Market Definition

Missiles and missile defense systems refer to advanced weaponry and protective technologies designed for offensive and defensive military applications. Missiles are self-propelled, guided weapons capable of delivering payloads with high precision over varying distances, including ballistic, cruise, and hypersonic missiles.

Missile defense systems are designed to detect, track, intercept, and neutralize incoming missile threats before impact. These systems include surface-to-air missiles (SAMs), interceptor missiles, radar networks, and space-based tracking systems.

Integrated with AI, advanced sensors, and cyber-hardened networks, modern missile defense systems enhance national security by countering evolving threats such as hypersonic weapons, UAVs, and ballistic missiles.

Missiles and Missile Defense Systems Market Overview

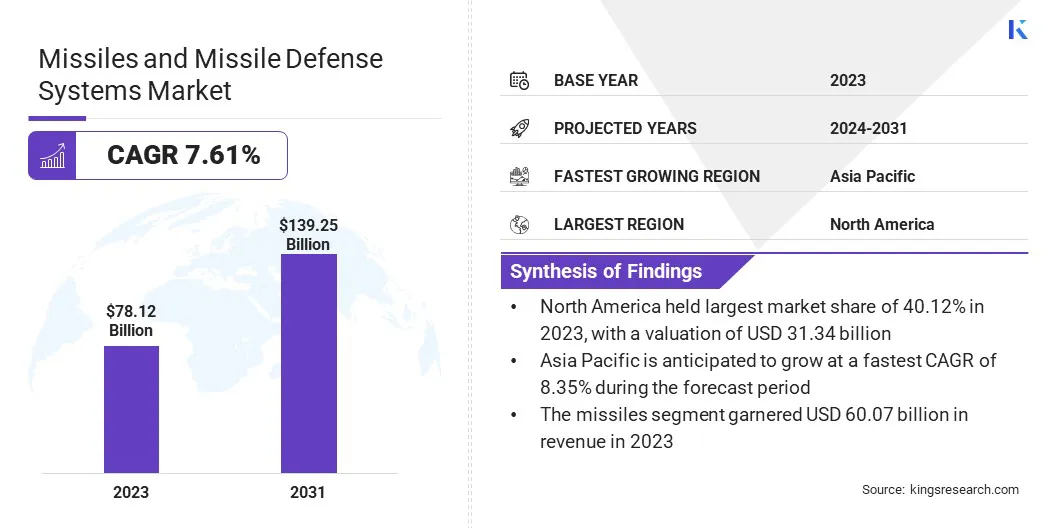

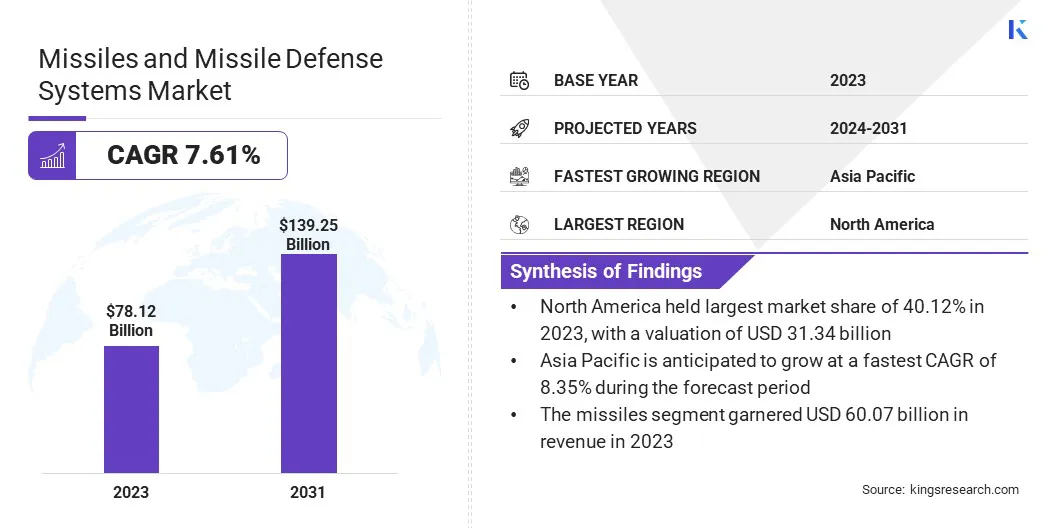

The global missiles and missile defense systems market size was valued at USD 78.12 billion in 2023 and is projected to grow from USD 83.33 billion in 2024 to USD 139.25 billion by 2031, exhibiting a CAGR of 7.61% during the forecast period.

