Market Definition

Nanofiltration membranes are semi-permeable filtration materials designed to remove dissolved salts, organic compounds, and other microscopic impurities from liquids. They operate at lower pressures compared to reverse osmosis membranes, offering energy efficiency while maintaining selectivity for divalent and larger ions.

The market includes polymeric, ceramic, and hybrid membranes in configurations such as spiral wound, tubular, hollow fiber, flat sheet, and other module types. Key applications include water and wastewater treatment, food and beverage processing, pharmaceuticals, and chemical industries, where they are used for softening, contaminant removal, and process stream purification.

Nanofiltration Membrane Market Overview

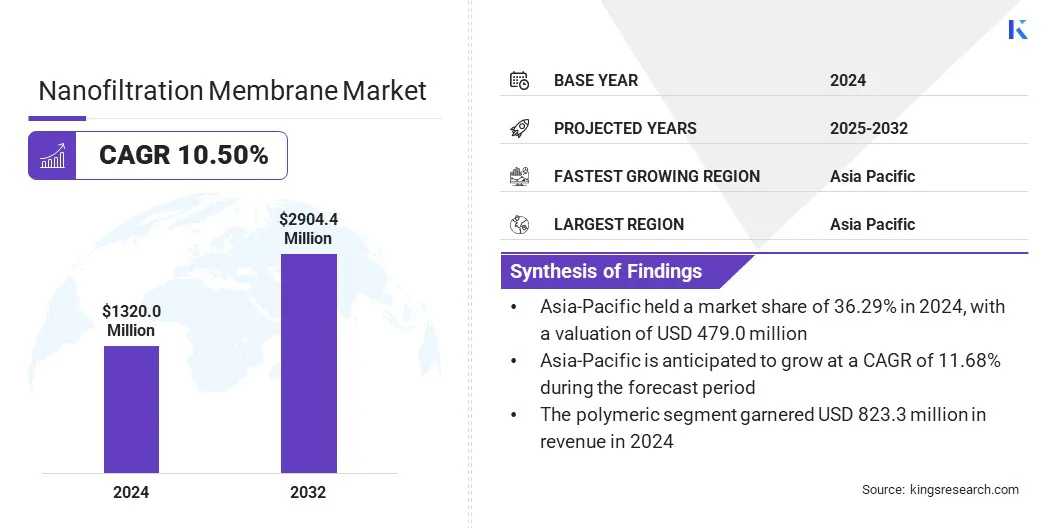

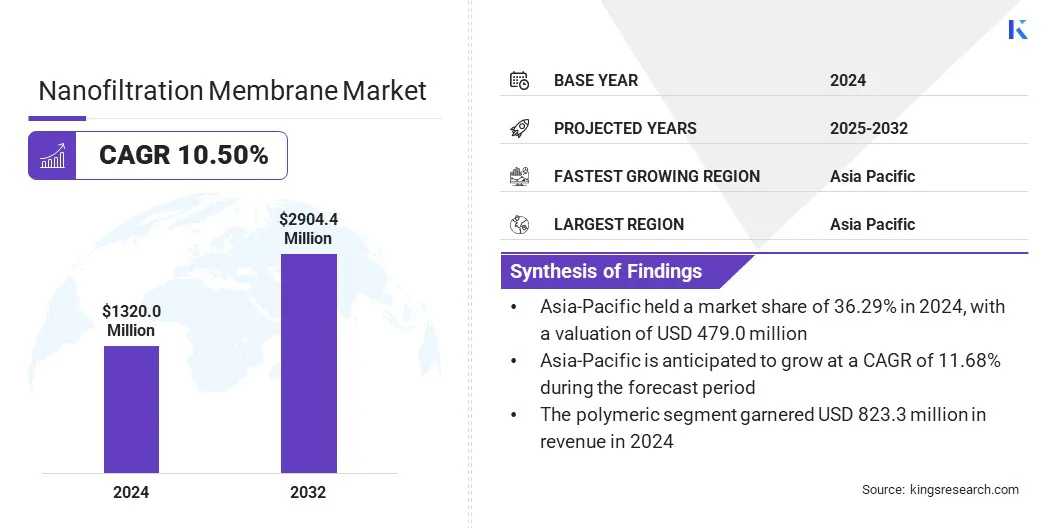

The global nanofiltration membrane market size was valued at USD 1320.0 million in 2024 and is projected to grow from USD 1444.0 million in 2025 to USD 2904.4 million by 2032, exhibiting a CAGR of 10.50% during the forecast period.

This growth is attributed to the increasing need for efficient separation technologies in water and wastewater treatment, supported by rising global concerns over water scarcity and stricter discharge regulations. Rising demand for energy-efficient filtration solutions is promoting adoption across food and beverage processing, pharmaceuticals, and chemical production.

