Market Definition

The market encompasses services, technologies, and solutions used to detect and quantify harmful secondary metabolites produced by fungi called mycotoxins in agricultural commodities such as grains, nuts, spices, and animal feed.

This market serves food producers, processors, and laboratories by providing critical safety assurance and quality control, ensuring that products meet established regulatory limits and industry standards for safe consumption.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Mycotoxin Testing Market Overview

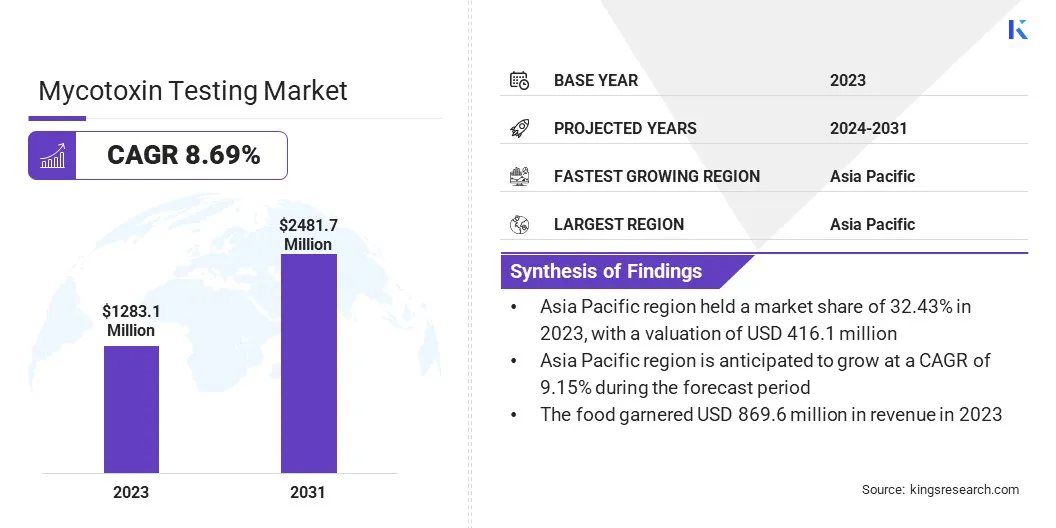

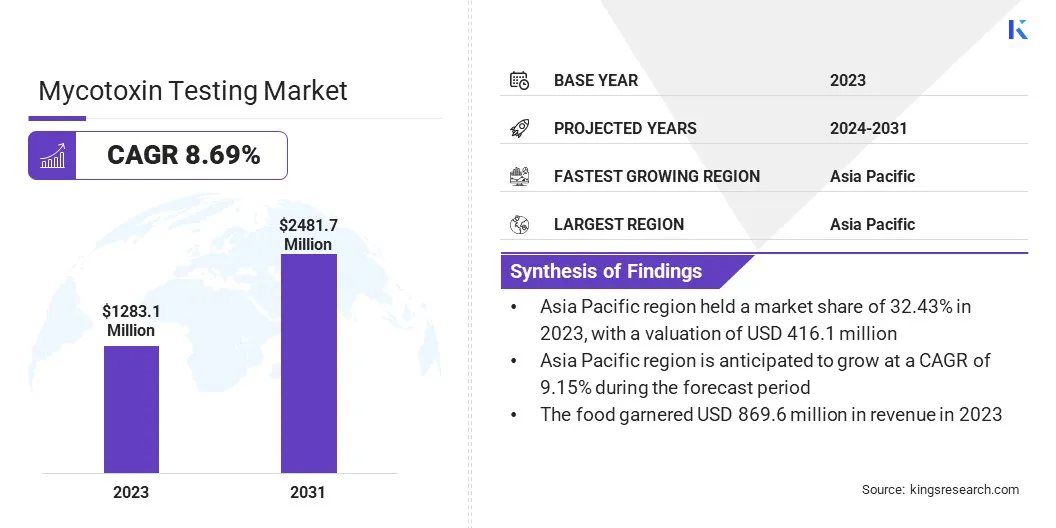

The global mycotoxin testing market size was valued at USD 1283.1 million in 2023 and is projected to grow from USD 1385.0 million in 2024 to USD 2481.7 million by 2031, exhibiting a CAGR of 8.69% during the forecast period.

