Market Definition

Mining chemicals are substances employed in various mining processes to facilitate the extraction, processing, and refinement of valuable minerals and metals from ore. These chemicals play a crucial role in enhancing operational efficiency, reducing costs, and minimizing environmental impact within the mining industry.

Mining Chemicals Market Overview

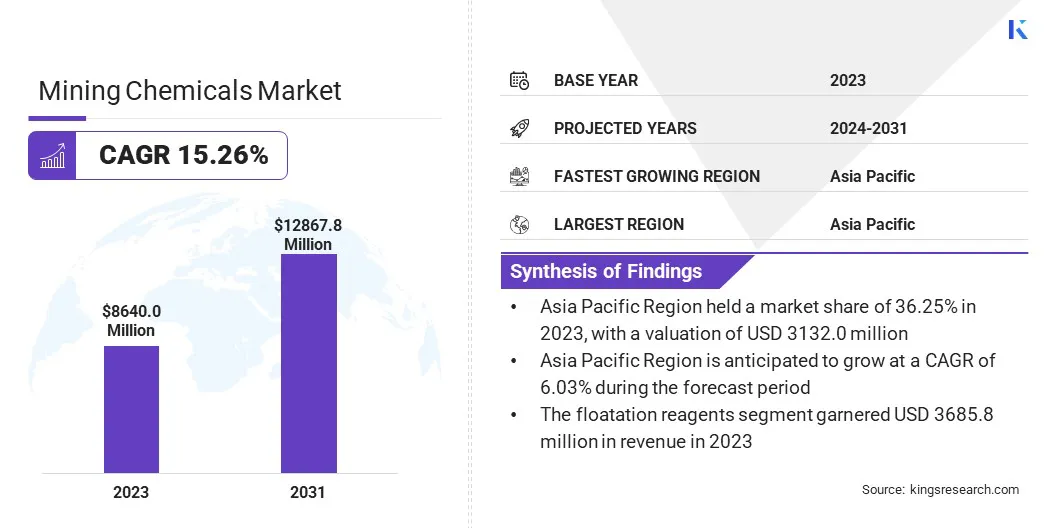

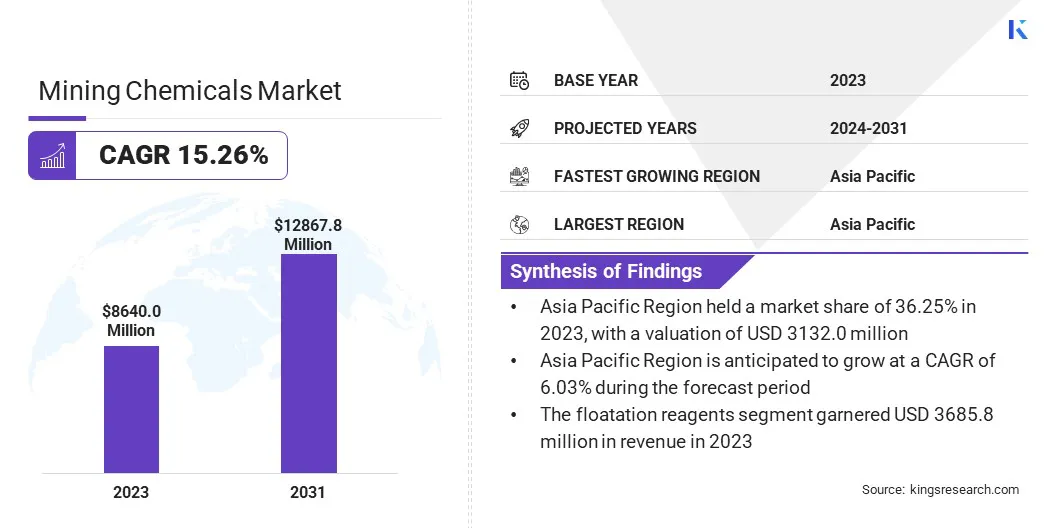

The global mining chemicals market size was valued at USD 8640.0 million in 2023, which is estimated to be valued at USD 9041.6 million in 2024 and is projected to reach USD 12,867.8 million by 2031, exhibiting a CAGR of 15.26% during the forecast period.

The global increase in demand for mining chemicals is fueled by rapid infrastructure development, ongoing technological advancements, depleting ore grades, and stringent regulatory framework.

Major companies operating in the mining chemicals industry are BASF, Solvay, Clariant, Mitsubishi Chemical Group Corporation, LyondellBasell Industries, Air Liquide Advanced Separations, Exxon Mobil Corporation, Linde Plc, LG Chem, China Petrochemical Corporation, SABIC, INEOS Group Limited, Sumitomo Chemical Co., Ltd., Akzo Nobel N.V., and Huntsman International LLC.

The global shift to renewable energy and electric vehicles (EVs) is fueling a surge in demand for critical minerals like lithium, cobalt, and nickel, which are essential components in battery technology and other clean energy applications. This increased demand has created a significant market opportunity for specialized chemicals used in the extraction and processing of these minerals.