Key Market Highlights:

- The nanofiltration membrane industry size was valued at USD 1320.0 million in 2024.

- The market is projected to grow at a CAGR of 10.50% from 2025 to 2032.

- Asia-Pacific held a share of 36.29% in 2024, valued at USD 479.0 million.

- The polymeric segment garnered USD 823.3 million in revenue in 2024.

- The spiral wound segment is expected to reach USD 1571.8 million by 2032.

- The pharmaceutical & biomedical segment is anticipated to witness the fastest CAGR of 12.13% over the forecast period.

- Middle East & Africa is anticipated to grow at a CAGR of 10.56% through the projection period.

Major companies operating in the nanofiltration membrane market are DuPont, TORAY INDUSTRIES, INC., Hydranautics, Veolia, AXEONsupply.com, Kovalus Separation Solutions, Pentair, Pall Corporation, ALFA LAVAL, NX Filtration BV, Vontron Technology Co., Ltd., Synder Filtration, Inc., Membranium, MANN+HUMMEL, and applied membranes, Inc .

The growing emphasis on reducing operational costs, improving process efficiency, and meeting quality standards is supporting wider deployment of nanofiltration membranes. Additionally, continuous innovations in membrane materials, enhanced module designs, and growing investments in sustainable water infrastructure are accelerating market growth.

- In July 2023, DuPont launched its first nanofiltration membrane elements, FilmTec LiNE-XD, for lithium brine purification. Through this innovation, the membranes enhance lithium recovery from chloride-rich brines while selectively removing divalent metals such as magnesium, supporting more efficient and sustainable direct lithium extraction (DLE) operations.

Market Driver

Surging Demand for High-Quality Water

The growth of the market is propelled by the rising need for high-quality water in municipal, industrial, and residential applications. Increasing concerns over water scarcity, pollution, and health risks are prompting greater investment in advanced purification solutions.

Nanofiltration membranes are widely adopted as they effectively remove pesticides, heavy metals, and organic contaminants while retaining beneficial minerals, making them ideal for both drinking water treatment and wastewater reuse. This ability to balance purification and mineral preservation differentiates them from reverse osmosis and ultrafiltration technologies.

Global urbanization, population growth, and stricter water safety standards are accelerating this shift. Utilities and industries are expanding the deployment of nanofiltration systems to secure sustainable water supplies, positioning them as a critical technology in the fight against water stress and contamination.

- In March 2025, Nijhuis Saur Industries (NSI) and NX Filtration launched the Mobile Nanofiltration (MONF) unit at Aquatech 2025. The modular system treats up to 100 m³/h of water, removing micropollutants, sulfates, and organics to support sustainable water reuse. Combining NSI’s water treatment expertise with NX Filtration’s hollow fiber membranes, the MONF unit enables rapid deployment while reducing water footprint and operational costs.

Market Challenge

Membrane Fouling and Maintenance Requirements

Membrane fouling and the associated maintenance needs create significant barriers to the growth of the nanofiltration membrane market.

Fouling occurs when organic matter, scaling, or microbial deposits accumulate on membrane surfaces, reducing water flux, raising energy consumption, and shortening operational lifespan. Frequent chemical cleaning and membrane replacement further increase operating costs and limit system reliability.

These issues are particularly severe in industries handling complex wastewater streams such as textiles, chemicals, and food processing, where fouling develops more rapidly.

The resulting downtime and high maintenance burden limit wider adoption, particularly in cost-sensitive markets where affordability is critical. Limited availability of skilled operators to manage and maintain advanced systems adds another layer of difficulty.

To mitigate these constraints, manufacturers are focusing on developing fouling-resistant membrane materials, advanced pretreatment technologies, and automated monitoring systems. Ongoing innovations aim to extend membrane life, reduce cleaning frequency, and enhance overall system efficiency, making nanofiltration more sustainable and economically viable.

Market Trend

Transition To Sustainable and Energy-Efficient Filtration

The market is witnessing a notable shift toward sustainable and energy-efficient filtration technologies, aided by rising demand for environmentally responsible water treatment solutions.

Low-pressure nanofiltration systems and advanced membrane materials enhance separation performance while reducing energy consumption, addressing both cost and carbon footprint concerns for operators. This shift is particularly prominent in municipal water treatment and industrial wastewater management, where sustainability targets and regulatory mandates are becoming stricter.

Manufacturers are focusing on longer-lasting, recyclable membranes and innovations that optimize resource utilization. Integration of energy recovery devices and eco-friendly operating practices is further supporting the adoption of greener nanofiltration systems.