The growth of the market is propelled by the increasing geopolitical tensions, advancements in missile technology, and rising defense budgets globally. Governments and defense organizations are prioritizing military modernization to enhance national security and counter emerging threats.

This growth is further fueled by the development of hypersonic missiles, integration of artificial intelligence (AI) in missile defense, and growing investments in space-based defense systems.

Major companies operating in the missiles and missile defense systems industry are Lockheed Martin Corporation, RTX, Boeing, Northrop Grumman, BAE Systems, Thales, IAI, Kongsberg Defence & Aerospace, MetalTek, General Dynamics Mission Systems, Inc., MBDA Inc., Rheinmetall AG, Leonardo S.p.A., Saab AB, Denel Dynamics, and others.

Geopolitical conflicts and regional security threats are prompting nations to strengthen their missile defense capabilities, supporting market growth. Countries in North America, Europe, and Asia-Pacific are investing in next-generation missile technologies to deter potential adversaries.

Military modernization programs in nations such as the U.S., China, India, and Russia are fueling demand for advanced missile systems, hypersonic weapons, and sophisticated interceptor technologies.

For instance, the U.S. Department of Defense (DoD) continues to invest in missile defense programs such as the Terminal High Altitude Area Defense (THAAD) and the Aegis Ballistic Missile Defense (BMD) system. Similarly, European countries are enhancing their missile defense infrastructure under NATO’s collective security framework.

- In April 2024, Raytheon, a subsidiary of RTX, secured a USD 344 million contract to upgrade missile systems critical to the defense of the United States and its international allies. The contract focuses on developing two missile variants, the SM-2 Block IIICU and SM-6 Block IU, which will feature a shared guidance section incorporating advanced electronics and software. This modernization effort aims to enhance missile production efficiency by streamlining manufacturing processes through a common production line.

Key Highlights:

Key Highlights:

- The missiles and missile defense systems industry size was recorded at USD 78.12 billion in 2023.

- The market is projected to grow at a CAGR of 7.61% from 2024 to 2031.

- North America held a share of 40.12% in 2023, Valued at USD 31.34 billion.

- The missiles segment garnered USD 60.07 billion in revenue in 2023.

- The land-based systems segment is expected to reach USD 72.37 billion by 2031.

- The conventional technologies segment secured the largest revenue share of 76.89% in 2023.

- The long range segment is set to grow at a CAGR of 8.41% through the projection period.

- Asia Pacific is anticipated to grow at a CAGR of 8.35% over the forecast period.

What are the major factors driving market growth?

The rapid development of hypersonic missiles is contributing significantly to the growth of the missiles and missile defense systems market. Hypersonic missiles, including Hypersonic Glide Vehicles (HGVs) and Hypersonic Cruise Missiles (HCMs), travel at speeds exceeding Mach 5, making them difficult to detect and intercept with conventional defense systems.

Leading defense contractors, such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies, are investing heavily in hypersonic missile research and development. The operational deployment of hypersonic missiles by Russia and China is prompting the U.S. and NATO allies to accelerate their hypersonic missile defense programs, propelling the expansion of the market.

- In January 2025, North Korea conducted a test of its latest hypersonic missile system, designed to strengthen its deterrence against Pacific rivals and advance its nuclear and missile capabilities. The missile traveled 1,500 km at a speed 12 times faster than sound. This development positions North Korea alongside the United States, Russia, and China as one of the few nations to successfully develop hypersonic missile technology.

What are the major obstacles for this market?

A significant challenge impeding the growth of the missiles and missile defense systems market is the high cost of developing and producing advanced missile systems.

The research, testing, and manufacturing of cutting-edge technologies such as hypersonic missiles, space-based defense systems, and interceptors require substantial investments, making these projects financially demanding.

To address this, companies are adopting cost-effective manufacturing processes, utilizing modular designs for easier upgrades, and exploring public-private partnerships to share financial burdens. Additionally, advancements in automation and AI-driven technologies are streamlining production and reducing overall costs, ensuring affordability while maintaining performance.

What are the major trends in this market?

The rising focus on space-based missile defense is fueling substantial investments in satellite-enabled early warning systems, directed energy weapons (DEWs), and space-based interceptors. The U.S. Space Force is leading the development of space-based missile tracking and interception systems to counter hypersonic and ballistic missile threats.

Advanced programs such as the Hypersonic and Ballistic Tracking Space Sensor (HBTSS) aim to provide real-time threat tracking from space, enhancing global missile defense capabilities. The deployment of laser-based and kinetic-energy space weapons is also being explored, further supporting market expansion.