Chemical companies are making substantial investments to expand their production capacity. This includes the construction of new production facilities and the optimization of existing operations to increase output and efficiency.

- In March 2024, BASF expanded the production facility in Tarragona, Spain to support the growing demand for paraffin inhibitor chemistries. Paraffin inhibitors play a crucial role in enhancing the efficiency of solvent extraction, a key technique used to recover valuable metals from ores, contributing to a more sustainable and cost-effective mining industry.

Key Highlights:

- The mining chemicals market size was recorded at USD 8640.0 million in 2023.

- The market is projected to grow at a CAGR of 5.17% from 2024 to 2031.

- Asia Pacific held a market share of 36.25% in 2023 with a valuation of USD 3132.0 million and is anticipated to grow at a CAGR of 6.03% during the forecast period.

- The flotation reagents segment garnered USD 3685.8 million in revenue in 2023.

- The mineral processing segment is expected to reach USD 5947.7 million by 2031.

Market Driver

"Mining Industry Increasingly Reliant on Chemical Solutions"

The global decline in ore grades and the increasing prevalence of complex ore bodies have made mining companies increasingly reliant on chemical solutions to maintain efficient and productive operations.

Froth flotation, a key beneficiation process, utilizes surfactants to selectively separate valuable minerals from waste rock by inducing hydrophobicity, allowing the minerals to attach to air bubbles and float to the surface.

This technique is essential for concentrating minerals from low-grade ores. The growing complexity of ore bodies further necessitates specialized chemical treatments to achieve effective mineral separation.

- A study conducted in January 2024 by LIGNOFLO investigated the potential of lignin, a natural polymer derived from plant cell walls and a byproduct of the pulp and paper industry, as a flotation collector. By utilizing this bio-based material, the LIGNOFLO approach offers a promising sustainable alternative to traditional flotation methods and contributes to the development of a more environmentally responsible mining industry.

Market Challenge

"Environmental Concerns Drive Shift to Sustainable Mining Chemicals"

The mining chemicals market, while registering strong growth, faces several environmental concerns. Many conventional mining chemicals, including cyanide and certain heavy metals, exhibit toxicity and environmental persistence, posing risks to both ecosystems and human health.

Thus, mining chemical manufacturers are prioritizing the development of biodegradable alternatives to traditional surfactants, flocculants, and other reagents. These biodegradable formulations break down naturally in the environment, minimizing their persistence and reducing their overall environmental impact.

- In March 2023, Barrick Gold implemented Draslovka’s GlyCat glycine leaching technology across several of its mines to reduce their environmental footprint. This technology will substantially replace the use of cyanide in processing refractory ores with a non-toxic, recyclable reagent.

Market Trend

"Regulations Drive Sustainable Innovation in Mining Chemicals"

The implementation of stricter regulatory frameworks globally is driving a significant shift toward sustainable practices within the mining industry. This regulatory pressure has created a growing demand for innovative chemical solutions that minimize environmental impact.

Mining chemical manufacturers are responding by developing less toxic, biodegradable, and environmentally friendly products, enabling mining companies to reduce their environmental footprint through decreased water and energy usage, reduced waste, and mitigated ecosystem effects.

- In June 2024, Nouryon, a global leader in specialty chemicals, achieved International Sustainability and Carbon Certification (ISCC PLUS) for the production of green ethylene oxide, ethanolamines, ethylene amines, and surfactants. These products have applications in mineral processing, corrosion inhibition, and the production of other mining chemicals.

Mining Chemicals Market Report Snapshot

| Segmentation |

Details |

| By Product Type |

Flotation Reagents (Collectors, Frothers, Depressants, Regulators), Grinding Aids, Flocculants, Others(Extraction Reagents, Biocides, pH adjusters, Scale Inhibitors, Disperants) |

| By Application |

Mineral Processing, Explosives and Drilling, Water Treatment, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Flotation Reagents, Grinding Aids, Flocculants, Others): The flotation reagents segment earned USD 3685.8 million in 2023, due to increasing metal demand, the shift to lower-grade ores, and continuous technological improvements.

- By Application (Mineral Processing, Explosives and Drilling, Water Treatment, Others): The mineral processing segment held 46.64% share of the market in 2023, due to its extensive use of frothers, collectors, and flocculants in metal extraction and refinement.

Mining Chemicals Market Regional Analysis

Asia Pacific accounted for 36.25% share of the mining chemicals market and was valued at USD 3132.0 million in 2023. Rapid industrialization and urbanization in countries like China and India are driving significant demand for metals and minerals used in infrastructure development, manufacturing, and construction.

Furthermore, the region is rich in various mineral resources, including coal, iron ore, copper, gold, and bauxite. The Philippines and Papua New Guinea, due to their volcanic and tectonic activity, possess rich deposits of base metals. This abundance of resources naturally leads to extensive mining activities and a corresponding high demand for mining chemicals.