The growing emphasis on energy efficiency and sustainability is positioning next-generation nanofiltration solutions as a preferred choice across diverse applications, setting new standards for performance and environmental responsibility.

- In February 2025, Researchers at the University of Bath developed a sustainable nanofiltration membrane made from plant-derived cellulose and lignin, avoiding fossil fuels and toxic solvents. The membrane effectively filters water dyes of varying sizes and maintains stable performance over 30 days, offering a promising solution for water purification and wastewater treatment.

Nanofiltration Membrane Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polymeric, Ceramic, and Hybrid

|

|

By Module

|

Spiral Wound, Tubular, Hollow Fiber, Flat Sheet, and Others

|

|

By Application

|

Water & Wastewater Treatment, Food & Beverage, Chemical & petrochemical, Pharmaceutical & Biomedical, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Polymeric, Ceramic, and Hybrid): The polymeric segment earned USD 823.3 million in 2024, mainly due to its cost-effectiveness, ease of manufacturing, and wide applicability in water and wastewater treatment.

- By Module (Spiral Wound, Tubular, Hollow Fiber, Flat Sheet, and Others): The spiral wound held a share of 57.45% in 2024, attributed to its high packing density, low operational cost, and suitability for large-scale filtration applications.

- By Application (Water & Wastewater Treatment, Food & Beverage, Chemical & Petrochemical, Pharmaceutical & Biomedical, and Others): The water & wastewater treatment segment is projected to reach USD 1323.2 million by 2032, owing to rising global water scarcity, stricter regulatory standards, and growing demand for clean and safe water.

