA Herbal

- Green Matters Natural Dye Company

- Sodhani Biotech Pvt Ltd

- Botanical Colors LLC

- Heenaagrima

Recent Developments (Investments/Partnerships)

- In November 2024, Phytolon, a startup specializing in natural food colors via precision fermentation, secured investment from Rich Products Ventures. Rich Products Corporation plans to evaluate Phytolon’s natural colors for applications in icings, toppings, and baked goods.

- In June 2024, Lenzing Group partnered with Exponent Envirotech and Cobalt Fashion to introduce ECOHUES, a waterless dyeing technology for wood-based cellulosic fibers. The partnership with Cobalt Fashion, a Hong Kong-based knitwear manufacturer, aims to showcase the performance and sustainability benefits of ECOHUES-dyed yarns in knitwear.