Market Definition

The market covers a broad range of solutions, platforms, and services that deliver AR experiences through mobile devices like smartphones and tablets.

It includes AR software, mobile applications, content development tools, and integration frameworks used across various sectors such as gaming, retail, healthcare, education, and tourism to enhance real-world environments with interactive digital elements. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Mobile Augmented Reality Market Overview

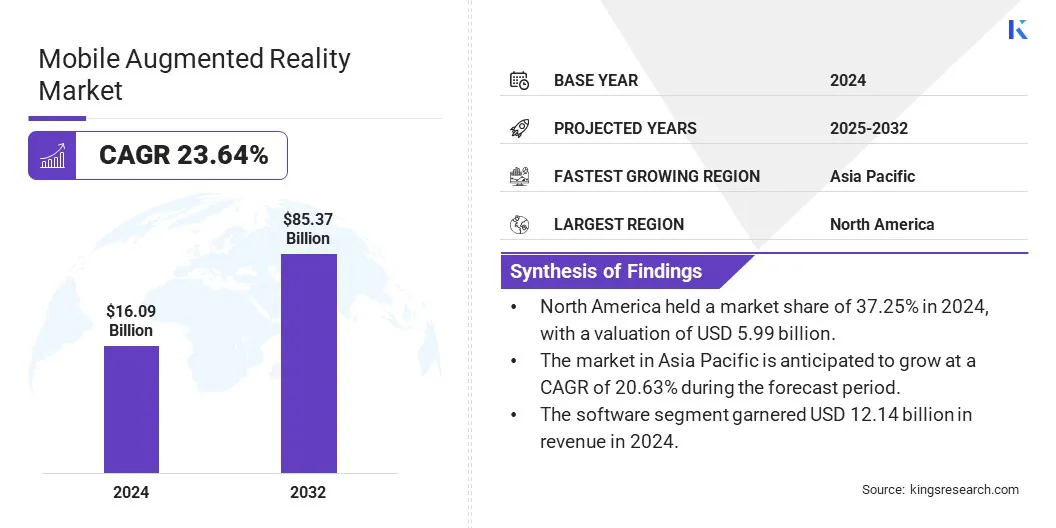

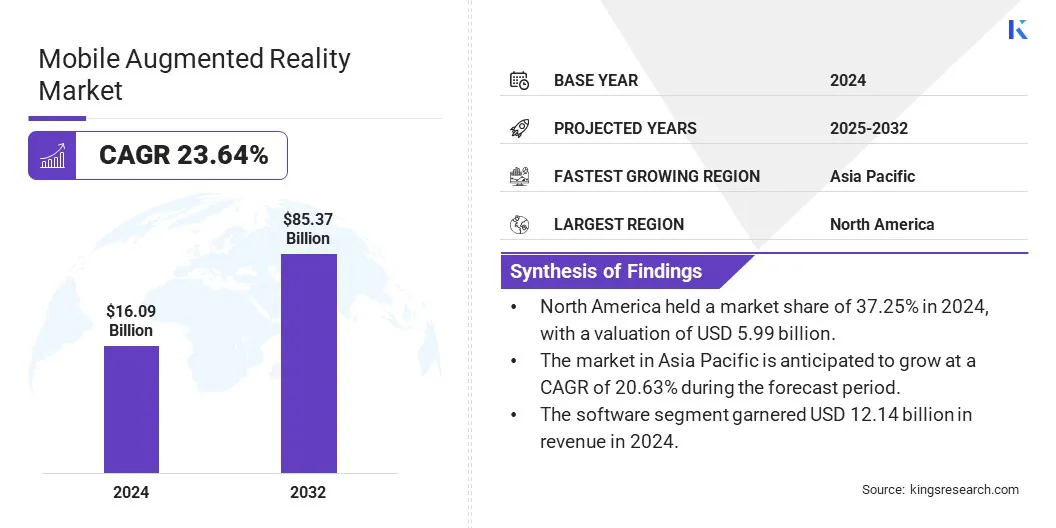

The global mobile augmented reality market size was valued at USD 16.09 billion in 2024 and is projected to grow from USD 19.33 billion in 2025 to USD 85.37 billion by 2032, exhibiting a CAGR of 23.64% during the forecast period.

The market is undergoing significant expansion as mobile devices become increasingly equipped with AR capabilities and software tools become more sophisticated. This growth is marked by the evolution of AR development platforms, increased developer engagement, and the emergence of innovative AR content formats.

