Market Definition

The market focuses on the research, development, manufacturing, and commercialization of therapies and diagnostic tools targeting the disease. Myasthenia gravis primarily affects the communication between nerves and muscles, causing muscle weakness and fatigue, particularly in the eyes, face, throat, and limbs.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Myasthenia Gravis Market Overview

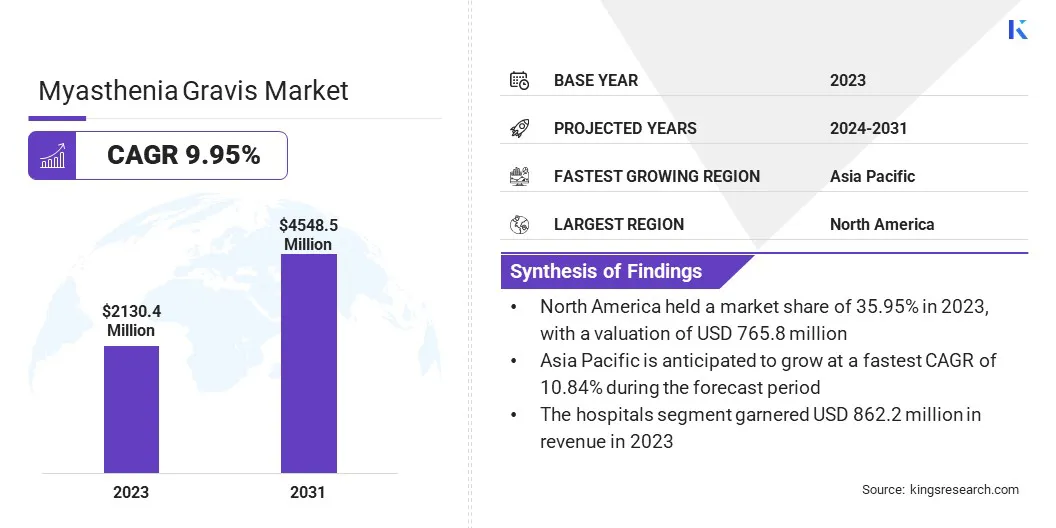

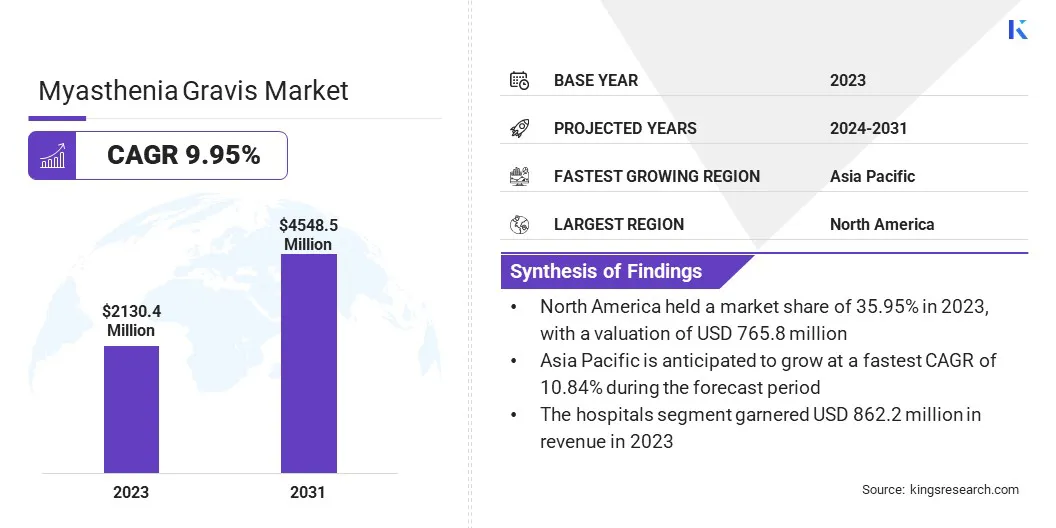

The global myasthenia gravis market size was valued at USD 2,130.4 million in 2023 and is projected to grow from USD 2,341.5 million in 2024 to USD 4,548.5 million by 2031, exhibiting a CAGR of 9.95% during the forecast period. Market growth is propelled by progress in targeted biologic therapies and robust regulatory support.

Enhancements in healthcare infrastructure and increased access to treatment in emerging markets are expanding the availability of these therapies. Moreover, the rising patient population, driven by improved diagnostic tools and a deeper understanding of myasthenia gravis, is boosting the demand for effective treatments.

