Market Definition

The market refers to the global economic landscape encompassing the research, development, approval, commercialization, distribution, and sales of therapies aimed at treating multiple myeloma, a type of blood cancer. This market includes pharmaceutical companies, biotech firms, healthcare providers, regulatory bodies, and payers.

It spans drug therapies, diagnostics, clinical trials, pricing strategies, reimbursement models, and market access initiatives. The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing market dynamics.

Multiple Myeloma Market Overview

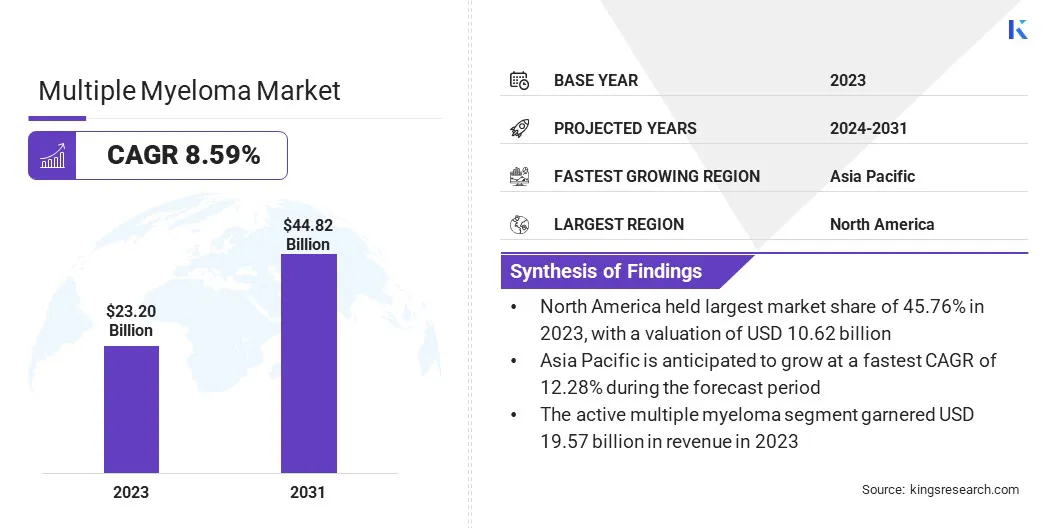

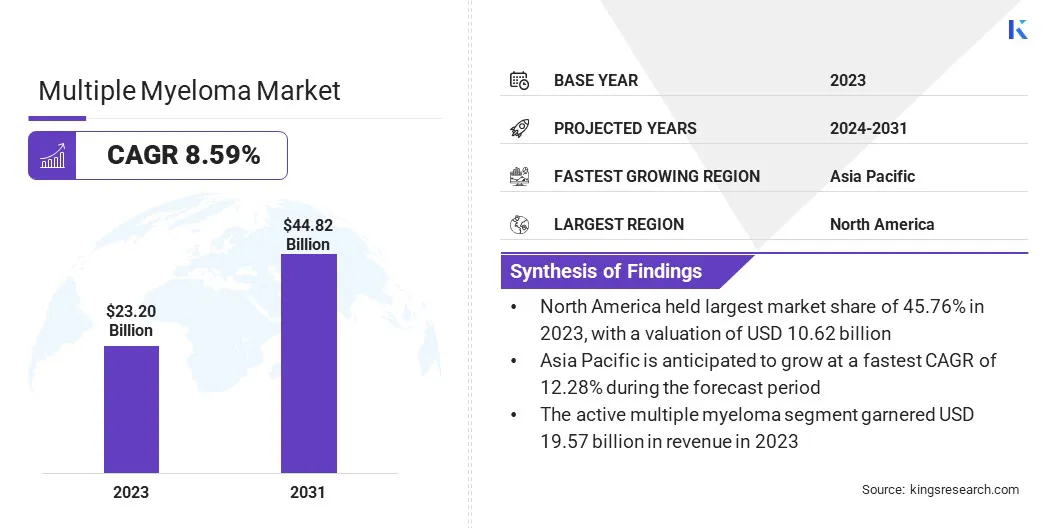

The global multiple myeloma market size was valued at USD 23.20 billion in 2023 and is projected to grow from USD 25.17 billion in 2024 to USD 44.82 billion by 2031, exhibiting a CAGR of 8.59% during the forecast period.

The market is registering steady growth driven by rising global incidence rates, increasing geriatric population, and advances in diagnostic technologies. Significant R&D investments and the introduction of innovative therapies, such as immunomodulators, monoclonal antibodies, and CAR-T cell therapies, are enhancing treatment efficacy and survival outcomes.

Major companies operating in the multiple myeloma industry are Johnson & Johnson Services, Inc., Bristol-Myers Squibb Company, GSK plc., Novartis AG, Amgen Inc., Pfizer Inc., Sanofi, AbbVie Inc., Legend Biotech, Arcellx, HaemaLogiX Ltd., Karyopharm, Oncopeptides AB, F. Hoffmann-La Roche Ltd, and Takeda Pharmaceutical Company Limited.