Major companies operating in the mobile augmented reality industry are Apple Inc., Alphabet Inc., Snap Inc., Niantic, Microsoft, SAMSUNG, Zappar Ltd., Blippar Group Limited, PTC, Qualcomm Technologies, Inc., Unity Technologies, Adobe, Huawei Technologies Co., Ltd., Banuba, and ROAR IO Inc.

Cloud integration and edge computing are further enabling real-time AR processing on mobile devices, enhancing scalability and performance. AR is becoming more embedded in mobile ecosystems through app stores, browsers, and social platforms.

Thus, the market is transitioning from experimental use cases to more mainstream applications, creating new revenue streams and transforming digital engagement strategies.

- In May 2024, ARway.ai launched ARway V3.1, a major update to its AR platform. The release features enhanced AR tracking and navigation capabilities, supporting larger venues with up to 600 meters of tracking range. It also includes a mini map for real-time navigation, improved web studio 3D map editing, and a network failure backup flow, aimed at improving AR experiences across shopping malls, airports, and universities.

Key Highlights

- The mobile augmented reality industry size was valued at USD 16.09 billion in 2024.

- The market is projected to grow at a CAGR of 23.64% from 2025 to 2032.

- North America held a market share of 37.25% in 2024, with a valuation of USD 5.99 billion.

- The software segment garnered USD 12.14 billion in revenue in 2024.

- The smartphones segment is expected to reach USD 36.03 billion by 2032.

- The gaming & entertainment segment is expected to reach USD 25.40 billion by 2032.

- The consumer segment is expected to reach USD 43.79 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 20.63% during the forecast period.

Market Driver

Government Collaborations for Digital Talent Growth

The mobile augmented reality market is increasingly benefiting from government collaborations aimed at boosting digital talent. Governments globally are recognizing the importance of supporting local talent in emerging technologies like AR, and they are partnering with private companies to create educational programs and training initiatives.

These efforts not only equip individuals with the skills needed to excel in the AR industry but also contribute to building a sustainable ecosystem for innovation.

By nurturing a workforce with specialized AR expertise, governments are ensuring the growth of both the mobile AR market and its associated sectors, such as gaming, retail, and education. Such collaborations aid in boosting local economies and positioning nations as leaders in the global AR landscape.

- In February 2025, the Government Communications Office (GCO) signed a Memorandum of Understanding (MoU) with Snap Inc. to launch the first Augmented Reality Academy in the Middle East & North Africa. The partnership aims to empower digital talent and strengthen the creative content industry in the region.

Market Challenge

Privacy and Data Security Concerns

Growing concerns around privacy and data security challenge the market growth. AR applications often require access to sensitive data, including real-time location information, camera feeds, and user behavior analytics.

Users are becoming more wary of how their personal data is being collected, stored, and utilized as AR becomes more integrated into daily life, especially for activities like shopping, navigation, and entertainment. Developers and industry stakeholders must prioritize data protection and transparency in their AR offerings.

Implementing robust security protocols, clear privacy policies, and offering users more control over their data is essential for gaining trust and ensuring long-term adoption of AR technologies.

Market Trend

Convergence of Advertising and Entertainment in Mobile Augmented Reality

The market is registering the growing trend of convergence between entertainment and advertising, as brands increasingly leverage AR technology to enhance consumer engagement. By blending immersive storytelling with interactive product experiences, mobile AR allows advertisers to capture attention in dynamic and memorable ways.

This transformation of traditional marketing strategies enables consumers to interact with branded content through engaging formats such as AR games, virtual try-ons, and filters. The result is a more personalized and immersive user experience that drives deeper engagement, boosts brand recall, and influences purchasing behavior, positioning mobile AR as a powerful tool for next-generation marketing.

- In June 2023, Niantic launched its Rewarded AR ads format. The new ad product, powered by Niantic’s AR development platform 8th Wall, integrates branded content into real-world experiences within mobile games like Pokémon GO, aiming to increase brand impact and consumer engagement.

Mobile Augmented Reality Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Services

|

|

By Device Type

|

Smartphones, Tablets, Smart Glasses, Others

|

|

By Application

|

Gaming & Entertainment, Retail & E-commerce, Education & Training, Healthcare, Others

|

|

By End-use Industry

|

Consumer, Enterprise, Government

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software, Services): The software segment earned USD 12.14 billion in 2024, due to the growing adoption of AR development platforms and SDKs that facilitate the creation of immersive mobile experiences.