Major companies operating in the myasthenia gravis industry are Argenx, Johnson & Johnson, AstraZeneca, UCB Pharma, Amneal Pharmaceuticals, Inc., Regeneron Pharmaceuticals, Immunovant Sciences GmbH, Bristol Myers Squibb, Novartis, Roche Holding AG, Amgen, Merck & Co., Inc., Mitsubishi Tanabe Pharma Corp., and CuraVac, Inc.

The regulatory acceleration is fueling the expansion of the market by enabling faster access to innovative treatments and boosting commercial viability. This reflects strong clinical potential, attract investment, fosters R&D activities, and expands the development of pipeline, accelerating market growth.

- In March 2025, the FDA approved eculizumab (Soliris) from AstraZeneca for pediatric patients aged 6 years and older with anti-AChR antibody positive generalized myasthenia gravis (gMG). This marks the first approved treatment for pediatric gMG patients. Eculizumab inhibits the C5 protein, to prevent tissue damage associated with the disease.

Key Highlights:

- The myasthenia gravis industry size was recorded at USD 2130.4 million in 2023.

- The market is projected to grow at a CAGR of 9.95% from 2024 to 2031.

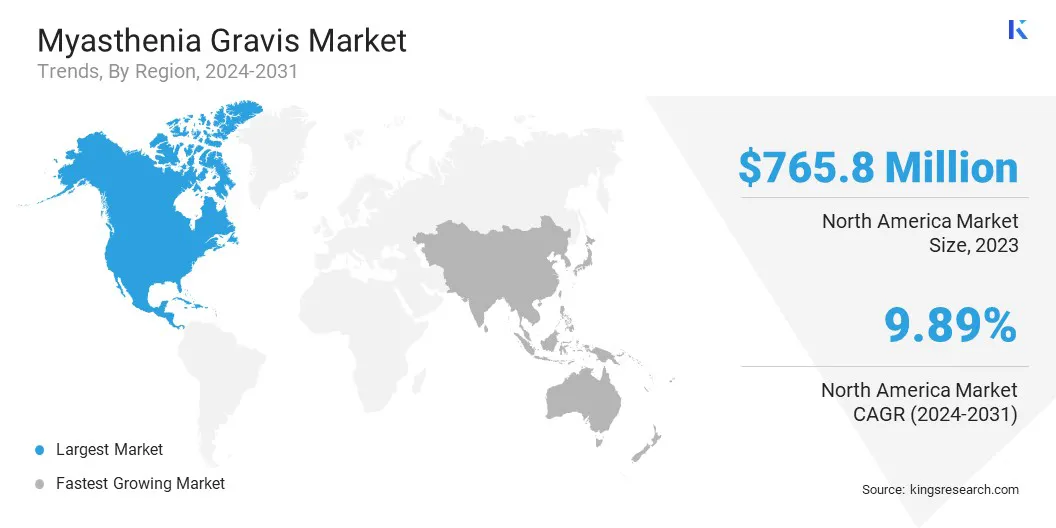

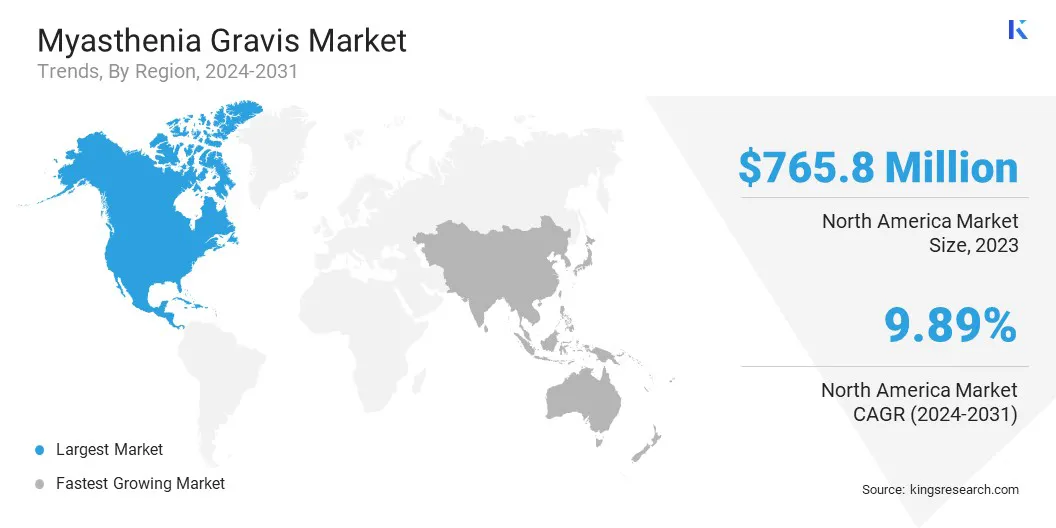

- North America held a market share of 35.95% in 2023, with a valuation of USD 765.8 million.