Additionally, the integration of advanced technologies such as genomics and precision medicine is enabling more personalized treatment approaches, driving better patient outcomes. The expanding pipeline of novel therapeutics and supportive care drugs is contributing to the market dynamism.

- In April 2024, Johnson & Johnson received the U.S. FDA approval for CARVYKTI (ciltacabtagene autoleucel), a personalized CAR-T cell therapy, for the treatment of relapsed or refractory multiple myeloma patients who have received at least one prior line of therapy. The approval is based on the positive results from the Phase 3 CARTITUDE-4 study.

Key Highlights

- The multiple myeloma market size was valued at USD 23.20 billion in 2023.

- The market is projected to grow at a CAGR of 8.59% from 2024 to 2031.

- North America held a market share of 45.76% in 2023, with a valuation of USD 10.62 billion.

- The immunomodulatory drugs (IMiDs) segment garnered USD 6.34 billion in revenue in 2023.

- The targeted therapy segment is expected to reach USD 17.23 billion by 2031.

- The active multiple myeloma segment is expected to reach USD 36.46 billion by 2031.

- The oral segment is expected to reach USD 22.30 billion by 2031.

- The hospital pharmacies segment is expected to reach USD 24.08 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 12.28% during the forecast period.

Market Driver

Expanding Treatment Options for Ineligible Multiple Myeloma Patients

The increasing availability of innovative therapies for patients with multiple myeloma who are not eligible for stem cell transplantation is driving the market. These patients, often older or with other health conditions that prevent them from undergoing the procedure, require alternative treatment options that can manage the disease effectively.

The development of targeted therapies, including combination treatments, is enhancing survival rates for these patients and helping to expand the market. Improving treatment access and outcomes for this specific patient group aids in the overall market growth, as more treatment options become available to those who would otherwise have limited choices.

- In September 2024, the U.S. FDA approved isatuximab-irfc (Sarclisa, Sanofi-Aventis) with bortezomib, lenalidomide, and dexamethasone for adults with newly diagnosed multiple myeloma ineligible for autologous stem cell transplant.

Market Challenge

Limited Treatment Options for Relapsed or Refractory Multiple Myeloma

A major challenge in the multiple myeloma market is the limited treatment options for patients with relapsed or refractory multiple myeloma. Despite advancements in therapy, multiple myeloma remains an incurable disease, and most patients will eventually experience a relapse.

When the disease becomes refractory to initial treatments, it becomes harder to manage, as it often becomes less responsive to standard therapies. This makes it increasingly difficult to offer effective treatment alternatives, which can negatively affect patient outcomes. The development of novel therapies targeting resistant forms of multiple myeloma addresses this challenge.

Additionally, clinical trials and ongoing research are crucial in identifying and evaluating new treatment approaches to expand the therapeutic options available for patients with advanced multiple myeloma.

- In January 2025, Sanofi received approval from China’s National Medical Products Administration (NMPA) for Sarclisa (isatuximab) in combination with pomalidomide and dexamethasone (Pd) for treating adult patients with relapsed or refractory multiple myeloma who have received at least one prior therapy.

Market Trend

Growing Adoption of Monoclonal Antibodies in Multiple Myeloma Treatment

The growing adoption of monoclonal antibodies in multiple myeloma treatment is reshaping the therapeutic landscape. Monoclonal antibodies are engineered to target specific proteins on myeloma cells, helping the immune system fight the disease more efficiently.

Supported by clinical trial successes and regulatory approvals, these therapies offer improved outcomes compared to traditional treatments. They offer a more precise and less toxic approach compared to traditional treatments, improving patient outcomes, reducing disease progression, and enhancing survival rates.

The market continues to expand as these therapies become more integrated into standard treatment protocols, providing more treatment options for patients at various stages of the disease.

- In January 2025, AbbVie and Simcere Zaiming partnered to develop SIM0500, an investigational trispecific antibody, with a focus on advancing its Phase 1 clinical trials for treating relapsed or refractory multiple myeloma.

Multiple Myeloma Market Report Snapshot

|

Segmentation

|

Details

|

|

By Drug Class

|

Immunomodulatory Drugs (IMiDs), Proteasome Inhibitors, Monoclonal Antibodies, Bispecific Antibodies, CAR T-Cell Therapies, Chemotherapeutic Agents, Corticosteroids, Others

|

|

By Therapy Type

|

Chemotherapy, Targeted Therapy, Immunotherapy, Stem Cell Transplantation, Radiation Therapy, Other Therapies

|

|

By Disease Type

|

Active Multiple Myeloma, Smoldering Multiple Myeloma (SMM)

|

|

By Route of Administration

|

Oral, Parenteral (Intravenous/Injectable)

|

|

By Distribution Channel

|

Hospital Pharmacies, Retail Pharmacies & Drug Stores, Online Pharmacies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Drug Class (Immunomodulatory Drugs (IMiDs), Proteasome Inhibitors, Monoclonal Antibodies, Bispecific Antibodies, and CAR T-Cell Therapies): The immunomodulatory drugs (IMiDs) segment earned USD 6.34 billion in 2023, due to their established efficacy in first-line and maintenance therapies, along with widespread clinical adoption.