- The Geological Survey of India (GSI) undertook 195 critical mineral exploration projects in the 2024-2025 financial year, according to a report from the mines ministry. This represents a substantial 53% year-over-year increase in such projects, highlighting a significant escalation in exploration activity.

The mining chemicals industry in North America accounted for a revenue of USD 2258.5 million in 2023. The region has a long history of mining activity and a well-established mining industry. Driven by stricter environmental regulations and increasing societal expectations for responsible mining practices, the market is shifting toward chemicals and technologies that minimize environmental impact.

This includes a rising demand for biodegradable and less toxic products such as bio-based flotation reagents, non-toxic flocculants, and coagulants, which reduce water consumption, waste generation, and pollution.

- In November 2024, the Mining Process Solutions (MPS) division of Draslovka a.s. partnered with Curtin University in a research contract of USD 3 million to commercialize sustainable mineral extraction technology based on Draslovka’s glycine leaching technology (GLT). The project aims to advance the use of non-toxic, biodegradable, and recyclable amino acids for the recovery of gold and copper.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Toxic Substances Control Act of 1976 (TSCA) provides a regulatory framework for manufacturers in the U.S. to manage chemicals used in mining, with the goal of protecting human health and the environment. As the primary federal law governing chemical substances, including those used in mining operations, TSCA mandates pre-manufacture notification for new chemicals and grants the Environmental Protection Agency (EPA) authority to regulate existing chemicals.

- REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) governs the manufacturing and use of chemicals used in mining operations, for companies operating within or exporting to the European Union (EU). It requires the registration of all chemicals manufactured or imported into the EU and includes authorization and restriction procedures for certain SVHCs.

- The Manufacture, Storage, and Import of Hazardous Chemicals (MSIHC) Rules, 1989 are regulations that govern the safe handling, storage, and import of hazardous chemicals in India. The rules establish a structured framework for industries to safely identify, store, and transport hazardous chemicals.

- The Mineral and Petroleum Resources Development Act (MPRDA) of 2002 provides the regulatory framework governing mining rights in South Africa. This Act governs operations and transactions related to the prospecting, exploration, mining, development, exploitation, research, and beneficiation of minerals, encompassing the processing, smelting, refining, and trading of mineral substances. The act inherently includes the risk associated with mining chemicals.

Competitive Landscape:

The global mining chemicals market is characterized by a large number of participants, including both established corporations and rising organizations. Mining chemicals manufacturers are prioritizing the replacement of traditional chemicals with more environmentally friendly alternatives.

This includes utilizing plant-derived materials, developing biodegradable polymers, and designing chemicals that decompose into less harmful substances. Companies are raising money to fund ongoing research on minimizing product toxicity and reducing impacts on ecosystems, water resources, and air quality.

- In July 2024, pH7 Technologies, a Vancouver-based startup, secured USD 1 million in funding from the B.C. Centre for Innovation and Clean Energy (CICE) to further develop its proprietary technology. This technology facilitates heap leaching for copper extraction from low-grade sulfide ores while simultaneously generating on-site green hydrogen.

List of Key Companies in Mining Chemicals Market:

- BASF

- Solvay

- Clariant

- Mitsubishi Chemical Group Corporation

- LyondellBasell Industries

- Air Liquide Advanced Separations

- Exxon Mobil Corporation

- Linde Plc

- LG Chem

- China Petrochemical Corporation

- SABIC

- INEOS Group Limited

- Sumitomo Chemical Co., Ltd.

- Akzo Nobel N.V.

- Huntsman International LLC.

Recent Developments:

- In November 2024, Vishnu Chemicals, a global manufacturer of specialty chemicals, acquired the Chrome Mining Complex, including its associated mining and infrastructure assets, from the Volclay Group of Companies in South Africa. The mining complex encompasses over 1,800 hectares and holds estimated resources of approximately 10 million tons.

- In September 2024, Coromandel International Limited increased its stake in Baobab Mining and Chemicals Corporation (BMCC), Senegal, to 53.8% through its wholly owned subsidiary, Coromandel Chemicals Limited. This acquisition of additional equity involved an investment of USD 6.5 million to support expansion projects and fulfill working capital needs.

- In July 2024, BASF sold its flocculants business to Solenis, a global specialty chemical producer, as part of a strategic portfolio realignment. The transaction includes the transfer of a range of products used in solid-liquid separation and material handling within mining operations, sold under the brand names Magnafloc, Rheomax, Alclar, Alcotac, Jetwet, Aerowet, and Alcotech.

- In February 2024, Orica announced the acquisition of Cyanco, a key manufacturer of sodium cyanide, for USD 640 million to expand its presence in the mining chemicals market. The acquisition is primarily funded through Orica’s existing cash reserves, with the remaining USD 245.7 million sourced through institutional placements.

- In October 2023, BASF launched two new flotation reagent brands, Luprofroth and Luproset, designed to separate valuable minerals from waste rock in mining operations. A key feature of these new products is their enhanced environmental, health, and safety (EHS) profile, characterized by lower toxicity & ecotoxicity values and reduced flammability risks.