- The cholinesterase inhibitors segment garnered USD 530.1 million in revenue in 2023.

- The hospitals segment is expected to reach USD 1821.5 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.84% over the forecast period.

Market Driver

"Increasing Prevalence of Autoimmune Disorders"

The global rise of autoimmune disorders is fostering the growth of the myasthenia gravis market. As autoimmune conditions become increasingly prevalent due to a combination of genetic, environmental, and lifestyle factors, the incidence of myasthenia gravis, an autoimmune neuromuscular disorder, continues to rise. This growing patient population is generating a strong demand for accurate diagnosis, effective treatments, and long-term disease management solutions.

- According to the Global Autoimmune Institute, autoimmune diseases affect 5% to 10% of the population in industrialized nations.

Market Challenge

"High Treatment Cost"

A key challenge hindering the expansion of the myasthenia gravis market is the high cost associated with these therapies. Although innovative treatments show promising results, their high costs hinder widespread adoption, particularly in price-sensitive markets. Additionally, the complexity of developing and manufacturing these treatments increases costs, leading to pricing pressures from healthcare systems.

To address this issue, companies can focus on developing cost-effective biosimilars and optimizing production processes to lower manufacturing expenses. Partnerships with healthcare providers and insurers can improve treatment access. Additionally, exploring alternative pricing models, such as value-based pricing, may improve affordability and access to therapies.

Market Trend

"Integration of Digital Health Solutions"

The integration of digital health solutions is emerging as a notable trend in the myasthenia gravis market. Mobile health apps, wearable devices, and telemedicine platforms are increasingly being used to monitor symptoms, track medication adherence, and support remote consultations for MG patients.

Additionally, AI-driven tools are enhancing engagement and supporting informed clinical decision-making, shifting the focus toward proactive, personalized, and data-driven myasthenia gravis care.

- In February 2025, Patients Rising and PeopleCare.ai launched the Myasthenia Gravis Patient Program, a digital healthcare solution aimed at improving care for patients with myasthenia gravis. The program addresses the challenge of limited, often ineffective doctor-patient interaction during short clinical visits. It seeks to enhance patient engagement and care efficiency through AI-driven tools.

Myasthenia Gravis Market Report Snapshot

|

Segmentation

|

Details

|

|

By Treatment

|

Cholinesterase Inhibitors Chronic Immunomodulators, Monoclonal Antibodies, Rapid Immunotherapies, Thymectomy, Others.

|

|

By End Use Industry

|

Hospitals, Clinics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Treatment (Cholinesterase Inhibitors, Chronic Immunomodulators, Monoclonal Antibodies, Rapid Immunotherapies, Thymectomy, and Others): The cholinesterase inhibitors segment earned USD 530.1 million in 2023 due to their widespread use as first-line symptomatic treatment for myasthenia gravis and their established clinical efficacy in improving neuromuscular transmission.

- By End Use Industry (Hospitals, Clinics, and Others): The hospitals segment held a share of 40.47% in 2023, owing to the higher patient inflow, availability of advanced treatment infrastructure, and access to specialized neurologists for managing complex MG cases.

Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America myasthenia gravis market accounted for a share of around 35.95% in 2023, valued at USD 765.8 million. This dominance is reinforced by regulatory support, increased access to innovative and cost-effective therapies, and improved patient access to advanced treatments.

Additionally, regulatory support for fast-track approvals and high healthcare spending are enabling early adoption of novel therapies. Additionally, increasing awareness of rare autoimmune disorders and improved access to specialized care are fueling regional market growth.

- In April 2025, Teva Pharmaceuticals and Samsung Bioepis launched EpySQLI, a biosimilar to eculizumab, in the U.S. for the treatment of PNH, aHUS, and generalized myasthenia gravis in adults. Priced 30% lower the reference product, the launch aims to improve affordability.

Asia Pacific myasthenia gravis industry is estimated to grow at a robust CAGR of 10.84% over the forecast period. This growth is fostered by increasing awareness of autoimmune diseases and rising diagnoses. The approval of a rapid subcutaneous treatment for generalized myasthenia gravis is enhancing therapeutic accessibility and improving patient adherence across the Asia-Pacific region.