Strict government regulations and technological advancements in mycotoxin testing are driving market growth by ensuring higher food safety standards and enabling more accurate, efficient detection methods.

Major companies operating in the mycotoxin testing industry are Neogen Corporation, Symbio Labs., Mérieux NutriSciences Corporation, Charm Sciences., Bio-Check (UK) Ltd., Dairyland Laboratories, Inc., AsureQuality., Microbac Laborataries, Inc., Premier Analytics Servies, Bureau Veritas Vietnam Limited, ALS, Krishgen Biosystems, SGS Société Générale de Surveillance SA, Intertek Group plc, and PerkinElmer Inc.

The market growth is driven by shifting weather patterns that increase the prevalence of fungal contamination in crops. Elevated temperatures and irregular rainfall create favorable conditions for mold development, raising the risk of mycotoxins in food and feed. This escalating threat prompts producers to implement routine testing to ensure product safety and maintain regulatory compliance.

Key Highlights:

- The mycotoxin testing market size was recorded at USD 1,283.1 million in 2023.

- The market is projected to grow at a CAGR of 8.69% from 2024 to 2031.

- Asia Pacific held a market share of 32.43% in 2023, with a valuation of USD 416.1 million.

- The aflatoxin segment garnered USD 519.2 million in revenue in 2023.

- The chromatography and spectroscopy-based segment is expected to reach USD 1,525.3 million by 2031.

- The food segment secured the largest revenue share of 67.77% in 2023.

- North America is anticipated to grow at a CAGR of 8.80% during the forecast period.

Market Driver

Increasing Government Regulations and Food Safety Standards

The global market is expanding due to stricter government regulations and rising food safety standards. Regulatory authorities are imposing strict limits on mycotoxin levels in food and feed to protect public health.

Meeting these standards demands advanced testing technologies and consistent monitoring. This regulatory pressure is prompting the food and agriculture industries to strengthen quality control measures across production and supply chains.

- For instance, in Canada, the regulation of maximum allowable levels of mycotoxins in food for humans and feed for livestock is overseen by Health Canada and the Canadian Food Inspection Agency (CFIA). The specific limits whether action levels, advisory levels, or maximum concentrations differ depending on the type of mycotoxin and the intended use of the final corn products.

Market Challenge

High Cost and Technical Complexity

The global mycotoxin testing market faces significant challenges, primarily due to the high cost and technical complexity of advanced testing technologies. This primarily affects small and medium-sized enterprises (SMEs), which often lack the financial resources and technical infrastructure needed to implement advanced mycotoxin testing methods.

This lack of infrastructure can result in inconsistent testing and non-compliance with international food safety standards. To address these challenges, key players are investing in cost-effective testing kits, partnering with local laboratories, and offering training programs to build technical capacity in developing regions.

Market Trend

Technological advancements

Technological advancements in mycotoxin testing are a key trend in the global market. Innovations like lateral flow assays, ELISA kits, and chromatography have enhanced detection accuracy, speed, and cost-efficiency.

These technologies enable real-time, on-site monitoring across supply chains. Portable, user-friendly devices are facilitating adoption, especially in resource-limited areas. These trends are expanding the reach and efficiency of mycotoxin testing and accelerating market development.

- In February 2025, CellMade unveiled its latest innovations and product launch aimed at transforming mycotoxin testing. The company introduced advanced methodologies and services such as ELISA, rapid lateral flow strips, high-purity mycotoxin standards, certified matrix reference materials, and specialized testing using ELISA, HPLC, and LC-MS to improve accuracy and reliability in analysis.