- By Therapy Type (Chemotherapy, Targeted Therapy, Immunotherapy, Stem Cell Transplantation, and Radiation Therapy): The targeted therapy segment held 36.65% share of the market in 2023, due to its ability to selectively attack cancer cells with fewer side effects.

- By Disease Type (Active Multiple Myeloma, Smoldering Multiple Myeloma (SMM)): The active multiple myeloma segment is projected to reach USD 36.46 billion by 2031, owing to rising diagnosis rates and increasing adoption of novel treatment regimens.

- By Route of Administration (Oral, Parenteral (Intravenous/Injectable)): The oral segment is projected to reach USD 22.30 billion by 2031, owing to improved patient compliance and convenience associated with at-home treatment options.

- By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, Online Pharmacies): The hospital pharmacies segment is projected to reach USD 24.08 billion by 2031, owing to the growing number of hospital-based treatment administrations and specialist drug availability.

Multiple Myeloma Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 45.76% share of the multiple myeloma market in 2023, with a valuation of USD 10.62 billion. This market dominance is primarily attributed to high disease prevalence, advanced healthcare infrastructure, strong presence of key pharmaceutical players, and rapid adoption of novel therapies such as monoclonal antibodies and CAR T-cell treatments. Additionally, investments in oncology research and widespread clinical trial activity have contributed significantly to the region’s leadership in the market.

The market in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 12.28% over the forecast period. This growth is attributed to increasing awareness of multiple myeloma, rising healthcare expenditure, and improving access to modern treatments across developing countries such as China and India.

A growing elderly population, expanding diagnostic capabilities and higher demand for affordable yet effective therapies are also contributing to the market’s rapid expansion in the region. Moreover, domestic pharmaceutical companies are increasingly entering the oncology space, boosting regional innovation and availability.

Regulatory bodies across the region are becoming more receptive to advanced combination therapies for multiple myeloma, enabling faster approval timelines and broader access to innovative treatment options for transplant-ineligible patients.

- In February 2025, Sanofi received approval from the Ministry of Health, Labour and Welfare (MHLW) in Japan for Sarclisa (isatuximab) in combination with bortezomib, lenalidomide, and dexamethasone (VRd) for treating newly diagnosed multiple myeloma (NDMM) in transplant-ineligible patients, based on positive results from the IMROZ Phase 3 study.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) oversees the regulatory framework for multiple myeloma therapies. It is involved in the development and approval of new therapies for multiple myeloma, offering designations such as Orphan Drug.

- In China, the National Medical Products Administration (NMPA) implemented the Priority Review and Approval system to accelerate the evaluation of novel anti-cancer drugs, including those for multiple myeloma.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates oncology treatments under the New Drugs and Clinical Trials Rules, 2019, with provisions for accelerated approval and compassionate use for critical conditions like multiple myeloma.

Competitive Landscape

The multiple myeloma market is characterized by key players employing strategic initiatives to maintain and expand their market positions. Many are diversifying their oncology portfolios by focusing on multi-targeted therapies and combination regimens that enhance treatment efficacy and delay resistance.

Companies are also emphasizing on lifecycle management strategies, including label expansions and reformulations to improve dosing convenience and extend product longevity.

Additionally, collaborations with academic institutions and biotech firms are facilitating early-stage innovation, while investments in real-world evidence generation are helping to support market access and payer negotiations. Market entrants are also leveraging digital health solutions to support treatment monitoring and patient adherence.

- In December 2024, GSK plc reported that Blenrep (belantamab mafodotin) combined with bortezomib and dexamethasone (BVd) reduced the risk of death by 42% compared to daratumumab-based therapy (DVd) in relapsed or refractory multiple myeloma patients, based on results from the Phase III DREAMM-7 trial. Regulatory filings for Blenrep combinations are under review in the U.S., EU, Japan, China, UK, Canada, and Switzerland.

List of Key Companies in Multiple Myeloma Market:

- Johnson & Johnson Services, Inc.

- Bristol-Myers Squibb Company

- GSK plc.

- Novartis AG

- Amgen Inc.

- Pfizer Inc.

- Sanofi

- Amgen Inc.

- AbbVie Inc.

- Legend Biotech

- Arcellx

- HaemaLogiX Ltd.

- Karyopharm

- Oncopeptides AB

- Hoffmann-La Roche Ltd

- Takeda Pharmaceutical Company Limited

Recent Developments (Marketing Approval)

- In April 2025, Regeneron Pharmaceuticals, Inc. received conditional marketing approval from the European Commission for Lynozyfic (linvoseltamab), a bispecific BCMA×CD3 antibody, for treating adults with relapsed and refractory multiple myeloma who received at least three prior therapies.