It is reflecting strong regulatory support for advanced biologics in autoimmune disease management. The adoption is rising as awareness and diagnostic capabilities for gMG are expanding, particularly in emerging markets.

Additionally, Strategic partnerships between global and regional pharmaceutical companies are accelerating product introductions, driving market growth and improving standards of care across the region.

- In July 2024, China’s NMPA approved efgartigimod alfa SC injection as an add-on therapy for adults with generalized myasthenia gravis (gMG) who are anti-AChR antibody positive. Co-developed by argenx and Zai Lab, the subcutaneous version offers a quick 30–90 second injection, improving patient convenience. The approval builds on strong adoption of VYVGART IV, with 2,700 new patients in Q1 2024. This marks a key step in expanding access to innovative gMG treatments in China.

Regulatory Framework

- In the U.S., the Food and Drug Administration (FDA) oversees the approval and regulation of medications. The FDA is responsible for ensuring the safety, efficacy, and security of all drugs.

- In Europe, the European Medicines Agency (EMA) evaluates and supervises the safety, effectiveness, and quality of medicines across the European Union and the European Economic Area.

- In China, the National Medical Products Administration regulates drug approvals.The Center for Drug Evaluation within the NMPA is responsible for reviewing and approving new drug applications.

Competitive Landscape

The myasthenia gravis industry is highly competitive, with leading players prioritizing strategic mergers and acquisitions. They are forming partnerships to secure long-term funding and reduce development risks for the early-stage therapies targeting rare autoimmune conditions.

These strategic moves are advancing clinical trials, expanding rare disease pipelines, and helping market players maintain a competitive edge in a rapidly evolving treatment landscape.

- In March 2025, Flerie and Toleranzia merged to strengthen long-term financing and advance TOL2, Toleranzia’s myasthenia gravis drug candidate. The merger follows regulatory approval in Sweden and Germany for a first-in-human clinical trial of TOL2. It aims to secure funding for this pivotal trial while advancing the company’s broader rare disease pipeline.

List of Key Companies in Myasthenia Gravis Market:

- Argenx

- Johnson & Johnson

- AstraZeneca

- UCB Pharma

- Amneal Pharmaceuticals, Inc.

- Regeneron Pharmaceuticals

- Immunovant Sciences GmbH

- Bristol Myers Squibb

- Novartis

- Roche Holding AG

- Amgen

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corp.

- CuraVac, Inc

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, the European Brain Council launched the "Rethinking Myasthenia Gravis" initiative in partnership with the Institute of Management at Scuola Superiore Sant’Anna. This research-driven project aims to develop policy recommendations to improve the enhance the quality of life for individuals with Myasthenia Gravis across Europe and to promote meaningful healthcare improvements.

- In January 2025, the U.S. FDA granted Priority Review to Johnson & Johnson’s Biologics License Application for nipocalimab for the treatment of antibody-positive generalized myasthenia gravis.

- In September 2024, Candid Therapeutics launched with USD 370 million in Series A funding and acquired two clinical-stage T-cell engager (TCE) antibody assets through a merger with Vignette Bio and TRC 2004. The company aims to advance bispecific TCEs as a scalable, antibody-based alternative to cell therapies for autoimmune diseases such as myasthenia gravis.

- In November 2023, Cartesian and Selecta Biosciences announced a merger to form a publicly traded company focused on pioneering RNA cell therapies for autoimmune diseases. The combined company’s lead asset, Descartes-08, is in Phase 2 development for myasthenia gravis. Backed by over USD 110 million in pro forma cash, the merger ensures funding through Phase 3 development and expands the pipeline into additional autoimmune indications.

- In September 2023, Recipharm partnered with Spanish biotech company Ahead Therapeutics to support the development of a novel treatment for myasthenia gravis, a rare autoimmune disorder. Recipharm will provide analytical, process development, and GLP manufacturing services for lipid nanoparticles encapsulating an antigen peptide. The collaboration also includes scale-up capabilities to prepare for the future commercialization of the therapy.

- In April 2023, Huma Therapeutics partnered with UCB to launch a digital technology platform designed to help patients with myasthenia gravis (MG) better understand and manage their condition. The platform, built on Huma's EU MDR Class IIb regulated Software as a Medical Device (SaMD), allows patients to track symptoms using the MG-Activities of Daily Living Scale (MG-ADL) and share data with clinicians for early detection of exacerbations. This initiative aims to improve patient care and support proactive clinical decision-making, starting in Europe with plans for global expansion.