Mycotoxin Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Pathogen Type

|

Aflatoxin, Patulin, Zearalenone, Fumonisins, Ochratoxins, deoxynivalenol, others

|

|

By Technology

|

Chromatography and Spectroscopy-based, Immunoassay-based, Others

|

|

By Application

|

Food(Cereals, Grains and Pulses, Nuts, Seeds & Spices, Fruits & Vegetables, Dairy Products, Others), Feed(Cereals and Cereals by products, Seeds and Seed products, Forage and Silage, Others)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Pathogen Type (Aflatoxin, Patulin, Zearalenone, Fumonisins, Ochratoxins, Deoxynivalenol, Others): The aflatoxin segment earned USD 519.2 million in 2023 due to its high toxicity, widespread contamination in staple crops, and stringent regulatory requirements for its detection in food and feed products.

- By Technology (Chromatography and Spectroscopy-based, Immunoassay-based, Others): The chromatography and spectroscopy-based segment held 60.39% of the market in 2023, due to their high precision, sensitivity, and ability to detect multiple mycotoxins simultaneously, making them the preferred technologies for regulatory compliance and accurate analysis in food safety.

- By Application (Food, Feed): The food segment is projected to reach USD 1,648.1 million by 2031, owing to the increasing need for food safety and quality assurance, driven by rising consumer awareness, regulatory pressure, and the risk of mycotoxin contamination in food products.

Mycotoxin Testing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific mycotoxin testing market share stood around 32.43% in 2023 in the global market, with a valuation of USD 416.1 million. This dominance is attributed to the region’s large-scale agricultural output, especially in crops vulnerable to mycotoxin contamination. The region's varied climate conditions promote fungal growth, heightening contamination risks.

Moreover, stricter food safety regulations, increasing export demands, and heightened consumer awareness are fueling the need for more rigorous testing. Combined with government investments in food safety infrastructure, these factors are propelling market growth in the region.

North America is poised for significant growth at a robust CAGR of 8.80% over the forecast period. The growth is driven due to its advanced technological capabilities that support the adoption of high-precision testing methods. Additionally, presence of well-established laboratory infrastructure and widespread use of technologies such as chromatography and mass spectrometry.

These advancements enable faster and more accurate detection of mycotoxins. Food producers and regulatory bodies in North America rely heavily on advanced testing to ensure compliance and maintain food safety standards.

Regulatory Frameworks

- In Asia Pacific region, the Australia New Zealand Food Standards Code (FSANZ) sets defined limits for aflatoxins and other mycotoxins in food products, especially in categories like nuts, grains, and dairy, with consistent compliance monitoring throughout the supply chain.

- In the U.S., the FDA sets action levels for mycotoxins, including aflatoxins, fumonisins, and patulin, in both human food and animal feed. These limits are enforced under the Federal Food, Drug, and Cosmetic Act (FD&C Act) to ensure that contaminated products do not enter the market.

Competitive Landscape

The mycotoxin testing market is highly competitive, with key players actively pursuing strategies such as product innovation, technological advancements, and strategic partnerships to strengthen their market position. Companies are focusing on launching advanced testing kits and solutions that offer improved accuracy, speed, and ease of use.

Collaborations with research institutions, investments in automation, and the integration of digital technologies are also becoming prominent approaches. These strategic moves are aimed at meeting evolving regulatory requirements and increasing demand for food safety across global markets.

List of Key Companies in Mycotoxin Testing Market:

- Neogen Corporation

- Symbio Labs.

- Mérieux NutriSciences Corporation

- Charm Sciences.

- Bio-Check (UK) Ltd.

- Dairyland Laboratories, Inc.

- AsureQuality.

- Microbac Laborataries, Inc.

- Premier Analytics Servies

- Bureau Veritas

- ALS

- Krishgen Biosystems

- SGS Société Générale de Surveillance SA

- Intertek Group plc

- PerkinElmer Inc.

Recent Developments (New Product launch)

- In May 2024, Waters Corporation, a leading provider of analytical instruments and software for food safety, introduced the VICAM Fumo-V ONE Strip Test. This new tool detects the three mycotoxins aflatoxin, fumonisin, and DON (deoxynivalenol or vomitoxin) in finished animal feed and pet food. The test helps streamline processing by delivering results in under 10 minutes while improving safety and quality assurance.

—