- In February 2025, the U.S. Space Development Agency (SDA) unveiled plans to integrate its satellite network into a large-scale missile defense initiative. The agency is exploring ways to incorporate its Proliferated Warfighter Space Architecture (PWSA) into a broader defense system, referred to as the “Iron Dome for America.” This initiative aims enhance national defense by countering advanced threats, including hypersonic and ballistic missiles.

Missiles and Missile Defense Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Missiles, Missile Defense Systems

|

|

By Deployment

|

Land-based Systems, Sea-based Systems, Air-based Systems

|

|

By Technology Type

|

Conventional Technologies, Advanced Technologies

|

|

By Range

|

Short Range, Medium Range, Long Range

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Missiles and Missile Defense Systems): The missiles segment earned USD 60.07 billion in 2023 due to the growing demand for advanced missile technologies, including hypersonic missiles and ballistic missile defense systems, increasing geopolitical tensions, and military modernization initiatives across the globe.

- By Deployment (Land-based Systems, Sea-based Systems, and Air-based Systems): The land-based systems segment held a share of 52.34% in 2023, attributed to its cost-effectiveness, strategic deployment capabilities, and the ability to provide extensive coverage in national defense against both ballistic and cruise missile threats.

- By Technology Type (Conventional Technologies and Advanced Technologies): The conventional technologies segment is projected to reach USD 105.20 billion by 2031, owing to its established performance, cost-effectiveness, and widespread adoption by global defense forces, making it the preferred choice for addressing immediate and evolving security threats.

- By Range (Short Range, Medium Range, and Long Range): The long range segment is set to grow at a CAGR of 8.41% through the forecast period, attributed to its critical role in providing enhanced strategic defense capabilities, allowing countries to protect vast territories and counter long-range threats effectively.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America missiles and missile defense systems market captured a share of around 40.12% in 2023, valued at USD 31.34 billion. North America faces increasing threats from intercontinental ballistic missiles (ICBMs) and unmanned aerial vehicles (UAVs), prompting investments in advanced missile interception systems.

The North America missiles and missile defense systems market captured a share of around 40.12% in 2023, valued at USD 31.34 billion. North America faces increasing threats from intercontinental ballistic missiles (ICBMs) and unmanned aerial vehicles (UAVs), prompting investments in advanced missile interception systems.

The U.S. military is enhancing its Ballistic Missile Defense System (BMDS) with technologies such as the Terminal High Altitude Area Defense (THAAD) and the Aegis Ballistic Missile Defense (BMD) system.

To counter UAV threats, the region is developing directed energy weapons (DEWs) and AI-powered counter-drone missile systems. In addition, North America is home to some of the world’s largest defense contractors, including Lockheed Martin, Boeing, Raytheon Technologies, and Northrop Grumman. These companies are heavily investing in next-generation missile technologies, fostering continuous innovation.

Asia Pacific missiles and missile defense systems industry is poised to grow at a CAGR of 8.35% over the forecast period. The region's security landscape is shaped by key regions such as China, North Korea, and India.

China’s growing missile capabilities, including its hypersonic missile program, and North Korea’s nuclear missile tests, are prompting neighboring countries to strengthen their missile defense capabilities.

- In November 2024, India's Defence Research and Development Organisation (DRDO) successfully carried out the inaugural flight test of a long-range hypersonic missile from Dr. APJ Abdul Kalam Island in Odisha. This achievement positions India alongside the U.S., Russia, and China in the development of advanced missile technologies.

Furthermore, countries in Asia-Pacific are strengthening defense collaborations to enhance their missile defense capabilities. For instance, the U.S.-Japan and U.S.-South Korea defense partnerships are facilitating joint development projects, including Aegis BMD systems and SM-6 missiles.

Additionally, the Quadrilateral Security Dialogue (Quad) involving the U.S., Japan, Australia, and India is promoting the sharing of missile defense technologies and capabilities.

Regulatory Frameworks

- The Missile Technology Control Regime (MTCR), Established in 1987 by the G-7 industrialized countries, including Canada, France, Germany, Italy, Japan, the UK, and the United States, is an informal political agreement aimed at limiting the proliferation of missiles and missile technology.

- In the U.S., the Missile Defense Review (MDR) outlines the U.S. strategy for missile defense, emphasizing the protection of the homeland and allies against missile threats. The Arms Export Control Act (AECA) regulates the export of defense articles and services, including missile technologies to ensure alignment with U.S. foreign policy and national security interests.