- By Device Type (Smartphones, Tablets, Smart Glasses, Others): The smartphones segment held 54.09% share of the market in 2024, due to their widespread global penetration and increasing AR capabilities through improved processors and camera systems.

- By Application (Gaming & Entertainment, Retail & E-commerce, Education & Training, Healthcare, and Others): The gaming & entertainment segment is projected to reach USD 25.40 billion by 2032, owing to the surge in demand for interactive and location-based AR content on mobile platforms.

- By End-use Industry (Consumer, Enterprise, and Government): The consumer segment is projected to reach USD 43.79 billion by 2032, owing to the rising popularity of AR-driven social media filters, mobile gaming, and virtual try-on features in e-commerce.

Mobile Augmented Reality Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 37.25% share of the mobile augmented reality market in 2024, with a valuation of USD 5.99 billion. This dominance is primarily attributed to the region’s early adoption of AR-enabled smartphones and the strong presence of leading technology firms that continue to invest heavily in mobile AR innovations.

High consumer readiness for digital experiences, especially in the U.S., has accelerated the integration of AR in social media, retail, and entertainment platforms. Furthermore, robust infrastructure for mobile internet and cloud services, combined with a mature app development ecosystem, supports the rapid deployment and monetization of AR applications.

The frequent introduction of new AR features by major tech companies has kept the consumer base engaged and contributed to consistent market expansion.

The mobile augmented reality industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 20.63% over the forecast period. This strong growth trajectory is driven by the increasing adoption of smartphones across populous countries such as China, India, and Indonesia, along with the rising availability of affordable AR-capable devices.

Regional tech giants and startups in China, South Korea, and Japan are heavily investing in mobile AR content, particularly in gaming, e-commerce, and education sectors with high youth engagement. Additionally, the region’s deep-rooted culture in mobile gaming and rapid digital content creation has positioned Asia Pacific as a fertile ground for mobile AR innovation and user base expansion.

Regulatory Frameworks

- In the U.S., the California Consumer Privacy Act (CCPA) mandates transparency in data collection, granting user rights to access, delete, and opt out of the sale of their personal information, thereby shaping how mobile AR applications handle sensitive data.

- In Europe, the General Data Protection Regulation (GDPR) enforces strict consent requirements, data minimization principles, and user rights over personal data, compelling mobile AR developers to implement robust privacy measures across their applications.

Competitive Landscape

The mobile augmented reality market is characterized by key players focusing on enhancing AR development platforms and forming strategic partnerships with telecom providers, device manufacturers, and content creators. Companies are investing in AR development kits to attract developers and foster innovation.

Integration of AR into mobile apps, such as social media, navigation, and e-commerce, is driving the market. Additionally, acquisitions of AR startups help firms expand their portfolios, improve technology, and differentiate through seamless, real-time AR experiences. These efforts collectively push the market toward more immersive and mainstream applications.

- In November 2023, Immersal entered into a strategic partnership with Burst, a leader in virtual reality fan experiences. The collaboration aims to enhance location-based AR experiences by integrating Immersal’s Visual Positioning System (VPS) with Burst’s immersive AR solutions. The partnership is set to expand mobile AR applications across events, retail, education, and navigation by combining accurate spatial mapping with real-time, photorealistic digital content.

List of Key Companies in Mobile Augmented Reality Market:

- Apple Inc.

- Alphabet Inc.

- Snap Inc.

- Niantic

- Microsoft

- SAMSUNG

- Zappar Ltd.

- Blippar Group Limited

- PTC

- Qualcomm Technologies, Inc.

- Unity Technologies

- Adobe

- Huawei Technologies Co., Ltd.

- Banuba

- ROAR IO Inc.

Recent Developments (Product Launches)

- In March 2025, Skidattl launched its AR engagement platform, enabling businesses to create virtual information overlays in physical spaces using geospatial intelligence. The platform uses smartphone activation and App Clip technology, and requires no programming experience.

- In May 2024, Google introduced new Geospatial AR features, including a pilot program that integrates AR content from select partners into Google Maps using Street View and Lens in Maps. Google also expanded Geospatial Creator access in Adobe Aero and announced plans to extend ARCore Geospatial API coverage to India.