Nanofiltration Membrane Market Regional Analysis

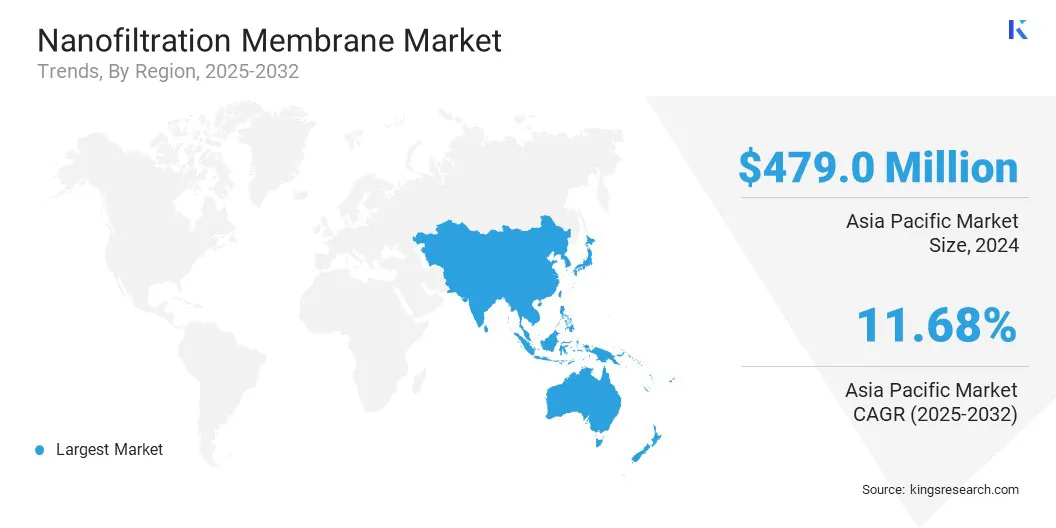

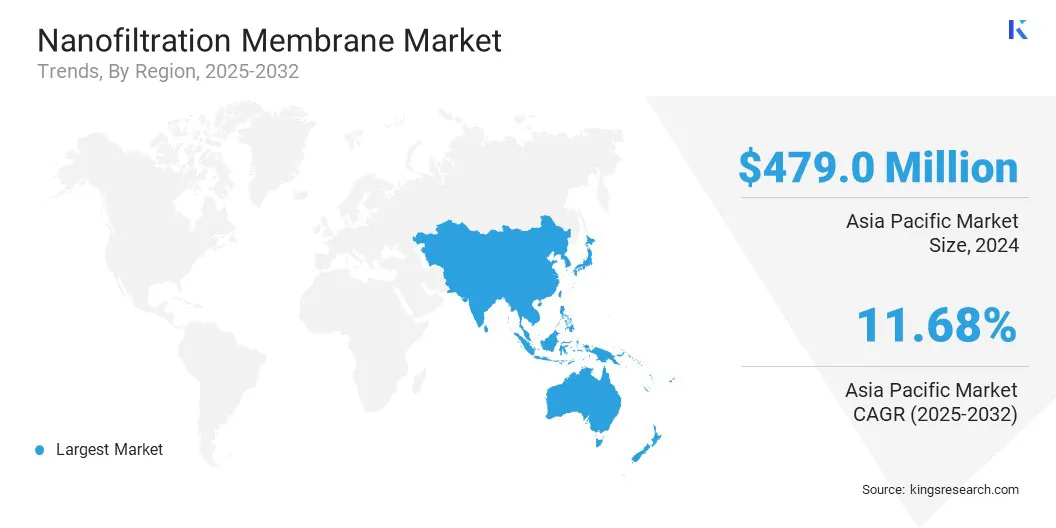

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific nanofiltration membrane market share stood at 36.29% in 2024, valued at USD 479.0 million. This strong position is reinforced by rising demand for clean water solutions, rapid industrial growth, and expanding infrastructure development across emerging economies.

Furthermore, the regional market benefits from increasing adoption of nanofiltration membranes in pharmaceuticals, food and beverage, and chemical processing, where water quality and process efficiency are critical.

The region’s emphasis on sustainable water management, government investments in treatment facilities, and technological collaborations with global players boost steady adoption of nanofiltration membranes. Industrial modernization, urbanization, and advancements in membrane design further position Asia Pacific as a key hub for nanofiltration membrane deployment.

- In January 2025, Researchers at the University of Hong Kong (HKU) developed a silk-based nanofiltration membrane that operates under low vacuum pressure (<1 bar), reducing energy use by around 80% compared to conventional systems. The membrane achieves a water flow rate of 56.8 liters per square meter per hour while rejecting over 99% of organic pollutants, offering a sustainable solution for industrial wastewater and household water purification.

Middle East & Africa is poised to grow at a CAGR of 10.56% over the forecast period. This growth is fueled by the surging demand for advanced water treatment solutions to combat scarcity, coupled with rising investments in desalination and wastewater recycling projects.

Expanding industries such as oil and gas, chemicals, and food and beverage are increasingly adopting nanofiltration membranes to ensure reliable water quality and operational efficiency. Government-backed programs promoting sustainable resource management, along with partnerships with global technology providers, are supporting infrastructure development and adoption.

Furthermore, the shift toward energy-efficient and durable membrane technologies, bolstered by urbanization and stricter environmental standards, is fueling long-term demand. The ongoing mega-projects and focus on industrial diversification further solidify the Middle East & Africa’s position.

Regulatory Frameworks

- In the EU, the Integrated Pollution Prevention and Control (IPPC) Directive regulates industrial emissions and environmental impact. It establishes Best Available Techniques (BAT) to minimize pollution from various industrial sources, ensuring that nanofiltration membranes used in industries such as water treatment and food processing meet stringent environmental standards.

- In the U.S., the Environmental Protection Agency (EPA) enforces the Safe Drinking Water Act (SDWA). The agency oversees states, localities, and water suppliers to ensure compliance, including the effective use of nanofiltration membranes for contaminant removal in public water systems.

Competitive Landscape

Companies operating in the nanofiltration membrane market are maintaining competitiveness through investments in advanced membrane technologies, sustainability-focused product innovations, and strategic mergers and acquisitions.

Tjey are developing high-performance membranes with improved fouling resistance, lower energy requirements, and longer service life to address rising demand across water treatment, food and beverage, and pharmaceutical applications.

Companies are also expanding their product portfolios with polymeric, ceramic, and hybrid membranes to cater to diverse industrial requirements and regulatory standards. Emphasis is placed on localized production facilities, partnerships with utilities, and collaboration with research institutions to strengthen supply chains and accelerate innovation.

Additionally, firms are prioritizing customer-centric solutions, technical support, and after-sales services, while leveraging digital tools and predictive maintenance technologies to deliver long-term performance and gain a competitive edge.

Key Companies in Nanofiltration Membrane Market:

- DuPont

- TORAY INDUSTRIES, INC.

- Hydranautics

- Veolia

- AXEONsupply.com

- Kovalus Separation Solutions

- Pentair

- Pall Corporation

- ALFA LAVAL

- NX Filtration BV

- Vontron Technology Co., Ltd.

- Synder Filtration, Inc.

- Membranium

- MANN+HUMMEL

- applied membranes, Inc.

Recent Developments (M&A)

- In February 2025, Kurita America Inc. announced its merger with Avista Technologies, Inc., a California-based provider of membrane treatment solutions including reverse osmosis (RO), microfiltration/ultrafiltration (MF/UF), nanofiltration (NF), and multimedia filtration (MMF). The merger integrates Kurita America's water treatment capabilities with Avista’s membrane expertise, enhancing service offerings for industrial and municipal clients across diverse sectors.