- The UK government enforces strategic export controls on military goods, including missile technologies, through the Export Control Order 2008. The UK ensures that missile systems and related technologies are not exported to countries where they could be used for destabilizing purposes, particularly in conflict zones or nations under UN sanctions

- In Germany, the War Weapons Control Act (Kriegswaffenkontrollgesetz) oversees the export of war weapons, including missiles, ensuring compliance with international law and Germany's foreign policy objectives.

- China maintains strict controls on the export of missile technologies, aligning with international nonproliferation efforts. Despite advancements in missile systems, including hypersonic missiles, it has pledged not to assist other countries in developing nuclear-capable ballistic missiles.

- Japan adheres to the Three Principles on Arms Exports, which restrict the export of arms, including missile systems, to countries engaged in conflict or subject to international sanctions. Japan's post-war pacifist stance limits its defense exports, focusing primarily on domestic defense capabilities.

- India joined the MTCR in 2016, which is a crucial step in aligning its missile export practices with global nonproliferation standards. India is committed to restricting the transfer of missile technologies that could potentially threaten regional or global security. India cooperates with the U.S. on the development of missile defense systems, such as the Advanced Air Defence (AAD) and Prithvi Air Defence (PAD) systems, while adhering to export regulations that ensure its missile technology is used responsibly.

- South Korea’s defense policy is shaped by its ongoing threat from North Korea, prompting the development of advanced missile defense systems, such as the THAAD (Terminal High Altitude Area Defense) system, under the governance of both international regulations and national defense requirements. As an MTCR member since 2001, South Korea adheres to strict export guidelines to prevent the proliferation of weapons of mass destruction while aligning with international and national defense regulations.

Competitive Landscape

The global missiles and missile defense systems market is characterized by a number of participants, including both established corporations and emerging players. Leading market participants are increasingly adopting strategies such as research and development (R&D) to advance air and missile defense capabilities.

This is driven by significant defense and army investments and contracts from various countries, which are focused on enhancing their national security and missile defense systems.

By advancing missile defense technologies, these players are securing contracts from government defense agencies, supporting market expansion. Additionally, partnerships with governments and defense organizations ensure continuous innovation in missile technologies, positioning these companies at the forefront of the industry.

- In February 2025, Northrop Grumman Corporation secured two major contracts totaling USD 1.42 billion to enhance air and missile defense capabilities for the U.S. Army and Poland. These contracts solidify Northrop Grumman's leadership in advanced integrated battle management solutions, fostering innovation through artificial intelligence and model-based systems engineering to bolster global security.

Key Companies in Missiles and Missile Defense Systems Market:

Recent Developments (Partnerships/Agreements/New Product Launch)

- In February 2024, Lockheed Martin received a follow-on development contract from the Missile Defense Agency (MDA) for the Terminal High Altitude Area Defense (THAAD) Weapon System. The contract has a maximum value of USD 2.8 billion if both options are exercised. This development will enhance THAAD’s ability to counter increasingly sophisticated missile threats.

- In January 2025, RTX was awarded a USD 333 million contract by the U.S. Navy to manufacture Standard Missile-6 (SM-6) Block IA missiles. The SM-6 has been successfully launched from a range of U.S. Navy ships, unmanned vessels, and land-based launchers. In March 2024, the SM-6 showcased its anti-missile capabilities by intercepting a medium-range ballistic missile target at sea during the Flight Test Aegis Weapon System (FTM)-32 exercise.

- In October 2024, BAE Systems successfully delivered 400 2-Color Advanced Warning Systems (2CAWS) to the U.S. Army as part of the Limited Interim Missile Warning System (LIMWS) program. These advanced aircraft survivability systems have demonstrated their effectiveness in combat, successfully countering sophisticated missile threats and safeguarding Army aviators and airborne soldiers.

- In May 2023, a German-modified M903 launcher successfully launched a Lockheed Martin PAC-3 Missile Segment Enhancement (MSE) interceptor during a flight test. The Germany Tactical Test / Operational Test 3, conducted by the German Air Force, targeted a virtual tactical ballistic missile to demonstrate the compatibility between the PAC-3 MSE and the German-modified Patriot M903 launch station.

Key Highlights:

Key Highlights: The North America missiles and missile defense systems market captured a share of around 40.12% in 2023, valued at USD 31.34 billion. North America faces increasing threats from intercontinental ballistic missiles (ICBMs) and unmanned aerial vehicles (UAVs), prompting investments in advanced missile interception systems.

The North America missiles and missile defense systems market captured a share of around 40.12% in 2023, valued at USD 31.34 billion. North America faces increasing threats from intercontinental ballistic missiles (ICBMs) and unmanned aerial vehicles (UAVs), prompting investments in advanced missile interception systems.